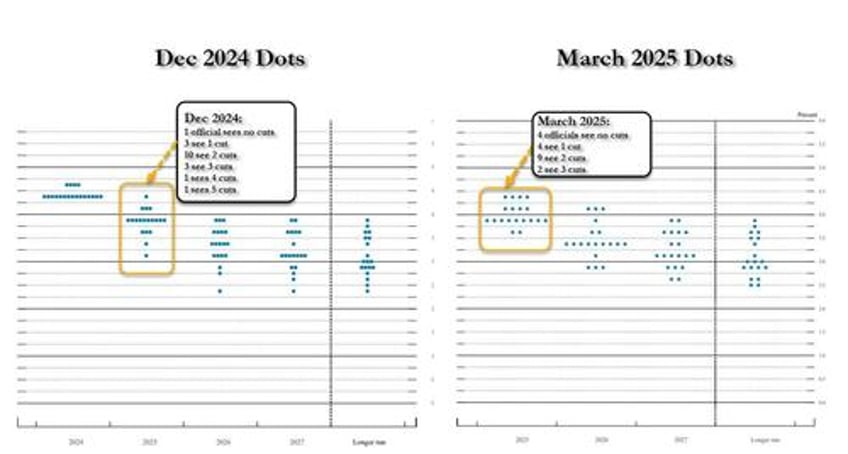

As broadly expected, the Fed held rates steady for 2nd time in the 4.25%-4.50% range with the update dot-plot showing 2x cuts by year end but showing large forecast dispersion within the Committee and a more hawkish outlook compared to December (9 officials showing 2x cuts vs 8x showing 1 cut or less) while the median estimate of the Fed’s neutral rate was kept steady this time, because - as Powell explained later - the increase in inflation expectations and the drop in growth forecasts offset each other.

The biggest highlights in the statement was the Fed's adjustment to the second paragraph of its statement, deleting the line “risks to achieving its employment and inflation goals are roughly in balance"; however in the presser that followed, Powell explained that this particular deletion - which would otherwise have a hawkish bias - did not mean to signal any change in policy or sentiment.