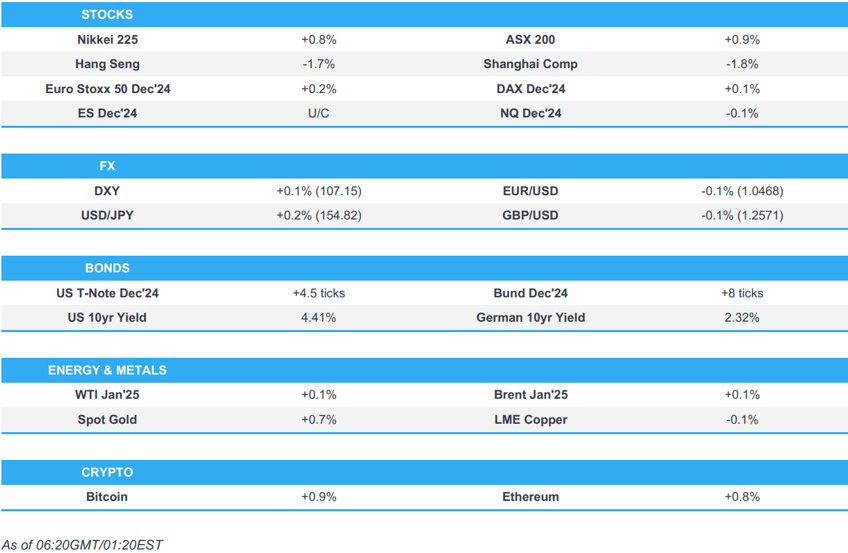

- US stocks ultimately finished higher with APAC mostly sustaining this momentum though China lagged

- DXY contained but remains above 107.00, EUR below 1.05 and Cable near 1.2550

- Fixed benchmarks are firmer but only modestly so as we await Flash PMIs

- Crude underpinned by ongoing geopolitical tensions as Russia fired a new medium-range ballistic missile

- US President-elect Trump considers Kevin Warsh to serve as Treasury Secretary and then Fed Chair, via WSJ

- Looking ahead, highlights include EZ, UK & US PMIs, UK Retail Sales, Speakers including ECB’s Lagarde, Nagel, Villeroy, de Guindos & Schnabel, SNB’s Schlegel & Fed's Bowman

- Click for the Newsquawk Week Ahead.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks ultimately finished higher after whipsawing throughout the day as participants digested NVIDIA (NVDA) earnings, geopolitical updates and mixed US data releases. There were early geopolitical escalation fears after Russia attacked Ukraine with what was initially reported as an ICBM although Western officials and Russian President Putin later stated it was an intermediate-range missile and the US also said it was not a game changer which facilitated the improvement in risk appetite. Furthermore, there were several data releases which printed mixed, while the latest comments from Fed speakers provided little to shift the dial.

- SPX +0.53% at 5,949, NDX +0.36% at 20,741, DJIA +1.06% at 43,870, RUT +1.65% at 2,364

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Goolsbee (2025 voter) said it makes sense to slow the pace of interest rate cuts as the Fed gets close to where rates will settle, while he added that over the next year, it feels like rates will end up a fair bit lower than where they are today. Furthermore, he said inflation is on its way down to 2% and the labour market is close to stable full employment.

- US President-elect Trump considers Kevin Warsh to serve as Treasury Secretary and then Fed Chair, according to WSJ.

- US President-elect Trump nominated Pam Bondi as Attorney General after Matt Gaetz withdrew himself for consideration.

- US SEC Chair Gensler plans to step down from the agency in January, while it was also reported that former SEC commissioner Paul Atkins is said to be in the lead position to replace Gensler, according to FBN's Gasparino.

APAC TRADE

EQUITIES

- APAC stocks mostly sustained the momentum from Wall St where stocks ultimately gained after whipsawing on geopolitical-related headlines and amid mixed data, although pressure was seen in China after weak earnings and an underwhelming briefing from Beijing.

- ASX 200 rallied with energy leading the advances seen in nearly all sectors aside from tech, while sentiment was also unfazed by the contractions across Australia flash PMI figures.

- Nikkei 225 gained following confirmation from Japanese PM Ishiba of a JPY 39tln stimulus package, while the latest inflation data from Japan printed mostly in line with expectations and is unlikely to have any ramifications for BoJ policy.

- Hang Seng and Shanghai Comp were pressured with Baidu the worst performer in the Hang Seng Index following a decline in its profit and revenue, while sentiment was also not helped by the PBoC's net liquidity drain and after comments from China's Vice Commerce Minister on foreign trade failed to inspire.

- US equity futures were rangebound but held on to most of the gains in the aftermath of yesterday's price fluctuations.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.3% after the cash market closed higher by 0.6% on Thursday.

FX

- DXY traded little changed but held on to the prior day's spoils after climbing to above the 107.00 level in a continuation of its recent upward momentum which coincided with gains in short-term yields and increased concerns regarding the Russia-Ukraine war. Furthermore, the mixed bag of US data releases failed to derail the dollar and there were several Fed comments including from Goolsbee who noted that it makes sense to slow the pace of interest rate cuts as the Fed gets close to where rates will settle.

- EUR/USD languished near a yearly low after slipping beneath the 1.0500 handle against the stronger dollar, while the contraction in EU Consumer Confidence was worse than feared and ECB rhetoric continued to suggest looming cuts.

- GBP/USD remained subdued beneath the 1.2600 level after falling to a six-month low and with participants now awaiting Retail Sales.

- USD/JPY price action was rangebound overnight with Japan's currency taking a breather after outperforming the greenback yesterday on the back of heightened geopolitical concerns, while the latest Japanese inflation data provided little to spur price action as the figures printed mostly in line with expectations aside from the core reading which was slightly firmer-than-expected at 2.3% (exp. 2.2%).

- Antipodeans were ultimately pressured as AUD/USD failed to sustain early gains that was spurred by cross-related flows in which AUD/NZD surged after climbing above the 1.1100 level, while NZD/USD underperformed and trickled to its lowest level in a year.

- PBoC set USD/CNY mid-point at 7.1942 vs exp. 7.2502 (prev. 7.1934).

- PBoC official said they will prevent the formation of one-sided expectations on the yuan and will keep the yuan basically stable at a reasonable and balanced level.

FIXED INCOME

- 10yr UST futures slightly recovered from the recent trough but with the rebound limited after mixed data and a weak TIPS auction.

- Bund futures took a breather following Thursday's gains whereby geopolitical headlines spurred an early flight to quality.

- 10yr JGB futures gradually edged higher in rangebound trade after Japanese CPI data printed mostly in line with estimates.

COMMODITIES

- Crude futures remained afloat following the Russia-Ukraine escalation in which Russia fired a new medium-range ballistic missile at Ukraine which was initially suspected to be an ICBM.

- Goldman Sachs sees upside risks to Brent prices in the short term with Brent seen rising to mid-USD 80s/bbl in 2025 H1 if Iran supply drops 1mln bpd on tighter sanctions enforcement, but sees medium-term price risks skewed to the downside given high spare capacity and estimates Brent to drop to the low USD 60s in 2026 in a 10% across-the-board tariff scenario or if OPEC supply rises through 2025.

- Spot gold gradually extended on gains despite the recent dollar and with bids seen as Shanghai commodities trade got underway.

- Copper futures retreated with demand sapped by the negative mood seen in its largest buyer, China.

CRYPTO

- Bitcoin continued on its record-setting trend and briefly climbed above the USD 99,000 level for the first time.

- Former CFTC Chairman Chris Giancarlo is reportedly eyed for the "crypto czar" role, according to Fox News

NOTABLE ASIA-PAC HEADLINES

- China's Vice Commerce Minister Wang said China's foreign trade maintained positive momentum and a stable and sound development trend but noted that China has seen slower foreign trade growth since August. Wang said regarding Trump tariffs and the yuan that China is able to resolve and resist impacts of external shock, while he added that China will safeguard its sovereignty, safety and development benefits, as well as announced that MOFCOM will roll out policies on expanding trade of green products sometime next year.

- China’s MIIT said it is to develop policies for digital transformation in manufacturing and AI-driven new industrialisation.

DATA RECAP

- Japanese National CPI YY (Oct) 2.3% vs. Exp. 2.3% (Prev. 2.5%)

- Japanese National CPI Ex. Fresh Food YY (Oct) 2.3% vs. Exp. 2.2% (Prev. 2.4%)

- Japanese National CPI Ex. Fresh Food & Energy YY (Oct) 2.3% vs. Exp. 2.3% (Prev. 2.1%)

- Japanese JibunBK Manufacturing PMI Flash SA (Nov) 49.0 (Prev. 49.2)

- Japanese JibunBK Services PMI Flash SA (Nov) 50.2 (Prev. 49.7)

- Japanese JibunBK Composite Op Flash SA (Nov) 49.8 (Prev. 49.6)

- Australian Judo Bank Manufacturing PMI Flash (Nov) 49.4 (Prev. 47.3)

- Australian Judo Bank Services PMI Flash (Nov) 49.6 (Prev. 51.0)

- Australian Judo Bank Composite PMI Flash (Nov) 49.4 (Prev. 50.2)

- Singapore GDP QQ (Q3 F) 3.2% vs Exp. 2.5% (Prelim. 2.1%)

- Singapore GDP YY (Q3 F) 5.4% vs Exp. 4.6% (Prelim. 4.1%)

GEOPOLITICS

MIDDLE EAST

- Israeli Home Front announced that sirens sounded in Haifa Bay and Krayot, according to Al Jazeera.

- Israeli army called on residents of three towns in southern Lebanon to evacuate their homes immediately, according to Asharq News.IAEA's board of governors passed a resolution ordering Iran to urgently improve cooperation with the IAEA, while the board asked the IAEA to produce a 'comprehensive' report on Iran by the spring of 2025.

- US lawmakers introduced measures seeking to halt the sale of some weapons to the UAE, citing Sudan concerns.

RUSSIA-UKRAINE

- Russian President Putin said after long-range strikes from Ukraine, the regional conflict gained elements of a global one and the enemy didn't achieve its goals, while he added that such actions won't influence the situation in Ukraine and that Russia fired a new medium-range ballistic missile which was conducted in response to Western aggression. Furthermore, he said Russia will respond symmetrically in the case of escalation and if Russia does use the hypersonic weapon against Ukraine, they will warn civilians.

- Ukrainian President Zelenskiy said Russian President Putin's missile strike on Thursday was a clear and severe escalation in the scale and brutality of the war, while he added the missile use shows Putin is not interested in peace and the world must respond. Furthermore, he said a lack of response sends the message that such behaviour is acceptable.

- US official said the US was pre-notified by Russia before Thursday's missile strike through nuclear risk reduction channels. Furthermore, a US official said Russia likely only possesses a handful of experimental intermediate-range ballistic missiles used for the strike on Thursday and the missile use seeks to intimidate Ukraine but does not mark a game-changer.

- North Korea’s entry into the Ukraine war and Donald Trump's election win factored into the US decision to relax Ukraine missile controls and Biden aides see easing of controls on Ukraine missiles as part of an effort to 'Trump-proof' Ukraine policy, according to sources cited by Reuters.

OTHER

- North Korean leader Kim called for developing and upgrading weaponry, as well as vowed to continue developing defence capabilities, while he said the US has ratcheted up tension and provocations while expanding nuclear-sharing alliances. Furthermore, Kim said the Korean Peninsula has never faced such risks of nuclear war as of now and that previous experience of negotiations with the US only highlighted its hostile policy, according to KCNA.

EU/UK

DATA RECAP

- UK GfK Consumer Confidence (Nov) -18.0 vs. Exp. -22.0 (Prev. -21.0)