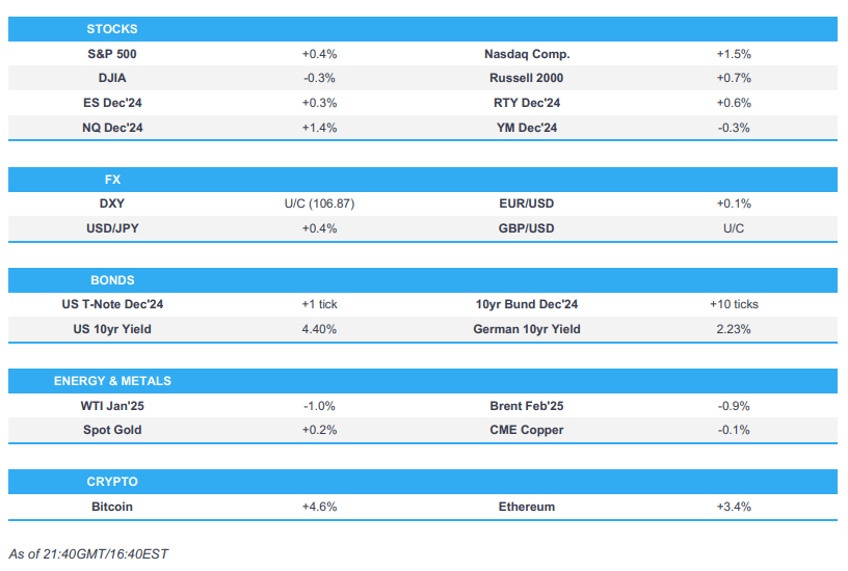

- US stocks were bid throughout the session with notable outperformance in the Nasdaq amid further upside in Broadcom (AVGO) and Micron (MU) supporting the move.

- USD was flat on Monday and within very contained ranges in thin newsflow as market participants await the pivotal FOMC on Wednesday and the accompanying SEPs and Chair Powell presser.

- T-notes ultimately little changed ahead of key risk events although Treasuries fell from highs after the strong S&P Global Services PMI beat.

- Oil prices saw slight losses to begin the week in choppy price action as key risk events await.

- Looking ahead highlights include New Zealand Budget Cash Balance, Japanese 20-year JGB Auction.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks were bid throughout the session with notable outperformance in the Nasdaq amid further upside in Broadcom (AVGO) and Micron (MU) supporting the move. Consumer Discretionary, Communications and Tech outperformed thanks to the upside in the heavyweights. On the flipside, Energy, Health Care and Materials underperformed.

- SPX +0.38% at 6,074, NDX +1.45% at 22,097, DJI -0.25% at 43,717, RUT +0.64% at 2,362.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US stopgap spending bill would temporarily fund Government through March 14th and avert partial shutdown beginning Saturday, according to Reuters citing a source familiar with negotiations.

- BoC Governor Macklem says there are risks around its inflation outlook and are equally concerned with inflation coming in higher or lower than expected. Firstly, elevated wage increases combined with weak productivity could boost inflation as businesses look to pass on higher costs. Or the economy could continue to grow below its potential which would pull inflation down. When they use extraordinary tools to tackle a crisis, need to be clear about what they're trying to achieve with those tools and under what conditions they'll no longer be needed.

- Canadian PM Trudeau to name Dominic Leblanc as Finance Minister, according to Bloomberg.

DATA RECAP

- US NY Fed Manufacturing (Dec) 0.2 vs. Exp. 10.0 (Prev. 31.2)

- US S&P Global Composite Flash PMI (Dec) 56.6 (Prev. 54.9)

- US S&P Global Services PMI Flash (Dec) 58.5 (Prev. 56.1)

- US S&P Global Manufacturing PMI Flash (Dec) 48.3 (Prev. 49.7)

FX

- USD was flat on Monday and within very contained ranges in thin newsflow as market participants await the pivotal FOMC on Wednesday and the accompanying SEPs and Chair Powell presser.

- EUR and CAD were more-or-less flat, while Antipodeans eked out gains against the Dollar with the NZD outperforming its counterpart. AUD and NZD benefitted from the broader risk sentiment as opposed to anything currency-specific, although New Zealand is to raise minimum wage by 1.5% from April 1st, 2025

- GBP was the clear G10 gainer with Cable hitting a peak of 1.2698, with the Pound just running out of momentum ahead of the round 1.27. Sterling was supported by the UK PMI release which saw the Services figure above expectations, climbing further into expansionary territory, while Manufacturing was a touch softer.

- JPY and CHF, were the clear G10 FX laggards against the Greenback as they were weighed on by broader risk sentiment. Swissy continues to weaken after the surprise 50bps SNB cut last week, while participants await the BoJ on Thursday.

FIXED INCOME

- T-notes ultimately little changed ahead of key risk events although Treasuries fell from highs after the strong S&P Global Services PMI beat.

COMMODITIES

- Oil prices saw slight losses to begin the week in choppy price action as key risk events await.

GEOPOLITICAL

MIDDLE EAST

- Proposed deal between Israel and Hamas calls for 60-day ceasefire for release of dozens of Israeli detainees in exchange for 700-1,000 Palestinian prisoners, via Sky News Arabia citing Israel Channel 14.

OTHER

ASIA-PAC

NOTABLE HEADLINES

- New Zealand to raise minimum wage by 1.5% from April 1st.

EU/UK

NOTABLE HEADLINES

- EUROPEAN CLOSES: DAX -0.45% at 20,314, FTSE 100 -0.46% at 8,262, CAC 40 -0.71% at 7,357, Euro Stoxx 50 -0.46% at 4,945, AEX -0.23% at 891, IBEX 35 +0.23% at 11,779, FTSE MIB -0.43% at 34,740, SMI -0.05% at 11,689.

- ECB's Schnabel said they should proceed with caution and remain data dependant and price stability is within reach; lowering policy rates gradually towards a neutral level is the most appropriate course of action. Once price stability has been restored, central banks can afford to tolerate moderate deviations of inflation from target, in both directions. In the absence of such shocks, policy should be careful not to overreact. Monpol should focus on responding forcefully to shocks that have capacity to destabilise inflation expectations. Central banks can have a greater tolerance for moderate deviations of inflation from target, in both directions. Monpol cannot resolve structural issues that durably weigh on price pressures. Over the next twelve months an economic expansion is still much more probable than a recession. Gradual removal of policy restriction remains appropriate.

- SNB has adjusted the remuneration of sight deposits, lowers the threshold factor from 22 to 20 as of 1st February 2025.

- ECB Holzmann said it would be wrong to cut rates just to help the economy, according to Reuters.

- ECB's Lagarde says more rate cuts are to come and the direction of travel is clear, via Bloomberg; risks around inflation are two sided. "The ECB is also moving through its monetary policy cycle, and we are now at a stage where the darkest days of winter look to be behind us, and we can start to look forward instead."

- ECB's de Guindos says "our confidence that inflation will converge to target in 2025 is reflected in our monetary policy". US tariff increases could result in inflationary pressures.

- ECB's Wunsch said there is a relative consensus that rates need to go close to the neutral level. Comfortable with market easing expectations.

- ECB's Escriva said he cannot anticipate the decision because it would go against what they do, when asked if he would be against a 50bps cut in January, via Econostream.

- German Chancellor Scholz has lost the no-confidence vote, paving the way for snap elections (as expected).

- Norges Bank to purchase NOK and sell foreign currency to fund transfers to the government for FY24.

DATA RECAP

- EU HCOB Manufacturing Flash PMI (Dec) 45.2 vs. Exp. 45.0 (Prev. 45.2); HCOB Composite Flash PMI (Dec) 49.5 vs. Exp. 48.1 (Prev. 48.3); HCOB Services Flash PMI (Dec) 51.4 vs. Exp. 49.4 (Prev. 49.5)

- EU Wages In Euro Zone (Q3) 4.4% (Prev. 4.5%, Rev. 4.9%); Labour Costs YY (Q3) 4.6% (Prev. 4.7%, Rev. 5.2%)

- French HCOB Services Flash PMI (Dec) 48.2 vs. Exp. 46.5 (Prev. 46.9); HCOB Composite Flash PMI (Dec) 46.7 vs. Exp. 45.8 (Prev. 45.9); HCOB Manufacturing Flash PMI (Dec) 41.9 vs. Exp. 43.0 (Prev. 43.1)

- German HCOB Services Flash PMI (Dec) 51.0 vs. Exp. 49.3 (Prev. 49.3); HCOB Composite Flash PMI (Dec) 47.8 vs. Exp. 48.0 (Prev. 47.2); HCOB Manufacturing Flash PMI (Dec) 42.5 vs. Exp. 43.2 (Prev. 43.0)

- UK Flash Services PMI (Dec) 51.4 vs. Exp. 51.0 (Prev. 50.8); Flash Composite PMI (Dec) 50.5 (Prev. 50.5); Flash Manufacturing PMI (Dec) 47.3 vs exp. 48.2 (Prev. 48.0)

LATAM

- Brazil's Lower House does not set a date for voting on the fiscal package, according to Estadao sources.