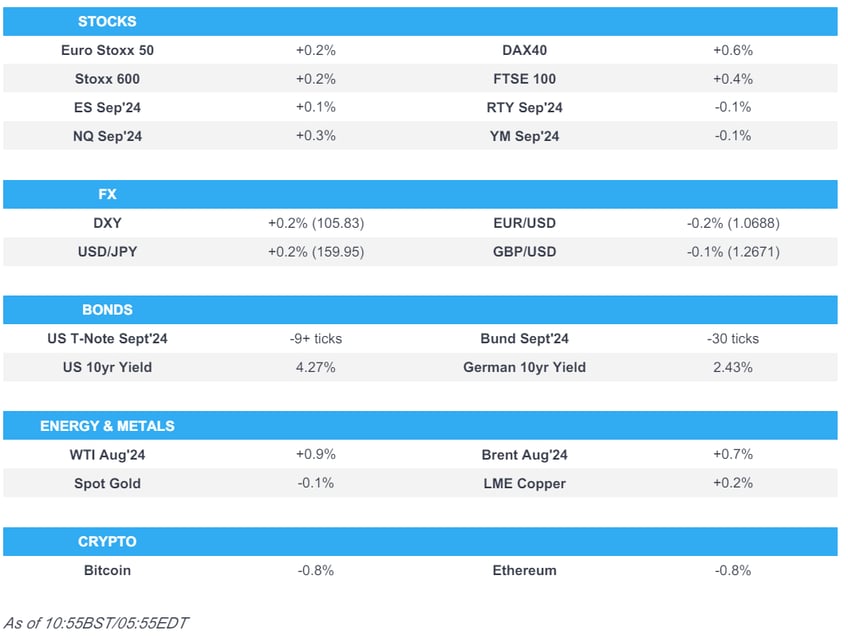

- European bourses higher across the board following the tech-led upside on Wall St, sectors mostly in the green though Autos lag on Volkswagen

- US futures firmer but only modestly so, awaiting Micron earnings after-hours; FedEx and Rivian bid in the pre-market

- USD/JPY breached 160.00; bringing the April 29th peak into view, a session which saw intervention and a large pullback in the pair

- DXY robust to the detriment of peers, Aussie outperforms after hot CPI which has raised the odds of a August hike

- Fixed softer given the tone and awaiting supply; Commodities initially contained though crude has extended in recent trade

- Looking ahead, highlights include Fed Bank Stress Test, Comments from ECB’s Rehn, Panetta & Lane, Supply from the US, Earnings from Micron, Paychex & General Mills

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses higher across the board following the tech-led upside on Wall St.; Stoxx 600 +0.2%.

- Sectors mostly in the green, Tech leads while Autos lag amid pressure in Volkswagen after their investment in Rivian.

- Stateside, futures firmer but only modestly so, ES +0.2% & NQ +0.3% as we count down to Micron earnings after-hours; Fedex leading in the pre-market +13% post-earnings.

- DigiTimes reported that Nvidia (NVDA) CEO Jensen Huang was reportedly concerned about the company's business development, with slow data centre expansion possibly impacting chip sales.

- Equity specifics between Volkswagen-Rivian & FedEx detailed below.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD/JPY has breached 160.00 to the upside, for the first time since April 29th when it peaked at 160.20, a session which saw intervention and a large pullback in the pair; note, the breach of 160.00 this morning was accompanied by modest two-way action. Currently holding around a 160.06 session high.

- DXY continues to incrementally build on Tuesday's advances to a current 105.86 peak but is yet to breach Monday's 105.90 high, which essentially matches Friday's 105.91 best.

- Action which is weighing on peers across the board; EUR/USD lost 1.07 to a 1.0686 base while Cable continues to slip from 1.27 and is approaching 12650.

- Aussie is the clear outperformer, bolstered by hot CPI which has increased the odds of a August hike to c. 33% (12% pre-release, AUD/USD to a 0.6688 peak; Kiwi softer and weighed on by the cross with NZD/USD just beneath Tuesday's 0.6107 base.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Benchmarks in the red as the overall risk tone saps haven demand and amid a lack of fresh fundamental drivers for the complex, European docket focuses on a speech from ECB's Lane.

- Bunds at the low-end of a 45 tick band that has seen it slip below Monday's 132.22 base to a new WTD low, if this goes, support at 132.02 before the figure and then 131.61.

- OAT-Bund spread steady at 71bp with no fall out from an unsurprisingly fiery French election debate.

- Gilts in-fitting with only a modest uptick on the back of a robust 2038 auction, complex looks ahead to the last Sunak-Starmer debate before the election this evening.

- USTs also have a thin docket ahead with no Fed speak due and the main highlight being the 5yr auction, a tap which follows a better-than-average 2yr sale; USTs at a 110-09 fresh WTD base and holding just above last week's 110-06+ low.

- Click for a detailed summary

COMMODITIES

- Initially contained trade with specifics quite light after the bearish inventory report has given way to a modest but growing bid for the crude benchmarks which are at the top-end of c. USD 1.0/bbl parameters.

- Action which comes despite a slight easing in the European risk tone (though still constructive overall) and an ongoing grind higher for the USD.

- Precious metals saw a contained start given the twin headwinds of a robust dollar and risk appetite. Yellow metal is at the low-end of a USD 2309-2323/oz band; one that sees it slip further from its 10-, 21- & 50-DMAs.

- Base metals tracking the tone but the gains capped by the dollar, overall the complex is firmer, it is yet to break the downward trend that has been in place for the likes of copper since end-May.

- US Private Inventory Data (bbls): Crude +0.9mln (exp. -2.9mln), Distillate -1.2mln (exp. -0.3mln), Gasoline +3.8mln (exp. -1.0mln), Cushing -0.4mln.

- Trading Hub Europe's Frank remarks that German gas caverns curently show comfortable filling levels; Europe has enough LNG terminal capacities and southbound transit capacities from the north-west have been boosted.

- Click for a detailed summary

NOTABLE DATA RECAP

- German GfK Consumer Sentiment (Jul) -21.8 vs. Exp. -18.9 (Prev. -20.9, Rev. -21.0)

NOTABLE EUROPEAN HEADLINES

- ECB's Rehn said he sees bets for two more rate cuts this year as reasonable and the market's terminal rate view of 2.25%-2.50% is also appropriate, while he sees the possibility for rate moves at any policy meeting and noted that rate cuts are contingent on additional disinflation. Rehn said he sees no disorderly market moves in France, as well as noted there is no debt crisis ahead and no need for TPI.

- ECB reportedly to begin the next strategic review once the summer break concludes, via Bloomberg; looking to present findings in H2-2025.

- Volkswagen (VOW3 GY) is to invest an initial USD 1bln in Rivian (RIVN), as part of a new, equally controlled JV to share EV architecture and software. The potential investment could rise to as much as USD 5bln by 2026 if certain milestones are achieved. The transaction could result in an unplanned cash outflow of up to EUR 2bln for Volkswagen in the current FY. Volkswagen expects FY24 net cash flow to range between EUR 2.5-4.5bln. Volkswagen will further its software-defined-vehicles plans via the JV, and transition to a pure zonal architecture. Each company will continue to separately operate their respective vehicle businesses. Rivian's stock jumped higher by 50% in extended trading, adding around USD 6bln to its market cap. (Volkswagen).

- Switzerland is to implement Basel III trading rules as of January 1st 2025, according to Bloomberg; sees no reason to deviate from the Basel III timetable. Note, the EU has delayed it by one year to January 2026.

NOTABLE US HEADLINES

- FedEx (FDX): shares gained 13.9% in extended trading after the freight and logistics company reported a profit beat, issued constructive guidance, and it said it was will carry out an assessment of its freight trucking business (which generated revenues of USD 2.3bln in the quarter)

- US FAA is to adopt a new airworthiness directive for Boeing (BA) 757-200 airplanes; directive mandates repetitive inspections, reinforcing structures, and replacing or repairing damaged parts to ensure safety.

GEOPOLITICS

MIDDLE EAST

- US Defense Secretary Austin said Hezbollah's 'provocations' threaten to drag Israeli and Lebanese people into war.

- Pentagon said US Secretary of Defense Austin discussed with his Israeli counterpart efforts to de-escalate tensions on the Israeli-Lebanese border, while he warned that a war between Israel and Hezbollah would be catastrophic for Lebanon, according to Asharq News.

OTHER

- Ukrainian President Zelensky will attend Thursday's European Union summit in Brussels where he is expected to sign an agreement on EU security commitments for Ukraine, according to the French President's office cited by AFP.

- Russian Defence Minister Belousov warned US Defense Secretary Austin regarding the dangers of an escalation of continued US arms supplies to Ukraine, according to the Russian Ministry.

- North Korea launched a suspected ballistic missile which was believed to have fallen outside of Japan's EEZ shortly after with no damage reported, while Yonhap later reported that North Korea's missile launch was believed to have failed and South Korean military said the missile used by North Korea in its failed launch was potentially a hypersonic missile.

- South Korean marines are to conduct live fire drills, according to Dong-A.

- NATO allies select Mark Rutte as the next Secretary General.

CRYPTO

- Bitcoin softer but essentially consolidating at the top-end of Tuesday's range which itself was a consolidation of Monday's marked Mt. Gox/technical inspired downside; at a base of USD 61.4k

APAC TRADE

- APAC stocks followed suit to the mixed performance stateside where the major indices reversed Monday's price action and tech rebounded as Nvidia snapped its losing streak, while markets continue to await fresh catalysts.

- ASX 200 was pressured with sentiment not helped by a hot monthly CPI print which saw both Deutsche Bank and Morgan Stanley call for a 25bps hike at the next RBA meeting in August,

- Nikkei 225 outperforms following recent currency weakness and with tech names boosted after Nvidia's rebound.

- Hang Seng and Shanghai Comp. were mixed with the former kept afloat above the 18,000 level, while the mainland was subdued despite another firm liquidity injection by the PBoC with sentiment clouded by tech and trade-related frictions as OpenAI was reportedly taking steps to block China access to its AI tools.

NOTABLE ASIA-PAC HEADLINES

- RBA Assistant Governor Kent said a range of measures shows that monetary policy is restrictive and policy is contributing to slower growth of demand and lower inflation, while he added that recent data reinforced the need to be vigilant to upside inflation risks and hence, they are not ruling anything in or out for interest rates.

DATA RECAP

- Australian Weighted CPI YY (May) 4.00% vs. Exp. 3.80% (Prev. 3.60%)