- New 10% tariffs on China exports to the US have taken effect; China is to levy countermeasures on some US imported products with 15% tariffs on coal and LNG, as well as 10% tariff on oil, agricultural machines and some autos from the US.

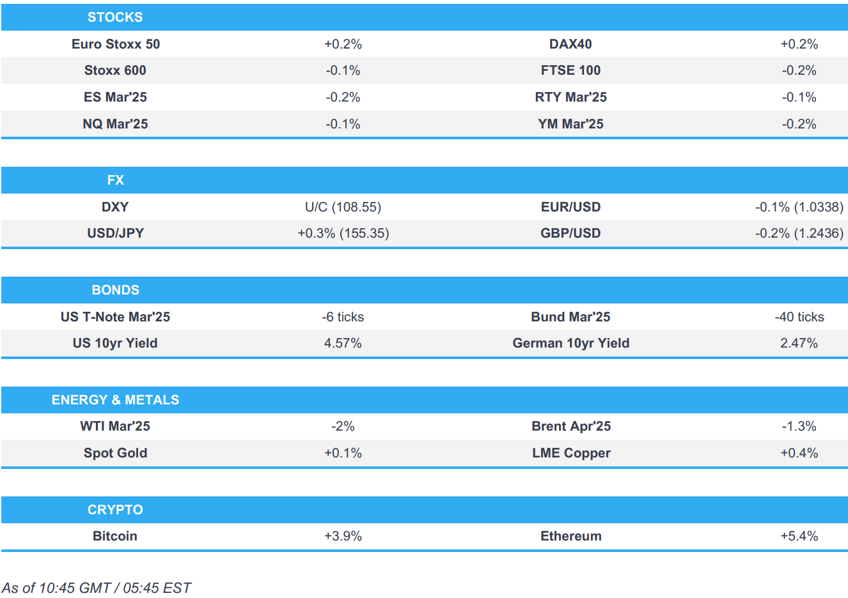

- European bourses trade tentatively, Tech buoyed by strength in Infineon; US futures are modestly lower.

- DXY is flat, JPY underperforms, unwinding the prior day’s strength, and Antipodeans lag.

- Bonds pullback but remain above Monday's lows as we await tariff updates from US/China.

- Crude softer amid Canada/Mexico tariff delays and China tariff retaliation.

- Looking ahead, US JOLTS Job Openings, NZ HLFS Jobs. Speakers including Fed’s Bostic & Daly.

- Earnings from BMPS, Intesa Sanpaolo, Ferrari, AMD, Google, Snapchat, Chipotle, Amgen, Paypal, Spotify, Pfizer, Regeneron, PepsiCo, Merck, Estee Lauder, Marathon Petroleum & Ball.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS

- The new 10% tariff on all China exports to the US took effect after the deadline passed.

- China is to levy countermeasures on some US imported products with 15% tariffs on coal and LNG, as well as 10% tariff on oil, agricultural machines and some autos from the US, while China's Finance Ministry said tariffs imposed are to counter 10% Trump tariff and will take effect on February 10th. China is also to probe Google (GOOGL) over alleged anti-trust law breaches and it imposed export controls on tungsten, tellurium, ruthenium, molybdenum, and ruthenium-related items.

- US President Trump said on Truth that Canada agreed to ensure the US has a secure Northern Border and the tariffs announced on Saturday will be paused for a 30-day period to see whether or not a final economic deal with Canada can be structured.

- Canadian PM Trudeau said he had a good call with President Trump who will pause the tariffs for at least 30 days and Canada will send almost 10,000 troops to protect the border, while Canada will also name a fentanyl czar.

- EU Commission President von der Leyen said that when targeted with unfairly or arbitrarily tariffs, the EU will respond firmly.

- Click for the Newsquawk rolling analysis article.

EUROPEAN TRADE

EQUITIES

- European bourses (Stoxx 600 -0.3%) began the day mixed, and traded modestly on either side of the unchanged mark, despite a mostly positive APAC session. Price action today has been very choppy, with sentiment initially slipping into the morning, before bouncing back to display a mixed picture in Europe.

- European sectors hold a slight negative bias, with only a handful of industries holding in the green. Tech is outperforming today, as it pares back some of the significant Trump-induced losses seen in the prior day. The sector has been propped up by strength in Infineon (+11.2%), which soared at the open after it reported strong headline metrics and lifted its Q1 guidance above expectations. Financial Services underperforms today, weighed on by losses in UBS (-5.7%); the Swiss bank reported a Q4 profit beat and a USD 3bln share buyback.

- US equity futures are modestly lower across the board, ES -0.2% & NQ -0.2%, in tandem with the losses seen in Europe and in a continuation of the downside seen in the prior session, as traders digest the pause to Mexico & Canada but not China. Ahead, US JOLTS Job Openings and Factory Orders; traders will also keep a keep eye out on the Trump-Xi call, expected later today.

- DeepSeek is reportedly preparing to adapt to China's domestic GPU chip preparation and switch to Chinese-made GPUs, to bypass restrictions around Nvidia (NVDA), via CNA citing reports; by using Nvidia's H800 chip and its PTX language, DeepSeek can tailor its model for compatibility with Chinese hardware, making future development smoother. The report adds that DeepSeek's move challenges Nvidia's dominance in AI development, particularly in large model creation.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

EARNINGS SUMMARY

- BNP Paribas (BNP FP) +1.9%: Q4 beat, EUR 1.1bln buyback.

- Diageo (DGE LN) +0.8%: H1 beat, withdraws mid-term guidance.

- Infineon (IFX GY) +11.2%: Q1 beat, Q2 outlook beat and FY revenue guided higher.

- Siltronic (WAF GY) -13.6%: Q4 beat; Demand recovery delayed due to continued high inventories at chip manufacturers and their customers

- UBS (UBSG SW) -5.7%: Q4 Net beat, Revenue slight miss. USD 3bln buyback.

- Vodafone (VOD LN) -6.8%: Q3 beat, reiterates guidance.

- NXP Semiconductors (NXP) +1.9% pre-market: Q4 beat, Q1 guide soft.

- Palantir Technologies (PLTR) +18.6% pre-market: Q4 beat on AI growth. Q1 & FY guides strong.

- Nintendo (7974 JT) : 9-month lower Y/Y, cut FY guidance.

FX

- DXY is flat. Once again, trade is continuing to dominate the narrative for the US. To recap, Trump was able to strike a deal yesterday with Canada and Mexico to delay the implementation of tariffs by one month. However, optimism on the trade front was dealt a blow overnight after the new 10% tariff on all China exports to the US took effect after the deadline passed. In response, China is to levy countermeasures on some US imported products. Today's data docket sees the latest JOLTS report ahead of Friday's NFP print. DXY currently sits towards the lower end of Monday’s 108.33-109.88 range.

- EUR is resilient vs. the USD after yesterday bouncing off a 1.0209 low to close at 1.0343 alongside relief that Trump was able to strike a deal with Canada and Mexico. That being said, the EU is far from out of the woods with the Telegraph reporting that Trump is reportedly considering plans to impose a 10% tariff on the EU.

- JPY is a touch softer vs. the USD after a choppy session yesterday which saw initial haven demand for the JPY unwound as Trump struck deals with Mexico and Canada. In terms of Japanese-specific updates, BoJ Governor Ueda said the BoJ is aiming to achieve 2% inflation as measured by overall CPI, on a sustainable basis. USD/JPY is currently tucked within Monday's 154.01-155.88 range.

- GBP is softer vs. the USD but once again to a lesser extent than most peers on account of the UK not being directly in the firing line of Trump tariffs (for now) on account of the UK's small trade exposure to the US. Furthermore, some positivity is also being attributed to the overtures of the Starmer government to develop a closer relationship with the EU. Cable is currently towards the top end of yesterday's 1.2250-1.2455 range.

- Antipodeans are both softer vs. the USD as the latest retaliatory trade measures by China act as a drag. On Monday, NZD/USD managed to pick itself up from a 0.5516 trough which was the lowest level since October 2022 but is back in the red today.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are essentially flat. Has a very mild bearish bias but this is minimal in nature with USTs at the mid-point of a slim 108-23 to 109-00 band; one which is entirely within Monday’s much more expansive 108-21+ to 109-15+ parameters. Treasuries picked up as US tariffs on China came into force, at which point China almost immediately retaliated with measures of its own on the US and an investigation into Alphabet’s Google. Amidst this, USTs lifted by around six ticks to print the above session high. Traders will keep a keen eye out for the readout from Trump-Xi's call; US JOLTS Job Openings and Fed speak also due.

- Bunds are pressured, as the region awaits any update on potential US tariffs on the EU. As a reminder, Trump described the EU as an “atrocity” on trade in remarks over the weekend. Bunds are off lows and holding just under 133.00 in a 132.72-133.16 band.

- Gilts are softer and currently marginally underperforming with the potential inflationary-impacts of Trump’s already announced tariffs and the possibility of measures on the EU and/or the UK lifting yields in the region. At a 92.67 low, with support below at Monday’s 92.53 trough. Additionally, and another possible driver of yields, are reports in Politico that the Treasury and OBR have been having some heated conversations over how much of the government's growth policies can be “scored” (i.e. accounted for in OBR forecasts) in the 26th March update.

- OATs are on the backfoot, but to a lesser degree vs peers. PM Bayrou triggered Article 49.3 twice for two components of the budget on Monday, the debate on it was brief and immediately, but unsurprisingly, overshadowed by La France Insoumise (LFI) and the Democratic and Republican (GDR) each tabling no-confidence (censure) motions against Bayrou’s government.

- Click for a detailed summary

COMMODITIES

- Softer trade across crude after the US reached a deal with Mexico and Canada to delay tariffs. WTI sees deeper losses after experiencing larger gains on the initial US tariff announcement. Elsewhere, the new 10% tariff on all Chinese exports to the US took effect after the deadline passed. In response, China imposed 15% tariffs on US coal & LNG, and 10% tariffs on US oil, agricultural machines, and some autos. WTI Mar resides between USD 71.54-72.48/bbl.

- Precious Metals are taking a breather following the prior day's price action, which saw spot gold hit a record high, whilst a deal delaying US tariffs on Canada and Mexico by at least a month provided some relief but did not erase uncertainty.

- Mostly lower trade across base metals after the aforementioned Chinese retaliation against the US tariffs. 3M LME copper awaits the Trump-Xi call and resides in a narrow USD 9,107.65-9,177.30/t range.

- Equinor's (EQNR NO) Sverdrup (755k/bpd) oil field shut due to power outage; earlier estimates had the outage lasting for eight hours.

- Kazakhstan said it will fulfil its OPEC+ obligations in 2025-2026 and will compensate for overproduction in 2024.

- Fire reported at the waste warehouse of Iran's Marun Petrochemical Refinery, according to IRNA.

- South Africa petrol pump prices to rise 82 cents/L, diesel price to rise by 105 cents/L from Feb 5th.

- Click for a detailed summary

NOTABLE EUROPEAN HEADLINES

- Polish PM Tusk said all 27 EU leaders confirmed readiness to minimise the negative effects of Brexit for both sides, while he noted EU leaders' unanimity in support of Denmark's territorial integrity was very important.

- Kantar Grocery Update, 12 weeks to Jan 26th: UK grocery inflation 3.3% (Prev. 3.7%).

- Riksbank Minutes: December policy guidance (possibly at terminal) holds but members stress the need to see a recovery over the coming months.

NOTABLE US HEADLINES

- Fed's Goolsbee (voter) said uncertainties likely mean that the Fed needs to be a little more careful and prudent on cutting rates, while he added there are risks that inflation could tick back up and if fiscal choices affect prices or employment, they have to think it through. Goolsbee also said there are concerns about inflation and the Fed might have to slow the pace of rate cuts amid uncertainty.

- US Secretary of State Rubio says he reached a migration agreement with El Salvador's Bukele on Monday in which El Salvador has agreed to accept for deportation any illegal alien in the US who is a criminal from any nationality and house them in its jails. El Salvador's Bukele also offered to house in his jails criminals, including those with US citizenship or legal residency.

- US President Trump's nominee Chris Wright was confirmed by the Senate as Energy Secretary through 59-38 votes.

GEOPOLITICS

MIDDLE EAST

- US President Trump is to host a bilateral meeting with Israeli PM Netanyahu on Tuesday, according to the White House.

- US reportedly readied a new USD 1bln arms sale to Israel, according to WSJ.

RUSSIA-UKRAINE

- US shipments of arms to Ukraine were briefly paused last week but resumed on the weekend, according to Reuters citing sources.

OTHER

- US Secretary of State Rubio said there are no talks to recognise Maduro as the legitimate leader of Venezuela and commented that they cannot continue to have the Chinese exercising control of the Panama Canal area.

- Philippine Air Force spokesperson said Philippines and US joint air patrol exercises were underway in the South China Sea.

CRYPTO

- Bitcoin (+3.5%) is on a firmer footing, climbing off lows after Trump agreed to pause tariffs on Canada and Mexico.

APAC TRADE

- APAC stocks traded higher as the region reacted to US President Trump's delay of tariffs against Canada and Mexico for a month, while the additional 10% tariffs on China took effect and prompted an immediate retaliation by China.

- ASX 200 was initially led higher by strength in tech and miners but ultimately settled flat owing to the US-China tariff frictions.

- Nikkei 225 briefly climbed back above the 39,000 level with the biggest gainers and losers dictated by earnings releases.

- Hang Seng surged amid hopes that China would also reach a tariff deal with the US after President Trump stated that he would probably speak with China within 24 hours, but then briefly wobbled after China announced tit-for-tat tariffs against the US.

NOTABLE ASIA-PAC HEADLINES

- **US President Trump commented on Truth "GREAT INTEREST IN TIKTOK! Would be wonderful for China, and all concerned".