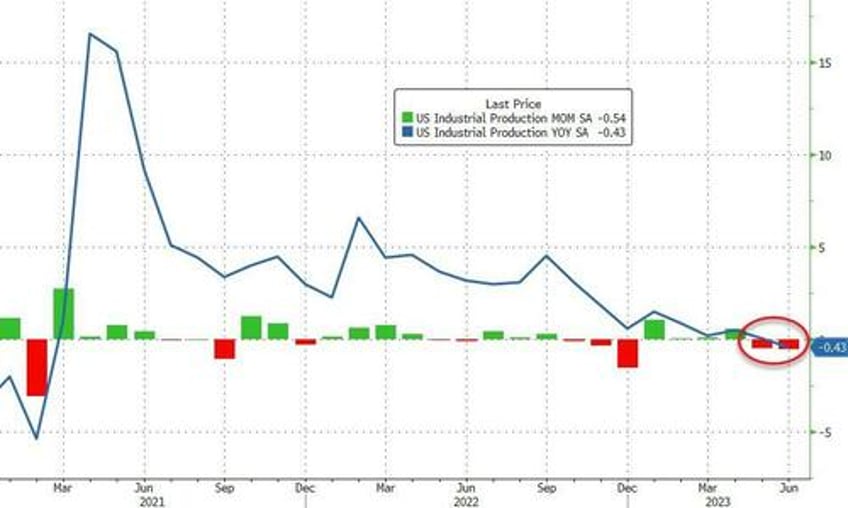

After an unexpected decline in May, US Industrial Production was expected to show no change in June as 'hard' manufacturing data begins to match the 'soft' survey collapse. However, things were considerably worse than expected with a 0.5% MoM decline - the biggest drop since Dec '22...

Source: Bloomberg

The consecutive declines pushed Industrial Production down 0.4% YoY - its first annual decline since Feb 2021.

Utilities saw a large decline (-2.6% MoM) but the index for consumer durables also fell 2.7%, led by notable decreases in the output of appliances, furniture, and carpeting (3.8 percent) and of automotive products (3.6 percent). The decrease of 0.9 percent in the index for consumer nondurables reflected declines in clothing (2.1 percent), energy (1.8 percent), and food and tobacco (1.3 percent).

Capacity Utilization declined to its lowest since 2021...

Source: Bloomberg

The Manufacturing sector also saw a decline, down 0.3% MoM vs unch expected.

Source: Bloomberg

That is the fourth straight month of YoY declines in Manufacturing output.

So much for the 'soft landing' narrative.