By Sagarika Jaisinghani, Bloomberg Markets Live reporter and strategist

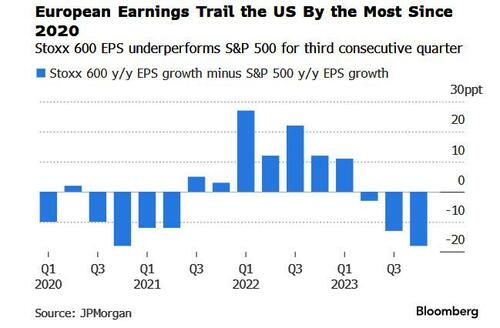

Europe Inc. just reported its worst earnings season relative to the US in three years, according to data from JPMorgan. And worst yet, strategists are bracing for more pain before recovery starts.

Profits of Stoxx Europe 600 firms are estimated to have dropped 11% in the fourth quarter, 2 percentage points more than analysts expected, the research shows. The decline is driven by sputtering economies — with both Germany and the UK in recession — as well as underwhelming growth in China, a key market for European companies.

The development marks a stark contrast to Corporate America, where the latest earnings grew by a better-than-expected 8%, data compiled by Bloomberg Intelligence show. That’s mainly thanks to the seven-largest stocks though, most of them tech. Without them, the rest of the S&P 500 saw a 1.6% drop in profits — still outperforming Europe.

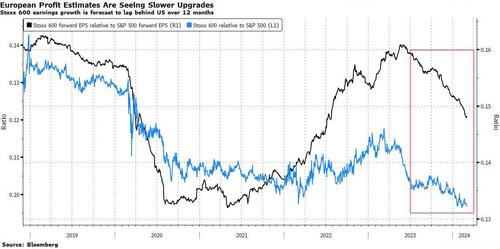

Fund managers and strategists aren’t fully convinced about an imminent recovery for European earnings, given the continent’s economic malaise, the bleak outlook for commodity prices and lack of AI darlings akin to Nvidia. While Europe has AI beneficiaries such as ASML, ASM International and BE Semiconductor, their performance has lagged well behind Nvidia. Data from BI shows S&P 500 profits are expected to rise 8.4% this year compared with a 4.4% increase in Europe.

A Citigroup index shows analysts are bearish, with earnings downgrades consistently outnumbering upgrades in the past five months. Still, Citi strategist Beata Manthey says the pessimism may have gone too far. “The silver lining for Europe is that US earnings are priced for perfection,” Manthey says. “In Europe, investors are pricing in flat earnings growth. That lowers the bar for earnings beats,” especially if local economies or China deliver a “positive surprise.”

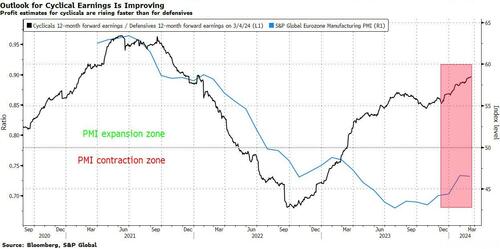

Signs of an improvement in the macro outlook are already showing up in the performance of cyclical stocks, which are more sensitive than their defensive peers to economic growth. Analysts are raising profit estimates for cyclicals at a faster clip than for defensives as business activity ticks up, according to data compiled by Bloomberg.

Barclays strategist Emmanuel Cau is also optimistic that an improving business cycle will feed a broader equity rally. “Soft data” such as manufacturing and services sector activity tend to be a good leading indicator for future earnings growth, Cau says, and they’re signaling a nascent rebound. “Investors are paying up ahead for potential EPS recovery later,” he says.

Fund managers in a recent Bank of America survey were broadly cautious, with about 54% of participants seeing downside for European EPS in the coming months. Still, that number is down from 75% in January and 88% in December. Hopes are also growing that luxury goods makers — which depend on China for a significant share of revenue — will revive along with demand from the world’s second-biggest economy. Resilient earnings at LVMH have fueled a 27% surge in the MSCI Europe Textiles Apparel & Luxury Goods Index the since mid-January.

“We agree that the first quarter is likely to be challenging with double-digit negative earnings growth,” Deutsche Bank strategist Maximilian Uleer says. But he expects a “pronounced” recovery in the second half of the year against the backdrop of global economic growth.