There is scope for positioning in the euro to push the currency higher as capital flows into Europe’s equity markets draw in speculators and trend followers.

The recent rise in the euro may have caught speculators off guard, with the currency on the march higher again this morning.

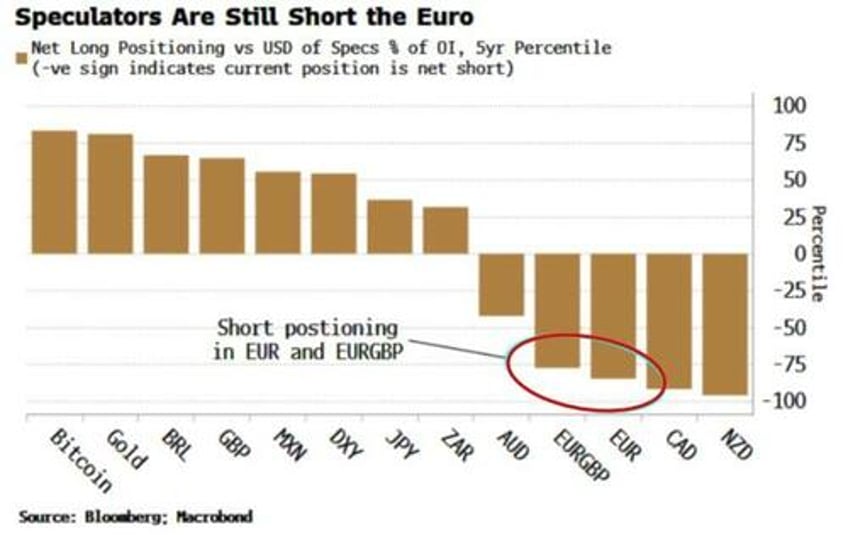

But, according to the Commitment of Traders report, they are still short the euro versus the dollar and sterling, as of last Tuesday.

The short in EUR/USD is small, but on a percentile basis over the last five years, it is large as speculators have been long the euro for most of that period.

It’s a little unlucky, then, that they have not been positioned correctly for a the slug of capital that has been flowing into Europe.

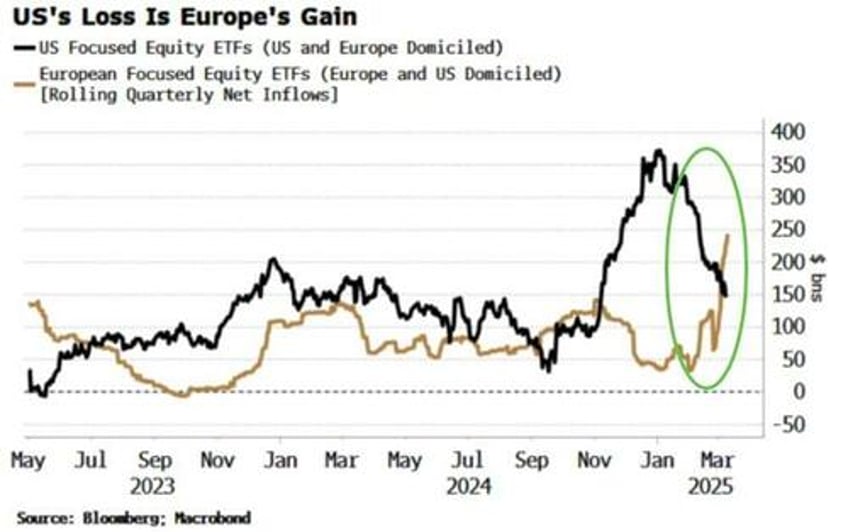

ETFs provide a real-time indication of capital flows in and out of equity markets. Taking the largest US and European focused equity ETFs domiciled in these two regions (which covers most of the flows), we can see there have been a rapid decline in inflows into US ETFs, and a sharp rise in inflows into European ETFs.

Whether these are reciprocal, we don’t know for sure, but as Europe has been the largest buyer of US stocks in recent years, it’s a fair bet capital is being pulled out of the US stock market and put into Europe.

No wonder, when there is the prospect of fiscal austerity in the first, and fiscal expansion in the second.

Equity flows tend to be unhedged, thus are supportive of EUR/USD. As pressure on the currency builds, momentum traders will join the trend. That applies to EUR/GBP as well, where speculators are also quite net short.

Capital might leave the fiscally retrenching UK looking for better returns across the English Channel.