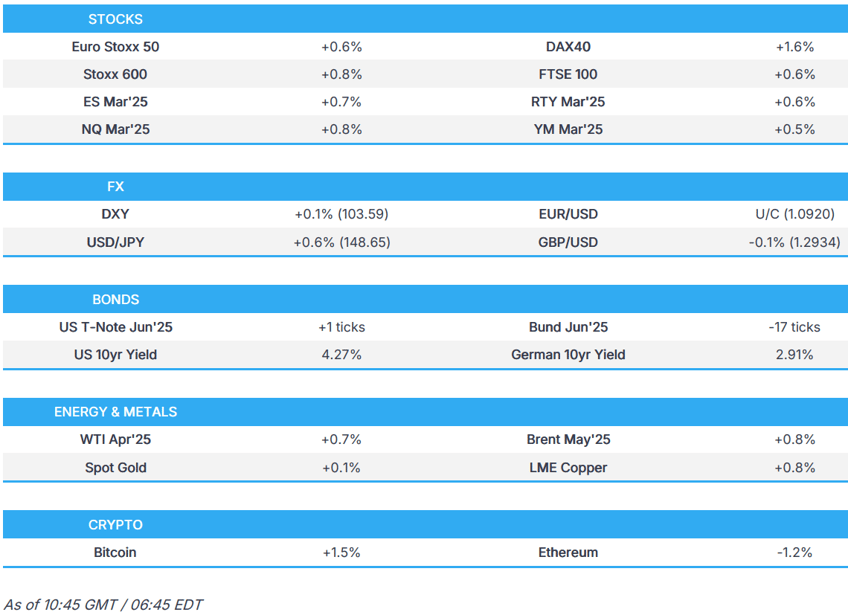

- European bourses are in the green as sentiment in the complex improves; US futures are also higher with the NQ slightly outperforming.

- USD is a little firmer ahead of US CPI data, JPY lags peers.

- Bonds are bearish overall amid supply, inflation updates & German fiscal developments.

- Oil and base metals firmer, gold trades sideways ahead of US CPI.

- Looking ahead, US CPI, BoC & NBP Policy Announcements, OPEC MOMR, US 25% tariff on all imports of steel and aluminium come into effect, Speakers including RBA's Jones, ECB's Centeno, Nagel, Lane & BoC's Macklem, Supply from the US, Earnings from Adobe.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- US President Trump's 25% tariffs on steel and aluminium took effect with no exemptions.

- US President Trump separately commented that tariffs are having and will have a tremendously positive impact, while he also suggested tariffs may go higher than 25% but did not specify which tariffs.

- Senior EU Official says confirms it is monitoring to see if Chinese steel overcapacity is re-routed to Europe, and "we stand ready to take measures where we need to take those measures", via SCMP's Birmingham. "We may indeed have to take further measures to deal with this indirect consequence of the US tariffs."

- Canada's Energy Minister said at CERAWeek that Canada may implement non-tariff measures such as restricting oil exports if the trade war with the US escalates and that ethanol is absolutely on the list of potential retaliatory tariffs being considered. Canada's Energy Minister also said Canada will respond shortly if tariffs come into play and will wait and see on tariffs, as well as noted that Canada does not want to provoke or escalate and seeks a positive outcome.

- EU Commission launched countermeasures on US imports in which it will allow the suspension of existing 2018 and 2020 countermeasures against the US to lapse on April 1st, while it is putting forward a package of new countermeasures on US exports. Furthermore, it stated that EU countermeasures could apply to US goods exports worth up to EUR 26bln to match the economic scope of the US tariffs but added the EU remains ready to work with the US administration to find a negotiated solution.

- French European Affairs Minister Haddad says, on EU's response to Trump tariffs, "we can go further"; reaffirms trade war is in no one's interest. Thereafter, EU Commission President von der Leyen says countermeasures will match the scope of US tariffs and will be entirely in place by April 13th.

- UK Business and Trade Secretary Reynolds said it is disappointing the US has imposed global tariffs on steel and aluminium, while he stated that negotiations are ongoing for a wider economic agreement with the US to eliminate additional tariffs.

- Australian PM Albanese reiterated they will not impose reciprocal tariffs on the US and will continue to engage with the US on tariffs.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.8%) are stronger today, and sentiment in the complex improves following the hefty downside seen on Tuesday and as the region reacts to Ukraine ceasefire optimism.

- European sectors hold a strong positive bias; Construction & Materials tops the pile, whilst Retail is the clear laggard. The latter is pressured by post-earning losses in Inditex (-8.2%, slow start to Q1) and Puma (-24%, very weak 2025 outlook). In terms of key movers today; Zealand Pharma (+25%) opened higher by 45% after it secured a deal with Roche (+3%) to collaborate on obesity drugs; Novo Nordisk (-5%).

- US equity futures (ES +0.7%, NQ +0.8%, RTY +0.6%) are firmer, attempting to stabilise from some of the hefty pressure seen in recent weeks; the NQ is the very marginal outperformer, with the index benefiting from pre-market strength in Intel (+8%) after it was reported that TSMC pitched an Intel foundry JV to some US chip designers. US CPI due later today.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY spent much of the morning essentially flat, having pared overnight strength as the index initially attempted to make back some of the pressure seen on Tuesday. More recently, it has lifted towards the upper end of a 103.43-71 range. Focus has been on the trade front, whereby US President Trump's 25% tariffs on steel and aluminium took effect with no exemptions, but did cancel 50% tariff on Canada. Furthermore, the EU Commission launched countermeasures on US imports with measures to come into force by April. Tariffs aside, US inflation data will be in focus.

- EUR is flat after trading lower in overnight trade, giving back some of the strength seen on the back of news Ukraine ceasefire optimism; currently at the upper end of a 1.0888-1.0923 range. As mentioned above, the EU Commission launched countermeasures on US imports; a senior EU Official suggested more measures may need to be taken place. In terms of EU-China; the Official said the bloc stands ready to take any measures in reference to re-routed Chinese steel, if it leads to overcapacity. In terms of monetary policy, a slew of ECB speakers have appeared at the ECB Watchers Conference, but their remarks had little impact on the Single-Currency.

- JPY is the clear underperformer today, with USD/JPY currently just off sessions highs at 148.65; further upside may see a test of the 149.00 mark, and then a recent high at 149.33 thereafter. Today saw commentary via BoJ Governor Ueda who said he is very worried about uncertainty regarding overseas economy and prices; he also noted that the BoJ is ready to conduct bond buying operation nimbly in exceptional cases, when long-term rates make irregular moves.

- GBP is essentially flat in what has been a quiet UK-specific session thus far; newsflow unlikely to pick up until Friday's GDP figures. Cable currently at the mid-point of a 1.2914-56 range.

- Antipodeans are flat and trade rangebound, with a lack of pertinent newsflow for the region thus far; focus of course has been on trade developments (discussed above).

- CAD is steady vs. the USD after a choppy session in which the trade agenda dominated price action. To recap events, US President Trump backed down from his plans to double tariffs on Canadian steel and aluminium imports to 50%. This followed the decision by the Ontario Premier to suspend its electricity surcharge on the US. Nonetheless, 25% tariffs on Canadian steel and aluminium have gone ahead.

- PBoC set USD/CNY mid-point at 7.1696 vs exp. 7.2324 (Prev. 7.1741).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are firmer by a handful of ticks, but do hold a downward bias, in tandem with peers. Currently trading at the bottom end of a 110-26+ to 111-02 range. Focus today has been on the Trump's rollout of the 25% tariffs on steel and aluminium took effect with no exemptions; however, the President did rollback the 50% tariff on Canadian steel/aluminium after Ontario suspended the 25% energy surcharge. Ahead, traders will remain laser focused on the US inflation data; particularly in the context of some of the economic activity woes displayed by data in the past few weeks. Also today, USD 39bln worth of 10yr notes due.

- Bunds are in the red, albeit modestly so. Currently trading around the 127.00 mark, in a 126.69-127.14 range. From a yield perspective the German 10yr has topped 2.9%; as a reminder the upside over the past week is attributed to Germany's defence spending plans. As for today the benchmark digests the inflationary implications of the EU tariff countermeasures on Trump’s metal tariffs; elsewhere, there has been a slew of ECB appearances, but with not one member sparking a significant move in German paper. ECB President Lagarde highlighted the need to set policy that it converges towards the 2% target. Ahead, markets await a few more ECB speakers as well as the Bank's Wage Tracker.

- Gilts are a little lower, and to a similar magnitude as Bunds; UK-specific newsflow has been light, with the next update out of the region coming on Friday (GDP metrics). Currently in a very tight 91.66-91.90 range. Some modest pressure was seen following the 2035 Gilt auction; b/c was strong (though just shy of the 3x mark), whilst the yield tail was a little high.

- UK sells GBP 4bln 4.5% 2035 Gilt: b/c 2.92x, average yield 4.679%, and yield tail 0.5bps.

- Germany sells EUR 3.455bln vs exp. EUR 4.5bln 2.5% 2035 Bund: b/c 2.1x (prev. 2.8x), average yield 2.92% (prev. 2.52%) & retention 23.22% (prev. 22.8%)

- Click for a detailed summary

COMMODITIES

- Crude is firmer today, benefitting from the generally positive risk tone, and shrugging off overnight indecisiveness after the larger-than-expected build for headline crude. The overarching theme for the complex is the optimism surrounding a 30-day Ukraine ceasefire deal; Ukraine seem ready, whilst Russian sources suggests that "It is difficult for Putin to agree to this in its current form". Brent'May 25 currently sits towards the upper end of a USD 70.33-69.80/bbl range.

- Spot gold is firmer by around USD 4.5/oz; the yellow-metal traded rangebound overnight, but did climb out of those confines in early European trade, to currently sits at session highs of USD 2925.34/oz.

- Base metals are entirely in the green, continuing to build on the prior day's upside; the complex is seemingly unfazed by the recent tariff updates. On that, US President Trump's 25% tariffs on steel and aluminium took effect with no exemptions and cancelled the 50% tariff on Canada, after Ontario's decision to suspend the 25% energy surcharge. 3M LME copper current trades in a USD 9,646.40-9,748.95/t parameter.

- US Private Inventory Data (bbls): Crude +4.2mln (exp. +2.0mln), Distillate +0.4mln (exp. -0.8mln), Gasoline -4.6mln (exp. -1.9mln), Cushing -1.2mln.

- Kazakhstan has yet to deliver oil output and CPC blend crude export cuts in March, according to sources cited by Reuters.

- India's Russian oil imports have recovered in March after a three-month decline following US sanctions, according to trading sources and shipping data cited by Reuters.

- Click for a detailed summary

NOTABLE DATA RECAP

- Spanish Retail Sales YY (Jan) 2.2% (Prev. 4.0%)

NOTABLE EUROPEAN HEADLINES

- Portugal's Parliament rejected the motion of confidence in the centre-right government, causing its collapse.

- SEB, on the Norges Bank following hot February CPI, writes: "We are still leaning towards a March cut, absent any upside surprises in the Regional Network Report".

- ECB's Centeno says the EZ economy remains burdened by higher rates, according to WSJ.

- ECB President Lagarde says cannot ensure that inflation will always be at 2% but need to set policy so that it converges towards target. In the event of large shocks, risk grows that inflation becomes more persistent. Need to pay particular attention to anchoring inflation expectations. Cannot provide forward guidance but need to be clear about the reaction function.

- ECB's Simkus says the direction of travel hasn't changed, is irrational to commit on future rate decisions; will see if the ECB cuts or pauses in April

NOTABLE US HEADLINES

- US President Trump posted "The price of eggs have come down, interest rates have come down, gasoline prices have come down—It's all coming down! We're doing it the right way, and I have tremendous confidence in this Country and in the people of this Country…", via Truth Social.

- US President Trump's administration is considering cutting the size of the Justice Department's public corruption unit.

- US Department of Education said it initiated a reduction in force impacting nearly 50% of the department's workforce with impacted staff to be placed on administrative leave beginning March 21st.

- Elon Musk has signalled to President Trump’s advisers in recent days that he wants to put USD 100mln into groups controlled by the Trump political operation, according to NYT.

- US House passed the spending bill to avert a government shutdown and sent it to the Senate.

- Senior US Democrats believe a government shutdown would be a lose-lose scenario, they are exploring alternative strategies to prevent this perception while avoiding accusations of supporting the President, according to Punchbowl.

GEOPOLITICS

MIDDLE EAST

- US Secretary of State Rubio said the US welcomes an agreement between Syrian interim authorities and Syrian democratic forces to integrate northeast into unified Syria, while the US will continue to watch decisions made by interim authorities.

RUSSIA-UKRAINE

- Russia's Kremlin says it expects US National Security Advisor Waltz and Secretary of State Rubio to brief it on details of talks with Ukraine in the coming days; a potential Russian President Putin and US President Trump call can be organised "very fast". Need to hear from Waltz and Rubio before it will comment on whether it accepts the ceasefire proposal.

- Russian lawmaker stated that any potential ceasefire agreement in Ukraine will be under Moscow's terms and not those set by Washington.

- Russia conducted an air strike on Ukraine’s capital of Kyiv, according to the Mayor. It was also reported that a Russian missile attack killed four people and damaged a grain vessel in Ukraine's Black Sea port of Odesa, while Russian air defence units reportedly destroyed 21 Ukrainian drones overnight, according to Russian agencies.

- Ukrainian Foreign Minister says they are ready to establish a team for developing a roadmap aimed at achieving a ceasefire with Russia.

OTHER

- Russian, Chinese and Iranian ships practised artillery fire in the Gulf of Oman, according to Russian agencies.

- North Korea said a recent misfire by South Korean fighter jets during training shows an accident could trigger armed conflict on the Korean Peninsula and US-South Korean military drills can start the world's first nuclear war, according to KCNA

- Chinese Foreign Ministry says China is to hold talks with Russia and Iran on the Iranian nuclear issue in Beijing on March 14th.

CRYPTO

- Bitcoin is a little firmer and sits comfortably above USD 82k; Ethereum remains below USD 2k.

APAC TRADE

- APAC stocks traded mixed following the choppy performance stateside where the focus was centred on tariff rhetoric and Ukraine ceasefire talks, while the US's 25% tariffs on steel and aluminium took effect overnight.

- ASX 200 underperformed with firm losses in consumer discretionary, industrials and financials, while risk sentiment was also pressured after Australia failed in its efforts to get an exemption from looming tariffs.

- Nikkei 225 remained afloat but with price action choppy after mixed PPI and BSI Manufacturing data.

- Hang Seng and Shanghai Comp were ultimately mixed with the mood indecisive in both the mainland and Hong Kong amid light fresh catalysts although China’s securities regulator recently pledged to consolidate the momentum of market stabilisation.

NOTABLE ASIA-PAC HEADLINES

- BoJ Governor Ueda says very worried about uncertainty regarding overseas economy and prices; underlying inflation still remains below 2%; Ready to conduct bond buying operation nimbly in exceptional cases, when long-term rates make irregular moves.

- Hitachi (6501 JT), Toyota (7203 JT) and NEC (6701 JT) agreed to fully meet unions' wage hike demands for 2025, while Nissan (7201 JT), Mitsubishi Electric (6503 JT), Honda (7267 JT), Nippon Steel (5401 JT) and Panasonic (6752 JT) agreed to average monthly wage increases below unions' demands.

- Global Times tweets "China’s Ministry of Commerce and other departments summoned Walmart on Tuesday for reportedly requiring some of its Chinese suppliers to slash prices significantly in an attempt to shift the burden of the US tariffs on China".

- Bank of Japan officials see several reasons against intervening in the bond market even after benchmark yields hit the highest level since 2008, Bloomberg sources say

DATA RECAP

- Japanese Corp Goods Price MM (Feb) 0.0% vs. Exp. -0.1% (Prev. 0.3%); YY (Feb) 4.0% vs. Exp. 4.0% (Prev. 4.2%)

- Japanese Business Survey Index (Q1) -2.4% (Prev. 6.3%)