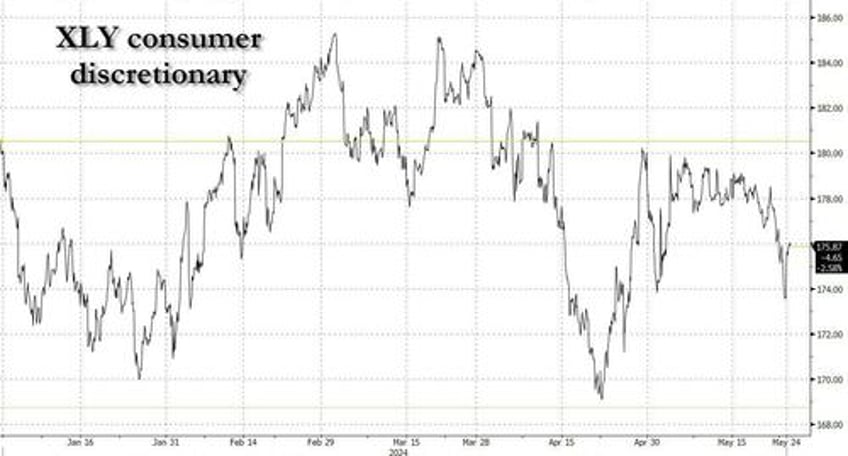

A little over a month ago, Goldman's Prime Brokerage desk observed that hedge funds were quietly liquidating their consumer exposure, prompting the bank to ask "did something change?" As it turns, following several notable blow-ups in the consumer discretionary space, the answer was a decisive yes, and not only is the XLY consumer discretionary ETF down about 4% since our April 8 note, but it is also down roughly the same for the year, even as the broader S&P plows higher, and is now some 11% higher.

Overnight, Goldman's formerly euphorically bullish consumer specialist Scott Feiler writes in a follow up note, "the title of my morning note yesterday was “Glass Half Empty?” The only thing we are doing this morning after watching the price action in the group yesterday is removing the question mark from that title and going to “Glass Half Empty.”