America's largest retailer delivered another strong quarter of sales, surpassing nearly all analyst estimates tracked by Bloomberg. This is mainly due to its strategy of offering the lowest prices and best deals for cash-strapped consumers struggling with elevated inflation and high interest rates. Walmart also increased its full-year outlook as Bidenomics continued to transform the nation of shoppers into Walmart regulars.

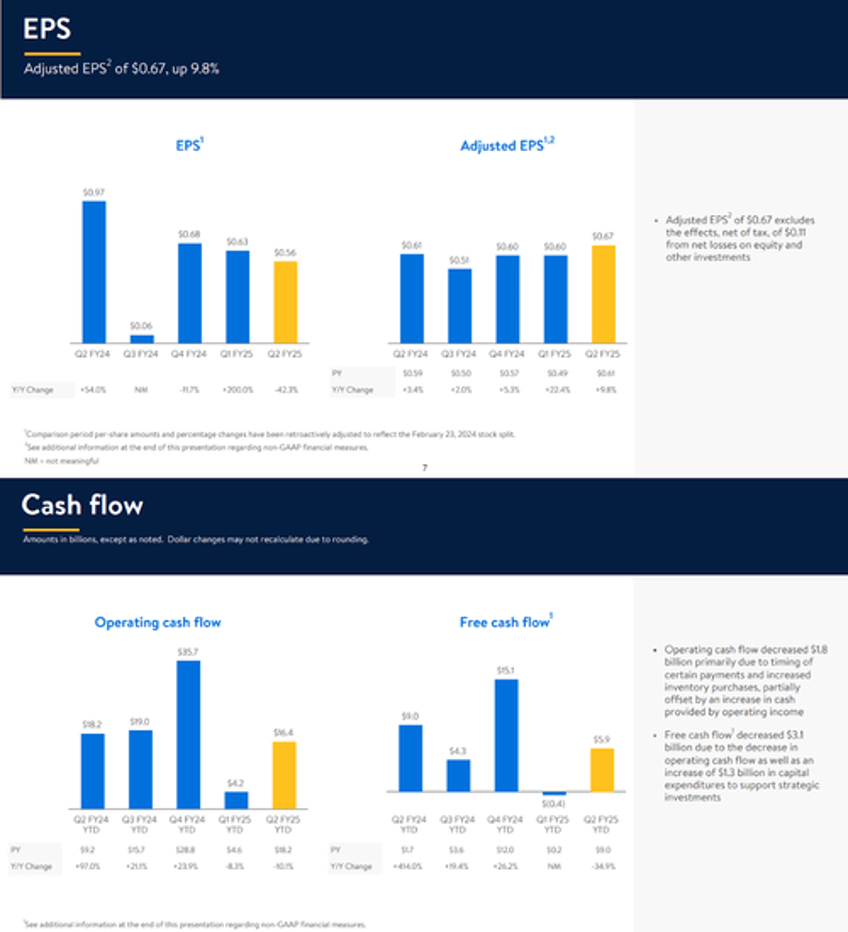

Walmart reported earnings of $4.5 billion, or 56 cents per share, for the three months ending July 31, compared to $7.9 billion, or 97 cents per share, in the same period last year. Adjusted earnings per share came in at 67 cents, beating Wall Street analysts' expectations of 65 cents per share, as tracked by Bloomberg.

Here are two visualizations of EPS and cash flow for the quarter, pulled from Walmart's earnings slide deck.

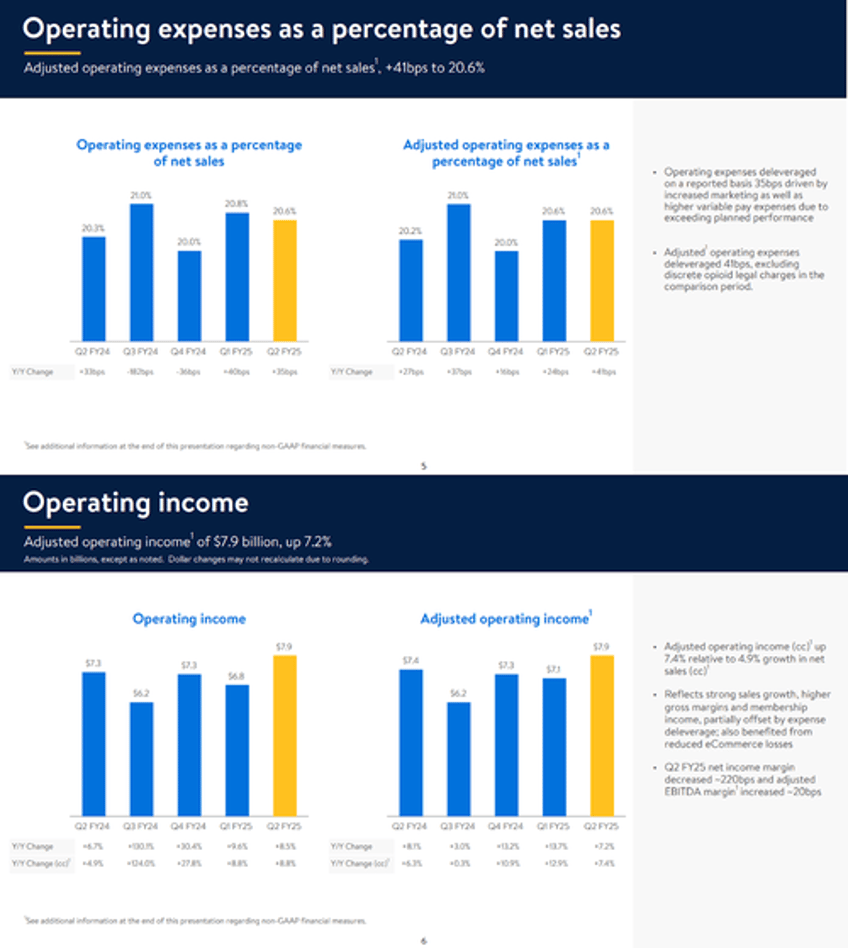

Operating expenses as a percentage of net sales.

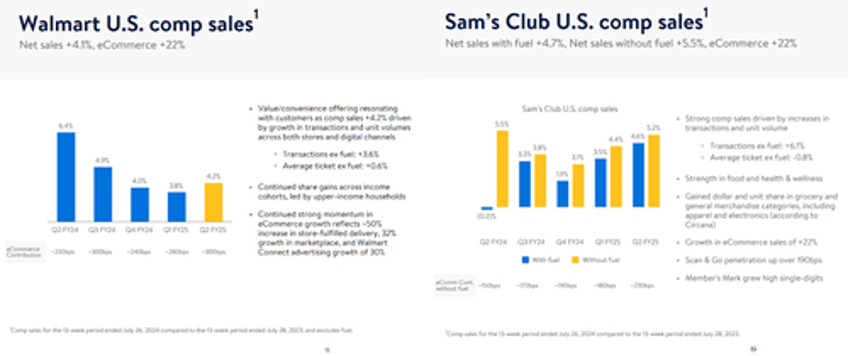

Sales for the quarter rose 4.8% to reach $169.33 billion, beating expectations of $168.46 billion.

Comparable store sales—which include online and stores open for at least one year—grew about 4.2% in the US, exceeding the estimate of 3.43%. At Sam's Club, US comparable store sales beat estimates at 5.2%.

Here's a snapshot of second quarter results (courtesy of Bloomberg):

Total US comparable sales ex-gas +4.3%, estimate +3.41%

Walmart-only US stores comparable sales ex-gas +4.2%, estimate +3.43%

Sam's Club US comparable sales ex-gas +5.2%, estimate +3.9%

Adjusted EPS 67c, estimate 65c

Revenue $169.34 billion, +4.8% y/y, estimate $168.46 billion

Change in Sam's Club e-commerce sales +22%, estimate +19%

Adjusted operating income $7.9 billion, estimate $7.76 billion

Walmart's second-quarter earnings offer insight into consumer spending habits under Bidenomics, as ultra-high grocery store prices strain household budgets. Last month, Goldman noted that Walmart has the best grocery store deals.

In an interview with Bloomberg, Walmart CFO John David Rainey said, "We are seeing that the consumer continues to be discerning, choiceful, value-seeking," adding, "We are not seeing any incremental fraying of our customers' financial health."

Walmart shares are trading 8% higher to the $74 handle in the premarket...

...a record high.

Meanwhile, the inflation-crushing policies of the Biden-Harris administration have led to an increasing number of consumers trading down to find deals. In May, Walmart revealed that even upper-income households were trading down to the retailer, which was a big reason why earnings beat.

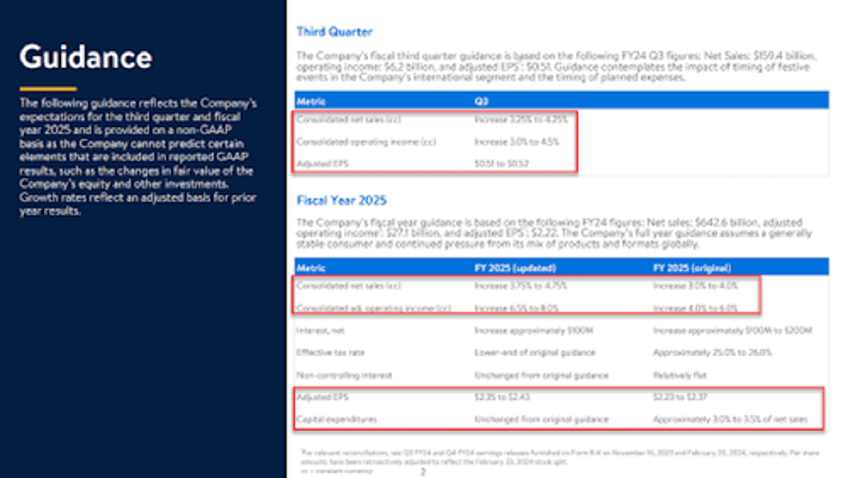

Looking ahead, the nation's largest retailer also raised its full-year outlook (but most notably, the consensus was already above these raised estimates):

- Sees adjusted EPS $2.35 to $2.43, estimate $2.45

- Sees net sales +3.75% to +4.75%

More color here on the full-year outlook:

Commenting on Walmart's earnings is Goldman's retail specialist Scott Feiler, who explained to clients this AM:

WMT (++): Believe it or not, there were a fair amount of concerns into the print for the 1st time in a while. This print was good on an absolute basis and much better vs some of the fears. They handily beat comp sales and are keeping their 2H guide intact (were some fears around 3Q guide). They say their FY guide assumes a generally stable consumer. We had positioning down to a 6 this quarter vs an 8 last quarter and noted a good bit of short selling into the print. This will provide big relief to WMT, and also some help to the rest of retail. The pushback will be +6% this morning is a lot with consensus EPS not moving higher, but expectations just were much lower vs the past few years.

Details: 2Q EPS of $0.67 vs Consensus $0.65 on revenues 40 bps better and comps of +4.3% vs Consensus +3.7%. Walmart US was +4.2% vs Consensus +3.4% but expectations lower at around +3%. Gross margins beat by 30 bps, offset by an SG&A miss. Raising the FY EPS guide to $2.35-$2.43 vs prior $2.23-$2.37 (consensus is already at the new range but still comforting to see the raise). They are also raising the FY sales guide. 3Q EPS is coming in a touch below at $0.51-$0.52 vs Consensus $0.55 but sales basically guided in-line, despite fears.

One of Walmart's main attractions for low-income and middle-of-the-road households has been the 'rollback' pricing. During the most recent quarter, Walmart offered more than 7,200 price rollbacks. The number of rollbacks on food items jumped 35% because this is where the consumer is most pressured.

In July, Walmart debuted as the biggest store-label food brand in two decades, capturing even more market share and funneling cash-strapped consumers into buying cheaper groceries at its big-box retail stores nationwide. These store-label items include frozen foods, dairy, coffee, and chocolate.

"Clearly, we see in this economic backdrop that we are quite relevant to our customers and members," Rainey said

Meanwhile, concerns about a consumer downturn have been mounting across corporate America. The frequency with which executives and analysts are mentioning phrases like "consumer downturn," "cautious consumer," and "consumer pressure" has reached alarmingly high levels, signaling fears low/mid-tier consumers are tapping out.

Outside Walmart, low/mid-tier consumers are entering hibernation mode:

Airbnb Shares Plunge On Slowing US Demand As Consumer Downturn Worsens

Disney CFO Admits Lower-Income Consumers Are "Stressed & Shaving Time Off At Parks

As the consumer space weakens, it's reasonable to expect that more higher-income households might trade down to Walmart, while low-tier consumers may increasingly turn to Dollar General.

* * *