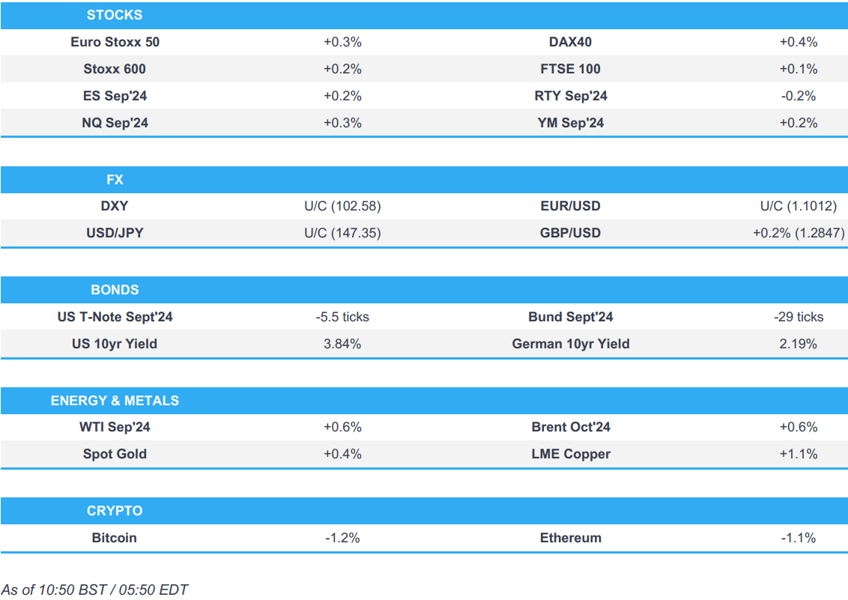

- European bourses are modestly firmer; US futures are mixed ahead of today’s jobless claims and retail sales

- Dollar is flat and AUD outperforms post-jobs data

- Bonds are modestly lower, with slight underperformance in Gilts while USTs are contained into data

- Crude is modestly firmer, XAU gains alongside strength in base metals

- Looking ahead, US NY Fed Manufacturing, Export/Import Prices, IJC, Retail Sales, Comments from Fed’s Musalem, Harker. Earnings from Deere, Alibaba & Walmart.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.2%) are modestly firmer across the board. Price action today has generally been rangebound, but some modest pressure has entered the complex in recent trade.

- European sectors hold a positive tilt; Healthcare takes the top spot, propped up by AstraZeneca (+0.9%). Insurance is also found near the top after Admiral (+7.3%) reported strong results. Travel & Leisure is at the foot of the pile.

- US Equity Futures (ES +0.1%, NQ +0.2%, RTY -0.1%) are mixed, with very slight outperformance in the NQ, ahead of a packed schedule including jobless claims, retail sales and Fed speak.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is steady and holding above 102.50 with the USD seeing a mixed performance vs. peers, ahead of key US data and Fed speak. A dovish batch of metrics could see DXY revisit the August 5th multi-month low at 102.16.

- EUR/USD is just about holding onto a 1.10 handle after pulling back from yesterday's YTD peak at 1.1047.

- GBP is one of the better performers across the majors after Q2 GDP metrics underpinned the view that the UK economy saw a solid H1. Cable has climbed from a 1.2820 low to a 1.2843 high but is yet to challenge Wednesday's 1.2868 best.

- USD/JPY remains within its recent 146-148 band as the recent impact of carry trade unwinding continues to recede.

- AUD leading the majors vs. the USD following strong jobs data overnight which was driven by full-time employment. AUD/USD as high as 0.6627 and back above its 200DMA at 0.6600.

- NOK experienced little follow-through from the Norges Bank's decision to stand pat on rates as expected and reiterate guidance.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are lower, but only modestly so, into a packed data docket. Headlined by Retail Sales while the weekly jobless claims data will draw particular focus as participants increase their focus on the jobs-side of the Fed’s dual mandate. USTs at a 113-18 base which is comfortably above the last two session’s 113-13+ and 113-02+ lows.

- Gilts are softer, and lagging slightly, after the morning’s GDP data for June/Q2. However, the release itself is perhaps not the driver behind the pressure, but more-so in a catch up play to the lows seen in APAC trade for USTs & Bunds.

- Bund benchmarks are in the red, with specific drivers and macro newsflow generally on the lighter side. Currently, Bunds at the low-end of 134.76-135.07 parameters.

- Click for a detailed summary

COMMODITIES

- Modest upward bias across crude contracts as broader market sentiment remains modestly positive and with geopolitics continuing to brew in the background as markets await the Iranian/Lebanese retaliation against Israel, with ceasefire talks due to continue in Doha (Qatar) today. Brent Oct trades in a USD 79.61-80.30/bbl parameter.

- Precious metals are firmer across the board to varying degrees despite an uneventful Dollar but against the backdrop of heightened geopolitics as Israel-Hamas ceasefire talks resume with low optimism whilst Ukraine makes ground in Russian territory. Spot gold trades in a contained USD 2,446.64-2,458.89/oz range.

- Base metals are seeing modest gains in fitting with the cautious but mildly positive sentiment across equities.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK GDP Estimate MM (Jun) 0.0% vs. Exp. 0.0% (Prev. 0.4%); YY 0.7% vs. Exp. 0.8% (Prev. 1.4%); 3M/3M 0.6% vs. Exp. 0.6% (Prev. 0.9%, Rev. 0.8%)

- UK GDP Prelim QQ (Q2) 0.6% vs. Exp. 0.6% (Prev. 0.7%); YY 0.9% vs. Exp. 0.9% (Prev. 0.3%)

NOTABLE EUROPEAN HEADLINES

- Norges Bank maintains its Key Policy Rate at 4.50% as expected, reiterates “policy rate will likely be kept at the current level for some time ahead”. Click for full details

- Norges Bank Governor notes of a "very high" threshold for Norges Bank to intervene in FX to support the NOK; adds a floating NOK is an advantage; no new prognosis on when the first rate cut will come. Not targeting a particular NOK level. Norges cares about the NOK due to its effects on inflation. Norges has information since the last rate meeting, but information pulling the bank in different directions. No new prognosis on when the first rate cut will come. Regarding debate on pegging NOK to EUR, says the Bank follows the mandate given.

NOTABLE US HEADLINES

- Fed's Bostic (voter) is open to a September rate cut as inflation cools and said as price pressures ease officials also need to be conscious of their mandate of maintaining full employment, while he added the labour market is weakening but is not weak, according to FT.

GEOPOLITICS

MIDDLE EAST

- US Secretary of State Blinken and Qatar’s PM warned all sides not to undermine Gaza ceasefire talks set to open in the Gulf nation, in a veiled warning to Iran, Hamas and Israel, according to Al Arabiya.

- US sources told Axios that former President Trump spoke with Israeli PM Netanyahu on Wednesday and encouraged Netanyahu to accept the deal to free hostages and for a ceasefire in Gaza.

- IRGC-linked hacking group APT42 has been targeting personal accounts of individuals connected to President Biden, VP Harris, and former President Trump, including current and former government officials, as well as those involved with their campaigns, according to Iran International citing Google.

- Hamas told mediators it was ready to meet them after today's talks "if there are developments or a serious response from Israel", via Sky News Arabia.

- "The Israeli delegation for the hostage deal talks has left Israel towards Doha", via Kann's Stein citing ItayBlumental.

OTHER

- Russia conducted a missile attack on Ukraine's Odesa which targeted port infrastructure and injured one person, according to Reuters citing the regional governor.

- South Korean President Yoon laid out the blueprint for establishing a unified Korea and said the freedoms enjoyed in the South must be extended 'to the frozen kingdom of the North'. Yoon said they will create a North Korean human rights fund to support activists and offered to create a working-level consultation body with North Korea, while he added they are ready to begin political and economic cooperation if North Korea takes the initial step to denuclearise.

CRYPTO

- Bitcoin slipped below USD 58k in early European trade, before reclaiming the level, but still remains modestly lower on the session thus far.

APAC TRADE

- APAC stocks shrugged off the mixed lead from the US and gained as participants digested a slew of key data.

- ASX 200 traded higher but with gains capped as participants digested earnings releases and jobs data.

- Nikkei 225 was among the biggest gainers after GDP data topped forecasts and showed a return to growth.

- Hang Seng and Shanghai Comp. gradually advanced in the aftermath of mixed Chinese activity data in which industrial production disappointed but retail sales topped forecasts, while Chinese indices were also unfazed by the steeper contraction in home prices. Furthermore, the PBoC delayed its MLF operation to later in the month but announced a firm liquidity injection via 7-day reverse repos which is meant to counteract maturing MLF loans, tax payments and government bond issuance.

NOTABLE ASIA-PAC HEADLINES

- PBoC announced it will conduct its MLF operation on August 26th and injected CNY 577.7bln via 7-day reverse repos, while it added that the reverse repo operation today is meant to counteract maturing MLF loans, tax payments and government bond issuances.

- China's stats bureau said China's economic operation was generally stable in July but noted a rising negative impact from changes to China's external environment, while it stated the economic recovery trend needs to be consolidated and expects the recovery in consumption to consolidate as policies gain traction. Furthermore, it said domestic demand is likely to improve due to policy support and Chinese foreign trade remains resilient despite rising protectionism.

- RBNZ Governor Orr addressed a parliamentary committee in which he stated that CPI is returning sustainably to the target band of 1%-3% and the current economic environment is weak with the economy weaker than anticipated six months ago. Orr added there is no talk on the committee of raising rates again and policy discussions in the future will focus on whether to maintain or reduce rates, as well as noted that they are to proceed with caution in adjusting interest rates and that removing restraint is appropriate for now.

- China's Commerce Ministry is to impose export controls on antimony (semi-metal) and other metals from 15th September.

- Earthquake in Taiwan reported to be magnitude 5.7 (vs prelim 4.7), striking off Taiwan's North-eastern Coast, according to Central Weather Bureau.

DATA RECAP

- Chinese Industrial Production YY (Jul) 5.1% vs. Exp. 5.2% (Prev. 5.3%)

- Chinese Retail Sales YY (Jul) 2.7% vs. Exp. 2.6% (Prev. 2.0%)

- Chinese Urban Investment (YTD) YY (Jul) 3.6% vs. Exp. 3.9% (Prev. 3.9%)

- Chinese Urban Unemployment Rate (Jul) 5.2% (Prev. 5.0%)

- Chinese House Prices YY (Jul) -5.0% (Prev. -4.5%)

- Japanese GDP QQ (Q2) 0.8% vs. Exp. 0.5% (Prev. -0.7%, Rev. -0.6%)

- Japanese GDP QQ Annualised (Q2) 3.1% vs. Exp. 2.1% (Prev. -2.9%, Rev. -2.3%)

- Australian Employment (Jul) 58.2k vs. Exp. 20.0k (Prev. 50.2k)

- Australian Full Time Employment (Jul) 60.5k (Prev. 43.3k)

- Australian Unemployment Rate (Jul) 4.2% vs. Exp. 4.1% (Prev. 4.1%)

- Australian Participation Rate (Jul) 67.1% vs. Exp. 66.9% (Prev. 66.9%)