Victoria's Secret's shift towards "woke" trends in fashion in recent years, which included showcasing trans and plus-size models instead of their traditional sexy models, sparked a wave of discontent among customers, resulting in a significant revenue drop, crashing stock price, and Victoria's Secret Fashion Show ratings hitting rock bottom.

The American lingerie chain spent the last several years 'Bud-Light-ing' itself with transgender models like Valentina Sampaio and super woke soccer player Megan Rapinoe while abandoning its iconic sexy models.

Trans model Valentina Sampaio

Soccer player Megan Rapinoe

What changed in the last two decades?

One can only guess who might have pushed 'wokeness' on the brand...

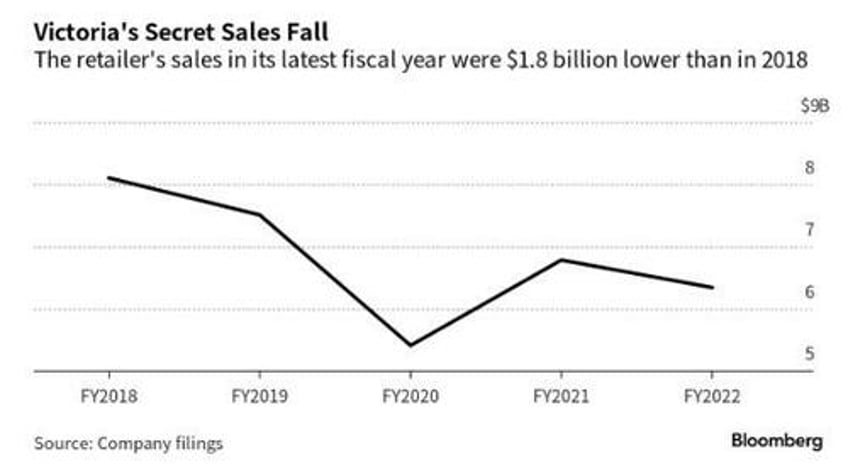

As consumers ditched Victoria's Secret, investors panic-dumped shares to record low prices.

... because sales plunged a stunning $1.8 billion since 2018 (revenue for its last full fiscal year fell 6.5%, with net income down nearly half). Consumers went elsewhere - maybe there was a conservative brand that took market share.

Earlier this year, CEO Amy Hauk was booted out of the company amid 'woke' controversies. Now CNN reports the brand has given up on out-woking others and wants to 'Make "Sexiness" Great Again.'

Victoria's Secret: The Tour '23, an attempt to revive the runway show format that launched last month fell somewhere in between the personification of male lust of the brand's aughts-era heyday and the inclusive utopia promoted by its many disruptors.

But in a presentation to investors in New York last week, it was clear which version of the brand Victoria's Secret executives see as its future.

"Sexiness can be inclusive," said Greg Unis, brand president of Victoria's Secret and Pink, the company's sub-brand targeting younger consumers. "Sexiness can celebrate the diverse experiences of our customers and that's what we're focused on."

Chief executive Martin Waters also disclosed that woke initiatives were not profitable for the company, stating, "Despite everyone's best endeavours, it's not been enough to carry the day."

This comes as the ESG bubble is imploding. And Larry Fink's BlackRock has ditched the term ESG.

BlackRock has faced intense criticism from Republican lawmakers who accuse the firm of violating its fiduciary duty by putting wokeness ahead of investment returns.

BlackRock, Vanguard, and State Street hold about 15 and 20% of the outstanding shares of S&P 500 companies and can have enormous direct power in corporate decision-making.

Some in corporate America are beginning to realize the challenges ESG poses for business sustainability.

However, if these companies want to go woke, and then go broke - so be it. There is a parallel economy that is exploding.