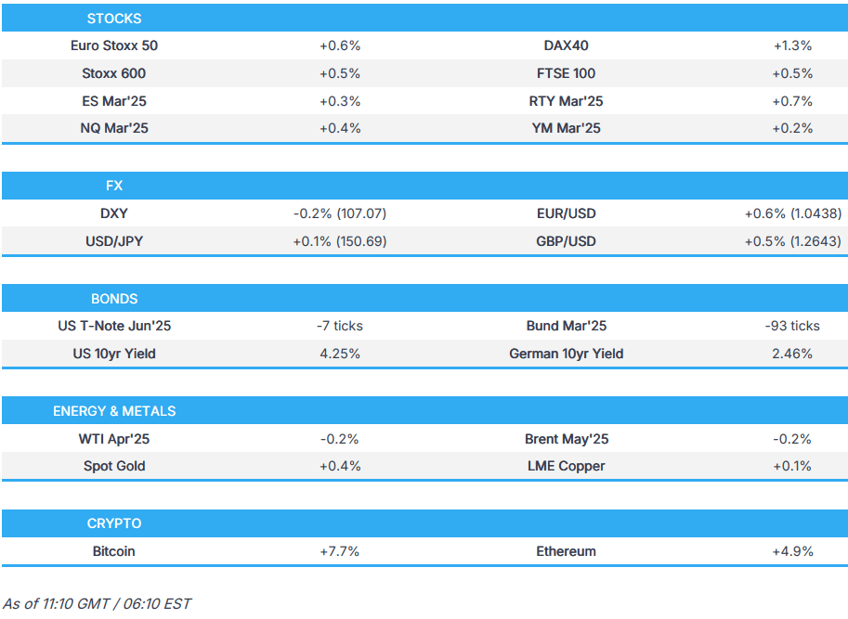

- European indices at session highs, Defence stocks roar on EU spending talks. US futures also gain, with the RTY outperforming.

- USD is on the backfoot as tariff deadline looms; EUR benefits from hotter-than-expected EZ HICP.

- Bonds are weighed on by developments around geopols/defence, currently at session lows.

- Crude clipped from APAC highs, Precious metals continue to benefit from the geopolitical risk-premia and softer Dollar.

- Looking ahead, US ISM Manufacturing PMI, Japanese Unemployment Rate, Comments from Fed’s Musalem.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- US Commerce Secretary Lutnick said Mexico and Canada have done a reasonable job on the border and there will be tariffs on Canada and Mexico on Tuesday but President Trump will decide at what levels. Lutnick added that China tariffs are set unless they end fentanyl trafficking into the US.

- White House official announced on Saturday evening that President Trump ordered to bolster the supply of forest resources and directed the Commerce Secretary to investigate harm to US National Security from imported lumber, while any tariffs resulting from the lumber investigation would be added to other tariffs, including fentanyl-related tariffs on Canada, Mexico and China. Furthermore, the official said China, Canada and Mexico could take quick action to avert fentanyl-related tariffs.

- China is studying countermeasures in response to the US March 4th tariff threat, while countermeasures will likely include both tariffs and a series of non-tariff measures with US agricultural and food products most likely to be listed, according to Global Times.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.3%) are mixed vs opening modestly firmer across the board; a significant sell-off was seen soon after the cash open, but with little fundamental driver at the time. As it stands, indices have rebounded from worst levels and look to be approaching the earlier highs. The complex was initially little reactive to slightly hotter-than-expected EZ HICP but then retreated from best levels thereafter.

- European sectors are mixed vs opening with a strong positive bias. Industrials take the top spot and is by far the clear outperformer, as Defence names prop up the industry. The likes of Rheinmetall (+8%), BAE Systems (+13%) and Rolls Royce (+5%) all gain for the reasons listed in the next bullets.

- Firstly, sentiment regarding a Ukraine-Russia peace deal has been hit after the recent bust-up between US President Trump and Ukrainian President Zelensky at the Oval Office on Friday. Secondly, French President Macron's proposed to raise the EU's defence spending to 3.5% of GDP. And finally, Germany is reportedly considering defence-specific funds in the formation of a new government.

- US equity futures (ES +0.3%, NQ +0.4%, RTY +0.7%) are very modestly in the green, but with the RTY performing a little better vs peers. Focus ahead is on US ISM Manufacturing.

- NVIDIA (NVDA) and Broadcom (AVGO) are reportedly running manufacturing tests with Intel (INTC) advanced process called 18A, according to Reuters sources

- For Crypto stocks; Bitcoin rose c. 10% over the weekend after US President Trump announced a US Strategic Reserve for several coins; Coinbase +8.5% in the pre-market.

- Tesla (TSLA) reinstated as "top pick" in US autos by Morgan Stanley

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is giving back some of Friday's upside, following the heated exchange between Trump, Vance and Zelensky. Focus today turns back to the US ISM Manufacturing PMI and on US tariffs. On the latter, US Commerce Secretary Lutnick said there will be tariffs on Canada and Mexico on Tuesday but President Trump will decide at what levels, and could be lower than 25%. DXY is around the 107 mark.

- EUR is firmer vs. the softer USD and one of the better performers across the G10 complex. Despite the tense conversation on Friday between Trump-Vance-Zelensky, markets remain optimistic over Europe's efforts to provide a plan to get the US and Ukraine back to the negotiation table. Elsewhere, EZ manufacturing PMI was revised a touch higher but ultimately remained below the 50 threshold. EZ flash CPI for February saw the headline (2.4% vs. Exp. 2.3%) and super-core (2.6% vs. Exp. 2.5%) metrics print a touch above expectations, whilst services fell to 3.7% from 3.9%. EUR/USD has moved back above its 50DMA at 1.0388 and gained a firmer footing on the 1.04 handle, towards highs of 1.0444.

- USD/JPY has pulled back after hitting resistance at the 151.00 level with the pair dragged lower amid the softer dollar and the early mild upside in Japanese yields; 30-year JGB yield touched its highest since October 2007. USD/JPY briefly made its way onto a 149 handle with a current session trough at 149.95.

- GBP is a touch firmer vs. the broadly weaker USD with UK newsflow on the light side and potentially set to remain so this week given the light calendar. The only real notable even this week is BoE Governor Bailey's appearance before the Treasury Select Committee on Wednesday. UK Manufacturing PMI printed a touch above the prior - but ultimately had little impact on price action. Cable currently sits towards the upper end of a 1.2577-1.2649 range.

- Antipodeans both have received some mild reprieve after trickling lower throughout most of last week, while the latest manufacturing PMI data from Australia and New Zealand’s largest trading partner China also provided some encouragement.

- PBoC set USD/CNY mid-point at 7.1745 vs exp. 7.2857 (prev. 7.1738).

- SNB Chairman Schlegel said the SNB will only reintroduce negative interest rates if necessary.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- A softer start for Bunds as sentiment in Europe has shrugged off the Zelensky-Trump fallout with Chinese PMIs and the APAC handover seeing a stronger start to the session which has been exacerbated by blockbuster performance in European defence names on reports/remarks around spending. Final Manufacturing EZ PMIs were revised modestly higher; EZ Inflation measures printed slightly hotter than expected and spurred a modest hawkish reaction, which then continued to take Bunds to a fresh session trough of 132.15.

- USTs are a touch softer as the latest geopolitical/defence developments don’t have quite the same ramifications for the US as they do for Europe. Currently at the lower end of a 110-27+ to 111-03 band, with recent pressure coming alongside the pressure seen across the pond. US newsflow is very much focused on the fallout from Trump-Zelensky, as we await concrete details into a potential Italian-led gathering, and the implementation of tariffs on Canada and Mexico tomorrow. Ahead, focus will be on US ISM Manufacturing PMI which will be scoured for tariff-related movements in input prices, as this could be indicative of a resurgence in inflation in the months ahead.

- Gilts are softer, trading in-fitting with European peers. As such, the benchmark is at the bottom end of a 92.76 to 93.39 band. February’s Manufacturing PMI was revised marginally higher but remains well into contractionary territory with internal commentary bleak.

- Click for a detailed summary

COMMODITIES

- Crude is flat but off overnight highs, as the complex unwinds some of the geopolitical premia seen overnight. Focus has been on both the Middle East and on Ukraine-Russia (Friday clash between Trump/Zelensky); on the former, Israel blocked aid to Gaza after the first phase of the truce deal expired over the weekend with no phase two deal in place. Brent'May trades around USD 72.90/bbl, and off worst levels.

- Some of the pressure today could be attributed to traders digesting news over the weekend that suggested Ukrainian President Zelensky is still "ready" to sign a minerals deal with Trump.

- Precious metals are on a firmer footing, with gold benefiting from the geopolitical uncertainty, with a softer USD also helping; XAU currently towards the upper end of a USD 2856.08-2876.62/oz range.

- Base metals are mixed; 3M LME copper was initially firmer as the complex digested the better-than-expected Chinese Manufacturing PMI figures - but the upside has gradually faded. 3M LME Copper is back towards opening levels of USD 9358 in USD 9330-9432 parameters.

- Guyana’s President Ali said a Venezuelan armed patrol ship entered Guyanese waters on Saturday morning and threatened oil production ships, claiming they were in Venezuelan waters, according to News Source Guyana.

- Canada is to extend mineral exploration tax credit for two more years, according to the Natural Resources Minister.

- Russian President Putin’s ally Matthias Warnig pushes a deal to restart the Nord Stream 2, according to FT.

- Russian oil products from Black Sea port of Tuapse planned at 0.798mln T in March vs 0.799mln T scheduled for February, according to traders cited by Reuters.

- Diesel loadings from Russia's Primorsk port set at 1.8mln T for March vs 1.73mln T scheduled for Feb, according to traders cited by Reuters.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU HICP Flash YY (Feb) 2.4% vs. Exp. 2.3% (Prev. 2.5%); services inflation 3.7% (prev. 3.9%); HICP Excluding Food, Energy, Alcohol & Tobacco Flash MM (Feb) 0.60% (Prev. -0.90%); HICP-X F&E Flash YY (Feb) 2.6% vs. Exp. 2.6% (Prev. 2.7%); HICP Excluding Food, Energy, Alcohol & Tobacco Flash YY (Feb) 2.6% vs. Exp. 2.5% (Prev. 2.7%).

- Spanish HCOB Manufacturing PMI (Feb) 49.7 vs. Exp. 51.5 (Prev. 50.9)

- Swiss Manufacturing PMI (Feb) 49.6 vs. Exp. 48.0 (Prev. 47.5)

- German HCOB Manufacturing PMI (Feb) 46.5 vs. Exp. 46.1 (Prev. 46.1)

- French HCOB Manufacturing PMI (Feb) 45.8 vs. Exp. 45.5 (Prev. 45.5)

- Italian HCOB Manufacturing PMI (Feb) 47.4 vs. Exp. 46.6 (Prev. 46.3)

- EU HCOB Manufacturing Final PMI (Feb) 47.6 vs. Exp. 47.3 (Prev. 47.3)

- UK S&P Global Manufacturing PMI (Feb) 46.9 (Prev. 46.4)

- UK Mortgage Lending (Jan) 4.207B GB vs. Exp. 3.55B GB (Prev. 3.568B GB, Rev. 3.343B GB)UK Mortgage Approval (Jan) 66.189k vs. Exp. 65.65k (Prev. 66.526k, Rev. 66.505k); BOE Consumer Credit (Jan) 1.74B GB vs. Exp. 1.2B GB (Prev. 1.045B GB, Rev. 1.062B GB); M4 Money Supply (Jan) 1.3% (Prev. 0.1%)

NOTABLE EUROPEAN HEADLINES

- Austrian liberal NEOS party members voted in favour of a coalition agreement which paves the way for a three-party government to take office.

- S&P affirmed France at AA-; Outlook revised to Negative from Stable and upgraded Portugal to A; Outlook Positive.

- S&P Global says US Tariffs would likely dent growth prospects in central Europe; weaker growth could compound existing fiscal challenges, impact of these tariffs are likely to be smaller than that of the weakening demand for German cars in China.

- Riksbank Business Survey: Economic activity is weak in most parts of the economy and largely unchanged compared with the previous survey in the autumn.

NOTABLE US HEADLINES

- US President Trump posted on Truth "We should spend less time worrying about Putin, and more time worrying about migrant rape gangs, drug lords, murderers, and people from mental institutions entering our Country - So that we don’t end up like Europe!".

- US President Trump commented on Truth "Treasury Department has announced that they are suspending all enforcement of the outrageous and invasive Beneficial Ownership Information (BOI) reporting requirement for U.S. Citizens".

- US Treasury Secretary Bessent said will appoint an affordability czar to address high prices, according to CBS News.

- US House Speaker Johnson said he wants a clean Continuing Resolution for the fiscal year through September, according to Punchbowl.

GEOPOLITICS

MIDDLE EAST

- Israel conducted strikes on Gaza on Sunday which killed four Palestinians, according to Reuters citing Gaza health officials. Furthermore, the Israeli military said it eliminated suspects who were planting an explosive device in Gaza.

- Israeli PM’s office said they will adopt the outline of US envoy Witkoff for a temporary ceasefire for the Ramadan and Passover holidays.

- Israel announced that it had ceased the entry of humanitarian aid into Gaza. It was separately reported that Israel’s Foreign Minister Saar said Hamas rejected the framework for a ceasefire and this is why were not able to move forward for the time being, while he added that the commitment for goods to enter was only for the first phase which has lapsed and the US understands Israel’s stance on the decision to halt Gaza aid. Saar also said that Israel is ready for the second phase of the agreement but “not for free”.

- Israel plans to increase pressure on Hamas to accept the proposal to extend the first phase of the Gaza agreement, according to Israeli media cited by Asharq News.

- Hamas said Israeli PM Netanyahu’s decision to halt humanitarian aid is cheap blackmail and a coup on the agreement while it urged Gaza ceasefire mediators to compel Israel to end punitive measures against Gaza. Furthermore, a Hamas official said the group will not agree to extend the first phase of the ceasefire deal and that the hostage release will only occur under the agreed phased deal, according to Reuters.

- Egypt’s Foreign Minister said Egypt will continue intensive efforts to start negotiations on the second phase of a Gaza ceasefire deal and the Gaza reconstruction plan has been completed which will be presented at the emergency Arab summit on Tuesday for approval, while foreign ministers of the Organisation of Islamic Cooperation will meet in Saudi Arabia after the emergency summit. Furthermore, Egypt’s Foreign Minister said using aid as a weapon of collective punishment and starvation in Gaza cannot be accepted or permitted.

RUSSIA-UKRAINE

- Russia's Kremlin on the London Summit, says this as not aimed at a peaceful settlement. On the Oval Office clash: Russia President Putin is aware of what happened at the Oval Office. Says Ukrainian President Zelensky does not want peace. Russia-US: Russia continues dialogue with the US on normalising bilateral ties. If Russian assets are given to Kyiv then there will be grave legal consequences.

- Ukrainian President Zelensky said late on Friday that he wants peace but will require security guarantees to prevent Russia from attacking again, while he is very thankful to US President Trump and said he respects him and the American people but refuses to apologise and believes the relationship with Trump can be repaired.

- Ukrainian President Zelensky commented on Sunday that they are ready to sign the minerals deal which he believes the US would be ready to sign as well, while he believes the relationship with the US will continue. Zelensky also said there has not been a day when they have not felt gratitude to the US for support and after meeting with European leaders, he said there will be more diplomatic peace efforts for the sake of Ukraine, all of Europe, and definitely America.

- Ukrainian President Zelensky met with UK PM Starmer on Saturday, while Ukraine and the UK signed an agreement that provides an additional GBP 2.26bln in loans towards Ukraine’s defence. It was separately reported that Zelensky said he met with Italian PM Meloni to discuss a common plan to end the war.

- UK PM Starmer said Europe needs a security guarantee from the US and that the UK, France and maybe others will work with Ukraine on a plan to stop the fighting which they will then discuss with the US and thinks it is a step in the right direction. Starmer said he would not trust Russian President Putin’s word and he does not think Ukrainian President Zelensky has done anything wrong, while he is clear that US President Trump does want lasting peace and added that there is a moment of real fragility in Europe.

- UK PM Starmer said on Sunday following the Ukraine summit that a new deal will allow Ukraine to use GBP 1.6bln of export finance and this will help protect Ukraine’s critical infrastructure, while he added that they agreed to keep military aid flowing to Ukraine and the economic pressure on Russia. Starmer said in the event of peace, they will boost Ukraine’s defence capabilities and the UK is willing to have boots on the ground and planes in the air regarding peacekeeping troops.

- US National Security Adviser Waltz said it was not clear Ukrainian President Zelensky was ready to negotiate in good faith at the White House and it is absolutely false that the Oval Office meeting was some kind of ambush. Waltz said Zelensky needs to make clear he is ready for peace and the US needs a Ukraine leader who can deal with Washington and Russia and end the war, while he added the US seeks a permanent end to the Ukraine war with European-led security guarantees, according to CNN.

- US Treasury Secretary Bessent said it is impossible to get an economic deal without a peace deal in Ukraine and the plan is for the EU to provide security guarantees for Ukraine not NATO.

- Ukraine’s Foreign Ministry condemned the breach of Ukraine’s territorial sovereignty by IAEA employees who visited the Zaporizhzhia nuclear plant via occupied territory which it said was the result of Russian blackmail.

- Russian Foreign Minister Lavrov said US President Trump is a pragmatist with the slogan common sense and the discussion in Europe about peacekeepers for Ukraine is arrogant. Lavrov said that the US bluntly said it wants to end the conflict in Ukraine but Europe demands the war to continue, while he added the West cannot explain what will happen to the territory of Ukraine and to the Russian language if European peacekeepers are deployed.

- Russia’s Medvedev said Russia is prepared to show flexibility in talks on Ukraine but only in accordance with the Russian constitution and realities on the ground, while he added Russia is ready to discuss a settlement but only with those who are ready to communicate.

- Russian Defence Ministry said Russian forces captured two new villages in eastern Ukraine, while Russian forces also struck gas processing plants in Ukraine, according to IFAX.

- French President Macron said France and Britain propose a one-month truce in Ukraine, according to The Telegraph.

- Germany reportedly discussed setting up special funds for defence and infrastructure, according to sources. It was separately reported that German Chancellor Scholz said they need to financially and militarily support Ukraine. Scholz also said they need a strong army in Ukraine in the future when the war is over and that Thursday’s summit will be about how to do more for their own defences.

- Polish PM Tusk said he supports Italian PM Meloni’s proposal to organise a US-Europe summit, while he sees no other power in the world than the US that can stop Russian aggression. Tusk separately commented that Ukraine summit participants declared they are ready to ramp up defence spending.

- EU’s von der Leyen said that they urgently need to rearm Europe and need to step up massively and have a surge in defence, while she added member states need more fiscal space to do a surge in defence and that they want the US to know that they are ready to defend democracy.

- Canadian PM Trudeau said everything is on the table when asked if he would contribute to a peacekeeping force in Ukraine and said nothing is more important to Canadians right now than standing up for their sovereignty, as well as noted regarding the Trump-Zelensky meeting that he stands with Zelensky.

CRYPTO

- Bitcoin is on a firmer footing and sits comfortably above USD 92k, as sentiment in the complex is lifted following Trump's recent announcement.

- US President Trump is to host the first White House cryptocurrency summit on March 7th. Trump also commented that the executive order on digital assets directed a strategic reserve that included XRP, Sol and ADA. Trump also stated that BTC and ETH, as other valuable cryptocurrencies, will be at the heart of the reserve, as well as commented that he loves Bitcoin and Ethereum.

APAC TRADE

- APAC stocks began the new trading month mostly higher in a rebound from Friday's Asian session sell-off and despite geopolitical uncertainty from the fallout of the Trump-Zelensky heated exchange in the Oval Office, while participants digested better-than-expected Chinese PMI data from over the weekend.

- ASX 200 traded higher with gains led by strength in the tech, real estate, telecoms, miners and materials sectors, while quarterly Australian company gross profits growth smashed forecasts.

- Nikkei 225 recovered some of Friday’s substantial losses despite the lack of fresh drivers and ongoing tariff uncertainty.

- Hang Seng and Shanghai Comp were underpinned following the better-than-expected official Chinese Manufacturing PMI data over the weekend which showed a surprise return to expansion territory, while Caixin Manufacturing PMI also topped forecasts. However, the gains in the mainland were contained as the tariff threat lingered with US Commerce Secretary Lutnick noting that China tariffs are set unless they end fentanyl trafficking into the US and with China reportedly studying relevant countermeasures in response to the US March 4th tariff threat.

NOTABLE ASIA-PAC HEADLINES

- Japan's Top-Currency Diplomat Mimura says the bright spots in the economy include tourism and strong corporate investment. Hearing not only big firms but from small/medium ones about the strong prospect of wage increases. Weaker JPY is a matter of inflation domestically, via increased import costs. Adds, Japan should increase reliance on foreign investors in the JGB market as the BoJ tapers and the population shrinks.

DATA RECAP

- Chinese Manufacturing PMI (Feb) 50.2 vs Exp. 49.9 (Prev. 49.1); Non-Manufacturing PMI (Feb) 50.4 vs Exp. 50.3 (Prev. 50.2)

- Chinese Composite PMI (Feb) 51.1 (Prev. 50.1)

- Chinese Caixin Manufacturing PMI Final (Feb) 50.8 vs. Exp. 50.3 (Prev. 50.1)