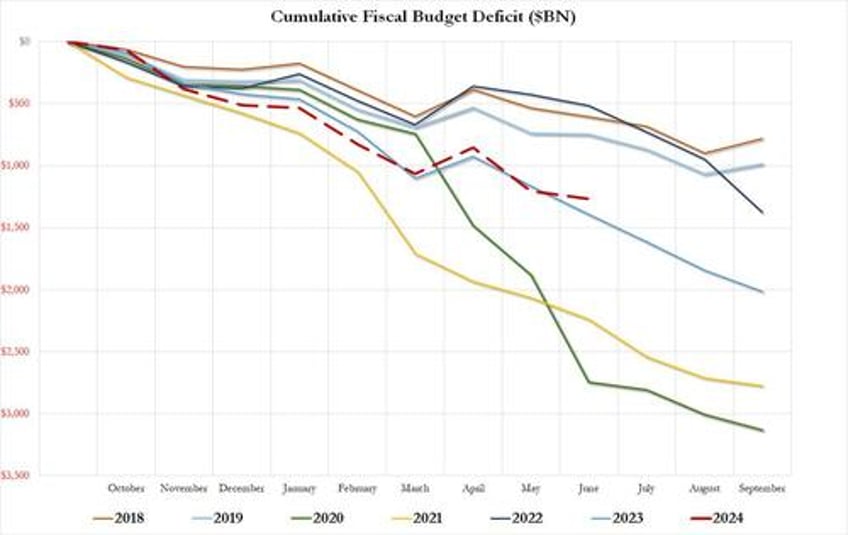

On the surface, and following 4 months of triple-digit deficits (in the billions), the June budget deficit of "only" $66 billion was a pleasant surprise (especially when the market expected an $83 billion deficit, and compares favorably to the $228 billion deficit a year ago). Indeed, the deficit was small enough it managed to shrink the cumulative YTD deficit ($1.268 trillion), below the deficit for the comparable period one year ago ($1.393 trillion).

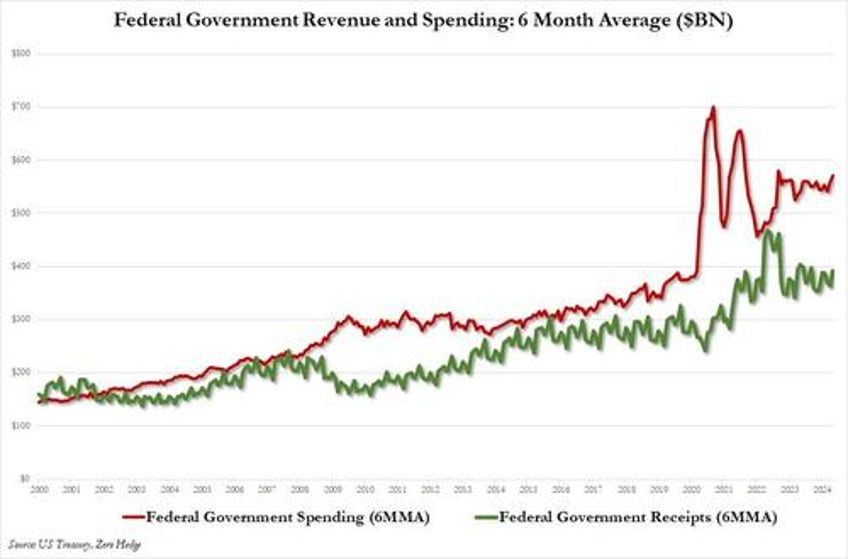

Unfortunately, that's as good as it gets, because when one takes a step back and ignores the monthly calendar effects, the picture remains the same: the US is spending far more than it is generating in tax revenues.

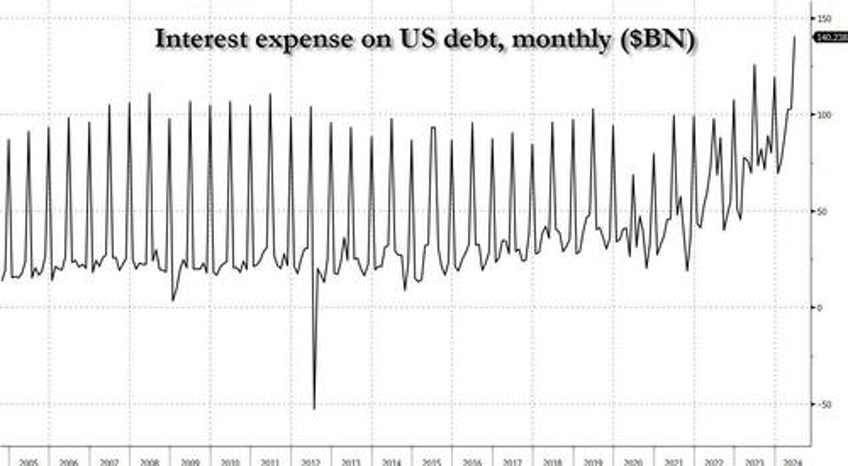

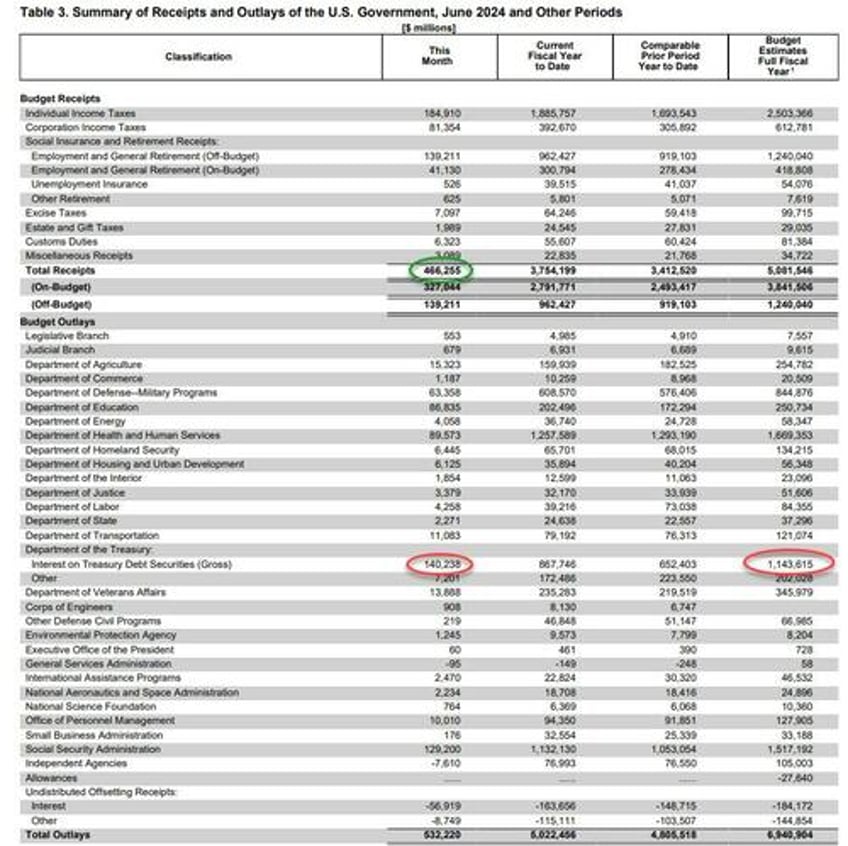

And it only goes downhill from there, because as we have noted previously, the biggest risk factor is not so much spending on such discretionary items as social security, health and national defense ("how dare you say these are discretionary! these are mandatory, untouchable outlays" some will scream, but if and when the taxes dry up and the dollar loses its reserve status you will see just how discretionary they are), but on interest, and here recall what we said back in April: "interest on US debt - currently the second biggest government outlay at $1.1 trillion - will surpass social security and become the single biggest US expense before the end of 2024 at $1.6 trillion."...

Now that rate cuts are off the table, interest on US debt - currently the second biggest government outlay at $1.1 trillion - will surpass social security and become the single biggest US expense before the end of 2024 at $1.6 trillion. pic.twitter.com/OQYjHhOks9

— zerohedge (@zerohedge) April 11, 2024

... and hit $1.7 trillion by April 2025, at which point it will be by far the single biggest outlay of the US government.

$1.7 trillion in interest spending next April.

— zerohedge (@zerohedge) April 26, 2024

This is the Minsky Moment pic.twitter.com/S3ChHjFbyg

So where are we now? Well, according to the latest Treasury Monthly Statement, in June the US spent a gross $140 billion on debt interest, bringing the YTD total to $868 billion and is on pace to hit $1.144 trillion for the full year.

This is a big number. How big? Well, as the chart below shows, this was the single biggest monthly interest outlay on record!

And putting it in context, the $140 billion in gross interest spending was just over 30% of all US receipts (mostly taxes) in June..

... a staggering number fast approaching the threshold where everyone will be forced to admit the US has crossed into a Minsky moment.