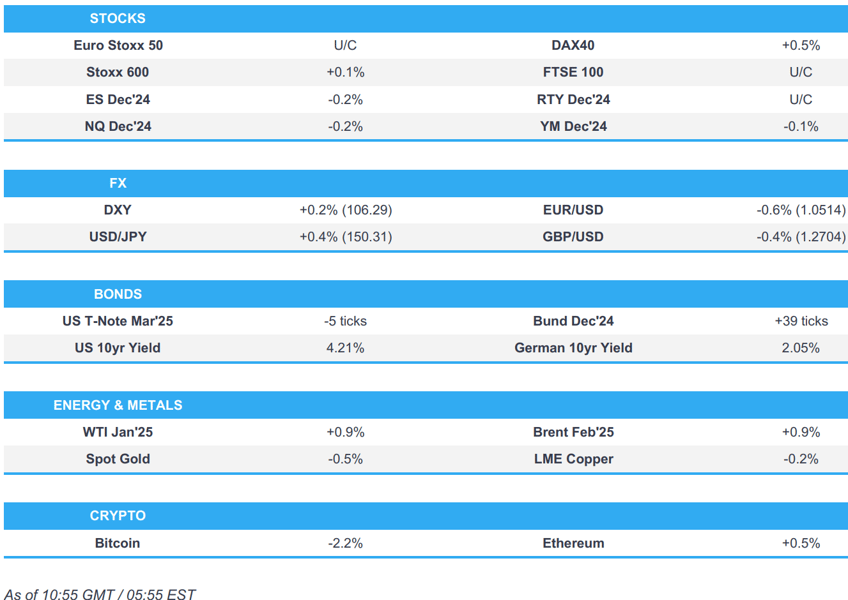

- European bourses began the session in negative territory, but sentiment quickly improved to show a mostly positive picture in Europe; US futures modestly lower.

- Dollar is propped up by further Trump tariff threats, EUR dragged by political uncertainty and tests 1.05 to the downside.

- OATs in focus as the French gov't awaits Le Pen's decision; USTs are slightly lower ahead of US ISM Manufacturing PMIs.

- WTI & Brent are on a firmer footing following better-than-expected Chinese PMIs, XAU/base metals pressured by the firmer Dollar.

- Looking ahead, US S&P manufacturing PMI, ISM Manuf. PMI & Construction Spending, Speakers including Fed’s Williams, Waller.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses began the session entirely in the red, but quickly after the cash open most indices caught a bid to display a mostly positive picture in Europe. The CAC 40 (-0.4%) is the underperformer given the political uncertainty surrounding the region.

- European sectors opened with a strong negative bias, but sentiment has since improved to show a mixed picture in Europe. Basic Resources takes the top spot, despite losses in base metals prices; sentiment in the sector might be buoyed by better-than-expected Chinese NBS & Caixin Manufacturing PMIs. Autos is by far the clear underperformer, dragged down by losses in Stellantis after its CEO Tavares resigned.

- US Equity Futures are very modestly on the backfoot, giving back some of the gains seen in the prior session which saw the S&P notch its best month of the year.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD firmer vs. all major peers following US President-elect Trump's latest tariff threat over the weekend in which he demanded that BRICS nations commit to not creating a new currency to challenge the US dollar or they will face 100% tariffs. The weaker EUR is also helping. DXY has eclipsed the 27th November peak @ 106.41 ahead of US ISM Manufacturing and speak from Fed's Waller and Williams.

- EUR near the bottom of the G10 leaderboard as political disruptions in France act as a drag on the wide currency with the far-right Bardella noting that a no-confidence motion will likely be passed unless there is a “last minute miracle”. As it stands, EUR/USD has delved as low as 1.0497. Elsewhere, ECB's Lane noted over the weekend there is a little bit of distance to go before the ECB's inflation target is reached.

- JPY is pressured vs. the USD with USD/JPY back above the 150 mark after. Fresh macro drivers for Japan were lacking over the weekend. Focus this week will be on the expected rate hike.

- GBP is on the backfoot vs. the USD alongside a lack of UK-specific drivers. This could remain the case with this week's calendar lacking in tier 1 UK data highlights. Cable is currently holding just above the 1.27 mark and sits within Friday's 1.2672-1.2750 range.

- Antipodeans are both softer vs. the broadly firmer USD but to a slightly lesser degree than most peers with some support being offered by Chinese PMI metrics from over the weekend. AUD/USD is currently lingering around the 0.65 mark after delving as low as 0.6489 overnight.

- South Africa says BRICS have no plans to create a new currency, via Bloomberg. A remark which sparked immediate downside in USD/ZAR

- India lowers Q2 GDP growth rate due to some "obvious reasons" which are likely to dissipate in the next 2 quarters; taking steps to facilitate achievement of FY25 GDP growth estimates of 6.5-7%.

- Russian Kremlin says USD is losing its appeal as a reserve currency for many nations and the trend is gathering pace.

- PBoC set USD/CNY mid-point at 7.1865 vs exp. 7.2384 (prev. 7.1877).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- OATs are firmer but have pulled back from a 127.04 session peak, in-fitting with action across benchmarks broadly in recent trade. Focus on the region is on French politics and particularly how PM Barnier will outline social security budget details to the National Assembly today as part of the budget, a budget which would almost certainly not pass due to it containing RN red lines. OAT-Bund 10yr yield spread has peaked at 86bps thus far today, elevated but shy of the 90bps high from last week.

- Bunds are firmer but off session highs of 135.40. Been on the front foot throughout the morning, given the above French political concern on the narrative that it could potentially spill over into a broader fiscal/economic crisis with implications for the bloc as a whole. This morning's PMIs were generally revised lower (though the pan-EZ figure was unrevised); metrics which had little impact on price action. Thereafter, ECB's Kazaks said the ECB is likely to discuss a bigger December cut, but the uncertainty is high; comments which sparked upside in Bunds.

- Focus for USTs ahead, aside from France, is firmly on ISM Manufacturing PMI ahead of the services release later in the week and then most pertinently the NFP report. Currently trading at the lower end of a 110-31+ to 111-06+ band.

- Gilts were initially firmer, taking the lead from EGBs and with further modest upside coming after a downward revision to its Final Manufacturing PMI. However, Gilts have faded from the 96.25 peak which printed early doors with specifics light, aside from data, and the focus very much on the EZ/France.

- Click for a detailed summary

COMMODITIES

- WTI and Brent are in the green, just off session highs of USD 68.81/bbl and USD 72.67/bbl respectively. Upside which comes after strong Chinese PMIs overnight and ahead of this week’s delayed OPEC+ gathering, currently set for December 5th.

- Gold was pressured despite uncertainty around France and geopolitical tensions with the USD firmer and stripping the yellow metal of any haven-allure it may have otherwise received. XAU peaked at USD 2656/oz peak, shy of last Wednesday’s USD 2658/oz high.

- Base metals are softer, dented by the USD strength and despite better-than-expected Chinese PMIs. 3M LME Copper continues to slip below the USD 9k handle down to a USD 8910/z trough.

- Kazakhstan says oil supplies via Druzhba pipeline to Germany were fully on schedule in November.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK S&P Manufacturing PMI (Nov) 48.0 vs. Exp. 48.6 (Prev. 48.6)

- EU Unemployment Rate (Oct) 6.3% vs. Exp. 6.3% (Prev. 6.3%)

- EU HCOB Manufacturing Final PMI (Nov) 45.2 vs. Exp. 45.2 (Prev. 45.2)

- Spanish HCOB Manufacturing PMI (Nov) 53.1 vs. Exp. 53.5 (Prev. 54.5)

- Italian HCOB Manufacturing PMI (Nov) 44.5 (exp. 45.7, prev. 46.9)

- French HCOB Manufacturing PMI (Nov) 43.1 vs. Exp. 43.2 (Prev. 43.2)

- German HCOB Manufacturing PMI (Nov) 43.0 vs. Exp. 43.2 (Prev. 43.2)

- Swiss Manufacturing PMI (Nov) 48.5 vs. Exp. 49.4 (Prev. 49.9)

- Swiss Retail Sales YY (Oct) 1.4% (Prev. 2.2%, Rev. 0.6%)

- UK Lloyds Business Barometer (Nov) 41 vs Exp. 40 (Prev. 44)

- UK Nationwide House Price YY (Nov) 3.7% vs. Exp. 2.4% (Prev. 2.4%); MM (Nov) 1.2% vs. Exp. 0.2% (Prev. 0.1%)

- Italian GDP Final QQ (Q3) 0.0% (Prev. 0.0%); GDP Final YY (Q3) 0.4% vs. Exp. 0.4% (Prev. 0.4%)

NOTABLE EUROPEAN HEADLINES

- ECB's Lane said while inflation had fallen close to the ECB’s target of 2%, there is a little bit of distance to go and while data dependence falls down in priority, the new challenge would be assessing the incoming risks on a meeting-by-meeting basis. Lane said the focus on the latest economic data will ebb and monetary policy decisions at some point in the future need “to be driven by upcoming risks rather than being backward-looking”. Furthermore, he said services inflation needs to come down further and at some point, there will be a transition from addressing the disinflation challenge to the new challenge of keeping inflation at 2%, according to FT.

- ECB's Stournaras says the ECB will probably continue cutting rates in December.

- ECB's Kazaks says the ECB is likely to discuss a bigger December cut, but the uncertainty is high

- French far-right figurehead Marine Le Pen said on Sunday that the government effectively "put an end to discussions" on the country's 2025 budget, which increases the likelihood of a vote of no confidence in PM Barnier, according to France 24. Click for the French budget deadline primer.

- S&P affirmed France at AA-; Outlook Stable, while Moody’s affirmed Hungary at Baa2; Outlook revised to Negative from Stable.

NOTABLE US HEADLINES

- US President-elect Trump demanded that BRICS nations commit to not creating a new currency to challenge the US dollar or they will face 100% tariffs. Trump also stated that he had a very productive meeting with Canadian PM Trudeau and they discussed many important topics that will require both countries to work together to address such as fentanyl and the drug crisis, while they also spoke about many other important topics like energy, trade and the Arctic. In the European morning, South Africa said the BRICS have no plans to create a new currency, via Bloomberg.

- US President Biden issued a pardon for his son Hunter Biden.

- US tightens China curbs on AI memory and semiconductor tools, according to Bloomberg. The Department of Commerce slapped additional curbs on the sale of high-bandwidth memory and chipmaking gear, including that produced by US firms at foreign facilities. US official cited said the new sanctions and entity list will be detailed in full on Monday.

GEOPOLITICS

MIDDLE EAST

- US envoy Hochstein says there are Israeli violations of the ceasefire agreement, according to Kann's Stein.

- Syrian opposition leader Al-Bahri says "we are ready to negotiate, starting tomorrow".

- Russian Kremlin says the continue to support Syrian President Al-Assad, are analysing the situation.

- Israeli Foreign Minister says "The presence of Hezbollah terrorists south of Litani - a fundamental violation of the agreement. They must move north!", according to Kann's Stein

- Israeli PM Netanyahu told the mother of a hostage that conditions are ready to complete a deal in Gaza after the end of the war in the north, according to Israel's Channel 12 cited by Sky News Arabia. It was also reported that Netanyahu decided to hold a security discussion on Sunday evening with the aim of reaching a deal in Gaza, while the security service warned the government that the army's continued dismantling of Hamas could lose control of the hostages, threatening their return due to the chaos.

- Israeli Foreign Minister said there are signs of progress on a deal with Hamas in light of flexibility that arose after the settlement in Lebanon, while the Israel Broadcasting Corporation reported that Hamas still insists that any agreement must ensure an end to the war, according to Sky News Arabia.

- Israel’s military said sirens sounded in a number of areas in central Israel following a launch from Yemen.

- UNRWA chief said aid delivery through the Israeli-controlled Kerem-Shalom crossing was paused due to an unsafe route and looting by armed gangs inside Gaza.

- Syrian opposition forces have taken control of much of the country’s second-largest city Aleppo, while rebel forces said all of Idlib province is under rebel control.

- Syrian and Russian air forces stepped up strikes on the positions of Syrian rebels and their supply lines with scores reportedly killed and injured, according to TASS citing the Syrian army.

- US-led international coalition forces launched two airstrikes against the positions of Iran-aligned forces in the suburbs of Syria’s Mayadeen, according to Syrian television cited by Iran International.

- Iran’s Foreign Ministry condemned aggression against its embassy in Aleppo and said all consulate members are safe, while the Iranian and Russian Foreign Ministers voiced support for Syria in confronting terrorist groups. Furthermore, the Iranian Foreign Minister said rebel attacks in Syria are part of an Israeli-US plan to destabilise the region.

- Turkey’s Foreign Minister spoke with US Secretary of State Blinken and discussed Syria, while the Turkish official also discussed Syria with his Iraqi counterpart.

RUSSIA-UKRAINE

- Ukrainian President Zelensky met with EU Council President Costa in Kyiv, while he said a NATO invitation is necessary for survival and that Ukraine will never recognise Russian occupation of its territory.

- White House National Security Adviser said the idea of returning nuclear weapons to Ukraine is not under consideration.

OTHER

- US State Department said it suspended the strategic partnership with Georgia and regrets Georgia’s decision to suspend EU accession. It was separately reported that Russian Security Council Deputy Chairman Medvedev said an attempted revolution is happening in Georgia and that Georgia is moving along the Ukrainian path into the abyss.

- China’s government said the Foreign Ministry lodged stern representations with the US over Taiwan President Lai’s Hawaii stopover and they are firmly opposed to Taiwan leaders transiting the US for any reason. China’s Foreign Ministry also lodged stern representations with the US over weapons sales to Taiwan and said it will take resolute countermeasures regarding the arms sale.

- Philippines President Marcos said the reported presence of a Russian submarine in the South China Sea is very concerning and any intrusion into the Philippine maritime zone is very worrisome.

CRYPTO

- Bitcoin pulls back from weekend highs to current levels of around USD 95.3k, and towards today's trough at USD 94.9k.

APAC TRADE

- APAC stocks began the new trading month mostly higher as participants reflected on Chinese PMI data in which the official headline Manufacturing and Caixin Manufacturing PMIs both topped forecasts, while markets await a deluge of releases this week.

- ASX 200 eked mild gains with outperformance in tech making up for the slack in defensives and with data providing some encouragement.

- Nikkei 225 saw two-way price action but ultimately gained with the help of a weaker currency and encouraging Chinese data.

- Hang Seng and Shanghai Comp were varied with outperformance in the mainland following the latest Chinese PMI data including the official releases over the weekend which showed headline Manufacturing PMI topped forecasts but Non-Manufacturing PMI disappointed, while Caixin Manufacturing PMI surpassed the most optimistic analyst expectations and printed its highest since June.

NOTABLE ASIA-PAC HEADLINES

- US will add roughly a dozen Chinese toolmakers plus their subsidiaries and affiliates to the Commerce Department’s restricted trade list, while it will expand its powers to curb exports of certain chipmaking equipment made in places including Malaysia, Singapore, Taiwan, and Israel, according to sources cited by Reuters.

- BoJ Governor Ueda said on Friday that the timing of the next interest rate hike was "approaching" as the economy was moving in line with the central bank's forecasts and noted that yen weakness will be a risk to the outlook if the currency falls further after inflation starts rising, while he added the BoJ is to focus on wages and other areas when deciding whether to hike interest rates, according to Nikkei.

- Japan reportedly wants to lift GPIF real investment return target to 1.9% from 1.7%, according to Bloomberg.

- PBoC Governor says China will continue to maintain a supportive monetary policy stance and direction next year; will strengthen counter cyclical adjustments

DATA RECAP

- Chinese Manufacturing PMI 50.3 vs Exp. 50.2 (Prev. 50.1)

- Chinese Non-Manufacturing PMI 50.0 vs Exp. 50.4 (Prev. 50.2)

- Chinese Composite PMI 50.8 (Prev. 50.8)

- Chinese Caixin Manufacturing PMI Final (Nov) 51.5 vs. Exp. 50.5 (Prev. 50.3)

- Australian Building Approvals (Oct) 4.2% vs. Exp. 1.5% (Prev. 4.4%)

- Australian Retail Sales MM Final (Oct) 0.6% vs. Exp. 0.4% (Prev. 0.1%)