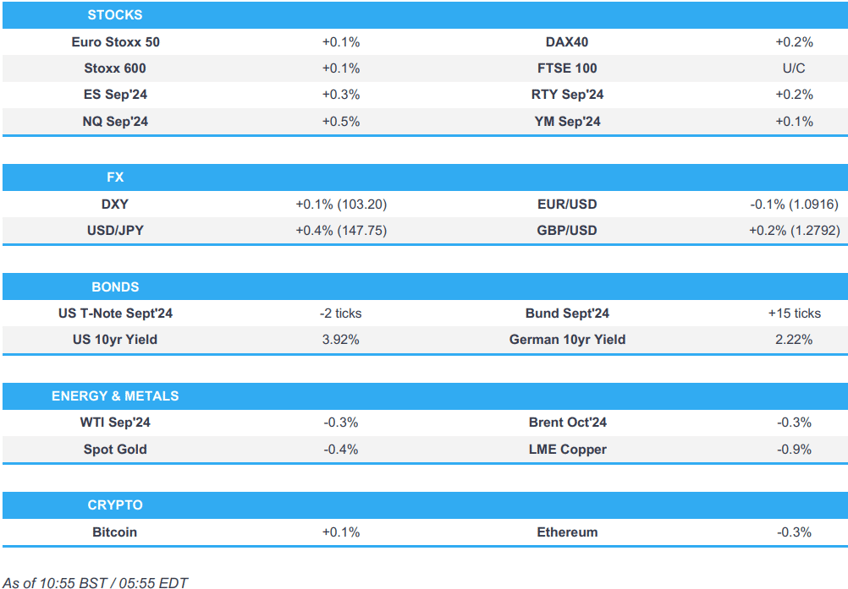

- A choppy session for European equities thus far, now currently modestly higher; US equity futures entirely in the green

- Dollar is softer vs the Antipodeans but gains vs the typical havens, GBP benefits post-jobs data

- USTs are flat awaiting today’s US PPI, Bunds benefit from dire German ZEW metrics

- Crude is slightly softer, XAU is lower but within a tight range, base metals are entirely in the red

- Looking ahead, US PPI, Comments from Fed’s Bostic

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.1%) started the session entirely in the green but succumed to some early morning pressure, which has since pared in recent trade; as it stands, indices are generally in the green.

- European sectors are mixed, having initially opened with a positive bias. Travel & Leisure is found at the foot of the pile, hampered by the recent advances in oil prices. Basic Resources also lags amid the weakness in the metals complex.

- US Equity Futures (ES +0.3%, NQ +0.5%, RTY +0.2%) are modestly firmer as traders remain mindful of today’s US PPI figures, ahead of CPI tomorrow.

- Firms have reportedly started testing Huawei's new Ascend 910C chips, according to WSJ sources; Huawei in talks to secure tens of thousands of chips; framed as a "challenge" to Nvidia (NVDA) on AI hardware.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is a touch firmer (within a 103.08-27 range) with the USD showing a mixed performance vs. peers (softer vs. risk currencies/firmer vs. havens). Today's focus for the greenback will fall upon PPI metrics, albeit any reaction may tempered somewhat by the fact that CPI is due out tomorrow.

- EUR is softer vs. the USD with a disappointing German ZEW release adding to the woes for the region's outlook. EUR/USD is managing to hold above yesterday's 1.0910 low.

- GBP was given a boost by UK jobs metrics which saw an unexpected fall in the unemployment rate, albeit, the usual data reliability caveats apply. BoE pricing points to a 66% chance of an unchanged rate in September.

- USD is edging gains vs. JPY with the dollar firmer vs. havens alongside gains in stocks. For now, USD/JPY is respecting yesterday's 146.41-148.22 range.

- Antipodeans are both benefitting vs. the USD with the Dollar currently losing out to cyclical fx currencies.

- PBoC set USD/CNY mid-point at 7.1479 vs exp. 7.1760 (prev. 7.1458)

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are essentially unchanged and awaiting PPI before Wednesday’s US CPI for insight into PCE at the end of the month, a figure which is scheduled for the week after the Jackson Hole symposium. Into the release, USTs are in a narrow 113-04 to 113-11+ band.

- Bunds are firmer but ultimately rangebound, continuing the holiday-thinned action seen on Monday. ZEW was particularly poor, with the strongest decline of expectations reported for two years, sparking a modest uptick in Bunds to re-approach their earlier 134.65 peak. No real reaction to subsequent Schatz supply.

- Gilts gapped slightly higher at the open to 99.82 from a 99.72 close on Monday, despite a hawkish reaction seen in the Pound following the release. Benchmarks did pull back off these levels ahead of the regions supply, but caught another bid following the robust auction but also in tandem with Bunds, which benefited from the dire German ZEW metrics. Gilts are now back towards their 99.88 peak.

- UK sells GBP 3bln 3.75% 2038 Gilt: b/c 3.28x (prev. 3.42x), average yield 4.131% (prev. 4.314%) & tail 0.1bps (prev. 0.1bps)

- Germany sells EUR 4.038bln vs exp. EUR 5bln 2.70% 2026 Schatz: b/c 2.1x (prev. 2.0x), average yield 2.38% (prev. 2.73%) and retention 19.24% (prev. 18.08%)

- Click for a detailed summary

COMMODITIES

- Crude is slightly subdued intraday but holding onto a bulk of yesterday's gains amid geopolitical uncertainty. Two major risks include the threat of a retaliation against Israel from Iran and Lebanon, whilst Ukraine's gains inside Russia could lead to increased tensions between the West and Moscow. Brent trades towards the upper end of a USD 81.50-82/bbl parameter (vs 82.40/bbl high yesterday).

- Precious metals trade lower amid the rising Dollar and as newsflow remains light thus far, with participants awaiting potential geopolitical escalations before or after US CPI tomorrow.

- Base metals trade lower across the board amid the cautious risk tone coupled with the firmer Dollar.

- US Department of Energy said the US seeks to buy 6mln bbls of oil to help replenish the SPR.

- IEA OMR: Maintains 2024 world oil demand growth forecast unchanged at 970k BPD; cuts 2025 forecast by 30k BPD; says weak growth in China now significantly drags on global gains - Chinese oil demand contracted for the third straight month. OPEC+ cuts are tightening physical markets. For now, supply is struggling to keep pace with peak summer demand - tipping the market into a deficit. Global observed oil inventories fell by 26.2mln bbls in June after four months of builds. US summer driving season set to be strongest since the pandemic.

- Workers at BHP's Escondida copper mine in Chile will begin strike action, according to the union.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK ILO Unemployment Rate (Jun) 4.2% vs. Exp. 4.5% (Prev. 4.4%), Employment Change (Jun) 97k vs. Exp. 3k (Prev. 19k)

- UK Average Week Earnings 3M YY (Jun) 4.5% vs. Exp. 4.6% (Prev. 5.7%); ex-Bonus 5.4% vs. Exp. 5.4% (Prev. 5.7%, Rev. 5.8%)

- German ZEW Economic Sentiment (Aug) 19.2 vs. Exp. 32.0 (Prev. 41.8); Current Conditions (Aug) -77.3 vs. Exp. -75.0 (Prev. -68.9); Economic outlook for Germany is breaking down, in the current survey, we observe the strongest decline of the economic expectations over the past two years; economic expectations for the EZ, the US and China also deteriorate markedly. It is likely that economic expectations are still affected by high uncertainty. Most recently, this uncertainty expressed itself in a turmoil on international stock markets.

- EU ZEW Survey Expectations (Aug) 17.9 (Prev. 43.7)

- Kantar: UK Grocery Inflation 1.8% (prev. 1.6% M/M), in the four-weeks to August 4th; UK grocery price inflation warms up for the first time since March 2023.

- Spanish HICP Final YY (Jul) 2.9% vs. Exp. 2.9% (Prev. 2.9%); MM -0.7% vs. Exp. -0.7% (Prev. -0.7%)

- Spanish CPI YY Final NSA (Jul) 2.8% vs. Exp. 2.8% (Prev. 2.8%); MM -0.5% vs. Exp. -0.5% (Prev. -0.5%); Core YY (Jul) 2.8% (Prev. 3.0%)

GEOPOLITICS

MIDDLE EAST

- Israeli forces stormed the city of Nablus in the northern West Bank from the Al-Tur military checkpoint, according to Al Jazeera.

- Source close to Hezbollah said Iran expressed concern that Israel and the US may strike its nuclear program and fears they will use the outbreak of any large-scale conflict as a pretext to neutralise Iran's nuclear deterrence, according to a report by The Washington Post.

- US and Israeli officials said their assessment was that the Iranian attack wouldn't happen on Monday night, while President Biden's top Middle East adviser will travel to Cairo for talks on security arrangements along the Egypt-Gaza border which is critical for a hostage deal, according to Axios's Ravid.

- US State Department said Secretary of State Blinken discussed in a call with his Turkish counterpart the importance of Hamas's return to negotiations in the middle of this month, while Blinken stressed the importance of completing the framework agreement for an immediate and permanent ceasefire in Gaza and the release of hostages, according to Al Jazeera.

- FBI was reportedly investigating suspected hacking attempts by Iran in the Biden and Trump campaigns, according to Reuters and The Washington Post.

- "Israeli Army Radio: Israel told allies that it would respond to any Iranian attack by hitting targets in the heart of Iran", according to Al Jazeera.

- "Hamas will participate in the round of negotiations expected next Thursday", according to Sky News Arabia citing CNN sources

OTHER

- Russia's Intelligence Service suggest Ukrainian President Zelensky is taking steps that threaten escalation far beyond Ukraine, via Ria.

CRYPTO

- Bitcoin is trading incrementally firmer and trading just below USD 59k, whilst Ethereum slips to USD 2640.

APAC TRADE

- APAC stocks followed suit to the mixed lead from the US ahead of key data and as markets continue to brace for Iran's retaliation.

- ASX 200 traded indecisively after mixed data releases and as gains in financials, real estate and the commodity-related sectors were counterbalanced by losses in tech, telecoms and defensives.

- Nikkei 225 surged on return from the long weekend and reclaimed the 36,000 status after returning to last week's pre-turmoil levels.

- Hang Seng and Shanghai Comp. were indecisive with the former supported in energy stocks after yesterday's oil rally, while the mainland index oscillated between gains and losses in a tight range owing to the lack of fresh macro drivers.

NOTABLE ASIA-PAC HEADLINES

- China's Vice Premier Liu called for efforts to minimise damage to agricultural production caused by torrential rains and flooding, as well as urged efforts to improve the agricultural sector's capacity for disaster prevention and mitigation. China's Vice Premier also said they need to step up financial support for the restoration of agricultural production, according to Xinhua.

- China's Hesai is to be removed from the US Defence Department blacklist, according to FT.

- Japan's parliament is to hold a special session at the Lower House committee on August 23rd to discuss the BoJ rate hike, while BoJ Governor Ueda is likely to be asked to attend the special session, according to sources cited by Reuters.

- China M2 (July): 6.3% (exp. 6.1%); Total Social Financing (CNY) 770bln (exp. 1.1tln)

DATA RECAP

- Japanese Corp Goods Price MM (Jul) 0.3% vs. Exp. 0.3% (Prev. 0.2%); YY (Jul) 3.0% vs. Exp. 3.0% (Prev. 2.9%)

- Australian Wage Price Index QQ (Q2) 0.8% vs. Exp. 0.9% (Prev. 0.8%); YY 4.1% vs. Exp. 4.0% (Prev. 4.1%)

- Australian Consumer Sentiment (Aug) 2.8% (Prev. -1.1%)

- Australian NAB Business Confidence (Jul) 1.0 (Prev. 4.0); Conditions 6.0 (Prev. 4.0)