- US stocks were slammed on return from the Labor Day weekend with the Nasdaq underperforming amid a slump in the tech sector which saw losses of c. 4.5%.

- The Dollar Index resumed last week's theme of strength on Tuesday, although, gains were modest relative to those witnessed last week.

- T-notes rally across the curve despite record corporate issuance with peaks seen after the headline ISM Manufacturing PMI and Construction Spending missed estimates.

- The crude complex saw significant pressure on Tuesday driven by a slew of bearish catalysts, such as Libya headlines and refineries coming back online.

- Looking ahead, highlights include the Australian AIG Index, Japanese Final PMIs, Australian AGB Auction, Australian GDP, Chinese Caixin Services PMI.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks were slammed on return from the Labor Day weekend with the Nasdaq underperforming amid a slump in the tech sector which saw losses of c. 4.5%. The Tech weakness was led by downside in chips with AI-darling NVIDIA (NVDA) falling 9.5% in the first trading session of September, which typically is the worst month for stocks. Energy and Communication names also underperformed, while the defensive sectors, Consumer Staples, Real Estate, and Utilities outperformed.

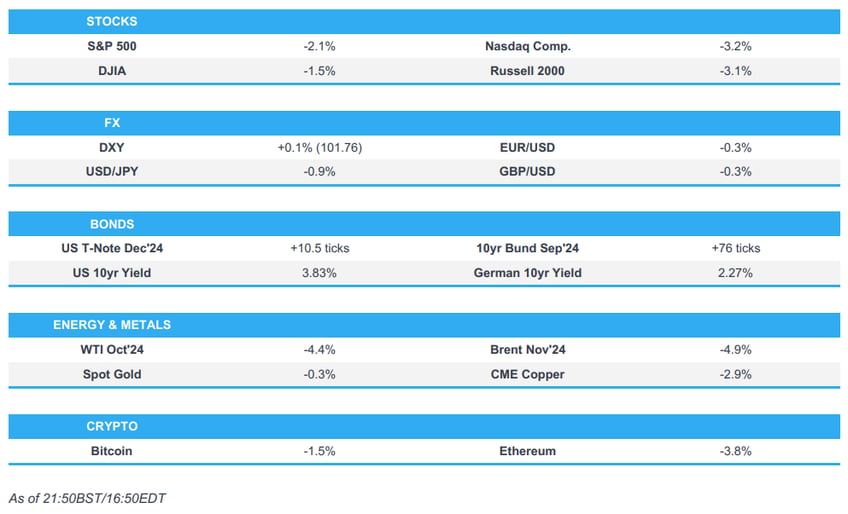

- SPX -2.12% AT 5,529, NDX -3.15% at 18,959, DJIA -1.51% at 40,937, RUT -3.09% at 2,149

- Click here for a detailed summary.

NOTABLE HEADLINES

- NVIDIA (NVDA) gets DoJ subpoena in escalating antitrust investigation, according to Bloomberg.

- Atlanta Fed GDPnow (Q3): 2.0% (prev. 2.5%).

DATA

- Canadian S&P Global Manufacturing PMI SA (Aug) 49.5 (Prev. 47.8)

- US ISM Manufacturing PMI (Aug) 47.2 vs. Exp. 47.5 (Prev. 46.8); Prices Paid (Aug) 54.0 vs. Exp. 52.5 (Prev. 52.9); Employment Idx (Aug) 46.0 (Prev. 43.4)

- US S&P Global Manufacturing PMI Final (Aug) 47.9 (Prev. 48); "Producers are also reducing payroll numbers for the first time this year and buying fewer inputs amid concerns about excess capacity." & "...one of the most worrying signals witnessed since the global financial crisis"

FX

- The Dollar Index resumed last week's theme of strength on Tuesday, although, gains were modest relative to those witnessed last week.

- G10 FX price action was skewed towards the downside versus the buck, led by Antipodes, while Havens outperformed, particularly in the Yen.

- The Euro saw weakness against the greenback, amid a lack of Euro-specific drivers as the US ISM report took influence over the cross, erasing an earlier rebound in the pair.

- Haven FX outperformed their major FX peers against the buck on Wednesday, helped by falling US Treasury yields and risk-off trade with equities slumping, with the upside most visible in the Yen.

- EM FX was broadly weaker on the day vs the buck, with CLP getting hit the most ahead of the Chilean Interest rate decision (expected to cut by 25bps to 5.5%), while its Latam peers closely follow in the red, just to a lesser extent.

COMMODITIES

- The crude complex saw significant pressure on Tuesday driven by a slew of bearish catalysts, such as Libya headlines and refineries coming back online.

- A Libyan Central Banker anticipates a deal leading to an oil restart to happen 'soon', via Bloomberg. Libya legislative bodies agree to appoint a central bank governor within 30 days following UN-sponsored talks, via statement from representatives of legislative bodies, according to Reuters.

FIXED INCOME

- T-notes rally across the curve despite record corporate issuance with peaks seen after the headline ISM Manufacturing PMI and Construction Spending missed estimates.

GEOPOLITICAL

- No notable update

ASIA-PAC

NOTABLE HEADLINES

- BoJ Governor Ueda submitted documents to a government panel explaining the recent policy announcement, via Bloomberg; article writes the document suggests the central bank will continue to hike if the economy/prices perform as expected.

- New Zealand GDT Price Index -0.4% to USD 3,833 (prev. +5.5% to 3,920); Whole Milk Powder -2.5% at USD 3,396 (prev. +7.2% to 3,482).

EU/UK

NOTABLE HEADLINES

- ECB's Simkus said for the cut in September he sees quite a clear case, but for cutting in October or by more than 25bp, finds it quite unlikely, via Econostream.

- ECB's Nagel said the great wave of inflation is over, but he will not commit in advance on whether he will vote for an interest rate cut in September, via FazFears operating losses for the Bundesbank this year at a similar level to 2023.

- French President Macron has reportedly discussed with political leaders the appointment of Xavier Bertrand (Les Republicans) as PM, via Le Monde; Macron is set to be "testing" the hypotheses of Xavier Bertrand and Bernard Cazeneuve with political groups.

- EUROPEAN CLOSES: DAX: -0.92% at 18,756, FTSE 100: -0.78% at 8,298, CAC 40: -0.93% at 7,575, Euro Stoxx 50: -1.21% at 4,913, AEX: -1.29% at 909, IBEX 35: -1.02% at 11,279, FTSE MIB: -1.33% at 33,863, SMI: -0.95% at 12,333, PSI: -0.99% at 6,707.

DATA

- Swiss CPI YY (Aug) 1.1% vs. Exp. 1.2% (Prev. 1.3%); MM (Aug) 0.0% vs. Exp. 0.1% (Prev. -0.2%).