- Trump signed a tariff order that confirms 25% tariffs on Mexico and Canada (with the exception of 10% on Canadian energy products) and 10% additional tariffs on top of existing levies for China.

- Canada has announced retaliatory action, Mexico is expected to announce its measures later today, China is to challenge tariffs at the WTO.

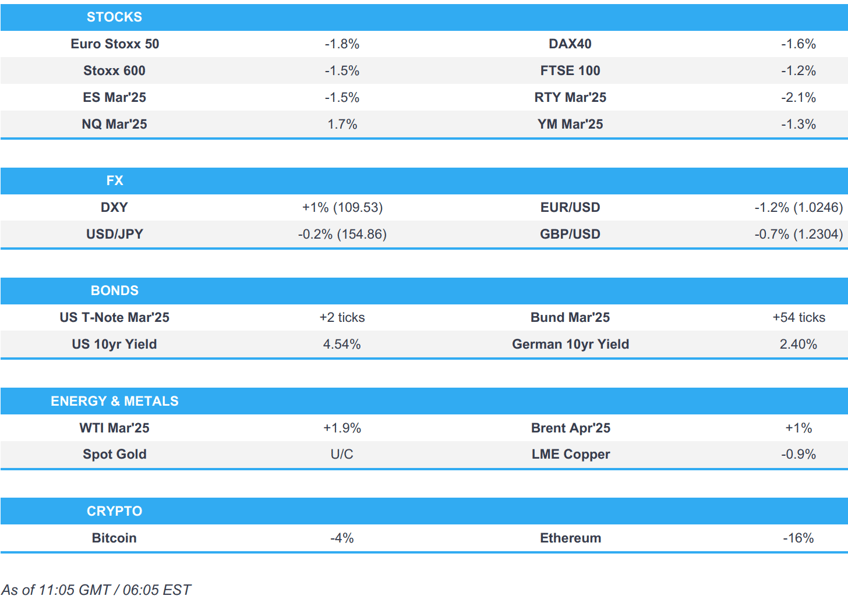

- European bourses sink as markets react to Trump tariffs and threatens the EU; RTY underperforms.

- USD surges and Bonds gain post-Trump tariff actions, JPY bolstered by safe-haven appeal, EUR/USD sits on a 1.02 handle.

- Crude firmer, precious metals subdued, but base metals slip on tariffs and Chinese PMI miss.

- Looking ahead, US ISM Manufacturing, Fed SLOOS, OPEC+ JMMC Meeting Speakers including Fed’s Bostic & Musalem, Treasury Financing Estimates, Earnings from Tyson Foods & Palantir.

More Newsquawk in 3 steps:

More Newsquawk in 3 steps:1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TRADE WAR

NOTABLE HEADLINES

- Click here for a full Newsquawk analysis on the Trump tariffs.

- White House said US President Trump signed the tariff order effective February 4th which confirms 25% tariffs on all Mexican and Canadian imports to the US with the exception of a 10% tariff on Canadian energy products, while imports from China are subject to an additional 10% tariff on top of existing levies with no exclusions offered. The order stated the new tariffs don’t apply to goods loaded onto vessels or in transit before February 1st and stated the President can remove new Canadian tariffs if enough steps are taken to reduce the health crisis but also included a retaliation clause that calls for further action which would likely be increased tariffs.

- US President Trump said tariffs will definitely happen with the EU, while he added the UK is out of line and the EU is really out of line but also noted that he is getting along well with UK PM Starmer, while he stated there are tremendous deficits with Canada, Mexico, China and the EU. Furthermore, Trump said he will be speaking with Canadian PM Trudeau on Monday morning and will also be speaking with Mexico on Monday.

- Canadian PM Trudeau said the new US tariffs violate the USMCA trade agreement and Canada will impose 25% tariffs on CAD 155bln of US goods with CAD 30bln in tariffs to take effect on February 4th and the rest starting in 21 days. Furthermore, Trudeau said they are considering several non-tariff measures including those relating to minerals and energy procurement, while he added that Canada and Mexico are working together to face the US tariffs.

- Canadian senior government official said the Canadian tariffs will not apply to goods in transit and that the actions of the US are a violation of the obligations of the free trade agreement, while the official added that Canada’s countermeasures will have an impact on the Canadian economy and the government has a plan to try to offset them.

- Canadian Ambassador said she is hopeful that the Trump tariffs don’t come into effect on Tuesday and that US consumers should know retaliatory tariffs are not actions Canada wants to do.

- Mexican President Sheinbaum ordered the start of a retaliatory tariff plan against the US and stated that tariffs will not fix problems but dialogue will, while it was separately reported that Mexico’s Economy Minister said ‘Plan B’ is underway in response to US tariffs. President Sheinbaum later commented that 25% tariffs will have a great impact on both the US and Mexico’s economies, while she added that they categorically reject the US statement that Mexico has ties to drug cartels and stated the US has done nothing to stop the illegal sale of drugs in its own country.

- China’s Commerce Ministry said China will take necessary countermeasures to new US tariffs and that Fentanyl is America’s problem. Furthermore, it said China will challenge the new US tariffs under WTO and that there are no winners in a trade war, while it urged the US to engage in frank dialogue and strengthen cooperation.

- Goldman Sachs believes US tariffs on Mexico and Canada are to be short-lived.

- JPMorgan said model estimates suggest that impact of a sustained 25% US tariff will be large enough to throw Mexican and Canadian economies into recession.

- China is to renew a pledge not to devalue the yuan to help its exporters and it is to offer to reinstate the 'Phase One' deal as part of its opening bid for trade negotiations, while it plans to include an offer to make more investments in the US and is to treat TikTok largely as a commercial matter in negotiations, according to WSJ.

- EU said it rejects US President Trump's decision to hit Canada, Mexico and China with tariffs and it would respond firmly if the US imposed tariffs on Europe, according to FT.

- Yale’s non-partisan policy research centre Budget Lab preliminary estimates project US PCE prices to increase by 0.76% and household purchasing power to be reduced by an average of USD 1250, while US real GDP is projected to contract by 0.2% in the medium run, as an impact from US President Trump’s tariffs.

EUROPEAN TRADE

EQUITIES

- European bourses (Stoxx 600 -1.5%) opened lower across the board following a dire APAC session as risk is hit by US President Trump's imposition of tariffs on Canada, Mexico, and China, whilst also keeping the EU in its sight. Broad-based losses are seen across the majors. Sentiment has attempted to improve in today's session but still reside firmly in the red.

- European sectors are entirely in the red, with a clear defensive bias; Autos are by far the clear underperformer today, with Tech and Basic Resources following behind - all of which are digesting the Trump tariffs.

- US equity futures are entirely in the red, with some underperformance in the economy-linked RTY (-2.1%) as traders weigh up the inflationary/economic impact on the US.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is firmer vs. all peers after US President Trump announced 25% tariffs on Mexico and Canada (with the exception of 10% on Canadian energy products) and 10% additional tariffs on top of existing levies for China. The risk-aversion and potential ramifications for Fed policy are acting as the driving force for price action this morning. US ISM Manufacturing is due later.

- EUR/USD has been hit after comments from US President Trump that tariffs will definitely happen with the EU. EU said it rejects US President Trump's decision to hit Canada, Mexico and China with tariffs and it would respond firmly if the US imposed tariffs on Europe, according to FT. ECB's Villeroy noted that Trump's tariffs will increase economic uncertainty and there will likely be further rate cuts". Headline EZ HICP Y/Y printed just above expectations but had little impact on the Single-currency; currently around 1.0234.

- JPY is marginally firmer vs. the USD on account of its safe-haven appeal. Macro drivers for Japan are lacking and therefore, global risk dynamics are likely to remain a key driver in the near-term. USD/JPY is back above its 50DMA at 154.87 with a current session peak at 155.88.

- GBP is notably weaker vs. the USD but firmer vs. the EUR. US President Trump stated that the UK is also out of line but then suggested he is getting on well with PM Starmer. GBP is seeing shallower losses than some peers on account of its relatively smaller trade deficit.

- Antipodeans are both markedly hit by the global growth impulse from Trump's trade war as well as suffering from their direct exposure to the Chinese economy. Other macro drivers include mixed Australian data, disappointing Chinese Caixin Manufacturing PMI and wide expectations for cuts from both the RBA and RBNZ this month.

- The Canadian Dollar and Mexican Peso have both been hit hard by US President Trump's decision to impose 25% tariffs on Mexico and Canada (with the exception of 10% on Canadian energy products). Canadian PM Trudeau said the US tariffs violate the USMCA trade deal. Canada considering non-tariff measures, including minerals & energy procurement.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are a little firmer today, with the main focus on US President Trump's announcement of 25% tariffs on Mexico and Canada. Seemingly the impact of inflation/economic headwinds has been outweighed by a flock to quality. The US curve is currently in bear-flattening mode with the 2s10spread narrowing by 6.9bps. The 10yr yield had been as low as 4.496% but has since stabilised around the 4.55% mark. Ahead, US ISM Manufacturing metrics.

- Bunds gapped notably higher at the open with traders wary of the negative growth impulse from the ratcheting up of trade tensions over the weekend. For the EU specifically, US President Trump that tariffs will definitely happen with the EU. ECB's Villeroy noted that Trump's tariffs will increase economic uncertainty and there will likely be further rate cut. Headline EZ HICP Y/Y printed just above expectations, but had little impact on Bunds; Mar'25 Bund has been as high as 133.26, stopping shy of the YTD peak at 133.48.

- Gilts are on a firmer footing, in-fitting with Bunds. US President Trump stated that the UK is also out of line but then suggested he is getting on well with PM Starmer. Mar'25 Gilt has hit a fresh YTD peak at 92.94. UK 10yr yield is just about holding above the 4.5% mark.

- Click for a detailed summary

COMMODITIES

- Choppy trade for crude prices thus far; the complex initially gapped higher when contracts opened, as traders digested a 10% tariff on Canadian energy products. Prices remain firmly in the green but have slipped off best levels, in-fitting with the risk-tone; action which continued into European morning. As it stands, WTI outperforms Brent by circa. USD 0.65/bbl - ING highlights that Canada is a key supplier of crude oil to the US and that many US refineries are configured to run on Canada's "heavier crude". WTI currently sits around USD 73.80/bbl within a USD 73.48-75.18/bbl range. OPEC+ JMMC Meeting is due at 13:00 GMT / 08:00 EST, but is unlikely to provide a meaningful recommendation.

- Spot gold is a little lower in today's session, and with price action fairly choppy; heading into the European morning, the yellow metal was considerably lower, but since pared in the European session, before falling back incrementally into the red. XAU/USD currently off by around USD 2.20/oz, trading in a USD 2772.20-2809.59/oz range.

- Base metals are entirely in the red, in reaction to the Trump tariffs on Canada, Mexico and China; latest tariff offensive and potential retaliation pose a risk to the global economy, while the red metal's largest buyer also remained absent from the market for the Spring Festival. 3M LME copper resides in a USD 8,922.20-8,992.13/t range this morning - off worst levels seen in APAC hours.

- OPEC+ JMMC meeting to be held at 13:00 GMT / 08:00 EST, according to Kepler's Bakr.

- Several OPEC+ sources suggested the group will not adjust its output plans for now since the crude market remains fragile and amid waning demand in China, according to Bloomberg sources.

- Gas processing plant in Russia's Astrakhan region suspended operation before drone attack, according to a Governor.

- Russian oil product exports from Black sea port of Tuapse planned at 0.799mln T in Feb, vs 0.789mln T scheduled for Jan, according to Traders cited by Reuters.

- Iraq’s parliament approved the compensation plan to resolve the Kurdistan oil dispute and seeks to expedite northern exports. It was separately reported that Iraq’s northern Khor Gas field was targeted by a drone attack although no damage was reported and production remained unaffected.

- Alberta’s Premier called for an immediate effort to build oil and gas pipelines to Canada’s coast and stated that Trump’s tariffs will harm people and strain US-Canada ties.

- Goldman Sachs said a potential tariff-driven decline in US natural gas imports from Canada is too small to significantly raise natural gas prices, while medium-run risks to oil prices are skewed downside because persistent broad tariffs would weigh and it expects limited near-term additional effects on global, Canadian, and Mexican crude prices.

- Vitol said it expects global oil demand to peak at almost 110mln BPD at the end of the decade and then retreat to around the current levels of about 105mln BPD in 2040, according to FT.

- JPMorgan said US tariffs keep them near-term bearish on base metals and reinforce their bullish gold view, while it added that LME base metals prices are likely to face stiff near-term bearish pressure on growth concerns, macro risk-off, and USD strength.

- US President Trump's advisers reportedly concede that US frackers won’t pump much more oil, according to WSJ sources. Trump's best level to bring down oil prices would might be to persuade OPEC to add more barrels, but Saudi has told former US officials that it is unwilling to augment global oil supplies. Advisers told some oil-and-gas donors they understand the president can’t rely on US frackers to boost production in the short term. On Iranian sanctions, Trump’s team has estimated Iran’s exports could be reduced by 500-750k BPD from sanctions under consideration, sources added. Iranian sanctions discussed include targeting Chinese ports that import Iran’s oil, Iraqi oil deals with Iran and other places used to facilitate the transfer of Iranian oil.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU HICP-X F&E Flash YY (Jan) 2.7% vs. Exp. 2.7% (Prev. 2.7%); HICP Excluding Food, Energy, Alcohol & Tobacco Flash MM (Jan) -1.0% (Prev. 0.50%); HICP Excluding Food, Energy, Alcohol & Tobacco Flash YY (Jan) 2.7% vs. Exp. 2.6% (Prev. 2.7%); HICP Flash YY (Jan) 2.5% vs. Exp. 2.4% (Prev. 2.4%); services inflation 3.9% (prev. 4.0%)

- Italian CPI (EU Norm) Prelim YY (Jan) 1.7% vs. Exp. 1.4% (Prev. 1.4%); CPI (EU Norm) Prelim MM (Jan) -0.7% vs. Exp. -1.1% (Prev. 0.1%) Consumer Price Prelim YY (Jan) 1.5% (Prev. 1.3%); Consumer Price Prelim MM (Jan) 0.6% (Prev. 0.1%)

- UK S&P Global Manufacturing PMI (Jan) 48.3 vs. Exp. 48.2 (Prev. 48.2)

- EU HCOB Manufacturing Final PMI (Jan) 46.6 vs. Exp. 46.1 (Prev. 46.1)

- German HCOB Manufacturing PMI (Jan) 45.0 vs. Exp. 44.1 (Prev. 44.1)

- French HCOB Manufacturing PMI (Jan) 45.0 (Prev. 45.3)

- Spanish HCOB Manufacturing PMI (Jan) 50.9 vs. Exp. 53.6 (Prev. 53.3)

- Italian HCOB Manufacturing PMI (Jan) 46.3 (Prev. 46.2)

- Swiss Manufacturing PMI (Jan) 47.5 (Prev. 48.4)

NOTABLE EUROPEAN HEADLINES

- EU leaders to meet on Monday talk defence; no specific discussion on US tariffs expected but issue likely to be raised, according to an official cited by CNBC. "There’s a consensus in the European Union that one way to mitigate trade tensions with the US will be by increasing energy purchases." Source added "there’s a realization that a trade confrontation with the EU is approaching."

- ECB's Kazimir said last week's 25bps rate cut moved the bank closer to its destination but is not there yet. Forecasts, services inflation and wage developments will help navigate what will happen in April and beyond.

- ECB’s Knot expects US tariffs to lead to higher interest rates and a weaker euro, while he said the best response to US tariffs would be to do nothing although he expects retaliation.

- ECB's Villeroy said US President Trump's tariffs will increase economic uncertainty, "it is a very worrying development", "There will likely be further rate cuts". Tariffs are brutal and will hit the autos sector. Everyone loses in this kind of protectionist trade war. Should not rule out any riposte from EU if Trump does impose tariffs on the bloc.

- German Chancellor Scholz said EU can react with its own tariffs [against the US] but cooperation is more important.

- UK Govt. Spokesperson said the UK and US have a fair and balanced trading relationship which benefits both sides of the Atlantic.

NOTABLE US HEADLINES

- Elon Musk’s team got access to the US Treasury Department’s payments system, according to NYT. It was separately reported that Elon Musk said they are in the process of shutting down the United States Agency for International Development and that it is beyond repair.

- US Transport Secretary Duffy said the US pilot messaging system experienced a temporary outage on Sunday.

- Wall Street is concerned about Treasury Secretary Scott Bessent’s approach to government borrowing, WSJ reports. Investors credit a 2023 strategy of relying on short-term Treasurys with stabilising markets, but Bessent has criticised this method amid fears of increased borrowing under Trump’s administration, WSJ reports.

- Russia's Kremlin, on US President Trump, said talks and meetings are scheduled with Russia, apparently contacts are planned, "we have a planning process".

- Saudi Arabia could be seen as a possible venue for a Trump-Putin meeting, according to Russian sources cited by Reuters.

- The US House Budget Committee is unlikely to mark up a budget resolution this week, according to GOP leadership sources and lawmakers, cited by Punchbowl.

GEOPOLITICS

MIDDLE EAST

- "Hamas leader told Al-Sharq: According to the ceasefire agreement, negotiations on the second phase are supposed to begin today ", according to Asharq News.

- "Iranian Foreign Ministry: We have not seen any sign of negotiation by the US government", according to Sky News Arabia.

- Israeli PM Netanyahu spoke on Saturday with US special envoy Steve Witkoff and then travelled to the US on Sunday for a meeting with US President Trump, while Witkoff will speak with Qatar’s PM and Egyptian representatives.

- Israel’s military said its aircraft fired to repel a suspicious vehicle moving towards northern Gaza without passing through the inspection route, in violation of ceasefire terms, while it was separately reported that four Palestinians were wounded in an Israeli strike on a car on Gaza’s coastline.

- ICRC announced 3 hostages were transferred out of Gaza to Israel and 175 Palestinian detainees were transferred from Israeli detention centres to Gaza and the West Bank.

- Qatar’s PM called on Israel and Hamas to immediately begin negotiations on the second phase of the Gaza ceasefire and said that Qatar is prepared to host released Palestinian prisoners if they choose to come but added there is no clear plan for when negotiations towards the second phase will begin.

- US President Trump and Egyptian President Sisi discussed complicated issues and crises in the Middle East during a phone call, as well as discussed the need to strengthen economic and investment relations.

- Hamas political bureau’s deputy head is to visit Moscow on Monday for talks scheduled at the Russian Foreign Ministry, according to RIA.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said a Russian aerial bomb destroyed a boarding school in Russia’s Kursk region even though dozens of civilians were there, while Ukraine’s military later stated that four died and dozens were injured in the Russian strike on the boarding school.

- Ukrainian President Zelensky’s aide said calls by US President Trump’s aide for a truce followed by an election is a failed plan if that is all it consists of.

- Ukrainian Air Force said on Sunday morning that 40 drones were launched by Russia during an overnight strike, while Russia’s Defence Ministry said Russia shot down a HIMARS projectile and 44 Ukrainian drones over the prior 24 hours and that Russia hit military airfields and fuel storage facilities in Ukraine, according to TASS. It was also reported that Russia launched 165 missiles and drones at Ukraine during an attack on Saturday.

- Russian aviation watchdog said it suspended flights at several airports to ensure safety and Russian officials said several Russian regions are under the threat of drone attacks. Furthermore, it was later reported that a Ukrainian drone attack sparked a fire at an oil refinery in Russia's Volgograd region although the fire has since been contained.

OTHER

- North Korea said US Secretary of State Rubio’s comments do not help US interests and it warned that North Korea will respond strongly to hostile US provocations, while it noted that the US new missile defence system plan makes it necessary for North Korea to progress its nuclear deterrence, according to KCNA.

- US President Trump ordered precision military air strikes on the senior ISIS planner and other terrorists he recruited and led in Somalia.

- US President Trump said Venezuela has agreed to receive all illegal migrants captured in the US, while it was later reported that the Trump administration moved to terminate protected status for hundreds of thousands of Venezuelans in the US, according to NYT.

- US President Trump said South Africa is treating certain classes of people very badly and he will be cutting off all future funding to South Africa until a full investigation of this situation has been completed.

- US Secretary of State Rubio called Chinese presence at the Panama Canal unacceptable and told Panamanian leaders that the US would protect its rights under the Panama Canal Treaty if Panama didn’t move to oust Chinese-connected companies near the canal, according to Bloomberg. Furthermore, Panama’s President Mulino said the meeting with Rubio was highly respectful and cordial, while Mulino added sovereignty over the Panama Canal is not up for discussion and that he will not renew the Panama-China agreement over the silk route.

- Taiwan's President said they welcome healthy exchanges with China and that there should be dialogue between Taiwan and China, with the aim of peace.

CRYPTO

- Bitcoin (-3.7%) has sank amid the risk-off sentiment, sparked by Trump's tariffs on China, Mexico and Canada; Ethereum (-16.5%) posts significantly deeper losses, and fell below USD 2.5k.

APAC TRADE

- APAC stocks sold off as all focus was on US President Trump's latest tariff action over the weekend in which he signed a tariff order which confirms 25% tariffs on Mexico and Canada (with the exception of 10% on Canadian energy products) and 10% additional tariffs on top of existing levies for China.

- ASX 200 declined with all sectors suffering firm losses while mixed data did little to spur demand.

- Nikkei 225 slumped firmly beneath the 39,000 level with Japanese automakers notably spooked by tariff jitters.

- Hang Seng conformed to the negative mood on return from the Chinese New Year holiday with demand constrained after disappointing Chinese Caixin Manufacturing PMI and amid the continued absence of mainland participants.

NOTABLE ASIA-PAC HEADLINES

- BoJ January Meeting Summary of Opinions stated one member said Japan public's inflation expectations are heightening as inflation exceeds 2% for four straight years and a member said raising rates at this timing would be sufficiently neutral when compared with average market expectations. It was also stated that Japan's economy is resilient enough to absorb potential downside stress from the new US administration's policies and that BoJ's policy flexibility has increased as the Fed is likely to pause on rate hikes. Furthermore, a member said real interest rates remain deeply negative even after a rate hike and need to keep raising rates if the economy and prices are on track

DATA RECAP

- Chinese Caixin Manufacturing PMI Final (Jan) 50.1 vs. Exp. 50.5 (Prev. 50.5)

- Australian Building Approvals (Dec) 0.7% vs. Exp. 1.0% (Prev. -3.6%, Rev. -3.4%)

- Australian Retail Sales MM Final (Dec) -0.1% vs. Exp. -0.7% (Prev. 0.8%)

- Australian Retail Trade (Q4) 1.0% vs. Exp. 0.8% (Prev. 0.5%)