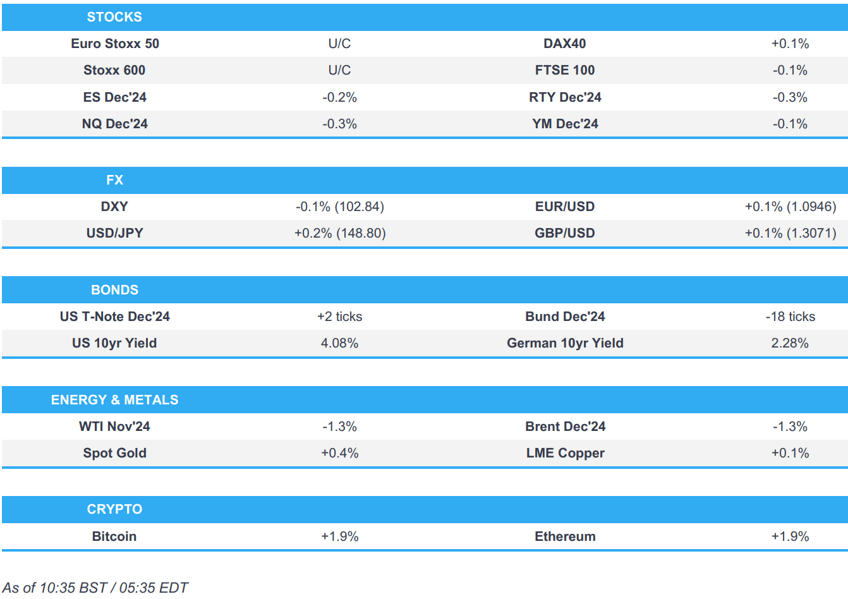

- European equities trade tentatively on either side of the unchanged mark; US futures are very modestly lower.

- Dollar is slightly lower with G10s mixed/flat; GBP was unreactive to mixed GDP figures.

- USTs remain firmer following the strong US 30yr auction, Bunds dip with pressure sparked from unrevised CPI figures (but with internals holding a hawkish skew), Gilts outperform post-GDP.

- Crude is under pressure, XAU gains and continues to extend above USD 2600/oz, base metals generally firmer.

- Looking ahead, US PPI, Canadian Unemployment, UoM Inflation Prelim., BoC SCE & Outlook Survey, Fitch Credit Review on France, Speakers including Fed’s Goolsbee, Logan & Bowman. Earnings from JPMorgan, BlackRock, Wells Fargo, Bank of New York Mellon & Fastenal.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (U/C) are bobbling around the unchanged mark in what has been a very lacklustre and indecisive session thus far.

- European sectors are mixed but with the breadth of the market fairly narrow; Real Estate takes the top spot alongside Basic Resources whilst Autos lags.

- US Equity Futures (ES, NQ, RTY) are very modestly on the backfoot, continuing the losses seen in the prior session. Tesla (-5.7%) slips in the pre-market after its event where it unveiled Cybercab and a driverless Model Y, but RBC said they heard much of what they expected to hear.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is slightly lower and trading within a very busy 102.76-94 range, which is within the confines of the prior session. Today’s docket includes US PPI, UoM Inflation Prelim. and speak from Fed’s Goolsbee, Logan & Bowman.

- EUR is slightly firmer vs the Dollar and trading just ahead of its 100 DMA (1.0934) in a current 1.0930-53 range. Today’s Final German CPI print for August were unrevised, but the internal commentary held a slight hawkish skew.

- GBP is firmer vs the Dollar and trading within a very narrow 1.3042-80 range. Cable was little moved on the back of the softer-than-expected GDP 3M/3M and Y/Y figures, with the Services figure also printing below expectations.

- JPY is very slightly lower vs the Dollar, with price action rangebound in what has been a quiet European session thus far. USD/JPY currently trades within a busy 148.41-85 range, which resides towards the midpoint of the prior day’s confines.

- Antipodeans are ever-so-slightly firmer vs the Dollar, attempting to nurse of their recent losses. Price action has been contained within a tight range given the lack of notable newsflow, so focus will ultimately lie on China’s MoF press conference on Saturday.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs remain bid following on from the US 30yr auction, which was well received. Since then, they have faded slightly from best but remain within reach of today’s 112-09+ peak and therefore only a few ticks shy of Thursday’s 112-11+ best.

- Bunds were initially firmer, in-fitting with USTs after the auction. However, an unrevised flash/prelim. set of German CPI (where the internals held a hawkish skew) sparked some modest pressure. A release which sparked around 10 ticks of pressure in Bunds, downside which has continued since to a 133.05 base.

- OATs are slightly firmer following the French draft budget; the OAT-Bund 10yr yield spread remains steady around the 76bps mark. Next up for France, is Fitch's credit review.

- Gilts are firmer and gapped higher at the open in reaction to today's somewhat mixed GDP figures with the M/M as expected but Y/Y figures coming in softer than expected, a dynamic which spurred a dovish reaction at the open but it is hard to say how much of this was from the UK or led by the catch-up to US supply. Gilts currently off best levels and holding around 96.18.

- Italy sells EUR 9.50bln vs exp. EUR 7.5-9.5bln 3.45% 2027, 2.65% 2027, 3.45% 2031, 4.15% 2039, 3.45% 2048 BTP:

- Click for a detailed summary

COMMODITIES

- Crude is under pressure having initially spent much of the APAC session within a tight range. Downside accelerated on reports that there was no vote at all at the end of the Israeli Security Council Meeting on Thursday.

- Spot gold is firmer, continuing to extend above the USD 2600/oz mark but yet to test the USD 2650/oz point and by extension the USD 2659/oz WTD peak.

- Base metals hold a positive bias vs generally flat overnight with price action somewhat hampered by the absence of Hong Kong participants with the remainder of the region largely awaiting the Chinese support updates which are expected on Sunday and Monday.

- Click for a detailed summary

NOTABLE DATA RECAP

- German CPI Final YY (Sep) 1.6% vs. Exp. 1.6% (Prev. 1.6%). FSO: "In particular, the renewed price declines for energy dampened the inflation rate in September 2024 more than in the previous months. In contrast, the continued above-average price increases for services had an inflationary effect,"

- UK GDP Estimate MM (Aug) 0.2% vs. Exp. 0.2% (Prev. 0.0%); YY 1.0% vs. Exp. 1.4% (Prev. 1.2%); 3M/3M (Aug) 0.2% vs. Exp. 0.3% (Prev. 0.5%)

NOTABLE US HEADLINES

- Fed's Goolsbee (2025 Voter) says does not see convincing evidence is overheating; repeats Fed must focus on both sides of the dual mandate; repeats inflation has cooled and job market is strong, via Bloomberg.

- DBRS calculates insured losses for hurricane Milton likely in the USD 30-60bln range.

GEOPOLITICS

MIDDLE EAST

- "Israel Hayom: Last night's cabinet meeting witnessed sharp differences between ministers", via Al Jazeera

- At the conclusion of Thursday's Israeli Security Council Meeting there was no vote on the outline of Israeli action in Iran or on giving "authorization of Netanyahu and Gallant to accept the decision", via Kann's Stein.

- Israeli Broadcasting Authority says the Security Cabinet has not yet made a decision on the nature of the response to Iran, according to Sky News Arabia.

- US President Biden and Israeli PM Netanyahu narrowed the gaps regarding the nature of Israel's response against Iran, according to Walla News' Ravid citing three US officials. The officials noted that Netanyahu and Biden made significant progress during their phone call in achieving an understanding of the scope of Israel's retaliation against Iran, while the administration was "a little less worried" after the call, and another official said "We are moving in the right direction".

- Iranian delegate to the UN said they do not seek war but are ready to defend their sovereignty against any aggression against their security and interests, while they will the exercise natural right to self-defence in accordance with international law against any attack. Furthermore, the delegate said Israel is a threat to international peace and its aggressive actions lead the region to all-out war.

- Lebanon's delegate to the UN said Lebanon is ready for a diplomatic solution and to facilitate the task of mediators.

- Israeli army said a local leader of the Islamic Jihad movement was killed in a raid on the Nour Shams camp in Tulkarm in the West Bank, according to Al Jazeera.

OTHER

- US Secretary of State Blinken denounces China's naval manoeuvres at ASEAN summit and said they are "increasingly dangerous".

CRYPTO

- Bitcoin and Ethereum continues to climb higher with the former looking to test USD 61k to the upside.

APAC TRADE

- APAC stocks traded mixed following the choppy price action stateside where markets reflected on disappointing data and hawkish-leaning comments from Fed's Bostic, while regional participants await the Chinese Ministry of Finance's press briefing.

- ASX 200 price action was lacklustre with the index contained by weakness in real estate, utilities and financials.

- Nikkei 225 eked marginal gains with index heavyweight Fast Retailing leading the advances post-earnings, while Seven & I was at the other end of the spectrum after it cut its guidance and announced a restructuring plan to fend off a takeover.

- KOSPI sits with marginal gains following the BoK's 25bps rate cut which Governor Rhee framed as a hawkish cut.

- Shanghai Comp was pressured in the absence of Hong Kong participants and stock connect flows, while participants await tomorrow's Ministry of Finance press conference and whether China will unveil large fiscal stimulus.

NOTABLE ASIA-PAC HEADLINES

- China issues guidelines on strengthening supervision, preventing risks and promoting high quality development of the Futures market. Will be cracking down on illegal and irregular activities. Measures will be implemented to curve specific speculation. To support deepening product and business cooperation

- China's Infrastructure Ministry, Ministry of Industry and Information Technology, and State Administration for Market Regulation are to hold a briefing on Monday at 10:00 local time (03:00BST/22:00EDT).

- BoK cut its base rate by 25bps to 3.25%, as expected, with the decision not unanimous as board member Chang Yong-Sung dissented and the central bank also voted to lower policy interest rate in special loan programmes. BoK said it will thoroughly assess trade-offs among inflation, growth, and financial stability, as well as noted that South Korea's economy is to continue moderate growth and the BoK will carefully determine the pace of further cuts to the base rate. Governor Rhee stated that five board members said keeping the policy rate at 3.25% is appropriate for the next three months and one board member was open to a further cut in the three months ahead, while Rhee added that today's policy decision could be viewed as a hawkish cut. Furthermore, he said they will look at property prices, Q3 growth figures and the pace of household debt growth for the rate review in November, while he added that they will look at financial stability risks for any further rate reduction decisions and the pace of rate cuts will be slower in South Korea compared with the US.