- US stocks mostly saw gains on Wednesday with Communications, Consumer Discretionary, and Technology the sectorial outperformers and the former once again supported by Alphabet (GOOG) (+5.5%) strength.

- Bank of Canada cuts its Rate by 50bps, as expected, to 3.25% (prev. 3.75%); Drops language about it being reasonable to expect further rate cuts if economy evolves in line with forecast

- BoJ reportedly sees little cost in waiting for the next rate hike, according to Bloomberg; Next rate increase is seen as a "matter of time".

- Yuan eased off weekly highs as reports suggest China's top policymakers are considering allowing the Yuan to weaken in 2025 as Trump tariffs loom. .

- Looking ahead, highlights include RBA's Jones, Japanese Foreign Purchases, UK RICS Housing Survey, Australian Labour Force Survey.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks mostly saw gains on Wednesday with Communications, Consumer Discretionary, and Technology the sectorial outperformers and the former once again supported by Alphabet (GOOG) (+5.5%) strength.

- Tech was further buoyed by gains in semiconductor names, highlighted by the SOXX ETF firming in excess of 2.5%. Healthcare was the clear sectorial laggard.

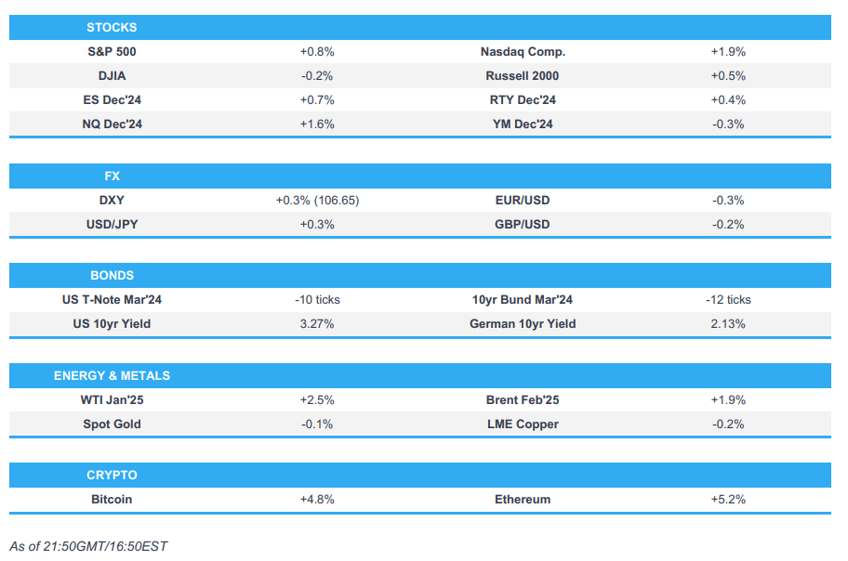

- SPX +0.82% at 6,084, NDX +1.85% at 21,764, DJIA -0.22% at 44,149, RUT +0.48% at 2,394

- Click here for a detailed summary.

NOTABLE HEADLINES

- Bank of Canada cuts its Rate by 50bps, as expected, to 3.25% (prev. 3.75%); Drops language about it being reasonable to expect further rate cuts if economy evolves in line with forecast. BoC's Macklem says "monetary policy no longer needs to be clearly in restrictive territory"; previous "cuts will be working their way through the economy".

- BoC Governor Macklem said it discussed both a 25bps and a 50bps rate cut today. There are some mixed signals in the data. Cannot run policy on something that might not happen (referring to US tariffs); if tariffs were implemented, would be highly disruptive to Canadian economy. Unemployment has gone up but yet to see widespread job losses as typically seen in a recession. Most of the depreciation in the CAD is in fact an appreciation of USD; CAD compared to other major currencies shows very little change. Until recently, CAD has been stable.BoC is not expecting a recession. Baseline will continue to be that the economy is growing. Tariffs as outlined would have a dramatic effect on the BoC's forecasts. Going forward, the BoC will be considering further reductions in the policy rate but will be taking a more gradual approach.

- BoC's Rogers says has seen a pretty large uptick in housing activity without an increase in prices; this is "good news".

- Bank of America (BAC) CEO Moynihan says they feel good about NII and expected to come in around USD 14.3bln (exp. 14.29bln) in Q4.

DATA RECAP

- US Core CPI MM, SA (Nov) 0.3% vs. Exp. 0.3% (Prev. 0.3%); Unrounded 0.308% (prev. 0.280%)

- US Core CPI YY, NSA (Nov) 3.3% vs. Exp. 3.3% (Prev. 3.3%)

- US CPI MM, SA (Nov) 0.3% vs. Exp. 0.3% (Prev. 0.2%); Unrounded 0.313% (prev. 0.244%)

- US CPI YY, NSA (Nov) 2.7% vs. Exp. 2.7% (Prev. 2.6%)

- US Real Weekly Earnings MM (Nov) 0.3% (Prev. 0.1%, Rev. -0.1%)

- US MBA Mortgage Applications 5.4% (Prev. 2.8%)

- US MBA 30-Yr Mortgage Rate 6.67% (Prev. 6.69%)

- US Cleveland Fed CPI (Nov) 0.2% (Prev. 0.3%).

FX

- USD saw broad gains against major peers with it initially benefitting off reports that China's top policymakers are considering allowing the Yuan to weaken in 2025 as Trump tariff looms, via Reuters sources.

- EUR was hit on Buck strength as EUR/USD fell back below 1.05. Newsflow continued to be thin in the region, although, Thursday will see updates kick-off, with the ECB expected to cut by 25bps to EUR (~85% of a 25bps cut vs 15% of 50bps).

- CAD caught a bid on the BoC's decision to cut rates by 50bps as expected, for the second consectuive meeting. Prompting the move higher, was a hawkish tilt in the statement, whereby the BoC no longer believe if the economy evolves broadly in line with their latest forecast, they expect to reduce the policy rate.

- JPY saw a volatile session in midweek as mixed BoJ remarks hit the wires. At first, the Yen strength arrived after reports indicated that the BoJ sees little cost in waiting for the next rate hike, however, the pair later spiked higher on the the BoJ's view "that there is less risk of a soft JPY boosting inflation", thus, alleviating the urgency to hike rates.

- Yuan eased off weekly highs as reports suggest China's top policymakers are considering allowing the Yuan to weaken in 2025 as Trump tariffs loom. The reports' sources added, "The contemplated move reflects China's recognition that it needs bigger economic stimulus to combat Trump's threat of bigger tariffs". Afterwards, the Yuan strengthened in wake of reports via a PBoC-backed paper, that the Yuan rate is stable with a foundation; the bid later on faded.

FIXED INCOME

- T-notes steepened as in-line CPI cements December 25bps rate cut expectations.

- US sells USD 39bln 10-year note; stop-through 1.7bps. High Yield: 4.235% (prev. 4.347%, six-auction average 4.122%). WI: 4.252%. Tail: -1.7bps (prev. -0.3bps, six-auction avg. -0.2bps). Bid-to-Cover: 2.7x (prev. 2.58x, six-auction avg. 2.55x). Dealers: 10.5% (prev. 14.7%, six-auction avg. 13.3%). Directs: 19.5% (prev. 23.6%, six-auction avg. 16.1%). Indirects: 70% (prev. 61.7%, six-auction avg. 70.6%).

COMMODITIES

- Oil prices gained and firmed throughout the US session after being initially pressured in the EZ morning by Reuters China reports.

- US Treasury Secretary Yellen says global oil demand is down and the market is well-supplied, creating the possibility to take additional sanction actions.

- Natgas pipeline declares force majeure - Comp STA 343.

- EIA Weekly Crude Production Change, bbl +118k (Prev. +20k). US EIA Weekly Crude Production 13.631M (Prev. 13.513M). US EIA Weekly Refining Util w/e -0.9% vs. Exp. -0.4% (Prev. 2.8%). US EIA Weekly Gasoline Stk w/e 5.086M vs. Exp. 1.9M (Prev. 2.362M). US EIA Weekly Dist. Stocks w/e 3.235M vs. Exp. 1.1M (Prev. 3.383M). US EIA Weekly Crude Stocks w/e -1.425M vs. Exp. -1.1M (Prev. -5.073M). US EIA Wkly Crude Cushing w/e -1.298M (Prev. 0.05M). US EIA Weekly Crude Production Change, 0.87% (Prev. 0.15%).

- OPEC MOMR (December): The global oil demand growth forecast for 2024 is revised down by 210k BPD the previous month’s assessment to 1.6mln BPD Y/Y; forecast for 2025 is also slightly revised lower.

- UBS forecasts Brent rising to USD 80/bbl and WTI rising to USD 75/bbl in 2025. UBS says for 2025, it holds a constructive natgas price outlook (see NatGas at USD 3.50/mmbtu in June 2025, rising to USD 3.60/mmbtu by September).

- Citi expects crude oil prices will gradually decline to USD 60/bbl by mid-2025 and remain around that level for H2 25 and 2026 in base case scenario. Sees European TTF and Asian JKM LNG gas prices likely to average USD 12.9/mmbtu and USD 13.2/mmbtu, respectively in 2025.

- Citi expects gold and silver markets to resume gradual uptrend over 3-12months, reaching USD 3,000/oz and USD 36/oz, respectively.

- Ukraine's military says it struck an oil depot in Russia's Bryansk region; military says the attack caused a 'massive fire'. Attack on an oil depot in Russia's Bryansk region did not affect oil transit to Europe via Ukraine, according to Reuters citing a industry source. Kazakhstan says Druzhba oil pipeline in Russia is not damaged by Ukrainian overnight strikes.

GEOPOLITICAL

MIDDLE EAST

- Israel Defense Minister says there is a chance for a deal that will release all hostages, including US citizens.

OTHER

ASIA-PAC

NOTABLE HEADLINES

- BoJ reportedly sees little cost in waiting for the next rate hike, according to Bloomberg; cites current prices. Next rate increase is seen as a "matter of time". View is that there is less risk of a soft JPY boosting inflation.

- Biden Administration reportedly split over US Steel (X) deal, with Pentagon and State Department all concluding USD 15bln Nippon Steel (5401 JT) acquisition poses no national security risk, but Biden thinks it does, via FT.

- Hyundai Motor (005380 KS/HYMTF) and Google (GOOGL) collab on software capability for future mobility innovation.

DATA RECAP

- New Zealand Elec Card Retail Sale MM (Nov) 0.0% (Prev. 0.6%, Rev. 0.7%)

- New Zealand Elec Card Retail Sale YY (Nov) -2.3% (Prev. -1.1%)

EU/UK

NOTABLE HEADLINES

- EUROPEAN CLOSES: DAX: +0.42% at 20,414, FTSE 100: +0.28% at 8,303, CAC 40: +0.39% at 7,423, Euro Stoxx 50: +0.16% at 4,960, AEX: +0.30% at 896, IBEX 35: -1.47% at 11,789, FTSE MIB: +0.60% at 34,731, SMI: +0.27% at 11,678, PSI: +0.14% at 6,352..

- New French PM reportedly set to be named on Thursday, according to a government source cited by Bloomberg.

- German Chancellor Scholz has submitted request to hold vote of confidence, according to a government spokesperson.

LATAM

- Brazilian Selic Interest Rate 12.25% vs. Exp. 12.0% (Prev. 11.25%); Decision unanimous; in light of more adverse inflation scenario, committee sees hikes of the same magnitude at the next two meetings.

- Brazil's President Lula to undergo a new medical procedure on Thursday to prevent further bleeding in the brain, via local press.

To download the report, please click here If you would like to subscribe to receive the research sheets directly in your inbox, you can now do so under the Research Suite section of the portal. To subscribe simply check the box next to "Email these reports" under the desired category.