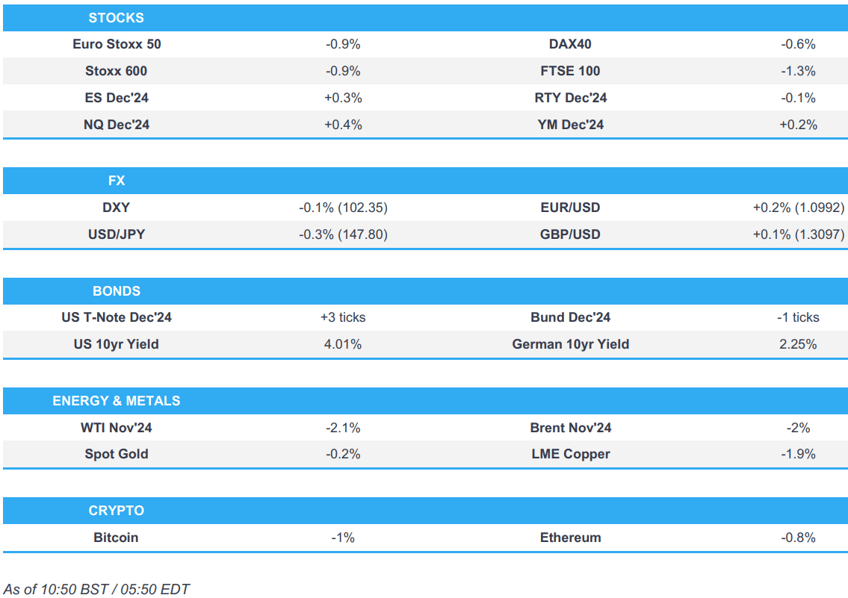

- European bourses are subdued across the board, with sentiment hampered after China’s disappointing NDRC press conference; US equity futures are mixed.

- Dollar is slightly lower, JPY is scaling back some recent losses whilst the Aussie is hampered by broader weakness in commodity prices.

- Bonds are flat, having initially opened with a positive bias, UK and German auctions provided no impetus.

- Crude is softer given the broader risk aversion, XAU/base metals are on the backfoot after China’s NDRC failed to deliver new major stimulus measures.

- Looking ahead, US NFIB Business Optimism Index, RCM/TIPP Economic Optimism, International Trade, Canadian Trade Balance, EIA STEO, Speakers including BoE’s Breeden, Fed’s Bostic & Collins, Supply from the US, Earnings from PepsiCo.

More Newsquawk in 3 steps:

More Newsquawk in 3 steps:1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.8%) are subdued across the board to varying degrees as markets digest the losses from Wall Street yesterday alongside the disappointment from China's NDRC overnight, who expressed confidence in economic stability but announced no new major stimulus measures.

- European sectors are mostly negative with a clear defensive bias amid the risk aversion. Basic Resources is the clear laggard following the hefty losses across base metals after China's disappointing NDRC press conference, whilst Consumer Products and Services are dragged by the luxury sector.

- US Equity Futures (ES +0.3%, NQ +0.4%, RTY -0.1%) are mixed, but with the ES and NQ on a firmer footing, despite the losses seen across Europe.

- RBC Capital Markets Upgrades US healthcare sector to Overweight; downgrades utilities to market weight.

- Honeywell (HON) plans to spin off its advanced materials business, which could be worth more than USD 10bln as a separately traded public company; an announcement could be made today, via WSJ.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is net softer vs. peers after a recent run of gains that lifted DXY from a 100.17 low last week to a 102.68 post-NFP. Fed's Williams speaking to the FT, noted that the US economy is well positioned for a soft landing; remarks which had little impact on the index. Next up, US NFIB and speak from Fed's Bostic and Collins are due.

- EUR is marginally firmer vs. the broadly weaker USD but with EUR/USD unable to reclaim 1.10 status. If 1.10 does give way, last Friday's high kicks in at 1.1039. If downside resumes, Monday's low is at 1.0954.

- GBP is a touch firmer vs. the USD after what has been a tough run for the pound on account of last week's dovish interjection by BoE Governor Bailey. For now, Cable is tucked within Monday's 1.3060-1.3134 range, and awaiting commentary from BoE's Breeden.

- JPY is the best performer across the majors. However, this appears to be more a case of scaling back recent losses rather than outright bullishness on the JPY.

- AUD is the laggard across the majors after the Chinese NDRC announcement disappointed lofty expectations heading into the event. NZD/USD is lower but to a lesser extent than its antipodean counterpart; ahead of the RBNZ announcement on Wednesday.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Dec'24 USTs are essentially flat, and taking a breather after four consecutive sessions of losses which were triggered by remarks from Powell guiding markets towards a 25bps rate cut and of course last Friday's hot US NFP report. The US 10 yr yield is currently around the 4% mark but down from Monday's peak at 4.03%.

- Bunds began the session on a firmer footing but has now edged lower and is unchanged on the session thus far; downticks from solid German Industrial output data proved to be fleeting given that the report is not enough to reassure markets about the Eurozone's growth prospects. The German 10yr yield is currently tucked within Monday's 2.212-2.26% range.

- Gilts are following suit to peers, initially holding a positive bias but now flat. However, Gilts may forge their own path later in the session with BoE's Breeden due to speak at 11:30BST. The UK 10yr yield is currently towards the top end of Monday's 4.153-4.212% range.

- UK sells GBP 1bln 0.125% 2039 I/L Gilt: b/c 3.14x (prev. 3.0x) & real yield 1.044% (prev. 1.053%).

- Germany sells EUR 0.95bln vs exp. EUR 1bln 2.30% 2033 Green Bund: b/c 2.4x (prev. 3.4x), average yield 2.16% (prev. 2.51%) & retention 5% (prev. 15.4%).

- Click for a detailed summary

COMMODITIES

- Softer price action across the crude complex as risk aversion in markets keeps prices subdued for now, but with geopolitics still very much in focus.

- Softer trade across the precious metals complex with hefty underperformance in spot palladium (-2.7%) whilst spot silver (-1.9%) also sees notable losses. XAU sits in a USD 2,631.23-2,649.26/oz range.

- Substantial losses across base metals after China's NDRC expressed confidence in economic stability but announced no new major stimulus measures. 3M LME copper slipped from a USD 9,991/t intraday peak to a low of USD 9,705.50/t.

- India's Oil Minister said India will be consuming 6mln bpd of crude oil in the foreseeable future from 5.4mln bpd now

- Click for a detailed summary

NOTABLE DATA RECAP

- UK BRC Retail Sales YY (Sep) 1.7% (Prev. 0.8%); BRC Total Sales YY (Sep) 2.0% (Prev. 1.0%)

- Swedish Flash CPIF (Sep) +1.1% Y/Y; CPIF-XE (Sep) 2.0% Y/Y; CPI (Sep) +1.6% Y/Y, according to the stats office

- German Industrial Output MM (Aug) 2.9% vs. Exp. 0.8% (Prev. -2.4%)

- French Trade Balance, EUR, SA (Aug) -7.371B (Prev. -5.884B, Rev. -6.042B); Imports, EUR (Aug) 57.028B (Prev. 55.682B, Rev. 55.508B); Exports, EUR (Aug) 49.657B (Prev. 49.798B, Rev. 49.466B); Current Account (Aug) -0.6B (Prev. -1.2B)

NOTABLE EUROPEAN HEADLINES

- UK launched the Regulatory Innovation Office in an effort to speed up approvals for new technology, according to FT.

- UK homes are reported to be offered payments to reduce electricity use all year round, according to FT. In relevant news, Britain's energy grid operators are confident of sufficient electricity and gas supply this winter, according to Reuters.

- Barclaycard said UK September consumer spending rose 1.2% Y/Y vs. prev. 1.0% growth in August and it cited a boost from discretionary spending but noted that essential spending fell 1.7% which was the steepest drop since April 2020.

- ECB's Elderson said many indicators show that the risks of lower economic growth are materializing; ECB is open-minded ahead of the October 17th meeting, ECB decisions are made on a meeting by meeting basis, via local press Delo.

- ECB's Kazaks said "The data points to October rate cut".

- ECB's Vasle said inflation risks abating but still some uncertainty, a rate cut in October is an option but this cut does not mean another in December; rates likely to be neutral by 2025 end.

- ECB's Nagel says he is open to an October rate cut, via a podcast.

- Kantar UK Grocery Market Share: Grocery price inflation increased slightly to 2.0% during the four weeks to 29 September, up from 1.7% last month.

NOTABLE US HEADLINES

- Fed's Williams (voter) said the US economy is well positioned for a soft landing and the current monetary policy stance is well positioned to both keep maintaining strength in the economy and labour market. Willaims said the rate decision was right in September and right today, while he added that the half-point rate cut in September was not the rule of how we will act in the future, according to FT.

- Fed's Musalem (2025 voter) said more rate cuts are likely given the economic outlook and his personal rate outlook is above the Fed's median view, while he won't predict the timing or size of future Fed easing. Musalem commented that the costs of easing too much outweigh easing too little and he supported the Fed’s decision last month to cut rates by 50bps. Furthermore, he said the September jobs report was very strong and the labour market is strong and healthy, as well as noted there is no emergency in the job market right now and the jobs report didn't cause a change in the outlook

- Fed's Kugler (voter) will support additional rate cuts if progress on inflation continues as expected; said policy will be data dependent. If downside risks to employment escalates, cutting rates more quickly may be appropriate. If incoming data does not provide confidence that inflation is moving to target, slowing normalisation may be appropriate. Kugler wants 'balanced' approach to inflation to avoid undesirable slowdown in labour market and economic growth. Adds that Hurricane Helene, and Middle East events could impact the US economic outlook. Last Friday's job report was very welcome, showed healthy level of jobs. Labour market cooling has started; Fed is looking at trends, not single data. Have seen a decline in inflation.

GEOPOLITICS

MIDDLE EAST

- Iran's Foreign Minister is to visit Saudi Arabia and other countries in the region, starting on Tuesday

- "Israel army said a fourth Division joins operations in Southern Lebanon", according to Walla News' Elster

- There was an initial unconfirmed report on X regarding explosions heard in Isfayah and Tehran in Iran. However, Iraqi Sabreen News, which is close to Iran, shortly denied that there was an attack on Iran and Iranian media also denied any violation of Iran’s airspace by hostile aircraft.

- Israel’s cabinet is in permanent session to discuss the response to Iran and choose the location, according to Al Jazeera citing an Israeli delegate to the UN.

- New York Times cited officials that stated Israel is likely to target Iranian military bases and possible intelligence sites in its response, while Israel seems to have postponed after a long discussion the targeting of Iranian nuclear sites to a later date, according to Al Jazeera.

- Israel's army said their fighter jets bombed Hezbollah intelligence headquarters in Beirut, while it was later reported that Israel's military said it eliminated Hezbollah HQ commander Suhail Hussein Husseini in Beirut.

- Israeli Home Front announced sirens sounded in western Galilee, while the IDF later stated that about 175 rockets were fired from Lebanon into Israel in the past 24 hours.

- Hezbollah announced that it shelled with rockets a gathering of enemy forces in the settlement of Shlomi and it targeted a military intelligence unit in the suburbs of Tel Aviv in a missile launch operation.

- Israel's army issues an urgent warning to beachgoers and boat users from Lebanon's Awali river southward and said it is easing some protective guidelines for residents in some areas of Galilee in northern Israel and Golan Heights.

- Israel's military issued new evacuation warnings on specific buildings in Beirut's southern suburbs on Monday evening.

OTHER

- Ukraine announced that a Russian missile hit a grain ship in the Odesa region which killed one person onboard the grain ship.

- Russian and Chinese ships conducted a joint practice of anti-submarine missions in Asia-Pacific, according to RIA.

- North Korean leader Kim said they are to speed up steps towards military superpower and strong nuclear power, while Kim also said they are to further strengthen Russia-North Korea cooperation in a birthday message to Russian President Putin, according to News1 and KCNA.

CRYPTO

- Bitcoin is slightly softer, and holds around USD 62.5k after China's NDRC press conference failed to impress the markets.

APAC TRADE

- APAC stocks were ultimately mixed after the negative lead from Wall St amid firmer yields and higher oil prices, while geopolitical concerns lingered as participants braced for Israel's response to Iran and China's NDRC press conference was met with disappointment.

- ASX 200 slightly weakened amid losses in the commodity-related sectors but with downside limited by the improvement in consumer and business surveys.

- Nikkei 225 retreated amid a firmer currency while the data was varied as Household Spending topped forecast and Labour Cash earnings slowed.

- Hang Seng and Shanghai Comp diverged in which the Hong Kong benchmark suffered heavy losses as it took a back seat to the return of mainland bourses, while price action was volatile for the mainland index with a double-digit percentage gain seen at the open on return from the National Day Golden Week holiday. However, the index nearly gave back all of its gains after the NDRC press conference was met with disappointment with very little new announced regarding stimulus, although mainland stocks then caught a second wind again but are well off their opening highs.

NOTABLE ASIA-PAC HEADLINES

- China's NDRC Chairman said China's economy is largely stable but is facing a more complex internal and external environment, while he added that new policies will improve the health of economic actors and he is fully confident of achieving full-year economic and social development targets. The state planner head said they will promote a sustained, stable and healthy economic development in 2024 and 2025, as well as expand domestic demand and prioritise consumption, promote an economic rebound and quicken fiscal spending to support the economy. Furthermore, they will speed up the implementation of additional measures, release an updated foreign investment negative list, speed up local government special bond issuance and plan to issue CNY 200bln in advance budget spending and investment projects from next year.

- China's regulator urged financial institutions to strengthen internal control over leverage and said Chinese bank loans are banned from entering China's stock market, according to Financial News.

- RBA Minutes stated the Board discussed scenarios for lowering and raising interest rates in the future and members felt not enough had changed from the previous meetings that the current Cash Rate best balanced risks to inflation and the labour market, while it stated that future financial conditions might need to be tighter or looser than at present to achieve the board's objectives and that scenarios lowering, holding and raising rates are all conceivable given the considerable uncertainty about the economic outlook. RBA noted that policy could be held restrictive if consumption growth picks up materially or could be tightened if present financial conditions are insufficiently restrictive to return inflation to target, while policy could be eased if the economy proves significantly weaker than expected and it is not necessary for the cash rate to evolve in line with policy rates in other economies. Furthermore, it stated that underlying inflation is still too high and policy will need to remain restrictive until board members are confident inflation is moving sustainably towards the target range, as well as noted that it is not possible to rule in or out future changes in the cash rate target at this time.

- China's Commerce Ministry say China is studying measures such as raising tariffs on imported Large displacement fuel vehicles; also to make a fair and objective ruling based on the investigation results of EU pork and dairy. China will take all necessary measures to firmly safeguard the legitimate rights and interests of Chinese industries and enterprises, a spokesperson for the commerce ministry said.

- Hyundai Motor India IPO to open October 14th for institutional investors, October 15-17 for others - Company to be valued up to USD 19bln.

DATA RECAP

- Japanese All Household Spending MM (Aug) 2.0% vs. Exp. 0.5% (Prev. -1.7%)

- Japanese All Household Spending YY (Aug) -1.9% vs. Exp. -2.6% (Prev. 0.1%)

- Japanese Overall Labour Cash Earnings (Aug) 3.0% vs. Exp. 3.0% (Prev. 3.6%, Rev. 3.4%)

- Australian Westpac Consumer Sentiment Index (Oct) 89.8 (Prev. 84.6)

- Australian NAB Business Confidence (Sep) -2.0 (Prev. -4.0)

- Australian NAB Business Conditions (Sep) 7.0 (Prev. 3.0)