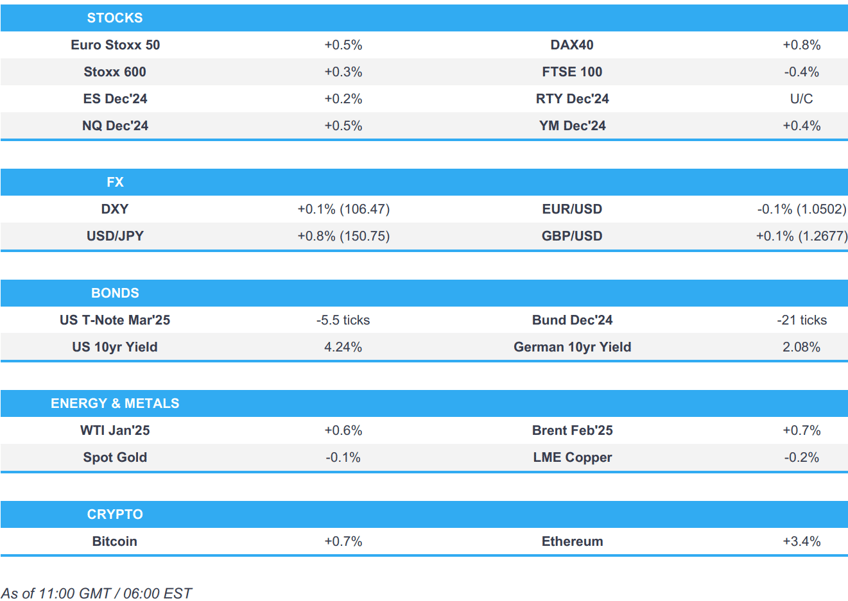

- European bourses are mostly trading in positive territory; US futures tilt higher ahead of Powell and a busy data slate.

- USD is broadly firmer vs. peers, AUD lags post-GDP, and GBP was weighed on by commentary from BoE’s Bailey who said he sees four 25bps cuts in 2025; a move which has since pared.

- European paper awaits French no confidence vote at 15:00 GMT.

- Crude holds an upward bias, WSJ reports that Saudi aims to keep oil prices elevated rather than chase market share; XAU/base metals are subdued amid the slightly firmer dollar.

- Looking ahead, highlights include US ADP, ISM Services PMI & Factory Orders, Fed Discount Rate Minutes, French Government No Confidence Motion, Speakers include ECB’s Lagarde, Fed’s Powell & Musalem.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses began the session mostly in positive territory, and continued to climb higher as the morning progressed. Today’s Final PMI metrics across Europe were mixed, and ultimately had little impact on price action.

- European sectors hold a slight positive vs initially opening almost entirely in the green. Autos, Retail and Tech take the top spots - seemingly beneficiaries of the risk-on mood seen in Europe today. Healthcare bottoms the sector list, weighed on by AstraZeneca after it received a PT cut at HSBC.

- US equity futures are trading on a firmer footing, taking impetus from a mostly positive session in Europe; the NQ is the marginal outperformer so far.

- ASM International (ASM NA) announces outcome of prelim assessment new export regulations; based on a prelim assessment newly issued US export controls are largely in line with previous assumptions.

- EU to crack down on Asian online retailers, such as Shein and Temu, according to the FT. Potential charges aim to slow surge of goods sold on sites such as Temu and Shein that evade custom duties and checks. The bloc’s safety authorities have detected a growing number of dangerous and counterfeit goods, many of which are dispatched direct to consumers.

- Marvell Technology (MRVL) topped Q3 earnings expectations, with strong AI demand driving a 19% sequential increase in revenue. Q3 adj. EPS 0.43 (exp. 0.41), Q3 revenue USD 1.8bln (exp. 1.46bln).

- Salesforce Inc (CRM) Q3 adj. EPS 2.41 (exp. 2.44) (note, strategic investments reduced EPS by around 0.18/shr), Q3 revenue USD 9.44bln (exp. 9.35bln). Sees Q4 adj. EPS between USD 2.57-2.62 (exp. 2.65), and sees Q4 revenue between USD 9.90bln-10.10bln (exp. 10.05bln).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY a touch higher with the USD showing greater performance vs. JPY and the antipodeans. Recent Fed commentary has continued to talk up the possibility of a rate cut on 18th December. Markets will be looking for greater clarity from Fed Chair Powell later in the session; but before that, traders will look out for US ADP and ISM services.

- EUR is slightly softer vs. the USD ahead of today's French no confidence vote on PM Barnier's government; a motion Barnier is expected to lose. Lagarde is due to speak at 13:30GMT but is unlikely to sway the 25bps vs. 50bps debate. EUR/USD has continued to pivot around the 1.05 mark and currently sits within yesterday's 1.0480-1.0535.

- JPY on the backfoot vs. the USD with USD/JPY continuing to chop around the 150 mark with prices consolidating after the recent declines in USD/JPY.

- GBP has been knocked lower in recent trade following dovish remarks from BoE Governor Bailey who stated that he sees four 25bps rate cuts in 2025; Note, market pricing ahead of his comments looked for three 25bps rate cuts next year. Cable slipped further onto a 1.26 handle, tripping below Tuesday's low at 1.2637.

- AUD is the laggard across the majors following soft domestic Q3 GDP data overnight which has seen money markets fully price an RBA rate cut for the April 2025 meeting. NZD/USD is lower but to a lesser extent; session low at 0.5832.

- PBoC set USD/CNY mid-point at 7.1934 vs exp. 7.2821 (prev. 7.1996)

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- The US curve is modestly bear-steepening after yesterday's Waller induced bull-steepening. Commentary from Fed officials since from the likes of Daly has done little to talk up the odds of a pause later this month. Today sees US ADP, ISM Services ahead of Chair Powell at 18:45 GMT. Mar'25 UST has broken below Tuesday's low and is eyeing the WTD trough at 110.23.

- Bunds/OATs are trading on the backfoot as traders await today's no confidence vote in French PM Barnier; a motion Barnier is expected to lose. DE/FR spread has narrowed to just below 85bps having peaked just shy of 89bps on Monday. Today’s German 2034 Bund auction passed without issue.

- Gilts have seen a pick-up in recent trade (but are ultimately softer on the session) following dovish remarks from BoE Governor Bailey who stated that he sees four 25bps rate cuts in 2025. Note, market pricing ahead of his comments looked for three 25bps rate cuts next year. Mar'25 Gilts rose from 95.82 to 96.06 within a few minutes to then stabilise around 96.00 ahead of a 2031 auction, which was fairly weak; the results sparked some fleeting pressure in Gilt prices.

- UK sells GBP 4bln 4.0% 2031 Gilt: b/c 2.91x (prev. 3.42x), average yield 4.155% (prev. 3.988%), tail 0.8bps (prev. 0.2bps)

- Germany sells EUR 2.866bln vs exp. EUR 3.5bln 2.60% 2034 Bund: b/c 2.4x (prev. 2.30x), average yield 2.07% (prev. 2.38%) & retention 18.1% (prev. 16.35%)

- Click for a detailed summary

COMMODITIES

- WTI and Brent are relatively flat and within a tight range ahead of Thursday's OPEC+ meeting slated for tomorrow at 11:30 GMT. Recent geopolitical developments include reports that "Israeli forces opened fire on Lebanese army forces during their inspection of the port of Naqoura". A WSJ article reported that Saudi Arabia is aiming to keep oil prices elevated rather than chase market share; news which fuelled some marginal upside in the complex, which ultimately proved fleeting. Brent Feb trades in a USD 73.54-74.17/bbl.

- Precious metals are generally subdued intraday against the backdrop of a slightly firmer Dollar, whilst major newsflow for the yellow metal remains sparse in the run-up US ISM Services PMI, Fed Chair Powell, and then Friday's US Jobs data. Spot gold resides in a tight USD 2,636.73-2,651.45/oz parameter.

- Mostly subdued trade across base metals amid a slightly firmer Dollar, but despite a mildly firmer risk tone elsewhere. 3M LME copper trades in a narrow USD 9,076.50-9,133.50/t range.

- US Private Inventory Data: Crude +1.2mln (exp. -0.7mln), Distillates +1.0mln (exp. +0.9mln), Gasoline +4.6mln (exp. +0.6mln), Cushing +0.1mln.

- OPEC+ meeting to take place tomorrow at 12:30 Vienna (11:30 GMT), according to Energy Intel.

- Saudi Arabia reportedly aims to keep oil prices elevated rather than chase market share, according to WSJ; Saudi reportedly averse to a price war with US shale. "Delegate noted that Angola already quit the cartel, and speculated that other countries could soon follow as a result of the policy".

- Click for a detailed summary

NOTABLE DATA RECAP

- EU Producer Prices YY (Oct) -3.2% vs. Exp. -3.3% (Prev. -3.4%); Producer Prices MM (Oct) 0.4% vs. Exp. 0.4% (Prev. -0.6%)

- EU HCOB - Composite Final PMI (Nov) 48.3 vs. Exp. 48.1 (Prev. 48.1); HCOB Services Final PMI (Nov) 49.5 vs. Exp. 49.2 (Prev. 49.2)

- German HCOB Composite Final PMI (Nov) 47.2 vs. Exp. 47.3 (Prev. 47.3); HCOB Services PMI (Nov) 49.3 vs. Exp. 49.4 (Prev. 49.4)

- French HCOB - Services PMI (Nov) 46.9 vs. Exp. 45.7 (Prev. 45.7); HCOB Composite PMI (Nov) 45.9 vs. Exp. 44.8 (Prev. 44.8)

- Spanish Services PMI (Nov) 53.1 vs. Exp. 53.2 (Prev. 54.9)

- Italian HCOB Services PMI (Nov) 49.2 vs. Exp. 51.2 (Prev. 52.4); HCOB Composite PMI (Nov) 47.7 (Prev. 51.0)

- UK S&P GLOBAL PMI: COMPOSITE - OUTPUT (Nov) 50.5 vs. Exp. 49.9 (Prev. 49.9); S&P GLOBAL SERVICE PMI (Nov) 50.8 vs. Exp. 50.0 (Prev. 50.0)

- Swedish PMI Services (Nov) 50.9 (Prev. 52.9)

NOTABLE EUROPEAN HEADLINES

- BoE's Bailey said he sees four 25bps BoE rate cuts in 2025, according to the FT. He welcomes recent inflation developments, and added the MPC has emphasised gradual outlook for rates, and the disinflation process is well embedded but there is further to travel. He noted inflation impact of higher trade tariffs are not straightforward at all.

- ECB's Holzmann said a 25bps rate cut is conceivable in December and not more, while he added nothing is decided on the next rate move and it will depend on data available at the December meeting. Furthermore, he stated that US President-elect Trump is casting a shadow over inflation in Europe and will probably drive up the inflation forecast.

- ECB policymaker and Bundesbank President Nagel said the German economy faces a weak outlook and 2025 is likely to be another year of weak growth, while he also called for a softer debt brake to ramp up investment, according to FT.

- ECB's Rehn said he sees more grounds for the ECB to cut rates in December, sees policy easing continuing in the coming months.

- ECB's Vujcic said a December rate decision will not be difficult, small steps on rates are better amid uncertainty, other ECB officials broadly agree on rates, via Politico.

NOTABLE US HEADLINES

- US President-elect Trump is considering Florida Governor Desantis as a possible replacement for Pete Hegseth as his pick for Defence Secretary. It was later reported that Senator Earnst of Iowa is among the names under consideration to replace Hegseth as pick to lead the Pentagon, while other Trump allies are floating Senator Hagerty of Tennessee for the role, according to CNN.

- US Speaker Mike Johnson anticipates the stopgap funding bill will expire in late March 2025. A final decision is expected in the coming days, according to PunchBowl News.

GEOPOLITICS

- "Israeli forces opened fire on Lebanese army forces during their inspection of the port of Naqoura", according to Al Arabiya

- The Israel-Hezbollah ceasefire agreement "will endure and not collapse despite all the shocks it has experienced since its announcement", according to a government source via Lebanese newspaper cited by Israeli journalist. "According to him, nothing has changed since reaching the agreement in terms of the political reality and the reality on the ground that led to its formulation. "The agreement was not forged so that it would collapse within a few days."

- Syrian army announced the entry of the largest military convoy to the countryside of Hama to support the forces deployed on the fronts, according to Al Arabiya.

- Iran's Deputy Foreign Minister of Political Affairs yesterday warned of possible NPT withdrawal if UN ‘snapback’ mechanism triggered, via IRNA citing a top lawmaker.

RUSSIA-UKRAINE

- Russian defence units were reportedly engaged in repelling a Ukrainian drone attack on Russia's Novorossiisk, while the report added that the Black Sea port of Novorossiisk is one of Russia's most important oil export gateways.

OTHER

- US and South Korea postponed planned defence talks and joint military exercises that were scheduled this week.

- China's Coast Guard said four Philippine Coast Guard ships attempted to enter China's territorial waters around Scarborough Shoal and the ships dangerously approached China's normal law enforcement patrol vessels, while it stated that China exercised control over the Philippine ships in accordance with the law. However, Philippine's Coast Guard said Philippine vessels encountered aggressive actions from several Chinese Coast Guard vessels and the Chinese Coast Guard fired a water cannon against Philippine vessels, as well as "intentionally sideswiped" a Philippine vessel on the starboard side.

CRYPTO

- Bitcoin is incrementally firmer and holds above USD 96.5k; Ethereum sees gains of a larger magnitude and sits above USD 3.7k.

APAC TRADE

- APAC stocks were mostly subdued with underperformance in South Korea following the martial law declaration and backtrack.

- ASX 200 was led lower by underperformance in real estate, defensives and financials, while Australian GDP data disappointed.

- Nikkei 225 swung between gains and losses with price action indecisive amid the lack of Japan-specific catalysts.

- KOSPI underperformed following South Korean President Yoon's martial law declaration and subsequent backtracking which has led to calls from within the party to step down and an effort by opposition parties to impeach him for treason.

- Hang Seng and Shanghai Comp lacked conviction after somewhat mixed PMI data in which Chinese Caixin Services PMI missed forecasts but Caixin Composite PMI accelerated, while trade frictions also lingered after China's MOFCOM banned the export of "dual-use items" relating to gallium, germanium, antimony and super-hard materials to the US.

SOUTH KOREA

- Click for a full overview of South Korea's current political environment.

- South Korean ruling party leaders urged President Yoon to resign from the party and the ruling party leader saw the need to oust the defence chief and suggested that Yoon be kicked out of the party although ruling party lawmakers had various views and were undecided on Yoon's departure from the party. Furthermore, the main opposition party announced it would seek to impeach President Yoon and it was also reported that South Korea's Cabinet offered mass resignation.

- BoK said it will increase short-term liquidity measures starting Wednesday and will loosen collateral policies in the repo operation to ease any bond market jitters, while it will deploy various measures to stabilise FX as needed and will make any special loans available to inject funds into the market if required.

- South Korea's regulator said it is ready to deploy the KRW 10tln stock market stabilisation fund anytime, according to Yonhap.

- South Korean main labour union group called for a general strike until South Korean President Yoon resigns, according to AFP.

- South Korea's metal workers' union said it will launch a full strike from December 11th unless President Yoon steps down, according to Yonhap.

- BoK Governor Rhee suggests more rate cuts are unlikely respite the turmoil; adds "political certainty may have actually increased"; not changing economic outlook, via Bloomberg TV.

- South Korea's Defence Minister offers to resign, according to Yonhap.

DATA RECAP

- Chinese Caixin Services PMI (Nov) 51.5 vs. Exp. 52.5 (Prev. 52.0); Composite PMI 52.3 (Prev. 51.9)

- Australian Real GDP QQ SA (Q3) 0.3% vs. Exp. 0.4% (Prev. 0.2%); YY SA 0.8% vs. Exp. 1.1% (Prev. 1.0%)