- APAC stocks traded mixed with the region only partially sustaining the positive momentum from the US, as Chinese markets reopened from the Spring Festival and participants digested disappointing China Caixin Services PMI data.

- US President Trump said he will speak to Chinese President Xi at the appropriate time and is in no rush, while he responded 'that's fine' when asked about China’s retaliatory tariffs.

- EU prepares to target US big tech if US President Trump pursues tariffs against the EU, according to FT.

- US equity futures were subdued with sentiment not helped by earnings including from Alphabet which missed on Google Cloud revenue and fell 7.6% after hours.

- European equity futures indicate a lower cash open with Euro Stoxx 50 futures down 0.4% after the cash market closed with gains of 0.9% on Tuesday.

- Looking ahead, highlights include Italian Retail Sales, US ADP National Employment, ISM Services, International Trade, ECB Wage Tracker, NBP Policy Announcement, Speakers including ECB's Lane, Fed’s Barkin, Goolsbee, Jefferson & Bowman, Supply from UK & US Treasury Quarterly Refunding Announcement

- Earnings from TotalEnergies, Credit Agricole, Novo Nordisk, Equinor, Pandora SSE, GSK, Santander, Uber, Disney, Ford, Arm & Qualcomm.

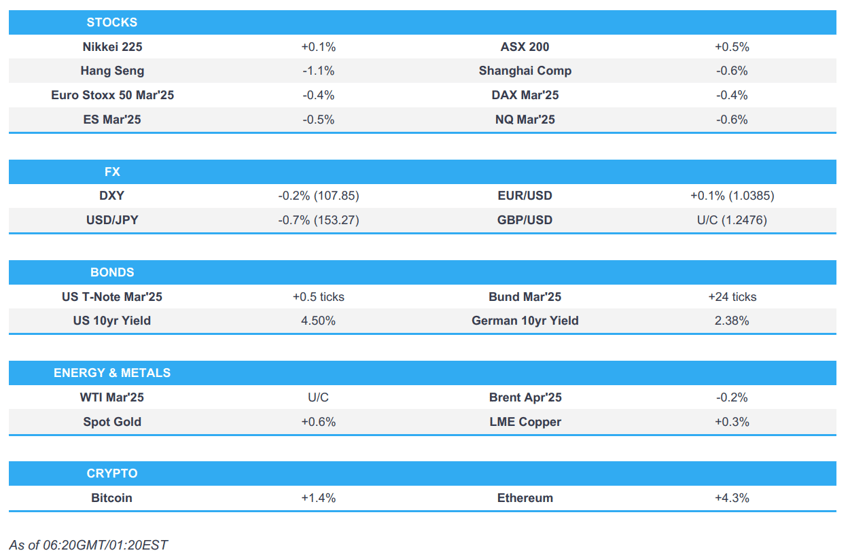

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

LOOKING AHEAD

- Highlights include Italian Retail Sales, US ADP National Employment, ISM Services, International Trade, ECB Wage Tracker, NBP Policy Announcement, Speakers including ECB's Lane, Fed’s Barkin, Goolsbee, Jefferson & Bowman, Supply from UK & US Treasury Quarterly Refunding Announcement.

- Earnings from TotalEnergies, Credit Agricole, Novo Nordisk, Equinor, Pandora SSE, GSK, Santander, Uber, Disney, Ford, Arm & Qualcomm.

- Click for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks closed in the green with the Russell 2000 and Nasdaq leading the gains, although sectors were mixed as defensives lagged, while Energy, Communications and Tech were bid.

- Market focus remained on tariff updates with the US having agreed to delay implementation of tariffs on Canada and Mexico by 1 month, although the additional 10% tariffs on China took effect which prompted retaliatory measures. The response was ultimately being framed as limited.

- SPX +0.72% at 6,038, NDX +1.26% at. 21,567, DJIA +0.30% at 44,556, RUT +1.41% at 2,290.

- Click here for a detailed summary.

TARIFFS

- US President Trump said he will speak to Chinese President Xi at the appropriate time and is in no rush, while he responded 'that's fine' when asked about China’s retaliatory tariffs.

- US Customs and Border Protection notice stated US tariffs of 10% will apply to Hong Kong as well as mainland China.

- US Postal Service temporarily suspended inbound parcels from China and Hong Kong, according to Bloomberg.

- EU prepares to target US big tech if US President Trump pursues tariffs against the EU, according to FT.

NOTABLE HEADLINES

- Fed Chair Powell is to deliver his semi-annual monetary policy report to the Senate on February 11th.

- Fed's Jefferson (voter) said there is no need to hurry further rate cuts and a strong economy makes caution appropriate, while he added that interest rates are likely to fall over the medium term and disinflation is expected to continue, though progress may be slow. Furthermore, he said the Fed faces uncertainty around government policy and that growth and labour market conditions are expected to remain solid.

- Fed's Daly (2027 voter) said the economy is in a very good place and the Fed can take its time to look at data and policy changes. Daly also commented that the Fed has not finished the job on inflation yet and has to make sure the Fed gets inflation down, as well as noted that the Fed is in a good position to wait and see.

- US President Trump mulls revoking loans from the USD 400bln clean energy office, according to Bloomberg.

- US government officials have privately warned that Elon Musk’s blitz appears illegal, according to The Washington Post. It was separately reported that the US Treasury gave Elon Musk's DOGE 'read-only' access to the payment system.

- US Senate confirmed US President Trump's nominee Pam Bondi as Attorney General.

AFTER-MARKET EARNINGS

- Alphabet (GOOGL) Q4 2024 (USD): EPS 2.15 (exp. 2.13), Revenue 96.469bln (exp. 96.56bln), Google Cloud revenue 11.96bln (exp. 12.19bln); shares fell 7.6% after-market.

- Advanced Micro Devices (AMD) Q4 2024 (USD): Adj. EPS 1.09 (exp. 1.08), Revenue 7.66bln (exp. 7.53bln); shares fell 8.8% after-market.

APAC TRADE

EQUITIES

- APAC stocks traded mixed with the region only partially sustaining the positive momentum from the US, as Chinese markets reopened from the Spring Festival and participants digested disappointing China Caixin Services PMI data.

- ASX 200 edged higher with the gains led by outperformance in the resources, tech and mining sectors, while Australian Services and Composite PMI figures were revised higher from the preliminary release.

- Nikkei 225 swung between gains and losses with the index pressured intraday as the Japanese currency strengthened after data showed the fastest pace of wage growth in Japan since 1997.

- Hang Seng and Shanghai Comp declined on the mainland's return from the Spring Festival holiday as participants digested the recent US-China tit-for-tat tariffs, while disappointing Chinese Caixin Services PMI data added to the downbeat mood.

- US equity futures were subdued with sentiment not helped by earnings including from Alphabet which missed on revenue.

- European equity futures indicate a lower cash open with Euro Stoxx 50 futures down 0.4% after the cash market closed with gains of 0.9% on Tuesday.

FX

- DXY remained lacklustre after the soft US data releases and the tariff delay for Canada and Mexico, while there were recent Fed comments in which Jefferson stated there is no need to hurry further rate cuts and a strong economy makes caution appropriate but added that interest rates are likely to fall over the medium term.

- EUR/USD maintained a firm footing above the 1.0300 level amid a softer dollar and despite recent dovish ECB rhetoric.

- GBP/USD took a breather after recent advances and with some resistance seen just shy of the 1.2500 handle.

- USD/JPY retreated from the open to beneath the 154.00 level after firm Labour Cash Earnings which showed the fastest pace of growth in wages since 1997 and supports the case for the BoJ to keep on its hiking path.

- Antipodeans were uneventful with NZD/USD largely unmoved by mixed but relatively inline employment and wages data.

- PBoC set USD/CNY mid-point at 7.1693 vs exp. 7.2661 (prev. 7.1698).

FIXED INCOME

- 10yr UST futures took a breather after the prior day's rebound which was facilitated by weaker-than-expected data releases, while the attention now turns to that quarterly refunding announcement scheduled for today.

- Bund futures gained following a return to above the 133.00 level and with ECB comments suggesting further rate cuts.

- 10yr JGB futures retreated at the open following firmer-than-expected Labour Cash Earnings data from Japan, while there were recent comments from former BoJ executive Hayakawa that the BoJ is likely to keep raising rates to above the current market consensus and could hike twice more this year.

COMMODITIES

- Crude futures were lacklustre after fluctuating yesterday on tariff and geopolitical headlines, while demand was also not helped by the mostly bearish private sector inventory data which showed a larger-than-expected build for crude and gasoline.

- Private Inventory Data (bbls): Crude +5.0mln (exp. +2.0mln), Distillate -7.0mln (exp. -1.5mln), Gasoline +5.4mln (exp. +0.5mln), Cushing +0.1mln.

- Spot gold extended on its recent advances and printed fresh record highs at USD 2,860/oz.

- Copper futures were rangebound despite the return to the market of its largest buyer as participants also digested disappointing Caixin Services PMI data.

CRYPTO

- Bitcoin was indecisive overnight and lingered around the USD 98,000 level.

- US House Financial Services Chair noted that both chambers of Congress are to form a crypto working group.

- White House crypto czar said the feasibility of a Bitcoin reserve is being studied.

NOTABLE ASIA-PAC HEADLINES

- US President Trump's administration weighs adding Shein and Temu to its forced labour list, according to Semafor.

- BoJ official Masaki said the BoJ sees underlying inflation gradually heading toward 2% and price rises post-pandemic have been driven mostly by cost-push factors, such as rising import costs from a weak yen. Masaki stated the BoJ will keep raising interest rates if underlying inflation accelerates towards the 2% target as projected but added the BoJ must support economic activity with accommodative monetary conditions.

DATA RECAP

- Chinese Caixin Services PMI (Jan) 51.0 vs. Exp. 52.3 (Prev. 52.2)

- Chinese Caixin Composite PMI (Jan) 51.1 (Prev. 51.4)

- Japanese Overall Labour Cash Earnings (Dec) 4.80% vs. Exp. 3.60% (Prev. 3.00%, Rev. 3.90%)

GEOPOLITICS

MIDDLE EAST

- US President Trump signed a memorandum regarding maximum pressure on Iran and said he was torn on signing the memo on Iran and called it very tough. Trump said hopefully they will not have to use it and will see if they can work out a deal with Iran, while he added that Iran cannot have a nuclear weapon and they have the right to block the sale of Iranian oil to other nations but noted he would hold talks with his Iranian counterpart and would reach out to Iran. Furthermore, Trump said if Iran were to retaliate and try to kill him, Iran would be obliterated, while he later commented that he would love to make a deal with Iran but repeated that Iran cannot have a nuclear weapon and thinks it will be unfortunate for them if they have a nuclear weapon.

- US President Trump said he had fantastic talks with Israeli PM Netanyahu and many countries will soon be joining the Abraham Accords, while they discussed how to ensure Hamas is eliminated and Trump stated that Gaza should not go through the process of rebuilding and occupation by the same people, and instead, various domains should be built for Gazans to live in. Trump added the US will take over the Gaza Strip and own it with the site will be levelled and economic development to be created. Furthermore, Trump said they are working hard to get all hostages and more hostages will be released, if not, it will make 'us' somewhat more violent.

- Israeli PM Netanyahu said US President Trump is the greatest friend Israel has ever had in the White House and they must eliminate Hamas, recover hostages and ensure that Gaza does not pose a threat to Israel. Netanyahu also stated that Trump sees a different future for Gaza and it is a different idea worth paying attention to and could change history.

- Hamas official Sami Abu Zuhri said President Trump's remarks about the desire to control Gaza are ridiculous and absurd, while he added that any ideas of this kind are capable of igniting the region.

- Saudi Arabia stressed its rejection of attempts to displace Palestinians from their land and said it will not establish relations with Israel without the establishment of a Palestinian state.

- US Middle East envoy Witkoff said President Trump is telling the Middle East that Gaza will probably be uninhabitable for 10-15 years.

RUSSIA-UKRAINE

- Ukrainian drone attack sparked a fire at an oil depot in Russia's Krasnodar region.

- Ukrainian President Zelensky said Ukraine is ready for a diplomatic track to end the war and that they are ready to talk to Russian President Putin if necessary.

OTHER

- Azerbaijani government source said a plane that crashed on 25th December was hit by a Russian surface-to-air missile and Azerbaijan has a fragment of the missile, according to Reuters.

EU/UK

NOTABLE HEADLINES

- The Times' Shadow BoE MPC voted 5-4 in favour of lowering the base rate by 25bps to 4.50% this week; the dissenters cited stubborn wage growth as justification for holding rates.

- US Treasury Secretary Bessent affirmed the importance of the US-EU economic relationship with transatlantic cooperation in a call with ECB President Lagarde.