- US stocks were ultimately lower on Wednesday, albeit not to the same extent as Tuesday's session. Losses were widespread, with Energy, Materials and Tech underperforming.

- The Dollar was weaker on Wednesday after the US JOLTS data, whereby the headline missed analyst expectations and even printed outside the bottom of the forecast range.

- T-Notes bull steepen after dovish July JOLTS, seeing 2s10s briefly un-invert while the probability of a 50bp cut in Sept nears 50%.

- The crude complex was choppy on Wednesday, but eventually extended on its recent losses, as demand woes and Libya supply updates outweighed bullish OPEC sources.

- Highlights include South Korean GDP, Japanese Cash Earnings, Australian Goods/Services Balance, and Japanese 30-year JGB Auction.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks were ultimately lower on Wednesday, albeit not to the same extent as Tuesday's session. Losses were widespread, with Energy, Materials and Tech underperforming, with NVIDIA (NVDA) hit again after a DoJ subpoena, although it denies this, while SMCI also was lower after a downgrade from Barclays.

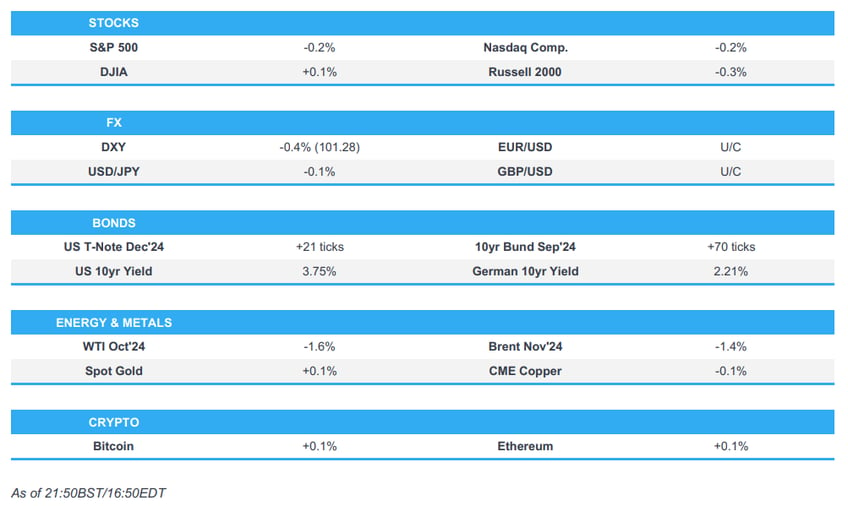

- SPX -0.16% AT 5,520, NDX -0.20% at 18,921, DJIA +0.09% at 40,974, RUT -0.34% at 2,141

- Click here for a detailed summary.

NOTABLE HEADLINES

- NVIDIA (NVDA) said they have not been subpoenaed by DoJ, according to Bloomberg.

- Fed Beige Book: Employment levels were generally flat to up slightly in recent weeks.

- Atlanta Fed GDPNow (Q3 24): 2.1% (prev. 2.0%)

DATA RECAP

- US JOLTS Job Openings (Jul) 7.673M vs. Exp. 8.1M (Prev. 8.184M, Rev. 7.91M); Vacancy Rate 4.6% (prev. 4.9%, rev. 4.8%); Quits Rate 2.1% (prev. 2.1%, rev. 2.0%).

- US Factory Orders MM * (Jul) 5.0% vs. Exp. 4.7% (Prev. -3.3%)

- US International Trade $ (Jul) -78.8B vs. Exp. -79.0B (Prev. -73.1B, Rev. -73.0B) Canadian Trade Balance C$ (Jul) 0.68B CA vs. Exp. 0.8B CA (Prev. 0.64B CA, Rev. -0.18B CA)

- US MBA Mortgage Applications w/e 1.6% (Prev. 0.5%); 30-Yr Mortgage Rate w/e 6.43% (Prev. 6.44%)

FX

- The Dollar was weaker on Wednesday after the US JOLTS data, whereby the headline missed analyst expectations and even printed outside the bottom of the forecast range, which saw the Dollar Index hit a trough of 101.24.

- Safe-havens, CHF and JPY, were the G10 outperforms vs. the Buck on Wednesday, although the Yen saw notably more strength than the Swissy, as they were supported by the continued slump in risk sentiment which saw USD/JPY hit a low of 143.87.

- All other G10 peers managed to eke out gains vs. the weaker Greenback, albeit to varying degrees, with Antipodeans the ‘underperformers’ highlighted by the Aussie more-or-less flat and weighed on by the subdued sentiment.

- CAD saw slight strength against the Greenback after the BoC rate decision, whereby the Loonie was flat heading into.

- EMFX was mixed. CLP and MXN saw weakness, with the former weighed on by falling copper prices and the latter by Mexico's Lower House giving final approval to the judicial reform after a detailed vote, which sends the bill to the Senate.

FIXED INCOME

- T-Notes bull steepen after dovish July JOLTS, seeing 2s10s briefly un-invert while the probability of a 50bp cut in Sept nears 50%.

COMMODITIES

- The crude complex was choppy on Wednesday, but eventually extended on its recent losses, as demand woes and Libya supply updates outweighed bullish OPEC sources.

- OPEC+ is reportedly discussing a delay to a planned oil output hike in October, via Reuters citing sources; delay comes as oil prices slump; market volatility from Libya shutdowns and a weak demand outlook reportedly increasing concern among OPEC.+

- OPEC+ members are reportedly considering delaying the production increase, via WSJ citing delegates; concerns over weak oil price. Producers are now reportedly considering holding production at current levels on the 2nd October meeting.

- US Private Inventory Expectations (bbls): Crude -7.4mln (exp. -1.0mln), Distillate -0.4mln (exp. +0.5mln), Gasoline -0.3mln (exp. -0.7mln), Cushing -0.8mln (prev. -0.49mln).

GEOPOLITICAL

- Senior US official said Palestinian prisoner exchange and areas of Israeli withdrawal are remaining obstacles to a deal, according to Reuters.

- Senior officials from the US and Israel reportedly held a low-profile virtual meeting on Tuesday to discuss how to ease tensions with Lebanon and prevent an all out war between Israel and Hezbollah, according to Axios citing officials

ASIA-PAC

NOTABLE HEADLINES

- JPMorgan cuts China stocks to neutral from overweight.

- China August prelim retail car sales -1% Y/Y, via PCA; +11% M/M.

- China mulls cutting mortgage rates in two steps to shield banks, via Bloomberg citing sources; regulators have proposed reducing rates on outstanding mortgages by a total of 80bps. Part of a package incl. an accelerated timeline for when mortgages become eligible for refinancing.

CENTRAL BANKS

- ECB's Kazaks said the ECB can take steps to lower rates at the next meeting; pace of wage growth is slowing; says we can lower rates but must remain cautious.

- ECB's Cipollone said investment remains weak, which suggest that firms do not believe a strong recovery, via Le Monde; broadly on track to for inflation; data so far confirms our direction of travel and hopes that this will allow the ECB to continue to be less restrictive. Adds, there is a real risk that the stance could become too restrictive.

- ECB's Stournaras says even with more rate cuts policy will remain restrictive.

- BoC Statement: Cuts by 25bps to 4.25%, as expected, citing continued easing in broad inflationary pressures. Macklem: "If inflation continues to ease broadly in line with our July forecast, it is reasonable to expect further cuts in our policy rate. We will continue to assess the opposing forces on inflation, and take our monetary policy decisions one at a time."

- Fed's Bostic (2024 Voter) says "we must not maintain a restrictive policy stance or took long; am now giving equal attention to max employment objective as inflation"

EU/UK

NOTABLE HEADLINES

- ASML (ASML NA) CEO repeated 2024 and 2025 guidance; said chip market recovery is uneven. China business supplying equipment to make older chips will remain strong. China business will return to 20%-30% of sales in coming years, according to Reuters.

- German economy is seen contracting 0.1% in 2024 (prev. forecast +0.2%), via IFW/Kiel; 2025 0.5% (prev. forecast 1.1%)

- Volkswagen (VOW3 GY) CFO sees industry-wide demand in Europe 2mln cars below peak; Europe's car market will not return to former size; its Europe overcapacity is 500k cars or two plants. Needs to increase productivity and reduce costs/reduce complexity.

- UK banking representatives are expected to meet Chancellor Reeves in the coming days to discuss concerns over a possible increase in bank taxes, via Reuters citing sources; sources expect the Treasury will seek to increase an existing surcharge on profits

DATA RECAP

- Spanish Services PMI (Aug) 54.6 vs. Exp. 54.5 (Prev. 53.9)

- German HCOB Composite Final PMI (Aug) 48.4 vs. Exp. 48.5 (Prev. 48.5); HCOB Services PMI (Aug) 51.2 vs. Exp. 51.4 (Prev. 51.4)

- French HCOB Composite PMI (Aug) 53.1 vs. Exp. 52.7 (Prev. 52.7); Services PMI (Aug) 55.0 vs. Exp. 55.0 (Prev. 55.0)

- Italian HCOB Composite PMI (Aug) 50.8 (Prev. 50.3); HCOB Services PMI (Aug) 51.4 vs. Exp. 52.6 (Prev. 51.7)

- EU HCOB Composite Final PMI (Aug) 51.0 vs. Exp. 51.2 (Prev. 51.2); Services Final PMI (Aug) 52.9 vs. Exp. 53.3 (Prev. 53.3)

- UK S&P Global PMI: Composite - Output (Aug) 53.8 vs. Exp. 53.4 (Prev. 53.4); Service PMI (Aug) 53.7 vs. Exp. 53.3 (Prev. 53.3)

- EU Producer Prices YY (Jul) -2.1% vs. Exp. -2.5% (Prev. -3.2%, Rev. -3.3%); Producer Prices MM (Jul) 0.8% vs. Exp. 0.3% (Prev. 0.5%, Rev. 0.6%)