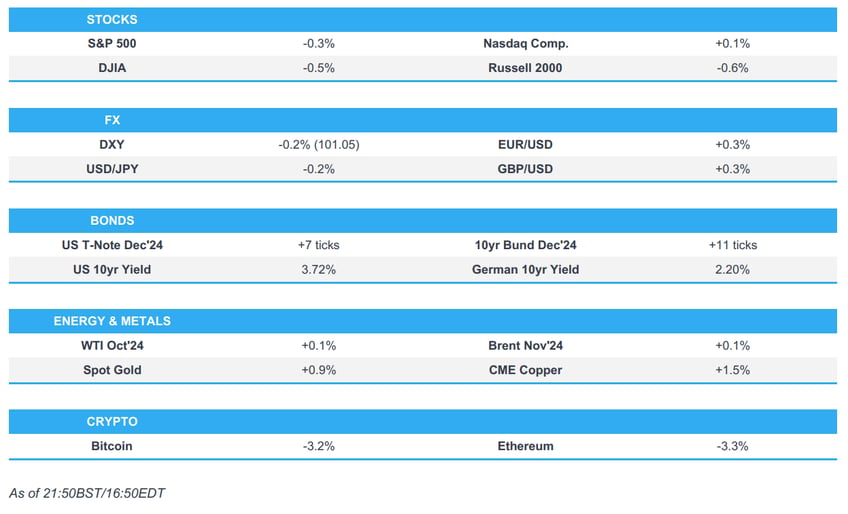

- US stocks lacked direction for the majority of the day (SPX +0.3%, NDX flat, DJIA -0.5%, RUT -0.6%), but ultimately, headed lower late in the day following a slew of mixed US data.

- The Dollar saw immediate weakness and hit session troughs of 100.96 after the ADP national employment report; G10 FX more-or-less saw gains across the board.

- T-Notes rallied across the curve, particularly in the longer end, amid a mixed bag of US data with 2s/10s again failing to sustain an inversion.

- The crude complex was choppy on Thursday, but eventually settled more-or-less flat despite large crude draws and bullish OPEC news.

- Looking ahead, highlights include Japanese Household Spending, Australian Home Loans, Japanese Coincident Indicator.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks lacked direction for the majority of the day (SPX +0.3%, NDX flat, DJIA -0.5%, RUT -0.6%), but ultimately, headed lower late in the day following a slew of mixed US data, as it was initially weighed on by soft ADP, which came in underneath the bottom end of the forecast range. Sectors finished largely to the downside led by Health Care, Industrials, and Financials.

- SPX -0.3% at 5,503, NDX +0.05% at 18,930, DJIA -0.54% at 40,756, RUT -0.61% at 2,132

- Click here for a detailed summary.

NOTABLE HEADLINES

- US Treasury Secretary Yellen says US labour market has become less tight, but continues to create jobs; have a good strong job market, and growth continues at a rapid pace.

- Republican Candidate Trump to propose 15% corporate tax rate for companies that make products in the US, WSJ reports.

- Republican candidate Trump says he will create Government efficiency commission; says he will end 10 regulations for every new one. Says he will make US the leader for crypto. No tax on social security benefits. For Companies that make products in US, will reduce corporate tax to 15% from 21%. Big tariffs is products come in from a different country. Says he'll use tariffs to encourage production in the US. Says he would open up portions of federal land for large-scale housing construction in zones that will be ultra low tax and low regulation. Says US should have its own sovereign wealth fund.

- Emerson poll finds Harris leads Trump 49% to 47% nationally.

- Broadcom Inc (AVGO) Q3 2024 (USD): Adj. EPS 1.24 (exp. 1.20), Revenue 13.07bln (exp. 12.96bln). Adj. EBITDA 8.22bln (exp 7.89bln); Sees Q4 revenue about 14bln (exp. 14.13bln). Semiconductor solutions revenue 7.27bln (exp. , 7.41bln). Infrastructure software revenue 5.80bln (exp. 5.5bln). Adj operating income 7.95bln (exp. 7.73bln). Adj. R&D expense 1.47bln (exp 1.47bln). Capital expenditure 172mln (exp 140.5mln).

DATA RECAP

- US Challenger Layoffs (Aug) 75.891k (Prev. 25.885k)

- US ADP National Employment (Aug) 99.0k vs. Exp. 145.0k (Prev. 122.0k, Rev. 111k). Median change in annual pay: Job-Stayers 4.8% (prev. 4.8% Y/Y); Job-Changers 7.3% (prev. 7.2% Y/Y)

- US Initial Jobless Claims w/e 227.0k vs. Exp. 230.0k (Prev. 231.0k, Rev. 232k); Continued Jobless Claims w/e 1.838M vs. Exp. 1.865M (Prev. 1.868M, Rev. 1.860M)

- US S&P Global Composite Final PMI (Aug) 54.6 (Prev. 54.1); Services PMI Final (Aug) 55.7 (Prev. 55.2); "survey data signaled a further cooling of selling price inflation, notably in the service sector" & "Hiring is meanwhile being constrained by labor shortages, which also continue to put upward pressure on wages".

- US ISM Services PMI (Aug) 51.5 vs. Exp. 51.1 (Prev. 51.4); Employment Idx 50.2 (Prev. 51.1); Price Paid Idx 57.3 (Prev. 57.0)

FX

- The Dollar was weaker on Thursday, in what was a choppy session. On the day, the Dollar saw immediate weakness and hit session troughs of 100.96 after the ADP national employment report.

- G10 FX more-or-less saw gains across the board vs. the Buck, albeit to varying degrees.

- Elsewhere, for the EUR, German industrial orders sparked modest strength in the single currency, whilst EZ construction PMIs had little impact.

- Antipodeans benefitted from the aforementioned broad Dollar weakness, as they attempted to claw back some of their steep losses this week amid the downbeat sentiment across markets.

- USD/JPY saw a peak of 144.22 versus a later low of 142.86, as at the risk of sounding like a broken record, the Yen caught a bid following the broader Dollar sell-off, after the US ADP release, but later retraced following the ISM print.

FIXED INCOME

- T-Notes rallied across the curve, particularly in the longer end, amid a mixed bag of US data with 2s/10s again failing to sustain an inversion.

COMMODITIES

- The crude complex was choppy on Thursday, but eventually settled more-or-less flat despite large crude draws and bullish OPEC news.

- OPEC said eight participating countries have agreed to extend their additional voluntary cuts of 2.2mln bpd for two months until the end of November.

- US EIA- Nat Gas, Change Bcf w/e 13.0bcf vs. Exp. 28.0bcf (Prev. 35.0bcf)

- US EIA Weekly Gasoline Stk w/e 0.848M vs. Exp. -0.7M (Prev. -2.203M)

- US EIA Weekly Dist. Stocks w/e -0.371M vs. Exp. 1.0M (Prev. 0.275M)

- US EIA Weekly Crude Stocks w/e -6.873M vs. Exp. -1.1M (Prev. -0.846M)

- US EIA Wkly Crude Cushing w/e -1.142M (Prev. -0.668M)

GEOPOLITICAL

- Israeli PM Netanyahu said the ceasefire deal with Hamas is not close.

- US Commerce Department unveils latest exports curbs and targets China with new quantum, chip-related export curbs and latest global controls exempt countries with similar measures, according to Bloomberg. Rules align with those from Japan, Netherlands, other allies.0

ASIA-PAC

NOTABLE HEADLINES

- Alibaba (BABA) and Mastercard (MA) team up to launch US co-branded business credit card powered by cardless.

- Nippon Steel (5401 JT) proposes draft national security agreement, and other commitments to address US government concerns about US Steel (X) acquisition, according to a letter seen by Reuters Nippon hires former US house lawmaker Dick Gephardt to assist in efforts to reach an agreement with the United Steelworkers union. Nippon proposes after the acquisition majority of the board of directors of US Steel be US citizens with three approved by the US government to oversee compliance with the national security agreement.

- National security risks from Nippon Steel's (5401 JT) bid for US Steel (X) relate to potential decisions by Nippon Steel that could lead to a reduction in domestic steel production capacity, according to Reuters citing a CFIUS letter

CENTRAL BANK

- BoE Monthly Decision Maker Panel data August 2024; inflation expectations 1-yr 2.7% (prev. 2.7%); 3-yr 2.7% (prev. 2.7%)

- NBP Governor Glapinski says forecasts show CPI could be over 5% at year-end and CPI dynamic may rise at start of 2025; in H2 '25 CPI should decrease and in 2026 CPI has a chance of returning to target.

EU/UK

NOTABLE HEADLINES

- Michel Barnier has been named new French PM, according to BFM TV.

DATA RECAP

- German Industrial Orders MM (Jul) 2.9% vs. Exp. -1.5% (Prev. 3.9%)

- EU HCOB Construction PMI (Aug) 41.4 (Prev. 41.4); Italian HCOB Construction PMI (Aug) 46.6 (Prev. 45.0); French HCOB Construction PMI (Aug) 40.1 (Prev. 39.7);

- German HCOB Construction PMI (Aug) 38.9 (Prev. 40.0)

- UK S&P Global Construction PMI (Aug) 53.6 vs. Exp. 54.9 (Prev. 55.3)

- EU Retail Sales MM(Jul) 0.1% vs. Exp. 0.1% (Prev. -0.3%, Rev. -0.4%); Retail Sales YY (Jul) -0.1% vs. Exp. 0.1% (Prev. -0.3%, Rev. -0.4%)