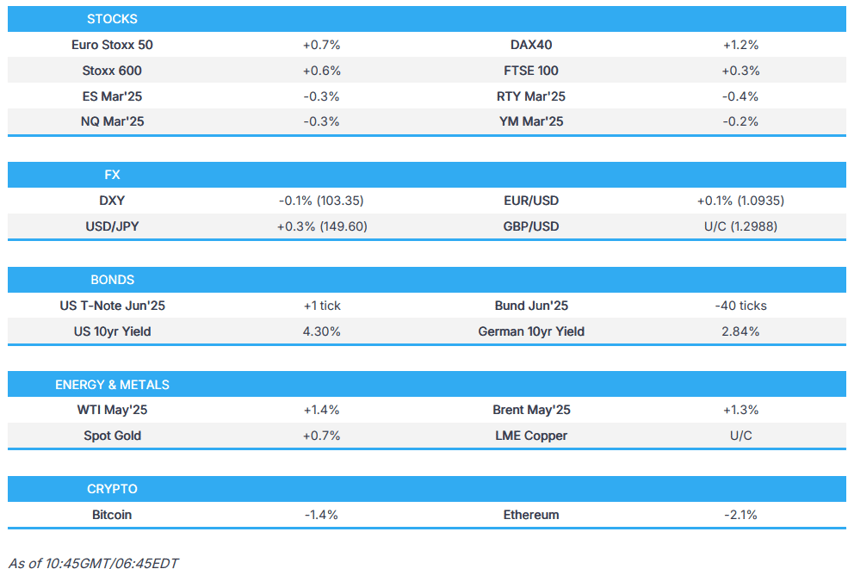

- European bourses are in the green ahead of German fiscal reform while US futures languish near the unchanged mark into data.

- Presidents Trump & Putin to hold a call between 13:00-15:00GMT, which the Kremlin says will last for as long as it takes.

- USD broadly on the backfoot, EUR/USD and GBP/USD both hit fresh YTD peaks while JPY hands back recent gains.

- Bunds softer into the Bundestag vote, USTs essentially flat with yields mixed and the curve steeper.

- Crude and Gold are underpinned by geopols while Gas pulls back into the Trump-Putin call.

- Looking ahead, highlights include Canadian Inflation, US Industrial Production, Imports/Exports, Japanese Exports/Imports, German Bundestag third reading on fiscal reform (vote), US President Trump-Russian President Putin Call, Speakers including ECB’s Escriva & NVIDIA CEO Huang, Supply from the US, Earnings from XPENG.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- US President Trump's team reportedly explored a simplified plan for reciprocal tariffs in which they recently debated sorting trading partners into one of three tiers instead of equalising tariff rates with every nation, although the proposal was said to have been ruled out, according to WSJ citing officials.

- USTR Greer is imposing a policy process on the reciprocal tariff plan in an attempt to inject order into new tariffs expected next month, after previous announcements roiled markets and fuelled business uncertainty.

EUROPEAN TRADE

EQUITIES

- European bourses are in the green and toward session highs in an extension of the gains seen on Monday. Focus firmly on upcoming fiscal reform with the vote set for around 13:30GMT in the Bundestag.

- DAX +1.3% is the regional outperformer with some of the budget beneficiaries such as Thyssenkrupp (+6.2%) near the top of the Stoxx 600.

- US equity futures are a touch softer, ES -0.4% & NQ -0.5%, count down to the afternoon's data docket where the latest import/export price data which will feed into both AtlantaFed and PCE. More broadly, the macro focus is on the Putin-Trump call which is set for between 13:00-15:00GMT and then the FOMC on Wednesday.

- Alphabet (+0.2%) in talks to purchase Wiz for USD 30bln, Tesla (-0.4%) softer as Toronto has excluded it from an incentive program due to US-Canada tensions, Walmart (+0.2%) CEO to sell shares and NVIDIA's (+0.5%) CEO to speak at 17:00GMT/13:00EDT.

- Apple (AAPL) has lost an appeal against a regulatory assessment that opens it up to stricter controls in Germany, according to a federal court ruling.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is broadly on the backfoot vs. peers with the exception of the JPY once again as the risk environment in Europe is currently an upbeat one; DXY at the lower-end of a 103.23-61 band.

- EUR is firmer and has been a high as 1.0954 vs the USD into the discussed German reform. A peak which is another YTD high, the next target comes via the 9th October peak @ 1.0980.

- JPY is continuing to hand back gains with USD/JPY as high as 149.91. Attention is turning to tomorrow's BoJ policy announcement with the central bank expected to stand pat on rates.

- GBP flat vs the USD but losing out vs the EUR given the above dynamics. BoE the near-term focus point. Despite the contained action, Cable hit a fresh YTD peak at 1.3004.

- CAD has been a touch lower against the USD into the regions inflation metrics, which are expected to show Y/Y CPI in Feb rising to 2.2% from 1.9% on account of the end of the sales tax holiday, according to ING.

- PBoC set USD/CNY mid-point at 7.1733 vs exp. 7.2364 (Prev. 7.1688).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Bunds are pressured and at the low-end of a 127.45-127.86 band with yields firmer across the curve which itself is notably steeper. Action which occurs into the fiscal reform vote, the process has begun in the Bundestag with the vote set for 13:30GMT (guidance only).

- USTs find themselves essentially unchanged once again into data and as the FOMC countdown begins, in a slim 110-17 to 110-24+ band which is entirely within Monday’s 110-14 to 110-30 parameters. For yields, the curve is once again mixed but today finds itself slightly steeper in-fitting with the bias from European peers.

- Gilts are lower and despite a lack of developments are the incremental underperformer with the stronger risk tone, EGB read across, looming OBR deadline and today’s earlier supply all perhaps factoring; supply was strong with a modest bounce seen thereafter.

- Click for a detailed summary

COMMODITIES

- Crude futures continue their geopolitically induced gains, as a slew of Middle East headlines supported benchmarks overnight, both WTI and Brent up around USD 1.0/bbl and at session highs of USD 68.72/bbl and USD 72.19/bbl.

- Dutch TTF is pressured ahead of the highly anticipated Trump-Putin call, where they are expected to talk about "power plants" and “land”, as Trump told reporters.

- Gold has made its way more convincingly past the USD 3k/oz mark, to a USD 3028/oz ATH.

- Base metals in the red with Aluminium underperforming on reports that the EU is set to announce a probe into aluminium imports to “protect the bloc’s industry from an expected surge in cheap imports displaced by US tariffs”,

- US President Trump posts on Truth that he is authorising his administration to "immediately begin producing Energy with BEAUTIFUL, CLEAN COAL"

- US Energy Secretary Wright said they expect to see a lot of pipelines getting built, according to Fox Business.

- Click for a detailed summary

NOTABLE DATA RECAP

- German ZEW Economic Sentiment (Mar) 51.6 vs. Exp. 50.3 (Prev. 26.0); Current Conditions (Mar) -87.6 vs. Exp. -80.5 (Prev. -88.5)

NOTABLE EUROPEAN HEADLINES

- Top German court rejected additional attempts to stop the debt brake reform vote.

- ECB's Rehn says growth in the Euro area economy is picking up gradually, notes that risk to inflation outlook are two sided.

NOTABLE US HEADLINES

- US President Trump is scheduled to sign executive orders at 15:30EDT/19:30GMT on Tuesday.

- US President Trump's administration is reportedly planning a 25% workforce reduction at the US IRS taxpayer help office, according to The Washington Post.

- WSJ's Timiraos, as part of his Fed preview, "Powell’s 18 colleagues who participate in monetary policy meetings have shifted their outlook. A few doves have become hawks, and vice versa. At least one has an eye on possibly succeeding Powell next year."

GEOPOLITICS

MIDDLE EAST

- Israel's military said it conducted extensive strikes and targets belonging to Hamas in Gaza and the Israeli PM Netanyahu's office said the PM and Defence Minister directed the military to take strong actions against Hamas in Gaza following the group's persistent refusal to release hostages and rejections of the proposals it has received.

- Israeli military said Home Command ordered restrictions on civilian activity near the Gaza Strip following strikes against Hamas and Israeli media said the air attack included the assassination of military and political leaders in Hamas. Furthermore, President Trump reportedly gave Israel the green light to resume attacks after Hamas refused to release hostages, according to an Israeli official cited by WSJ.

- Israeli media quoted security sources that stated the aim of the resumption of fighting in Gaza is to pressure Hamas to return to the negotiating table and release as many hostages as possible, while security sources added if Hamas does not respond, the operation will expand and will not be limited to air activity only.

- Hamas said Israel resumed aggression against civilians in Gaza and is unilaterally ending the ceasefire agreement, while it also stated that Israeli PM Netanyahu and his government decided to overturn the ceasefire agreement, exposing hostages in Gaza to an unknown fate. It was also reported that Israeli strikes killed at least 310 people and senior Hamas security official Mahmoud Abu Watfa was killed in Israeli strikes on Gaza.

- US Secretary of State Rubio said without Iran there would be no Houthi threat of this magnitude and that Iran created this terrifying monster which they have to take responsibility for.

- US Central Command said its forces continued strikes against Iranian-backed Houthi terrorists, according to Sky News Arabia. It was separately reported that a US spy drone retreated from near Iranian airspace after encountering Iranian F-14 fighter jets and reconnaissance drones, according to NourNews.

- Iran rejected and condemned 'reckless, provocative' statements by US President Trump and said it has not violated the UN arms embargo on Yemen or engaged in destabilising activities in the region, according to a letter to the UN Security Council Furthermore, Iran said that the Houthis and Yemeni authorities operate independently in their decision-making and actions.

- Yemen's Houthis are at war with the US now and will retaliate against strikes, via Reuters citing Houthi Minister Amer; will not be "dialling down" Red Sea action in response to US pressure or appeals from allies such as Iran.

RUSSIA-UKRAINE

- US President Trump posted on Truth that he will be speaking to Russian President Putin concerning the war in Ukraine on Tuesday morning and many elements of a final agreement have been agreed to, but much remains.

- Russian President Putin reportedly wants all arms sales to be halted in the event of a ceasefire agreement, according to Bloomberg.

- Kremlin says Russia President Putin and US President Trump will hold a call between 1-3pm GMT today; call will last as long as is necessary

CRYPTO

- Bitcoin is lower on the session but in a relatively narrow parameter and holding comfortably above the USD 80k handle.

APAC TRADE

- APAC stocks were mostly higher after the advances on Wall Street and with light catalysts heading into this week's central bank announcements, although some of the gains were capped as Israel resumed its bombardment of Gaza.

- ASX 200 was underpinned at the open but then pared the majority of its initial gains with strength in energy and defensives partially offset by losses in tech and consumer discretionary.

- Nikkei 225 coat-tailed on recent currency moves and retested the 38,000 level to the upside with strength in Japanese trading houses after Berkshire Hathaway boosted its stake in Japan's five largest trading houses.

- Hang Seng and Shanghai Comp were ultimately mixed with the Hong Kong benchmark significantly outperforming on tech strength and with Baidu leading the advances after its recent AI reasoning model launch, while the mainland struggled for firm direction in rangebound trade.