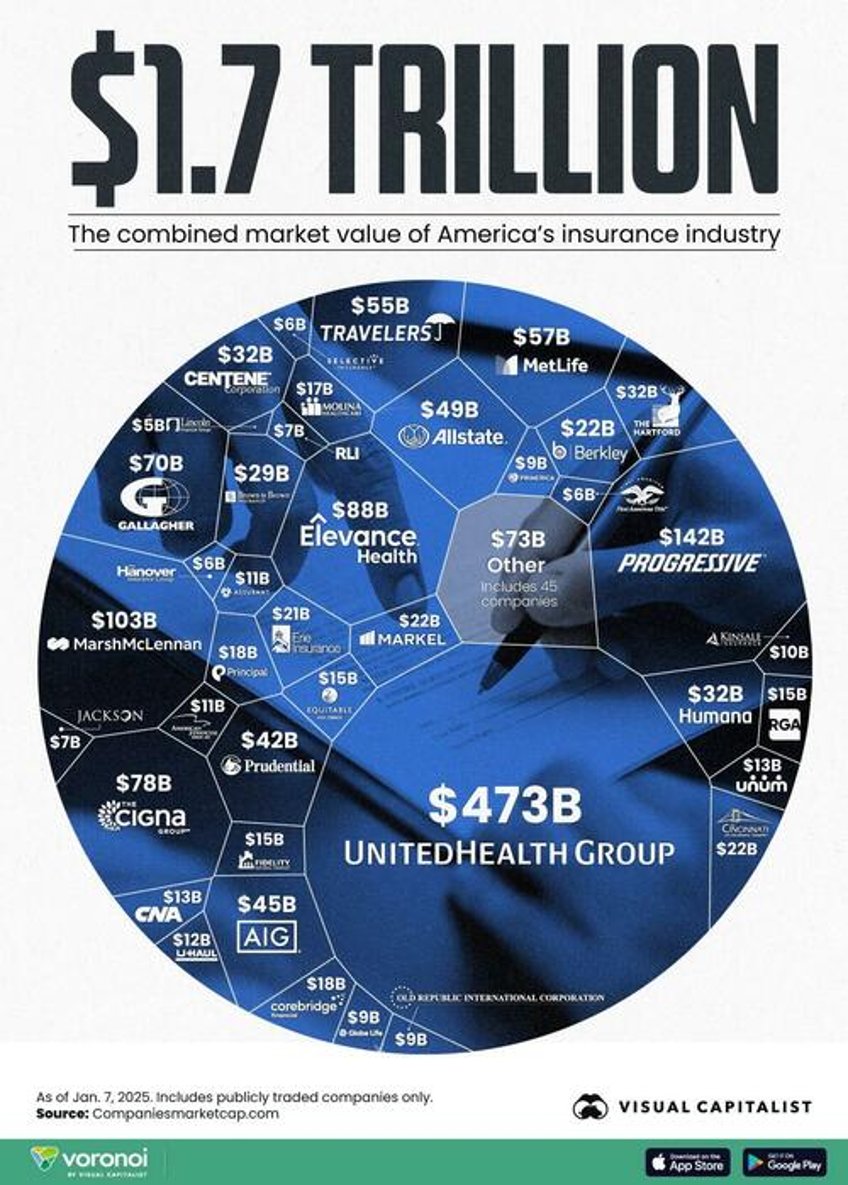

This graphic, via Visual Capitalist's Marcus Lu, breaks down the total market capitalization of America’s insurance industry, using data from Companiesmarketcap.com.

As of Jan. 7, 2025, UnitedHealth Group is the country’s most valuable insurance company, with a market cap of $473 billion.

Data and Key Takeaways

The data we used to create this graphic is listed in the table below. Note that this ranking includes publicly traded companies only.

| Rank | Name | Market Cap |

|---|---|---|

| 1 | UnitedHealth | $473,256,000,000 |

| 2 | Progressive | $141,930,000,000 |

| 3 | Marsh McLennan | $103,126,000,000 |

| 4 | Elevance Health | $88,304,689,152 |

| 5 | Cigna | $77,863,362,560 |

| 6 | Gallagher | $69,887,385,600 |

| 7 | MetLife | $56,875,376,640 |

| 8 | Travelers | $54,865,952,768 |

| 9 | Allstate | $49,263,951,872 |

| 10 | AIG | $45,279,391,744 |

| 11 | Prudential | $42,419,859,456 |

| 12 | Humana | $32,175,022,080 |

| 13 | Centene | $31,609,597,952 |

| 14 | The Hartford | $31,603,916,800 |

| 15 | Brown & Brown | $28,901,777,408 |

| 16 | Cincinnati Financial | $22,245,187,584 |

| 17 | Markel | $21,944,627,200 |

| 18 | Berkley | $21,911,468,032 |

| 19 | Erie Insurance | $21,034,135,552 |

| 20 | Principal | $17,909,245,952 |

| 21 | Corebridge Financial | $17,674,076,160 |

| 22 | Molina Healthcare | $16,958,656,512 |

| 23 | Fidelity National Financial | $15,400,402,944 |

| 24 | Equitable | $15,387,979,776 |

| 25 | RGA | $14,604,749,824 |

| 26 | Unum | $13,398,243,328 |

| 27 | CNA | $12,846,034,944 |

| 28 | U-Haul | $12,048,060,416 |

| 29 | AFG | $11,094,878,208 |

| 30 | Assurant | $10,616,492,032 |

| 31 | Kinsale | $9,797,028,864 |

| 32 | Globe Life | $9,359,039,488 |

| 33 | Primerica | $9,209,505,792 |

| 34 | Old Republic | $8,666,577,920 |

| 35 | RLI | $7,162,358,784 |

| 36 | Jackson | $6,637,221,376 |

| 37 | First American | $6,233,802,240 |

| 38 | Selective Insurance | $5,529,822,208 |

| 39 | Hanover | $5,503,021,056 |

| 40 | Lincoln Financial | $5,413,500,928 |

| 41 | Other | $73,980,086,936 |

It’s worth noting that prior to the Dec. 2024 killing of CEO Brian Thompson of its largest subsidiary (UnitedHealthcare), UnitedHealth’s valuation was above $500 billion.

As we highlighted in a previous graphic, the company is the world’s eighth largest company by revenue, bringing in $372 billion during its 2024 fiscal year.

UnitedHealth has made several major acquisitions in recent years, with one example being LHC Group, a provider of in-home healthcare services, for $5.4 billion.

Progressive Gains

The second largest company in the U.S. insurance industry is Progressive, which is known for its popular ads featuring “Flo”, a fictional saleswoman.

Rather than health insurance, Progressive focuses on vehicle insurance (personal and commercial).

Shares of Progressive (Ticker: PGR) have climbed 230% over the past five years, significantly outperforming the S&P 500’s return of 81%.

Not all insurance companies are rising, though. Shares of Elevance Health, #4 on this ranking, fell over 20% in 2024 after the company reduced its forward earnings guidance.

If you enjoy graphics like these, check out the Markets section on Voronoi, the new app from Visual Capitalist.