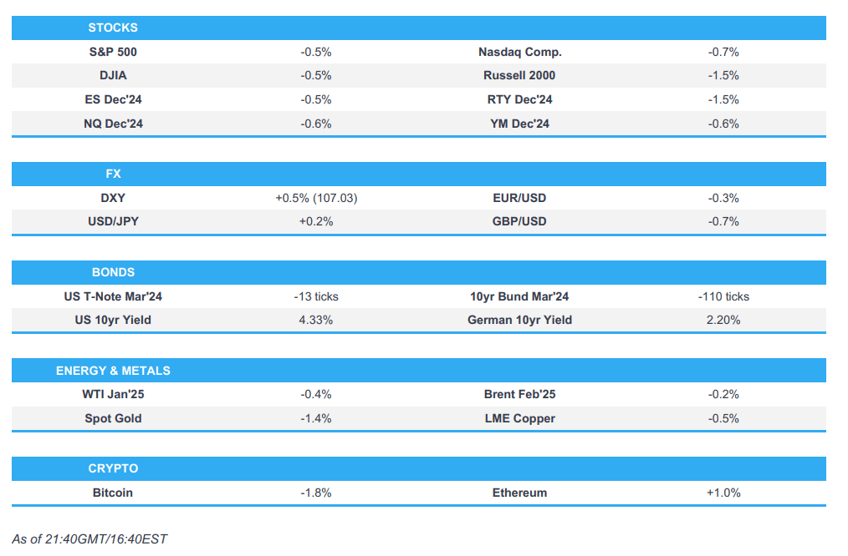

- US stocks saw weakness with continued underperformance in the small-cap Russell 2000 (-1.4%), as all sectors resided in the red apart from Consumer Staples and Real Estate.

- USD continued for the fifth straight day, lent a hand by a surprise 50bps cut by the SNB and a tweak in the ECB's statement after cutting by 25bps.

- T-notes chop to above forecast jobless claims, while PPI data was hot on the headline, but PCE components were soft.

- Oil prices had a very choppy session, albeit in limited energy-specific newsflow as benchmarks settled with mild losses but well off earlier lows.

- Looking ahead, highlights include Japanese Tankan Survey, UK GfK Consumer Confidence, RBA's Hunter, Japanese Industrial Output, Indian WPI.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks saw weakness with continued underperformance in the small-cap Russell 2000 (-1.4%), as all sectors resided in the red apart from Consumer Staples and Real Estate.

- Health, Consumer Discretionary, and Communications were the laggards with the latter weighed on by Tesla (TSLA) (-1.7%) and Alphabet (GOOGL) (-1.8%), respectively, although GOOGL has seen notable gains recently.

- SPX -1.4% at 5,447, NDX -2.4% at 18,890, DJIA -1.2% at 40,348, RUT -3.0% at 2,186.

- Click here for a detailed summary.

NOTABLE HEADLINES

- BofA Consumer Checkpoint (Nov): The 2024 theme of consumer resilience showed no sign of waning in November; aggregated credit and debit card data, spending per household was up 0.6% Y/Y and spending on holiday items was 6.1% higher Y/Y.

- Broadcom Inc (AVGO) Q4 2024 (USD): Adj. EPS 1.42 (exp. 1.39), Adj. net revenue 14.05bln (exp. 14.1bln).

- Microsoft (MSFT) file for debt shelf; size undisclosed, via SEC filing.

DATA RECAP

- US PPI Final Demand MM (Nov) 0.4% vs. Exp. 0.2% (Prev. 0.2%, Rev. 0.3%); YY 3.0% vs. Exp. 2.6% (Prev. 2.4%, Rev. 2.6%)US PPI exFood/Energy MM (Nov) 0.2% vs. Exp. 0.2% (Prev. 0.3%); YY 3.4% vs. Exp. 3.2% (Prev. 3.1%)

- US Initial Jobless Claims w/e 242.0k vs. Exp. 220.0k (Prev. 224.0k, Rev. 225k); Continued Jobless Claims w/e 1.886M vs. Exp. 1.875M (Prev. 1.871M)

FX

- USD continued for the fifth straight day, lent a hand by a surprise 50bps cut by the SNB and a tweak in the ECB's statement after cutting by 25bps.

- EUR deepened further below the 1.05 handle following the ECB's decision to cut rates by 25bps. The 21DMA (1.0528) is a key level to watch on the upside

- GBP unexpectedly cut rates by 50bps to 0.50%, sparking immediate downside in the Franc, which enlarged as the session progressed. SNB's Chair Schlegel maintained the rhetoric of willingness to intervene as necessary, adding, that the SNB still has room for further interest rate moves, albeit, said they don't like negative rates, but will use them again if required.

- JPY saw weakness overnight on Reuters reports that the BoJ is leaning towards keeping rates steady next week, though there is no consensus on the final decision.

FIXED INCOME

- T-notes chop to above forecast jobless claims, while PPI data was hot on the headline, but PCE components were soft.

- US sold USD 22bln in 30yr bonds; High Yield: 4.535%(prev. 4.608%, six-auction average 4.356%); WI: 4.523%. Tail: 1.2bps (prev. -2.2bps, six-auction avg. 0.2bps). Bid-to-Cover: 2.39x (prev. 2.64x, six-auction avg. 2.44x). Dealers: 14.4% (prev. 10.2%, six-auction avg. 14.5%). Directs: 19.1% (prev. 27.1%, six-auction avg. 17.8%) . Indirects: 66.5% (prev. 62.7%, six-auction avg. 67.7%)

COMMODITIES

- Oil prices had a very choppy session, albeit in limited energy-specific newsflow as benchmarks settled with mild losses but well off earlier lows.

- IEA Monthly Oil Market Report: cuts 2024 world oil demand growth forecast to 840k BPD (prev. 920k BPD); raises 2025 forecast to 1.1mln BPD (prev. 990k BPD), citing Chinese stimulus measures.

- US EIA- Nat Gas, Change Bcf w/e -190.0bcf vs. Exp. -170.0bcf (Prev. -30.0bcf).

- El Paso Natural Gas Co. declares force majeure on line 3140 and the Jameson Plant, according to Reuters.

GEOPOLITICAL

MIDDLE EAST

- US National Security adviser Sullivan says is looking to close a hostage release deal, and will continue to pressure Iran, especially in its nuclear program. according to Reuters.

- US President-elect Trump, when asked about the chances of war with Iran, said "anything can happen", via Time Magazine interview.

OTHER

- Canada weighs export tax on uranium and oil if Trump adds tariffs, according to BloombergAlso mulls export tax on potash if Trump imposes tariffs.

ASIA-PAC

NOTABLE HEADLINES

- China's Central Economic Work Conference: To stabilise property and stock markets. To implement more proactive macro policies. Must coordinate the relationship between supplies and demand. To implement rate cuts and RRR. To stimulate domestic demand, particularly household consumption. Will take steps to cope with external shocks. To keep total social financing and money supply growth in-line with expected economic growth and price levels. To issue ultra-long special sovereign bond; to increase issuance and usage of local gov't special bonds. Forceful measures to boost consumption and expand domestic demands in all directions. To implement appropriately loose monetary policy. To vigorously boost consumption and expand domestic demand. To move forward with fiscal and tax reform. To stabilise foreign trade and investment. To appropriately deal with the risks from small/medium financial institutions. Promote new development for the property market. To stabilise/ensure the supply of grain and key agricultural products. To deepen reform of the mechanism for promoting foreign investment and steadily open the services sector. To stimulate domestic demand, particularly household consumption.

- China's President Xi said the economy faces many difficulties and challenges. Will develop new productive forces based on local conditions. China is willing to continue exploring right paths with the US for two countries to coexist in the "new era". China is ready to maintain communication with the US, expand cooperation and manage differences.

- South Korean opposition files a second motion to impeach President Yoon, via Bloomberg

DATA RECAP

- Indian CPI Inflation YY (Nov) 5.48% vs. Exp. 5.53% (Prev. 6.21%)

- Indian Industrial Output YY (Oct) 3.5% vs. Exp. 3.5% (Prev. 3.1%)

- Indian Manufacturing Output (Oct) 4.1% (Prev. 3.9%)

- Indian Cumulative Ind. Output (Oct) 4.0% (Prev. 4.0%)

- South Korea Import Price Growth YY (Nov) 3.0% (Prev. -2.5%)

- South Korea Export Price Growth YY (Nov) 7.0% (Prev. 2.0%)

CENTRAL BANKS

- ECB cuts Deposit rate 25bps to 3.00%; Refi rate cut 25bps to 3.15%, both as expected; expects a slower economic recovery. Will follow a data-dependent and meeting-by-meeting approach to determining the appropriate monetary policy stance. Note: Statement has removed the line that ECB "will keep policy rates sufficiently restrictive for as long as necessary". Forecasts: Cuts growth forecasts across forecast horizon and lowers 2024 & 2025 HICP inflation forecast; Core HICP forecasts unchanged for 2024 and 2025, lowered for 2026.

- ECB President Lagarde: policy decision was "agreed by all", some discussions around a 50bps move. Policy is currently restrictive. Council has not discussed the neutral rate. Did not discuss TPI.

- A handful of policymakers were initially in favour of a 50bps cut and some argued that ECB is overestimating growth, which could be below 1% next year under Trump tariffs, according to Reuters sources. Policymakers have little appetite for rushing policy amid uncertainty.

- ECB prepared for a quarter-point rate cut at next two meetings if inflation stabilizes at the 2% target and economic growth remains sluggish, Bloomberg reports. A gradual approach to lowering borrowing costs is the most appropriate path forward provided the economy develops in line with current expectations. A larger, half-point reduction remains an option in case of emergency, they said. But they stressed that such a step risks conveying an unintended sense of urgency.

- Swiss SNB Policy Rate (Q4) 0.50% vs. Exp. 0.75% (Prev. 1.00%); "also remains willing to be active in the foreign exchange market as necessary". SNB's Schlegel says development of CHF is still the important factor. Remains willing to intervene as necessary. Rate cuts remain the main policy instrument if further easing is required. Uncertainty on future inflation path is high, inflationary pressure has decreased markedly over the medium term. SNB still has room for further interest rate moves. Main instrument is policy rate, with that can influence the economy and exchange rate. This step us intended to stabilise inflation between 0 and 2%. Can tolerate weakening of inflation below 0-2% target range, as long as it is temporary.

- SNB Chair Schlegel says the SNB does not like negative interest rates; the likelihood of negative interest rates has become small. He later said that they don't like negative rates but they do work. Will use negative rates again if required.

EU/UK

NOTABLE HEADLINES

- French Presidential office said the appointment of PM postponed until Friday morning, according to Reuters.

- Italian Economy Minister sees GDP growth of 0.7% this year and lower-than-expected growth does not change government budget framework, according to Reuters.

- German Economy expected to stagnate in 2025 (prev. forecast 0.5%); German GDP expected to expand by 0.9% in 2026.

- Ifo institute forecasts Germany's growth between 0.4 - 1.1% in 2025. If German economy fails to overcome structural challenges, only 0.4% growth compared to the 1.1% if the right economic policy course is set. Expects 2.3% inflation in 2025 and 2.0% in 2026, in both scenarios