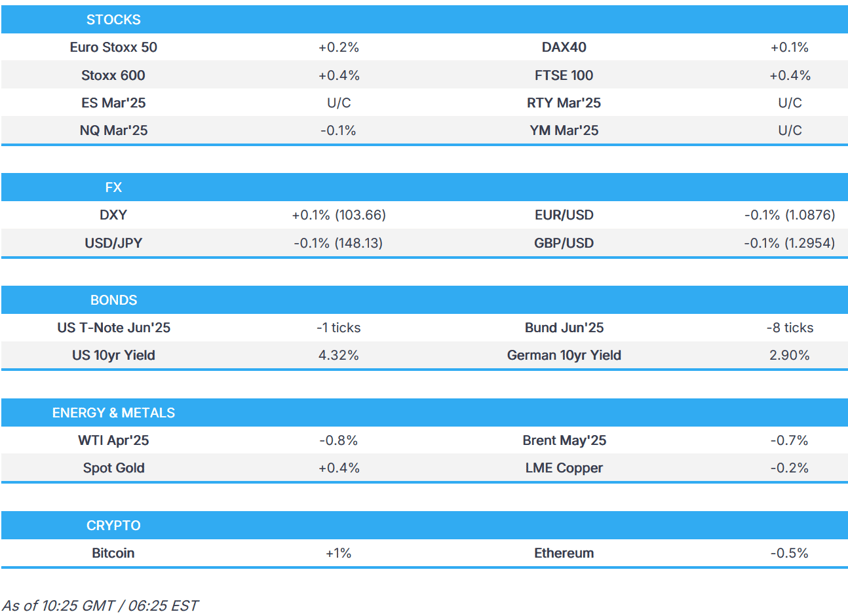

- European bourses opened lower but have gradually picked up; US futures are modestly lower/flat.

- USD is steady ahead of PPI metrics, fleeting EUR softness as German political tensions mount.

- Bunds are modestly lower awaiting the Bundestag debate while USTs look to PPI and shutdown developments.

- Industrial commodities softer on tariff woes; spot gold inches closer to all-time-highs.

- Looking ahead, US Initial Jobless Claims, US PPI, Speakers including ECBʼs Lagarde, Holzmann, Villeroy, Supply from the US.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- US Secretary of State Rubio is to today meet with Canada's Foreign Minister Joly in Charlevoix, Canada.

- US food giants including PepsiCo (PEP) and Conagra (CAG) are reportedly pushing to exempt certain imports from tariffs, according to the trade group.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.3%) opened mostly lower, but sentiment has improved as the morning progressed to display a modestly positive picture in Europe.

- European sectors are mixed, and holds a slight defensive bias; Telecoms is towards the top of the pile, joined closely by Healthcare, which is propped up by Novo Nordisk (+3%); the Co. benefits from a broker upgrade at Kepler and as it bounces back from recent losses. Autos sits at the foot of the pile, with no clear driver but with tariff uncertainty still at the forefront of traders minds.

- US equity futures (ES -0.1%, NQ U/C, RTY -0.1%) mixed/modestly lower, taking a breather from the upside seen on Wednesday. Focus today is on US PPI, which does follow a softer-than-expected CPI report on Wednesday.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is incrementally firmer/flat and trades within a 103.50-76 range, as traders await US PPI and weekly jobless claims. The former includes key components which feed into the Fed's preferred US PCE measure; following the softer-than-expected CPI yesterday, JP Morgan provisionally forecasted core PCE to have risen 0.31% M/M; this would lift Y/Y to 2.7% (prev. 2.6%). Trade updates will of course also be in focus, as will any commentary surrounding a potential US shutdown.

- EUR is a little lower and trades within a 1.0860-97 range, with a slew of ECB speakers set to appear throughout the day. Traders will keep an keen out on any commentary out of Germany, where the Bundestag is set to debate fiscal reform. Commentary this morning has come via a German Green Party official who said there is no progress in talks with CDU/CSU and SPD on debt plans; remarks which sparked some modest pressure in the Single-currency, which entirely pared soon after. Elsewhere, on the growth front for Germany; IfW Institute raised its 2026 GDP forecast, citing tailwinds from a boost in public spending under incoming Chancellor Merz.

- GBP is a little lower and ultimately trading rangebound, given the lack of UK-specific updates, but ahead of GDP figures on Friday. High for the day sits at 1.2973, a little shy of the prior day's peak at 1.2987.

- JPY was the marginal G10 outperformer, before then paring the upside as the day progressed. USD/JPY currently sits at the mid-point of a 147.59-148.37 range. Overnight, BoJ Governor Ueda said underlying inflation remains slightly below 2% but expects it to gradually accelerate as the economy recovers, while he added that the BoJ is gradually shrinking the size of its balance sheet and will take time to assess the ideal size, considering overseas examples.

- Antipodeans are the clear underperformers today, largely a factor of the subdued risk tone in Asia overnight and in a slight paring of the upside seen on Wednesday.

- PBoC set USD/CNY mid-point at 7.1728 vs exp. 7.2439 (Prev. 7.1696).

- Canadian Prime Minister-designate Mark Carney will be officially sworn in on Friday and is to shrink the cabinet when he takes over with the cabinet expected to have between 15 and 20 ministers, down from the current 37, according to Bloomberg

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are flat, after spending the early portion of the morning a little firmer following a strong 10yr auction, which garnered strong demand with a stop-through of 0.5bps. Back to today, US paper has held a downward bias, in tandem with pressure seen in Bunds. Focus today will be on the US PPI, where some components will feed into the US PCE metric. Sentiment has also taken a slight hit following updates out of Washington; US Senate Democratic Leader Schumer said Senate Republicans do not have the votes to approve the House-passed government spending bill without amendments. On the supply front, a 30yr auction is due.

- Bunds are on the backfoot, after spending most of the morning firmer; the complex has slipped from a intraday high of 127.53 to a current trough of 126.93. All eyes are on the German Bundestag today, where the main German officials involved will each outline their approaches and views before a general debate. Pre-debate commentary thus far has come via a German Green Official who said that there has been no progress in talks on debt plans; this sparked some modest upside in German paper, before entirely paring. More recently, a Greens official said there has been no rapprochement so far and will continue to reject the draft legislation; remarks which knee-jerked Bunds, but proved fleeting. Ultimately focus will be on the debate at 11:00 GMT / 07:00 EDT. Ahead, a slew of ECB members are set to speak throughout the day.

- Gilts are lower by a handful of ticks and directionally in-fitting with peers; UK-specific newsflow has been light this week, but picks up in the form of GDP figures on Friday.

- Italy sells EUR 6.75bln vs exp. EUR 5.5-6.75bln 2.65% 2028, 2.45% 2033, 4.30% 2054 BTP and EUR 1.5bln vs exp. EUR 1.25-1.5bln 4.00% 2031 Green BTP.

- Click for a detailed summary

COMMODITIES

- Crude has been exceptionally choppy today, but is now firmly in the red and resides at session lows. Early morning trade saw a pick up in oil prices, but lacked any fundamental driver. Thereafter, crude dipped off best levels and continued lower after some US-Russia related updates; the first bout of pressure stemmed from reports that US Envoy Witkoff's plan crossed the Russia border (has since landed). A second leg lower was seen after Russia's Kremlin said President Putin may have an international call later on Thursday, and also pushed back on reports that it had laid out demands for talks. Brent'May currently at the bottom end of a USD 70.43-71.25/bbl range.

- Spot gold is firmer by around USD 12/oz, continuing the upward momentum following the US CPI report on Wednesday. Currently sits at the top end of a USD 2,933.03-2,947.15/oz range.

- Base metals hold a negative bias, following a subdued session in Asia overnight. 3M LME copper resides in a current USD 9,721.42-9,811.90/t range.

- Citi forecasts Dutch TTF and JKM gas prices are likely to be rangebound in respective EUR 34-35/MWh and USD 11.50-13.50/MMBtu ranges during Q2-2025.

- IEA OMR: Cuts 2025 oil demand growth forecast to 1.03mln BPD (prev. 1.1mln BPD); "the scope and scale of tariffs remains unclear, and with trade negotiations continuing apace, it is still too early to assess the impact on the market outlook".

- Saudi Crude oil supply to China set to fall to 34mln/bbls in April, according to Reuters sources.

- Qatar set to start supplying Syria with gas via Jordan with Washington's approval, according to Reuters sources.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK RICS Housing Survey (Feb) 11.0 vs. Exp. 20.0 (Prev. 22.0, Rev. 21.0)

- EU Industrial Production YY (Jan) 0.0% vs. Exp. -0.9% (Prev. -2.0%); Industrial Production MM (Jan) 0.8% vs. Exp. 0.6% (Prev. -1.1%, Rev. -0.4%)

NOTABLE EUROPEAN HEADLINES

- German Green Party official says there is no progress in talks with CDU/CSU and SPD on debt plans, via an RTL interview.

- German Greens Spokesperson says there is no rapprochement so far in talks with the SPD and CDU/CSU; will continue to reject the draft legislation of the CDU and SPD.

- ECB's Nagel says US trade tariffs on the EU could push Germany into a recession in 2025.

- ECB's Kazaks says "I cannot say everything is done on inflation"; rates will be decided meeting by meeting amid uncertainty.

- ECB's Rehn says you can only hope that the Trump administration can respect central bank independence; should aim at negotiated solutions for US tariffs, encourage the administration to avoid the unnecessary and harmful measures.

- IFW Institute says German economy is expected stagnate in 2025 (unchanged from prev. forecast); to grow by 1.5% in 2026 (prev. forecast of 0.9%); anticipates tailwinds from a public spending boost that incoming Chancellor Merz is pushing for.

NOTABLE US HEADLINES

- US Treasury Secretary Bessent spoke with congressional leaders about making Trump tax cuts permanent and said that is what they will deliver, according to Fox Business's Lawrence.

GEOPOLITICS

MIDDLE EAST

- Hamas official said they welcomed US President Trump's apparent retreat from calls for the displacement of Gazans.

RUSSIA-UKRAINE

- Russian Foreign Minister says the deployment to Ukraine of foreign military personnel under any flag as unacceptable. Russia considers any foreign military bases in Ukraine as unacceptable. Deployment of troops or building bases in Ukraine would mean direct involvement of these countries into the conflict with Russia. Russia would respond with all available means to deployment of foreign troops and bases in Ukraine.

- US Envoy Witkoff has arrived in Moscow, according to TASS.

- Russia's Kremlin says Russian President Putin may have an international phone call on later on Thursday; on reports that Russia has laid out demands for talks, says there is a huge amount of misinformation out there; confirms US envoy is flying to Russia. US National Security advisor Waltz spoke with Russia's Ushakov

- US Envoy Witkoff's plane has crossed the Russian border, according to Tass citing Flightradar.

- Russian President Putin said troops should defeat the enemy in the Kursk region and completely liberate the region, while it was also reported that Russia's Chief of the General Staff said Kyiv's plans in Kursk region failed and Ukrainian forces in the Kursk region are surrounded, according to IFX. It was later reported that the Kremlin said the operation in the Kursk region is at the final stage, according to TASS.

- "Kremlin: Putin may comment today on the proposal for a ceasefire in Ukraine", according to Al Arabiya.

OTHER

- Polish President Duda urged for the US to move nuclear warheads to Polish territory, according to FT.

CRYPTO

- Bitcoin is a little firmer and trades just above USD 83k whilst Ethereum remains flat and holds shy of USD 1.9k.

- Ripple (XRP) Secures Dubai License for Crypto Payments in the UAE

APAC TRADE

- APAC stocks were subdued as risk appetite soured despite the mostly positive handover from Wall St where sentiment was underpinned after softer-than-expected CPI data but with the upside capped as concerns lingered.

- ASX 200 was dragged lower by consumer stocks, energy and financials, with the consumer sector pressured as electricity bills are to jump as much as 9% in a cost-of-living blow following the energy regulator’s price ruling.

- Nikkei 225 initially outperformed and briefly reclaimed the 37,000 level before wiping out the gains.

- Hang Seng and Shanghai Comp gradually deteriorated following a tepid PBoC liquidity operation and with participants unfulfilled by the lack of policy action so far by the central bank post-NPC, while reports that Hong Kong is mulling reducing thresholds for purchasing the most expensive stocks did little to spur a bid.

NOTABLE ASIA-PAC HEADLINES

- PBoC says will lower rates and the RRR at a "proper time"; will keep liquidity ample. Will guide social financing costs lower. Will balance short and long-term developments. Will keep CNY basically stable at a reasonable and balanced level. Will strengthen expectation guidance.

- BoJ Governor Ueda said underlying inflation remains slightly below 2% but expects it to gradually accelerate as the economy recovers, while he added that the BoJ is gradually shrinking the size of its balance sheet and will take time to assess the ideal size, considering overseas examples. Ueda also said Japan’s monetary base and balance sheet are somewhat too big which is why bond buying is being slowed.

- Hong Kong mulls reducing thresholds for purchasing the most valuable stocks, according to Bloomberg.

- Japan's Bankers Association Chair says market view on BoJ's terminal rate have risen more than expected; long-term interest rates have scope to rise further due to BoJ rate hikes and bond-buying taper.

- Acer (2353 TW) FY (TWD): net 5.54bln (+2.1% Y/Y); plans to raise up to TWD 10bln via unsecured bond; cash dividend of 1.7/shr; will de-list its GDR from LSE.