- US President Trump responded "We'll see" when asked if reciprocal tariffs are still coming on Wednesday.

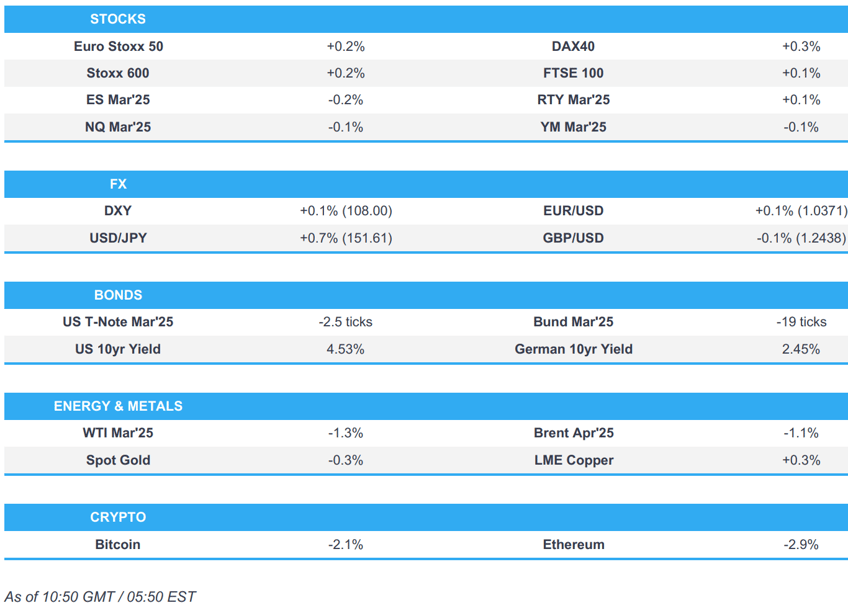

- European bourses hold an upward tilt pre-US CPI and with tariffs capping optimism; US futures are mixed.

- USD steady ahead of CPI, JPY is on the backfoot given the yield environment.

- USTs trade steady ahead of CPI, German yields continue their march higher.

- Crude slips on inventories which saw a surprise build in headline crude stockpiles, reports suggest there is “some optimism about reaching a solution” on Middle Eastern talks.

- Looking ahead, US CPI, OPEC MOMR, BoC Minutes, Speakers including Fed Chair Powell, Bostic, Waller & BoE’s Greene, Earnings from Vertiv, CVS, Biogen, Reddit.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

TARIFFS

- US Trump aide Navarro is said to be the leading advocate for the reciprocal-tariffs, WSJ sources said; which could also go beyond simply matching other nations’ tariffs to take into account nontariff trade barriers. Potentially leaves Japan, Europe, and China on the hook for higher tariffs.

- US President Trump responded "We'll see" when asked if reciprocal tariffs are still coming on Wednesday.

- White House said 25% steel tariffs would stack on other levies, according to Canadian press cited by Reuters.

- Japanese Industry Minister Muto said they requested the US to exclude Japan from steel and aluminium tariffs, while Finance Minister Kato said they will assess the impact of US tariffs on the Japanese economy and respond appropriately.

- The first conversation between European Commission President von der Leyen and US VP JD Vance yesterday was said to be "very constructive" and focused on areas where interests aligned, according to sources cited by the FT.

- US President Trump will sign executive orders at 14:30 EST (19:30 GMT), via Punchbowl.

- Click for the Newsquawk tariff analysis.

EQUITIES

- European bourses are generally modestly firmer, despite a mixed handover from the APAC session.

- European sectors hold a positive bias; Real Estate takes the top spot, propped up by post-earning strength in homebuilder Barratt Redrow (+5.6%). Heineken (+11.4%) jumped at the open after the co. beat on profit and announced a share buyback. Energy is the clear laggard, given the weakness in oil prices today.

- US equity futures are mixed and trade on either side of the unchanged mark. Focus for today will be on US CPI as well as several Fed speakers including Chair Powell, who is to appear before the House Financial Services Committee.

- Computer researchers in China using domestically made graphics processors have achieved a near-tenfold boost in performance over powerful US supercomputers that rely on Nvidia’s (NVDA) hardware, according to a peer-reviewed study cited by SCMP.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is steady ahead of upcoming US CPI data whereby core M/M CPI is expected to tick higher to 0.3% from 0.2%, Y/Y nudge lower to 3.1% from 3.2%, headline M/M is seen falling to 0.3% from 0.4% and Y/Y is expected to hold steady at 2.9%. Elsewhere, today sees Powell address The House. Bostic and Waller are also due (latter is speaking on Stablecoins). DXY is back below the 108 mark and in close proximity to its 50DMA at 107.95.

- EUR is stronger vs. the USD for a third consecutive session. However, it remains to be seen how durable the recent uptick will be given the Eurozone's uncertain growth outlook, easing bias at the ECB and vulnerability of the Eurozone to tariff action from the Trump administration. ECB's Nagel is due to speak on the natural rate later today. EUR/USD has been as high as 1.0379 but is yet to breach yesterday's 1.0381 peak.

- JPY is the clear laggard across the majors, potentially a factor of the relatively higher yield environment. Japanese-specific drivers have been on the light side asides from some non-incremental remarks from BoJ Governor Ueda overnight who stated that the pace of monetary adjustment should depend on the economic situation and he is aware that rising inflation, including fresh foods, is having a negative impact on households. USD/JPY is now back above its 200DMA at 152.70 with a current session peak at 153.88. Focus is now on a test of 154.

- GBP is steady vs. the USD with the lone highlight on today's UK calendar coming via a speech by MPC member Greene at 15:00GMT. Greene's remarks will follow those yesterday of dovish dissenter Mann who gave her reasoning behind her dovish dissent at the last meeting but noted her “active rate policy does not mean cut, cut, cut" and suggested she may not opt for another 50bps cut at the next meeting. Cable briefly popped above yesterday's 1.2454 peak but ran out of steam ahead of the 50DMA at 1.2476.

- Antipodeans are both marginally softer in quiet trade for the antipodes. AUD/USD is pausing for breath after two consecutive sessions of gains which has brough the pair above its 50DMA at 0.6271 but failed to sustain a move above the 0.63 mark with a current session peak at 0.6309.

- PBoC set USD/CNY mid-point at 7.1710 vs exp. 7.2971 (prev. 7.1716).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are steady ahead of upcoming US CPI data. An in-line report could cement the markets view of inflation stickiness given that the most recent Fed statement did not include language that inflation had made progress to its 2% goal. On the trade front, WSJ reports that reciprocal tariffs could go beyond simply matching other nations’ tariffs to take into account nontariff trade barriers. For the docket today; US 10yr supply, and Fed speak from Bostic, Waller and Powell. After printing a base at 4.40% on 5th February, the US 10yr yield has been up for 5 sessions in a row and ventured as high as 4.556% today.

- Bunds are lower by around 20 ticks. German yields are higher once again after a strong showing yesterday which Rabobank attributes to a glut of (particularly sovereign) issuance given an absence of any market moving type newsflow (including a lack of fresh EZ data or a shift in tone from central bank speakers). EZ-docket is fairly light, but ECB's Nagel is due; US CPI will take focus. German 2054/2050 lines passed without issue, sparking little move in German paper.

- Gilts marginally higher after yesterday's session of losses. The lone highlight on today's UK calendar coming via a speech by MPC member Greene at 15:00GMT. Mar'25 Gilts are currently sat just below the 93.00 mark with the corresponding 10 year yield holding above the 4.5% mark.

- Germany sells EUR 1.189bln vs exp. EUR 1.5bln 2.50% 2054 Bund and EUR 0.795bln vs. Exp. EUR 1bln 0.00% 2050 Bund.

- Click for a detailed summary

COMMODITIES

- A soft session for the crude complex today, giving back some of the geopolitical-induced upside in the prior session; but underlying tensions still remain unresolved regarding US-Israel and Gaza. Although Journalist Kais did report that there is "some optimism" about reaching a solution. Brent currently trades at the bottom end of a USD 76.22-91/bbl range.

- Spot gold is a little lower today, currently off by around USD 5.00/oz; price action has been very rangebound and contained within a USD 2883.79-2900.75/oz confine.

- Mixed trade in base metals with markets cautious ahead of US CPI and potential Trump reciprocal tariffs. 3M LME copper resides in a USD 9,347.85-9,416.00/t range this morning.

- EU considers a temporary gas price cap to counter diverging costs with the US, although the proposal has spurred backlash from the industry which warned it could damage trust, according to FT.

- Vitol CEO said European LNG prices are reaching levels where demand is going to start to be impacted. EU government intervention will be required to ensure adequate winter LNG supplies.

- UAE Energy Minister said "I don't think that Deepseek's AI advancement will hit demand for Nuclear energy". There will be huge demand for energy, probably greener, to supply data centres. "Optimistic that we will have sufficient energy to supply the AI boom". Ensuring market stability to benefit of producing and consuming nations is very hard, especially with OPEC's shrining market share.

- Russian Deputy PM Novak says it fully complied with OPEC+ oil cuts deal in January and will do the same in February. Expects to keep or increase oil refining throughout in 2025. There is no discussion of gas swaps with Azerbaijan for exports to Europe via Ukraine.

- Click for a detailed summary

NOTABLE DATA RECAP

- Italian Industrial Output MM SA (Dec) -3.1% vs. Exp. -0.2% (Prev. 0.3%); Industrial Output YY WDA (Dec) -7.1% (Prev. -1.5%, Rev. -1.6%)

NOTABLE EUROPEAN HEADLINES

- ECB's Holzmann said lowering rates by 50bps increments this year would "not be a wise move"

- Riksbank's Bunge said inflation outcome for Jan was higher than expected, but the reasons for this are not known and figures should be interpreted with caution

NOTABLE US HEADLINES

- Fed's Williams (Vice Chair) said monetary policy is well positioned to achieve Fed goals and the US economy is in a good place, while inflation expectations are well anchored and the US unemployment rate should stay between 4% to 4.25%. Williams also stated that the US is to grow by around 2% this year and next, while inflation is to hang around 2.5% this year and 2% in the coming years. Furthermore, Williams said it is hard to determine if uncertainty is weighing on the economy, as well as noted that monetary policy is where it should be and monetary policy remains appropriately restrictive.

- US President Trump's advisers reportedly eye bank regulator consolidation and are said to discuss consolidating bank regulators' OCC and FDIC, according to WSJ. In relevant news, the White House plans to nominate Jonathan McKernan to lead the CFPB full-time and Jonathan Gould to lead the OCC, according to Punchbowl.

- US President Trump is lined up to attend a Saudi-backed conference in Miami this month, according to Reuters sources.

GEOPOLITICS

MIDDLE EAST

- Journalist Kais said "Qatar and Egypt are in contact with the US on the [Ceasefire] issue, and there is some optimism about reaching a solution", citing mediating sources.

- Iran's Supreme leader Khamenei said Tehran should further continue improving it's defence sector, accuracy of Iranian missiles should be further improved.

- "Syrian sources: The Israeli army penetrates into the town of "Saida Golan" in the southern countryside of Quneitra", via Sky News Arabia.

- "The [Israeli] negotiating team advised cabinet ministers to resolve the crisis with Hamas and not to allow the deal to collapse", according to Israeli sources via Al Jazeera.

- US Secretary of State Rubio said if Hamas does not abide by the agreement by Saturday, he thinks Israel will intervene again, while he added that Trump wants to get all detainees out of the Gaza Strip at once and that Hamas violates the ceasefire agreement in the Gaza Strip, according to Asharq News.

- Egypt plans to offer a comprehensive proposal to rebuild Gaza while ensuring Palestinians remain on their land and looks forward to cooperating with US President Trump to achieve a comprehensive and just peace in the region. Egypt also affirmed the rejection of any proposal to allocate land to Gaza residents.

RUSSIA-UKRAINE

- Russia's Kremlin said Russia will never discuss swapping Ukrainian territory it controls or area Ukraine holds in the Kursk region.

- Russian Deputy Chairman of the Security Council Medvedev said "we can have peace through strength" and Russian showed strength with missiles and drone strikes on Kyiv (Ukraine).

- Ukrainian President Zelensky stated in a recent interview with AFP that he is willing to swap Russian territory captured by Ukraine in the Kursk region for Ukrainian territory captured by Russia in the east in a negotiated peace settlement to end the ongoing war.

- Russian air attack sparked fires in two Kyiv districts, according to the head of Kyiv's military administration. Furthermore, Ukrainian President Zelensky's aide said Russia carried out a missile strike on Kyiv, while the city mayor said emergency services were called to several districts.

- US President Trump said on Truth that he will send US Treasury Secretary Bessent to Ukraine to meet Zelensky, while he added the war must end and will end soon. It was separately reported that White House National Security Adviser Waltz said they are moving in the right direction to end the brutal and terrible war in Ukraine.

OTHER

- US Navy confirmed two US warships carried out a north-to-south Taiwan Strait transit and said it was routine, while China's military organised its naval and air force to monitor US ships crossing the Taiwan Strait from Feb. 10th-12th.

- China's Taiwan Affairs Office said it resolutely opposes and will never allow any foreign interference, while it has full confidence and sufficient ability to safeguard national sovereignty and territorial integrity. It also said the US should prudently and properly handle Taiwan-related issues and not send wrong signals to independence separatist forces.

- China's Coast Guard conducted a 'rights defence' patrol in the 'territorial waters' of the Diaoyu/Senkaku Islands on Wednesday, according to state media.

CRYPTO

- Bitcoin is a little weaker in today's session, trading just above USD 96k.

APAC TRADE

- APAC stocks were ultimately mixed with price action somewhat choppy following the similar performance stateside in the aftermath of Trump's recent tariff announcements and with US CPI data on the horizon.

- ASX 200 traded higher as strength in the top-weighted financial sector and the industrials atoned for the losses in tech, while participants digested key earnings releases including from Australia's largest bank and most valuable company, CBA.

- Nikkei 225 advanced on return from yesterday's holiday closure amid recent currency weakness but momentarily pared all of its gains amid rising yields and tariff-related uncertainty.

- Hang Seng and Shanghai Comp were varied with outperformance in Hong Kong led by strength in tech stocks including Alibaba after reports that Apple partnered with Alibaba to develop AI features for iPhone users in China, while SMIC benefitted after it posted stronger-than-expected revenue and guided revenue growth. Conversely, the mainland was contained with price action choppy amid ongoing trade frictions and the PBoC's liquidity effort.

NOTABLE ASIA-PAC HEADLINES

- BoJ Governor Ueda said they will conduct monetary policy appropriately to achieve the 2% target and will monitor the impact of US tariff and immigration policies. Ueda said the pace of monetary adjustment should depend on economic situations and he is aware that rising inflation, including fresh foods, is having a negative impact on households, while he added there could be risks that rising prices of fresh foods may not be temporary and could affect people's sentiment.