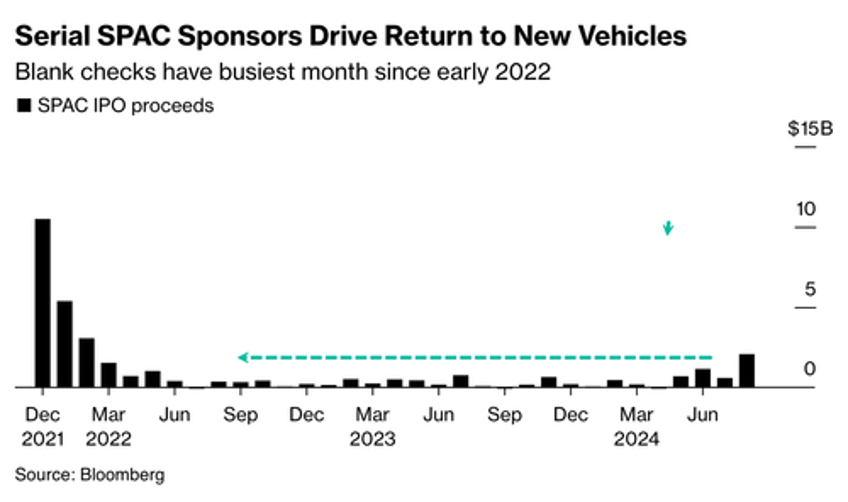

After a blockbuster year in 2021, with athletes and celebrities promoting blank-check offerings, the SPAC bubble imploded and has since been depressed under a high interest rate environment that the Federal Reserve kicked off in early 2022. But more than three years later, signs of life have returned to the black-check market ahead of the Fed's interest rate-cutting cycle that could begin in just weeks.

Bloomberg data shows $2 billion was raised across nine US-listed special-purpose acquisition companies in August, the largest flow of deals and proceeds since early 2022.

Avi Katz's GigCapital Global closed five deals, while Howard Lutnick and Asia casino magnate Lawrence Ho's family office each priced their own offerings last month.

Here's more from Bloomberg:

Cantor Fitzgerald LP, where Lutnick is CEO, has been a key player in the SPAC space as a bank and backer, sponsoring at least nine blank-check companies, the data show. Rumble Inc., the Peter Thiel-backed conservative video network, is among the companies Cantor brought public through SPACs, though most of the stocks have slumped since debuting.

Black Spade Acquisition II Co., which raised $150 million, is sponsored by an affiliate of Ho's Black Spade Capital. The firm's first SPAC brought Vinfast Auto Ltd. public at a $27 billion valuation last year.

Josef Schuster, founder and CEO of IPOX Schuster, an index provider focused on new listings, noted, "The SPAC structure isn't being put on the shelf — companies are realizing that the IPO may not be for everyone," adding, "Smaller deals in riskier areas or larger industrial mergers make sense as companies look for a public listing."

Some of the main drivers of the SPAC downturn included rising inflation and a high interest rate environment, disappointing performance by newly de-SPACed companies, rising macroeconomic uncertainty, and increased regulatory scrutiny from the SEC.

SPAC Research data show that SPAC proceeded have been rising, somewhat unevenly, since May. This suggests that financial conditions are loosening just enough that companies feel more confident that going public through a SPAC won't end in total disaster, with the Fed expected to begin cutting interest rates on Sept. 18.

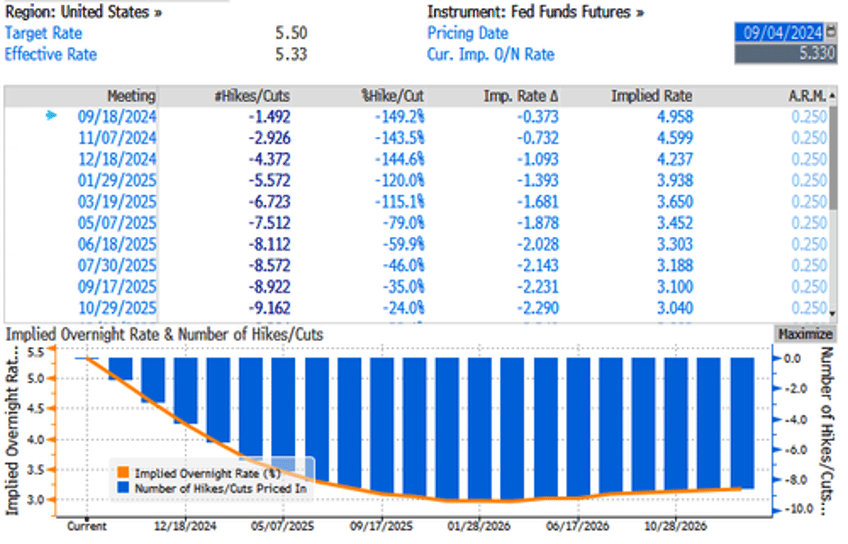

Fed swaps show 1.4 cuts are being priced this month, with as many as 4.2 by the end of the year.

The Fed was instrumental in inflating the SPAC bubble and deflating it...

According to SPAC Research data, around 100 blank-check companies are currently searching for deals, with 20 new ones launched in the last three months. This is a far cry from the SPAC bubble days of more than 600 pre-deal vehicles in the market.