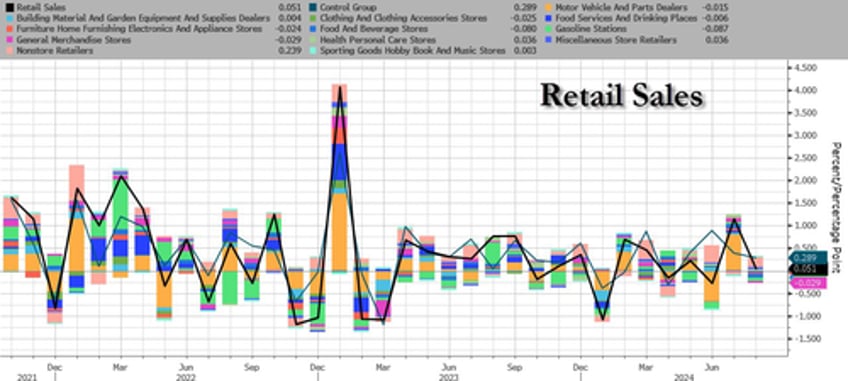

After August's upside surprise (+1.0% MoM, thanks to some shenanigans in the used car sales segment of the economy), US Retail Sales was expected to decline MoM (-0.2% MoM) in August (with BofA suggesting a 0.3% MoM decline).

But.... just like in July, the headline retail sales print for August beat expectations, rising 0.1% MoM (with July revised up to +1.1% MoM) thanks to non-store retailers...

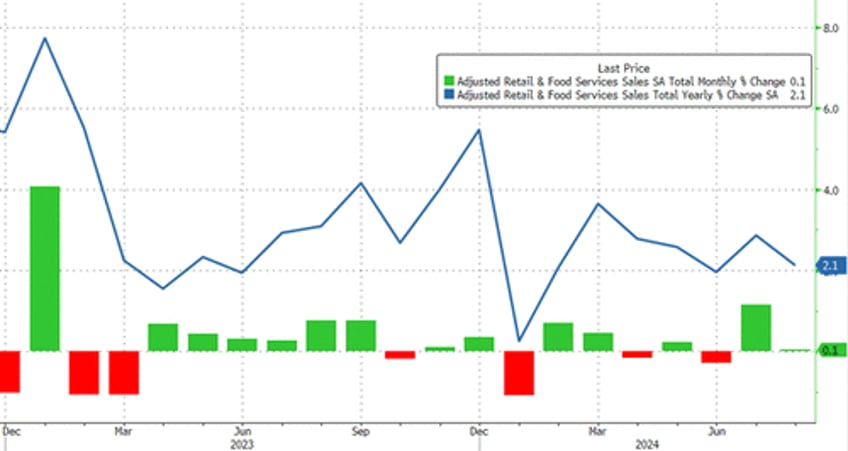

This slowed the YoY retail sales print to +2.1%...

Source: Bloomberg

However, core retail sales (ex-Autos) rose just 0.1% MoM (less than the +0.2% expected), but the core YoY print rose to +3.9%...

Source: Bloomberg

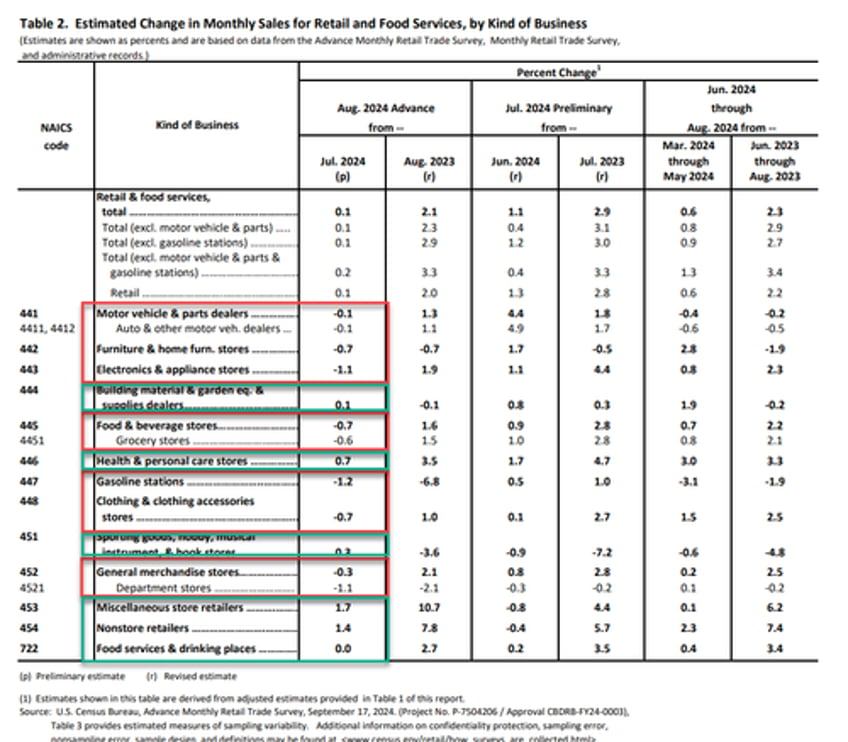

Under the hood, Motor Vehicle and Electronic Appliance sales contracted while non-store retailers (internet) surged...

After last month's surge, vehicle sales were flat MoM at the highs ignoring the slide in CPI Used car prices which suggest sales are anything but robust...

Source: Bloomberg

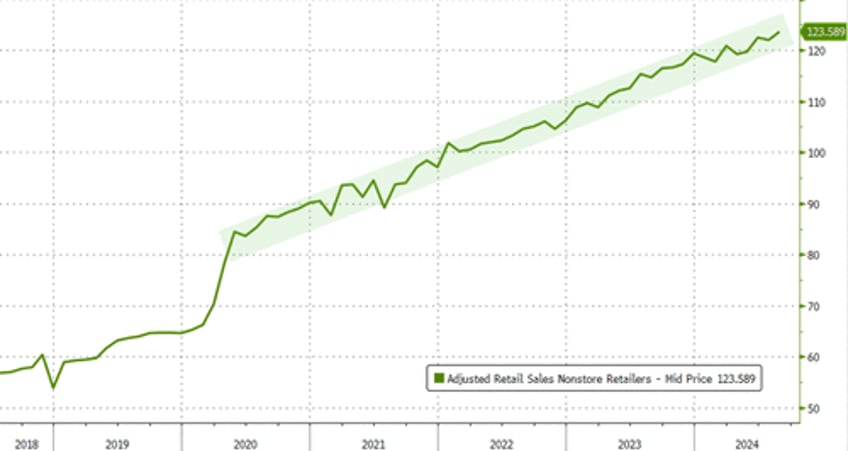

Non-Store Retailers hit a new record high...

Source: Bloomberg

Does anyone else think that line is just a little too linear for the real world?

As a reminder, retail sales data is nominal. A simple adjustment based on CPI shows real retail sales are flat YoY...

Source: Bloomberg

Will any of this stop Powell and his pals from cutting rates by 50bps tomorrow? Of course not...