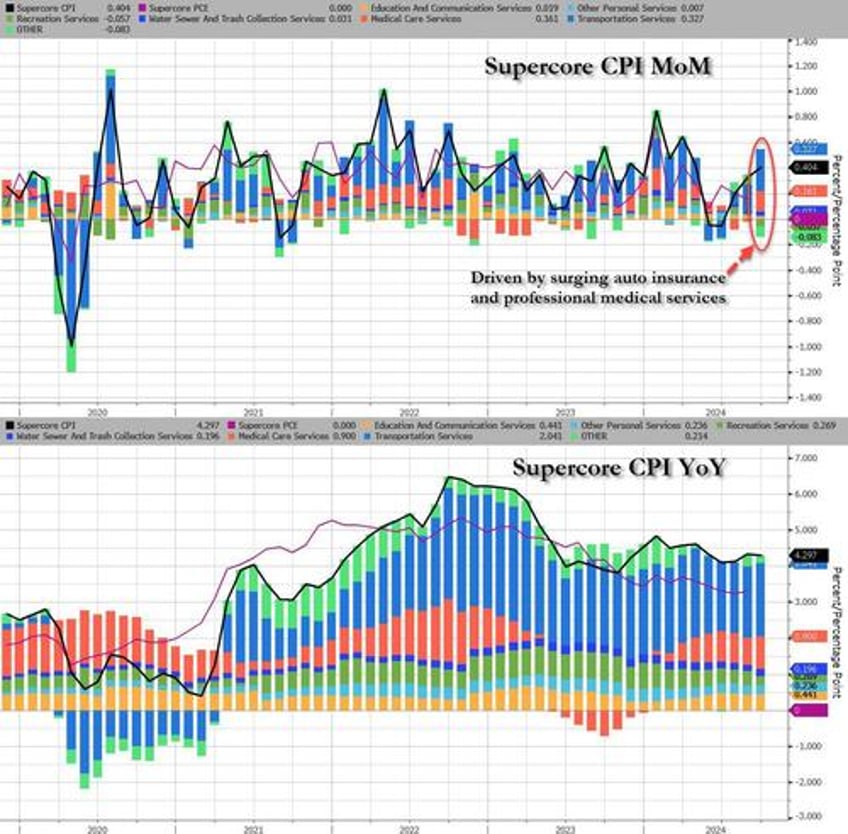

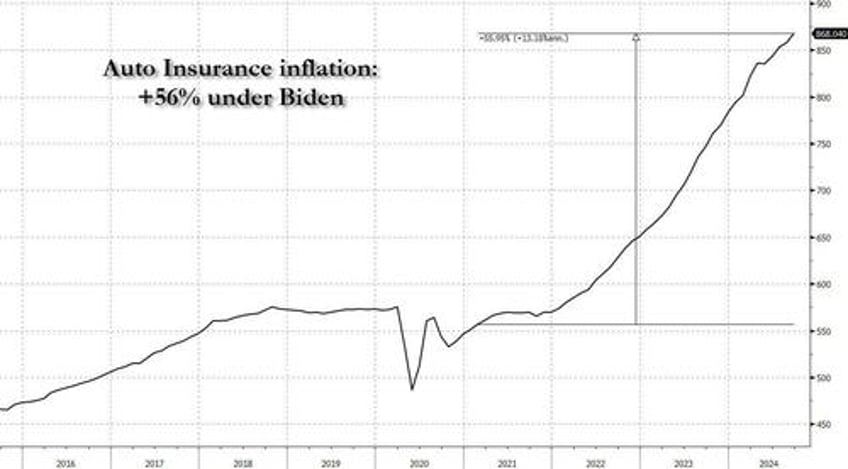

On the surface, today's PCI prints came in hotter than expected across the board, yet all were in line with whisper numbers which as we noted, were higher than consensus. To be sure, the continued surge in auto insurance, and medical costs, will come as surprise to exactly nobody...

... and if anything, some will balk at the BLS's suggestion that auto insurance has risen "only" 56% under Biden when many have seen their auto insurance premiums double in just the past year.

Adding insult to wallet injury, food inflation is also back: five of the six major grocery store food group indexes increased. The index for meats, poultry, fish, and eggs rose 0.8% in September; the eggs index jumped 8.4%. The fruits and vegetables index increased 0.9% over the month, following a 0.2-percent decline in August. “The index for shelter rose 0.2 percent in September, and the index for food increased 0.4 percent. Together, these two indexes contributed over 75 percent of the monthly all items increase” the BLS said.

Some other notable highlights from the report:

- College textbook prices jumped 4.2%, a record monthly rise

- Admission to sporting events surged by 10.9%MoM in Sept, the biggest monthly increase on record

- Jewelry and watches rose 5.2% MoM, the biggest-ever monthly climb.

- Despite the narrative around airlines losing their pricing power, airfares rose 3.2% in the month.

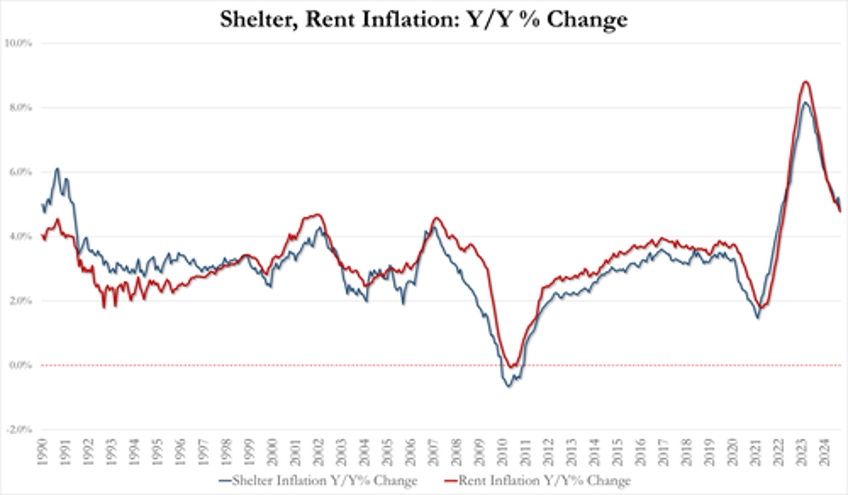

And yet, there was a several silver lining to today's report, most notably the unexpected easing in shelter/rent inflation...

.... yet even here questions emerge: just where does the BLS see this slowdown in housing costs? After all, according to both Case-Shiller and various real-time indexes, both prices are the highest they have been and are rising 6% YoY.

While that contrasting dynamic summarizes today's CPI report, here is a sample of what some of Wall Street's fastest-to-draw analysts and strategists had to say about today's inflation report:

Leo He, UBS S&T

"US headline and core CPI printed 18bp m/m and 31bp m/m in September, respectively, higher than respective 0.1% and 0.2% m/m consensus. Looking at the detail, owners' equivalent rent slowed to 33bp in September from 50bp the prior month. However, medical care services rose to 66bp from -9bp, used cars rose 0.3% m/m from -1%. Super core rose to 40bp, the highest since April."

Ali Jaffery, CIBC Capital Markets

“Today’s data will reinforce the message that the Fed is not in a hurry. The labor market is cooling but not breaking yet, and inflation is trending a bit above target.”

Karl Schamotta, chief market strategist at Corpay

“Investors may have been overoptimistic in expecting a rapid sequence of outsized cuts after September’s decision, but a long series of gradual moves still remains the most likely outcome in coming months.”

Anna Wong, head of Bloomberg Economics

“The September CPI report contains both good and bad news about inflation. The good is that rent disinflation may finally be making faster progress. The bad is evidence that elevated inflation is lingering in some key services categories, like car repairs and insurance. Disinflation in core goods prices has stalled.

“Even so, the Fed’s preferred price gauge, the core PCE deflator (due out Oct. 31), could increase more slowly than the CPI, as has been the case in recent months. Altogether, despite the upside surprise in core CPI, we don’t think the report will do alter the FOMC’s view that inflation is on a downtrend trajectory. We expect the FOMC to cut rates by 25 basis points at the Nov. 6-7 meeting.”

Ira Jersey, head rates strategist at Bloomberg Econ

"The higher-than-expect CPI headlines should take any chance of 50-bp rate cuts off the table and may cause the market to doubt the Fed may cut another 150 bps, as priced. Our focus has been the consumer, so next week’s retail sales report is key for the Treasury-yield outlook for the rest of the month. Core services continued to moderate, and most of the upside surprise appears to have come from automobile costs, which have been extremely volatile... Less-volatile sectors within core CPI continue to trend lower, while this month it was a spike amid more volatile sectors that appear to have driven the core CPI to beat expectations. Over time, this suggests inflation will once again trend lower.”

David Russell, head of market strategy at TradeStation:

“This number might not be as bad as it looks because shelter slowed sharply. That’s important because housing costs have been the biggest lingering issue for inflation. It’s not great news overall, but it’s also unlikely to have much impact because the Fed is still early in its easing cycle. The days of CPI triggering major volatility could be fading.”

Jamie Cox, Harris Financial Group

“Disinflation continues, but anyone who thought the Fed was going to lower rates by another 50 basis points in November is dead wrong. When interest rates aren’t high enough to lower growth, they aren’t high enough to stifle inflation completely either. The Fed will lower rates, but at a measured pace from here.”

Olu Sonola, head of US econ research at Fitch Ratings

“The good news is that the trend remains broadly disinflationary, but the bad news is that services inflation is still a problem. Inflation is dying, but not dead. Coming on the heels of the surprisingly strong September employment data, this report encourages the Fed to maintain a cautious stance with the pace of the easing cycle. The likely path is still a quarter point rate cut in November, but a December cut should not be taken for granted.”

Michael Brown, Pepperstone

“Despite the stronger than expected September jobs report, and given continued disinflationary progress, 25bp cuts at each of the remaining 2 FOMC meetings this year, with that cadence of cuts likely to continue into 2025 as well, until the fed funds rate returns to a roughly neutral level around 3% next summer. This, in essence, is the ‘Fed put’, which persists in a forceful and flexible form, and continues to provide participants with confidence to reside further out the risk curve, while also leaving equity dips to remain relatively shallow, and viewed as buying opportunities.”

Florian Ielpo, Lombard Odier

“The inflation data, while generally unwelcome, plays favorably into corporate earnings, thus benefiting stocks. A significant portion of the recent gains in equities can be attributed to the dual tailwinds of lower interest rates and economic stimulus from China. However, with inflation proving stickier than expected, interest rates might face temporary upward pressure.”

Source: Bloomberg