Financial risk falls under the limelight during market stress.

In periods of uncertainty, liquidity becomes especially valuable to investors. Assets that are more liquid are convertible into cash without losing much of their value. Consider how investors often flock to U.S. government bonds during economic turmoil thanks to their relative safety.

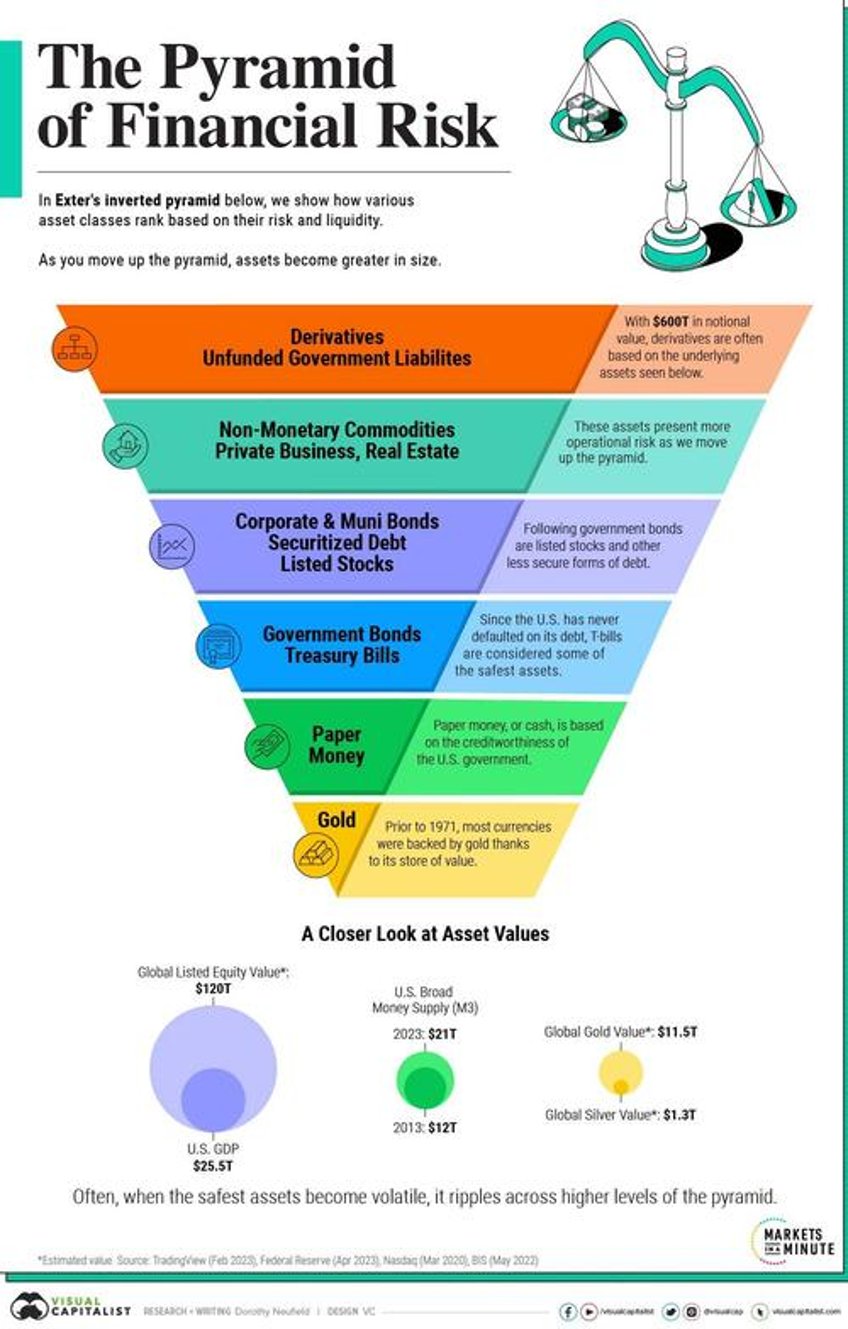

using an adapted model from TradingView, Visual Capitalist's Dorothy Neufeld shows in the graphic below how assets become both riskier and greater in size by dollar value as they move up Exter’s pyramid.

The Anatomy of Financial Risk

John Exter, an economist and former member of the Federal Reserve, developed the model of financial risk in the mid-1970s.

While he is most known for this inverted pyramid, he also was a founding governor of the Central Bank of Sri Lanka and was an advisor to Paul Volcker when he was chair of the Fed.

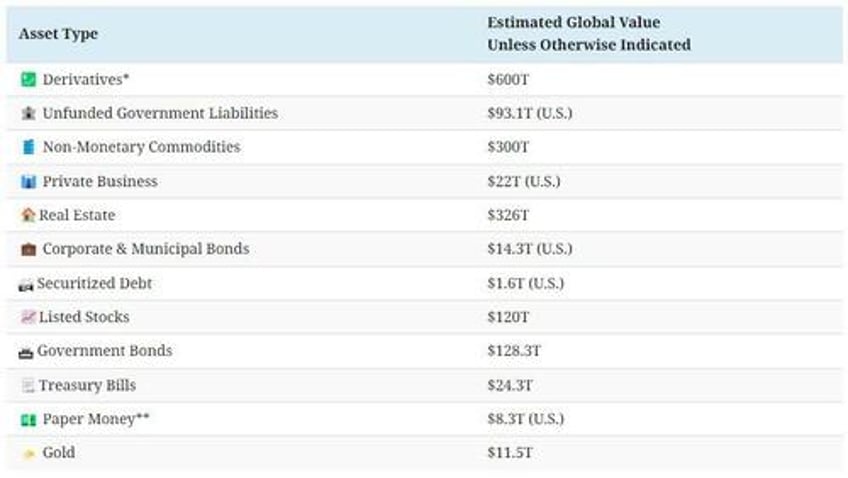

In the table below, some of the riskiest assets are derivatives. These are financial instruments based on the movements of an underlying security, such as currencies or commodities. They are often highly leveraged, meaning investors put very little money down to make these wagers, and in turn, can generate losses quickly.

Derivatives have a stunning $600 trillion in notional market value.

*Represents notional value, the total value of the underlying contract. **Paper Money represents tangible currency including coins and bank notes. Gold is based on a spot price of $1,750 per oz and 205,238 tonnes. Unfunded government liabilities are debt obligations that have insufficient funds to pay for them.

Private business and real estate are also considered to have higher financial risk. Since there is no central marketplace where they can be sold quickly, they present higher operational risk and lower liquidity. Often, they are more difficult to convert into cash.

Moving down the pyramid are the $120 trillion in listed stocks, which have a centralized market, can trade in significant volumes, and disclose financials while adhering to securities regulations.

U.S. government bonds are considered to have some of the least financial risk globally, thanks to the U.S. never having defaulted on its debt, and the U.S. dollar’s role as a reserve currency. Short-term Treasuries are considered safer than longer-term bonds since they have a lower chance of default given the shorter holding period.

In the event of a liquidity squeeze, many consider cash to be king. Yet to Exter, gold was the safest asset thanks to its finite supply. Prior to 1971, most currencies were pegged to gold. In fact, the current era of fiat money—currencies that are not backed by a physical commodity—is a historical exception.

Domino Effects

During a market crisis, assets at the top of the pyramid tend to have the largest drops in value.

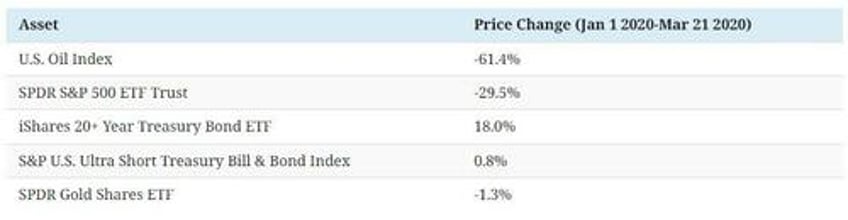

In this way, the degree of loss generally gets smaller the lower down you go in the pyramid. Relatively safer assets may rise in value due to higher demand. Here’s an example from the 2020 market crash that shows how asset classes responded:

Source: Nasdaq (Mar 2020), S&P Global (May 2023)

As we can see in the table above, oil fell over 60% as uncertainty increased. Demand for oil typically falls during a weaker economy. By contrast, longer-dated bonds jumped in price.

It’s worth noting that the returns didn’t perfectly follow of the order of the pyramid, but the model can serve as a general guideline for how assets may respond to crisis.

Financial Risk in Today’s Environment

The recent U.S. banking turmoil spurred volatility in some financial assets.

Just as U.S. Treasuries saw extreme volatility since interest rate spikes led them to fall in value, U.S. bonds faced market turbulence. In this way, when safer assets experience uncertainty it can impact levels above in the pyramid.

Interestingly, volatility in bond markets has been higher than volatility in the S&P 500. This can be seen in the difference between the bond market volatility index, known as the MOVE Index, and the VIX Index, which tracks S&P 500 volatility. In April 2023, the difference between the MOVE Index and the VIX Index was near 20-year highs.

What this could point towards is that stocks have become mispriced relative to their true value. As interest rates rise to 16-year highs, borrowing costs have risen and this has hit corporate cash buffers and liquidity.

Overall, how current volatility impacts broader financial risk in the market could take time to materialize. Historically, it has taken roughly 18 months to two years for the true impact of monetary policy to filter through the market.