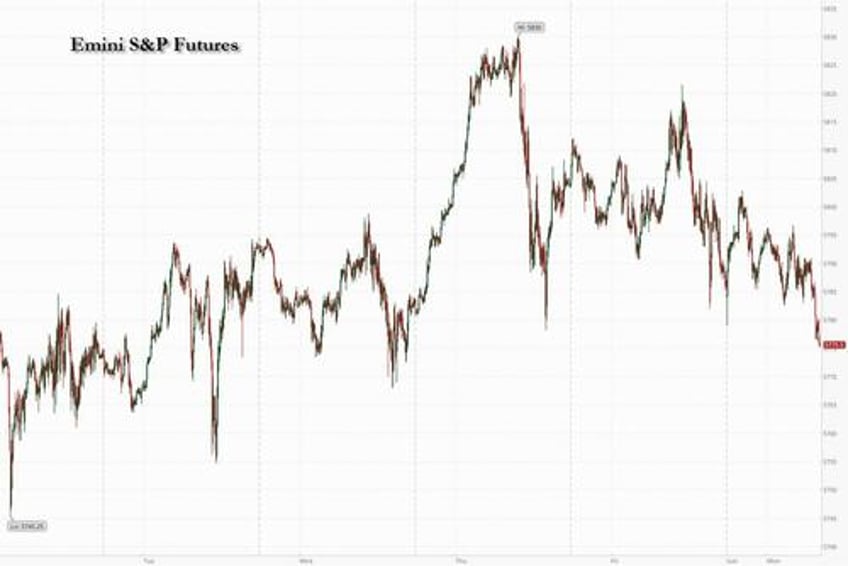

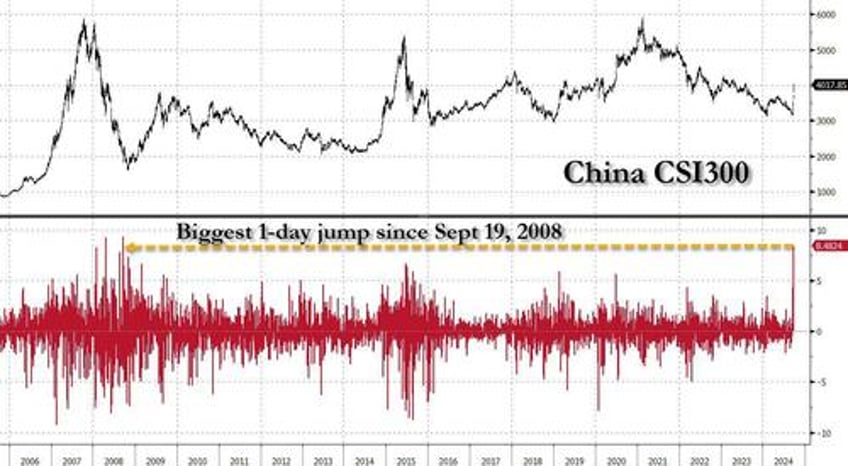

US equity futures reversed earlier gains and are now down at session lows, tracking European market weakness as we close the quarter even as Chinese stocks have their best day since Sept 19, 2008. As of 8:00am, S&P futures are down 0.2% after last week’s record highs on Wall Street, while both Nasdaq (-0.4%) and Russell (-0.6%) underperform pre-market with Mag7 names lower ex-AAPL and TSLA, and semis weaker with NVDA -1.8% as traders look forward to Friday's jobs data and its impact on Federal Reserve interest-rate cuts. Treasury yields climbed 2-4bps, led by the policy-sensitive two-year note, the USD is weaker though. Commodities are mixed with base metals the standout, moving higher on the China trade while oil tumbles as the usual (record) shorters emerge in force despite epic chaos in the Middle East. This heavy data week kicks off with regional indicators and 2x Fed speakers. As JPM notes, economic strength with a Fed tailwind pushed markets to shrug off both negative seasonality and JPY carry unwind. But given the reflationary China growth reboot, can positive US data push this trend into Oct/Nov, or do we see Election uncertainty/vol spike create another downdraft before rallying into year-end as concerns emerge about the Fed's easing cycle when overlaid on China's historic stimulus bazooka? This week’s data may help answer those questions, but the medium-term trend appears to be higher.

In premarket trading, US-listed Chinese stocks rallied - again - after the latest steps by authorities to boost the economy which included step by three of the country’s largest cities easing rules for homebuyers. The moves come after China’s policymakers unveiled aggressive home stimulus to prop up the beleaguered real estate sector. Alibaba (BABA) +4%, Nio (NIO) +13%, Bilibili +8%. Here are some other premarket movers:

- AT&T gains less than 1% after agreeing to sell its majority stake in DirecTV to private equity firm TPG Inc. for $7.6 billion in cash.

- CVS Health Corp. rises 2% as the Wall Street Journal reported that Glenview Capital Management plans to meet Monday with CVS management to propose ways for the health-care company to improve its operations.

- Gogo gains 2% after the in-flight broadband company agreed to buy Satcom Direct.

- EchoStar, which owns Dish, rises 3%% after DirecTV and Dish agreed to combine in a deal that will create the biggest pay-TV provider in the US.

- Stellantis drops 13% after slashing its forecasts for the year, citing plans to lower production and spend more on promotional incentives in a slowing and more competitive auto market.

Last week, US data bolstered bets for further interest-rate cuts by the Fed and investors will be tuning in for remarks by Fed Chair Jerome Powell on Monday when he takes the stage at a National Association for Business Economics conference. Further out, the US jobs print on Friday could decide whether last week’s risk—on rally can extend. A strong reading might lead to a rotation toward stocks with weaker earnings, according to Goldman strategists.

A positive report may prompt some investors to “price lower odds of substantial labor market weakening,” leading them to “rotate out of expensive ‘quality’ stocks into less-loved lower quality firms,” the team led by David Kostin wrote.

As they prepare for the US data to gauge the outlook for Fed rate cuts, investors must also ponder a cocktail of risks, including rising tensions in the Middle East. The record-setting rally in stocks will also be tested by third-quarter corporate results set to kick off in mid-October.

Political developments in Europe provide an additional layer of complexity. Austria’s traditional political powers are pledging to block the far-right Freedom Party from forming a government following Sunday’s national elections that resulted in its historic victory.

“Right now, we see an improvement in sentiment, which is driven by more stringent action that we see in China — that is good news for the European equity markets,” Marcus Poppe, co-head of European equities at DWS Investment, said in an interview with Bloomberg TV. “But I would caution against expecting that we will see in three-four weeks companies saying: ‘China is picking up.’”

It wasn't good enough on Monday, however, and unlike the boiling euphoria in China, Europe started the week on the back foot with the Euro Stoxx 50 down 0.9% after a series of profit warnings from major automakers. VW and Porsche warned on Friday after the close, followed by Stellantis and Aston Martin on Monday; the Stoxx autos index is down 3.9%. Auto names had benefited from the rotation into cyclical over the past two weeks, but the warnings highlight the risk of blindly jumping into pockets of consumer-exposed names when trends show no signs of improvement. IBEX is flat but outperforms peers, CAC 40 lags, dropping 1.4%. Autos, construction and real estate are the worst-performing sectors. China proxies are seeing support after Hong Kong closed 2.5% higher and CSI300 was up 8.5%, the biggest one day gains since Sept 19, 2008! Iron ore is up 10% supporting mining stocks. France is still weak as the government weighs taxes on corporates earning and higher taxes on share buybacks. Meanwhile concerns of stagflation in Germany, the euro area’s largest economy, and inflation accelerating on a monthly basis in its states prompt traders to trim bets on an ECB interest-rate cut in October. Here are the biggest European movers:

- Stellantis shares fall as much as 14% in Milan to their lowest since October 2022 after the carmaker slashed its profit margin forecast for the year, citing US costs and a slowing and more competitive auto market.

- Aston Martin shares fall as much as 28%, the biggest drop in more than four years, after the luxury carmaker reduced its outlook, warning annual adjusted Ebitda will be lower than last year and scrapping its aim to deliver positive free cashflow in the second half.

- Volkswagen shares fall as much as 3.1% after the German carmaker posted its second profit warning in three months, citing weakening demand for its cars.

- Rightmove falls as much as 5.3%, the most since Sept. 3, after the property listings website said it has rejected a fourth bid from REA and now urges the Rupert Murdoch-owned group to submit “a best and final proposal” ahead of Monday’s deadline at 5 p.m. UK time.

- Smiths slides as much as 2.7% after being downgraded by analysts at Barclays, who believe the engineering company boasts less attractive fundamentals over its UK peers.

- Ocado shares rise as much as 4.1% after BofA Global Research reinstated coverage of the online grocer with a buy rating given the growth potential of the company’s retail and tech solutions businesses.

- Hensoldt shares rise as much as 4.7% after analysts at both Kepler Cheuvreux and Deutsche Bank upgraded the company, which makes sensors and other equipment for the defense industry.

UBS' European trading desk writes that it is 60/40 better to sell with hedge funds balanced and long-only accounts 60/40 sellers. They are busiest in miners and markedly better to buy after the rally in China. There are sellers of industrial and consumer discretionary on the back of the autos profit warnings. Clients are active in food and beverages ahead of a few pre-close calls. There are balanced flows in financials and slightly better buyers in consumer staples.

Europe's downbeat start was in contrast to the mood in China, where the CSI 300 Index jumped as much as 9.1%, the most since 2008, fueled by the stimulus package. The policy steps also buoyed European mining and luxury stocks.

In retrospect, our Sept 21 call that it was "time for China to turn on the printing press" was well-timed.

Taking a broader look at the region, Asian stocks fell amid a selloff in Japan as investors fretted over a surprise outcome in the ruling party’s leadership race, offsetting the optimism in Chinese markets. The MSCI Asia Pacific Index dropped as much as 1.3%, with TSMC and Toyota Motor among the biggest drags. Benchmarks in Japan slumped more than 3% in delayed reaction to the surge in the yen following the LDP election outcome last Friday, while those in Taiwan and Korea fell more than 2% after declines in US tech shares on Friday.

The losses in Japan came after Shigeru Ishiba’s victory wrongfooted investors, forcing them to pare positions that had been built on speculation that Sanae Takaichi would become the nation’s new prime minister and encourage the Bank of Japan to keep interest rates low.

As noted above, shares in China bucked the region’s trend ahead of a weeklong holiday. The CSI 300 Index soared the most since 2008 and entered a bull market, as sentiment got another boost from further government stimulus. Three of the nation’s largest cities relaxed rules for homebuyers, while the central bank also moved to lower mortgage rates. The Hang Seng China Enterprises Index rose for the 12th session.

“Regional allocations may be adjusted to favor China, particularly as Japanese equities face pressure due to rising yen strength following Ishiba’s victory in the LDP election,” said Derek Tay, head of investments at Kamet Capital Partners.

In rates, treasuries bear-flattened, with front-end yields cheaper by around 4bp on the day, following similar front-end-led selloff in bunds after September German regional CPIs. US long-end yields cheaper by only about 0.5bp, with 10-year around 3.77%, cheaper by about 1.5bp; gilts in the sector lag by 0.5bp while bunds outperform slightly. Front-end-led losses flatten 2s10s, 5s30s spreads by 2bp-3bp on the day. Focal points of US session include comments from Fed Chair Powell in the afternoon, while month-end flow has potential to support long-end of the curve. Month-end Treasury index rebalancing at 4pm New York time will extend its duration by an estimated 0.06 year

Meanwhile concerns of stagflation in Germany, the euro area’s largest economy, and inflation accelerating on a monthly basis in its states prompt traders to trim bets on an ECB interest-rate cut in October.

Yields rise across the curve, with the front-end up about 4bps each in bunds, gilts and Treasuries. The Bloomberg Dollar Spot Index is steady. CHF and JPY are the weakest performers in G-10 FX, AUD and DKK outperform. Crude erases gains, with WTI drifting lower to around $68. Spot gold falls roughly $8 to trade near $2,650/oz. Most base metals trade in the green. Bitcoin drops.

Looking at today's calendar, US economic data calendar includes September MNI Chicago PMI (9:45am, several minutes earlier to subscribers) and September Dallas Fed manufacturing activity (10:30am). Fed speakers scheduled include Governor Bowman (8:50am) as well as Powell’s address at the National Association for Business Economics conference in Nashville (1:55pm, text and Q&A expected).

Market Snapshot

- S&P 500 futures little changed at 5,786.50

- STOXX Europe 600 down 0.7% to 524.30

- MXAP down 1.0% to 195.26

- MXAPJ up 0.1% to 620.73

- Nikkei down 4.8% to 37,919.55

- Topix down 3.5% to 2,645.94

- Hang Seng Index up 2.4% to 21,133.68

- Shanghai Composite up 8.1% to 3,336.50

- Sensex down 1.3% to 84,474.63

- Australia S&P/ASX 200 up 0.7% to 8,269.83

- Kospi down 2.1% to 2,593.27

- German 10Y yield little changed at 2.17%

- Euro up 0.3% to $1.1192

- Brent Futures up 0.7% to $72.49/bbl

- Gold spot down 0.1% to $2,654.93

- US Dollar Index little changed at 100.28

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed heading into month-end amid the backdrop of recent geopolitical escalation and as participants digested a slew of data releases, as well as China's latest support efforts and Japan's leadership transition. ASX 200 was led by outperformance in the commodity-related sectors as oil and metal prices benefitted from geopolitics and China's policy announcements. Nikkei 225 suffered heavy losses amid a firmer JPY following Ishiba's victory against Abe protege Takaichi in the LDP leadership race, while the data releases from Japan were mixed with a steeper-than-expected drop in Industrial Production but Retail Sales topped forecasts. Hang Seng and Shanghai Comp rallied ahead of National Day Golden Week holiday closures despite mixed PMI data from China with advances led by strength in property developers after the PBoC instructed banks to lower interest rates on existing mortgages and lower downpayments, while some Chinese cities also eased home purchase restrictions. Furthermore, the mainland index is on course for its largest gain since 2015 and is set for a bull market after China's latest policy announcements and the PBoC's Monetary Policy Committee quarterly meeting where it pledged several supportive efforts

Top Asian News

- PBoC’s Monetary Policy Committee held its third-quarter meeting and stated that China’s economy still faces challenges such as insufficient demand and weak social expectations, while it added that it must accurately and effectively implement prudent monetary policy, as well as pay more attention to counter-cyclical adjustments. PBoC said it must focus on expanding domestic demand, boosting confidence and promoting a sustained recovery in the economy. Furthermore, it is to maintain a reasonable abundance in liquidity, guide reasonable credit growth, support banks to supplement capital, support the reduction of interest rates on existing mortgages and promote the stable and healthy development of the real estate market, according to Reuters,

- PBoC said all commercial banks must in batches lower interest rates on all existing mortgages by October 31st to no less than 30bps below the PBoC’s Loan Prime Rate, while it said the adjusted mortgage rates in some Chinese cities including Beijing, Shanghai and Shenzhen must not be less than the floor of their existing rates. Furthermore, Guangzhou city announced to lift all restrictions on home purchases, while Shanghai and Shenzhen announced to ease restrictions on home purchases by non-local buyers and cut the minimum downpayment ratio to no less than 15%, according to Reuters.

- PBoC injected CNY 182bln via 7-day reverse repos on Sunday with the rate lowered to 1.50% (prev. 1.70%) and injected CNY 212.1bln via 7-day reverse repos on Monday with the rate kept at 1.50%.

- China's MOFCOM said it will further improve policy targetedness and effectiveness, as well as improve the consumption structure and focus on fostering new consumption business, while it will promote the steady growth of foreign trade business.

- China’s Finance Ministry said state-owned firms’ August YTD profits fell 2.1% Y/Y.

- Japan’s Finance Minister post is likely to go to former Chief Cabinet Secretary Kato and the Foreign Minister position is likely to go to former Defence Minister Iwaya, while the Defence Minister post in the new cabinet is likely to go to former Defence Minister General Nakatani, according to Japanese press. It was also reported that newly elected ruling LDP leader Ishiba is considering a plan to conduct a Lower House election on October 27th.

- Japanese ruling LDP executive said incoming PM Ishiba proposed lower house election to be held on October 27th and to dissolve parliament October 9th

European bourses, Stoxx 600 (-0.7%) are modestly lower across the board and to varying degrees, with sentiment in the region failing to piggy-back off China's performance but instead focusing on escalating geopolitics, profit warnings, and upcoming risk events such as Friday's NFP. European sectors are mostly negative; Basic Resources remain aflaot, given the strength in metals prices. Autos is by far the clear laggard after a myriad of guidance cuts today; Stellantis (-12.9%), Aston Martin (-27.5%) and Volkswagen (-2.7%) all slip. As a reminder, Mercedes-Benz (-1.7%) and BMW (-1.9%) both lowered forecasts already earlier in the month. US Equity Futures (ES U/C, NQ -0.1%, RTY -0.3%) are flat/subdued on month end, with traders keeping an eye on this week's risk events including Fed Chair Powell today, US ISMs throughout the week, and US NFPs on Friday. Bytedance, the owner of TikTok, reportedly plans a new AI model built with Huawei's Ascend 910B chips, according to sources; Bytedance is NVIDIA's (NVDA) largest customer for H20 AI chips tailored for the Chinese market.

Top European News

- Germany is reportedly poised to abandon forecasts for economic growth this year, according to Bloomberg sources; Germany forecasts economic stagnation this year at most

- Former UK PM Sunak urged for the Tories to unite behind who succeeds him as party leader and warned that the party risks marginalisation if divisions persist, according to FT.

- Far-right Freedom Party of Austria was projected to be first in the Austrian parliamentary election with 29.3%, while the ruling conservatives are seen at 25.3% and social democrats at 20%. Furthermore, Austria’s Chancellor and conservative leader Nehammer conceded that his party failed to catch up with the far-right freedom party in the election and said talks between the parties are important once the final election result is in, while the far-right party leader Kickl said they are ready to lead a government.

- ECB's Stournaras said that based on the most recent data for inflation and the real economy, he finds it reasonable to proceed with a 25bps cut in October, or risk inflation falling below target, according to an FT interview.

- EU is to continue China EV talks even after final vote on its proposal to impose final import tariffs on Chinese EVs, via Reuters citing sources.

FX

- USD is softer vs. cyclically-exposed peers and firmer vs. havens. Incremental US developments have been lacking since Friday's PCE report with markets instead looking ahead to a slew of upcoming data releases, including the key NFP report. DXY is in a 100.17-48 range and within Friday's 100.15-88 parameters.

- EUR is marginally firmer vs. the USD but unable to reclaim 1.12 status which was lost late last week on account of soft inflation prints from Spain and France. Today's German Regional CPI figures have thus far painted a picture of cooling Y/Y inflation, but had little impact on the Single-Currency. EUR/USD is tucked within Friday's 1.1124-1.1203 range.

- GBP is firmer vs. the USD with Cable just about making its way back onto a 1.34 handle after venturing as high as 1.3433 last week. Downward revisions to Q2 GDP metrics had little follow-through into the market. BoE's Greene is due after-hours.

- JPY is a touch softer vs. the USD in the wake of mixed data from Japan overnight. Broader focus for the JPY is on the fallout from Friday's LDP leadership race, with the victory of Ishiba viewed as a hawkish outcome. USD/JPY is currently trading towards the bottom end of today's 141.66-142.95 range.

- Antipodes are top of the leaderboard as the positivity surrounding China continues to reverberate around the market. As such, AUD/USD has printed another YTD peak at 0.6941

Fixed Income

- USTs are currently scaling back some of the post-PCE upside seen on Friday with not a great deal of fresh US drivers over the weekend. NFP will likely be the highlight for the week given the Fed's increased focus on the employment side of its mandate. As it stands, markets currently see the November meeting as a near-enough coinflip between a 25 or 50bps reduction. Dec'24 USTs are currently contained within Friday's 114.08-25 range.

- Bunds showing similar price action to other global peers by scaling back some of the ground made on Friday, which was driven in part by soft regional inflation metrics from Spain and France ahead of the German release today and EZ-wide metric tomorrow. Regional CPIs for Germany have thus far painted a picture of cooling Y/Y inflation. Dec'24 Bunds have returned to a 135 handle but are contained within Friday's 134.31-135.19 range.

- Gilts are also on the backfoot with not much in the way of notable UK newsflow with downward revisions to Q2 GDP metrics having little follow-through into the market. BoE's Greene (voted for a hold in August and September) is due to speak afterhours.

Commodities

- Crude oil was initially on a firmer footing, but has since slipped since the European cash open and slowly drifted into negative territory. Price action today is focused on continued industrial commodities tailwinds from Chinese stimulus coupled with escalating geopolitics after Israel’s assassination of Hassan Nasrallah; on which, Bloomberg suggested Iran will try to transfer thousands of fighters to the border areas between Lebanon and Syria. Brent Dec trades in 71.24-72.79/bbl confines.

- Subdued trade in the precious metals complex despite the escalating geopolitical tensions, but still within contained parameters thus far in the run-up to risk events this week including Fed Chair Powell, ISM PMIs, and the US jobs reports. XAU resides within an USD 2,647.33-2,666.05/oz range.

- Base metals are firmer but off best levels as the optimism from Chinese stimulus is somewhat hampered by a broader cautious tone across markets.

- Russian Deputy PM Novak said Middle East geopolitical risks are already priced in, and global oil prices will not fluctuate significantly, via Ria

- BSEE estimated about 3% (prev. 12%) of oil production and 1% (prev. 6%) of natural gas production in the Gulf of Mexico was shut-in on Sunday. It was also reported that the death toll from Helene reached 89 and North Carolina’s Governor said that almost 464k customers in the state remain without power.

Geopolitics: Middle East

- "Israeli Walla website: The Israeli army completes its preparations for the ground incursion into south Lebanon", according to Sky News Arabia.

- "Iran will try to transfer thousands of fighters to the border areas between Lebanon and Syria", via Al Jazeera citing Bloomberg.

- "Iranian Foreign Ministry said we will not send forces to help Hezbollah", via Al Arabiya.

- "Reports of explosions in the Syrian capital, Damascus", via Sky News Arabia

- Hezbollah Deputy chief said will confront any possibility and are ready if Israel decides to enter by land; Hezbollah forces are ready for a ground incursion; confident Israel will not achieve its aims

- "Israeli special forces have been carrying out small, targeted raids into southern Lebanon, gathering intelligence and probing ahead of a possible ground incursion that could come as soon as this week," according to WSJ sources

- Israel conducted strikes on Lebanon’s capital of Beirut on Friday and targeted the headquarters of Hezbollah which killed Hezbollah leader Nasrallah.

- Israeli military said it struck dozens of Hezbollah terror targets in Lebanon including launchers that were aimed at Israeli territory, while it also announced that it killed senior Hezbollah figure Nabil Kaouk and the commander of Hezbollah’s southern front Ali Karaki.

- Israeli Walla website reports that Israeli forces are concentrated on the northern front and preparing for a ground invasion of Lebanon.

- Israeli military said sirens sounded in an area of Jerusalem following a launch from Lebanon towards Israeli territory on Saturday and reports noted that Hezbollah launched a new rocket attack on Israel after announcing the death of its leader and said the group is to continue its battle against Israel.

- Israeli military announced sirens sounded after a missile was fired from Yemen which was intercepted and Yemen’s Houthis said they fired a ballistic missile at Israel’s Ben Gurion Airport upon Israeli PM Netanyahu’s arrival, while it was also reported that the Israeli military conducted strikes on Houthi targets in Yemen on Sunday including a power plant and sea import used to import oil.

- Israeli army said it bombed dozens of rocket launchers and Hezbollah weapons storage buildings in eastern Bekaa, while the Popular Front for the Liberation of Palestine said three of its leaders were killed in an Israeli strike on Beirut.

- Israeli PM Netanyahu said on Saturday that Hezbollah’s Nasrallah was the main engine of Iran’s axis of evil and Nasrallah’s elimination was a necessary step towards changing the balance of power in the Middle East, while he added that their work is not done and there are challenging days ahead.

- Israel’s Defence Minister was reported to be holding talks on the expansion of IDF activities in the northern arena.

- Israel warned Lebanese air control that it would use force if an Iranian plane landed at Beirut Airport, while the Lebanese Transport Ministry asked the Iranian plane to stay away from Lebanese airspace and the plane obliged.

- Lebanon’s caretaker PM said that they have no option but the diplomatic option, while the Lebanese Information Minister said following a cabinet meeting that diplomatic efforts for a ceasefire are continuing. It was also reported that the head of the Lebanese government crisis cell said around 1mln Lebanese people have been displaced by Israel attacks.

- Lebanon’s top Christian cleric said Lebanon’s patriarch calls for diplomacy because war means all sides lose, while the top Christian cleric added that Nasrallah’s killing opened a wound in the hearts of the Lebanese and that the international community must work to stop the cycle of war, killing and destruction.

- Iran’s Supreme Leader Khamenei announced five days of mourning over the death of Hezbollah leader Nasrallah and said that Nasrallah’s blood will not go unavenged.

- Iran's President Pezeshkian said Lebanese fighters should not be left alone so that Israel does not attack countries of the axis of resistance one after the other.

- Iran’s Foreign Minister Araqchi said the killing of the IRGC deputy commander Nilforoushan in Lebanon will not go unanswered, according to a statement.

- Iran called for a UN Security Council meeting on Israel’s actions in Lebanon and across the region, while it warned against any attack on its diplomatic premises and representatives. Furthermore, it was stated that Iran will not hesitate to exercise its inherent rights under international law to take every measure in the defence of its vital national and security interests, according to Iran’s UN mission.

- Iran’s parliament speaker Qalibaf said the resistance will continue confronting Israel with the help of Iran, according to state media.

- US President Biden said it is time for a ceasefire now and replied that they are responding when asked if the US would respond to missile attacks on US warships in the Red Sea. It was also reported that President Biden is reviewing the status of the US military force posture in the region and directed continued diplomatic efforts to coordinate with allies and partners and de-escalate the ongoing conflicts.

- US Defense Secretary Austin spoke with Israeli Defence Minister Gallant and expressed support for Israel’s right to defend itself against Iranian-backed terrorist groups, while Austin stressed the US is determined to prevent Iran and Iranian-backed partners and proxies from exploiting the situation or expanding conflict.

- US is to reinforce defensive air support capabilities in the coming days in the Middle East and Defense Secretary Austin has put other US forces on a heightened readiness to deploy. US also ordered the departure of certain US Embassy direct hire employees and their eligible family members from Lebanon.

- US Central Command said it conducted targeted strikes in Syria which killed 37 terrorist operatives including senior leaders of ISIS and Hurras Al-Din.

- China’s Foreign Ministry said China opposes any violation of Lebanon’s sovereignty and urges the parties concerned, especially Israel, to immediately cool the situation.

Geopolitics: Other

- UAE condemned a 'heinous attack' on UAE's mission in Sudan's Khartoum and said the attack was carried out by a Sudanese military aircraft.

- Russian forces took control over the settlement of Makiivka in eastern Ukraine’s Luhansk region, according to IFX.

- Russia’s Kremlin said amendments to Russia’s nuclear doctrine have been prepared and will now be formalised, according to RIA.

- Russian PM Mishustin will visit Iran on Monday and will meet with the Iranian President.

- China’s Foreign Minister Wang told the UN General Assembly that China is not throwing oil on fire or exploiting the situation for selfish gain by promoting Ukraine peace talks, while he also stated that the complete reunification of China will be achieved and that Taiwan will eventually return to the embrace of the motherland.

- North Korea said the US’s USD 8bln military aid to Ukraine is an incredible mistake, while it added that Ukrainian President Zelensky who called Pyongyang an accomplice in the Ukraine war is waging reckless political provocation, according to KCNA.

- South Korea’s Foreign Minister Cho said Russia is engaging in illegal arms trade with North Korea.

Economic Data

- 09:45: Sept. MNI Chicago PMI, est. 46.0, prior 46.1

- 10:30: Sept. Dallas Fed Manf. Activity, est. -10.3, prior -9.7

Central Banks

- 08:50: Fed’s Bowman Speaks on Economic Outlook, Policy

- 13:55: Fed’s Powell Speaks at NABE

Government:

- 10:30 a.m.: Joe Biden delivers remarks on response efforts to Hurricane Helene

DB's Jim Reid concludes the overnight wrap

Welcome to the last day of the month and it’s a busy week ahead bookended with a Powell speech today and payrolls on Friday. Also key will be the flash CPIs from Germany and Italy (today), and the Eurozone (tomorrow), especially after weak numbers from France and Spain on Friday. This could tip the balance for an October ECB cut. Elsewhere the global reaction to the China stimulus blitz last week will stay ever present even if their golden week holiday starts tomorrow and we won't see domestic markets open over the period. As you'll see below investors are again scrambling to put on China risk this morning ahead of the holiday.

Let's now go into detail on the main events ahead before summarising the rest of the week's highlights. For payrolls, DB expect headline (150k forecast vs. 142k previously) and private (125k vs. 118k) payrolls to be slightly ahead of their 3-month averages of 116k and 96k, respectively. This is broadly in-line with consensus. DB expect the unemployment rate to round up to 4.3% on the back of a slight pick-up in participation (to 62.72%), but the risk is that it could remain at last month's 4.2% reading which is in-line with consensus. There are plenty of other employment signals this week with the ISM surveys, ADP, claims and JOLTS tomorrow. The JOLTS report has historically had one of the most reliable longer-term correlations to the prevailing employment trends but is always lagging by a month. Last month the private sector hiring rate continued near 2014 lows (outside the pandemic) but lay-offs were also lower than any period prior to the pandemic. The private sector quits rate (2.3%), which my colleague Francis Yared places great significance on, is also back close to 2018 levels and he believes more consistent with an unemployment rate of 4.5% using historical correlations as your guide. In short the US labour market can be characterised by currently having relatively low hirings and very low firings. So this is why there is no current drama but why it's wise to be on high alert. One small shock could move things very quickly. Equally a recovery in hiring could increase the gap between the two quite sharply. Interestingly the following month's payrolls figures could be influenced by the Boeing strike in mid-September that we don't think will influence Friday's figures, and a potential dockworkers' one from tomorrow.

The risk of lay-offs increasing and tipping the balance in the current labour market is why the FOMC recently opened up their account with a 50bps cut. Powell's speech today will likely stick to his FOMC script but it's fair to say that Fedspeak since the meeting has been more amenable to additional 50bps cuts than we'd thought they would be. We have another round of Fedspeak this week as you'll see in the day-by-day calendar at the end so plenty of opportunity for that debate to move along even if the payrolls at the end of the week could have a bigger impact.

In Europe, today's German and Italian CPI will take on added significance given how weak Friday's French (1.5% YoY vs. 1.9% expected) and Spanish (1.7% YoY vs. 1.9% expected) numbers were. The Eurozone numbers come tomorrow. If these misses are repeated it probably forces the ECB to either lean towards 25bps next month or 50bps in December instead of 25bps. So important releases.

In terms of the rest of the week across the globe, the main highlights outside those already discussed are the Chicago PMI and Lagarde speech today, various global manufacturing PMIs and US ISM alongside the US Vice President debate and the Japanese tankan survey tomorrow, US ADP and Eurozone unemployment on Wednesday, and various global services PMIs and ISM and Eurozone PPI on Thursday. Outside of data a policy speech by French PM Barnier tomorrow will give clues to how the budget will materialise.

This morning, Asian equity markets have seen some big early moves. The Nikkei has dropped by -4.64% following Friday's surprise selection of Shigeru Ishiba as the next prime minister, who has previously criticised the Bank of Japan’s loose policies. In contrast, stocks in mainland China are notching up a ninth day of gains ahead of a week long holiday tomorrow. The CSI is up by +5.84%, initially surging as much as +6.5%, the largest jump since 2015. The Shanghai Composite is also up by +5.28% with the Hang Seng +2.91% in early trading. Elsewhere the KOSPI is down by 0.88% and US futures are pretty flat.

Coming back to China, official factory activity slightly improved in September but stayed below 50 for a fifth consecutive month in September. This will be seen as backward looking now but for completeness, the manufacturing PMI came in at 49.8 in September (v/s 49.4 expected), up from 49.1 in August with the services PMI at 50.0 (v/s 50.4 expected), down from a level of 50.3 in the previous month. However, China’s Caixin PMI was 49.3 in September (v/s 50.5 expected), experiencing its sharpest contraction in 14 months. It followed a reading of 50.4 in August. The services Caixin PMI at 50.3 in September, was down from 51.6 in August.

Elsewhere, Japan's industrial output in August fell -3.3% m/m, as significant miss compared to market expectations of a -0.5% decline and against an increase of +3.1% in July. On a brighter note, retail sales increased by +2.8% y/y in August, surpassing market forecasts of +2.6% y/y following an upwardly revised gain of +2.7% in July.

Turning to politics, Austria’s far-right Freedom Party achieved a landmark victory in the parliamentary election on Sunday, strengthening pro-Russian and anti-establishment movements in Central Europe. This marks the first far-right national parliamentary election victory in Austria since World War II. Preliminary official results showed that the Freedom party secured first place with 29.2% of the vote, while Chancellor Karl Nehammer’s Austrian People’s Party came in second with 26.5%. The center-left Social Democrats finished third with 21%. The outgoing government, a coalition between Nehammer’s party and the environmentalist Greens, lost its majority in the lower house of parliament. Despite the Freedom Party’s success, it seems unlikely that their leader, Herbert Kickl, will become the new leader, as he would need a coalition partner to achieve a parliamentary majority. Rivals have stated they will not collaborate with Kickl in government.

Looking back at last week now, risk assets surged as China’s stimulus announcements and positive US data led to renewed optimism about the global outlook. In fact, it was the strongest week for the Hang Seng since 1998, with a +13.00% advance over the week (+3.55% Friday). And for the CSI 300, it was its best week since 2008, with a +15.70% advance (+4.47% Friday). China-exposed stocks in the US and Europe did very well in response too.

In terms of those broader gains, the stimulus announcement meant the CAC 40 had its best weekly performance since March 2023 with a +3.89% gain (+0.64% Friday), aided by the luxury goods companies in the index. Copper was another beneficiary, posting its biggest weekly gain since May with a +7.43% advance (+0.40% Friday). And the major indices more broadly had a very strong week, as the STOXX 600 hit another all-time high thanks to a +2.69% gain last week (+0.47% Friday). The gains were more modest in the US, with the S&P 500 advancing by +0.62% (-0.13% Friday).

Sovereign bonds had a decent end to the week thanks to softer-than-expected inflation data on both sides of the Atlantic. As already discussed, the preliminary reading for French CPI fell to +1.5% in September on the EU-harmonised measure (vs. +1.9% expected), and the Spanish reading was down to +1.7% (vs. +1.9% expected). So that led to growing expectations that the ECB might deliver another cut at their October meeting, particularly after the weak flash PMIs at the start of the week. Over the course of the week, that saw investors dial up the chance of an October cut from 26% to 82%, so a significant move. And in turn, that led 10yr bund yields to fall -7.4bps last week (-4.9bps Friday). However, there were still several concerns about the fiscal situation in France, and the Franco-German 10yr spread widened +2.9bps last week to 79bps.

Over in the US, on Friday we got the August numbers for PCE inflation, which is the measure that the Fed officially targets. This came in slightly below expectations, with headline PCE inflation down to +2.2% year-on-year (vs. +2.3% expected), which is only just above the Fed’s 2% target, and the lowest reading since February 2021. Annual core PCE was in line with expectations at +2.7%, but with the monthly reading a touch lower at +0.1% (+0.13% unrounded vs. +0.2% expected). That helped the 10yr Treasury yield to fall back on Friday, although over the week as a whole it was still up +1.0bps (-4.5bps Friday). The other report of note on Friday was the University of Michigan’s final consumer sentiment index for September, which came in at a 5-month high of 70.1.