WMT stock surged in premarket trading after the company not only reported Q1 earnings that blew away expectations, but guided even higher than consensus, and now expects the full year to be slightly better than planned as the big-box retailer attracts price-conscious consumers looking for essentials and discounts.

In the quarter ended April 26, Walmart sales rose 3.8%, higher than what Wall Street was anticipating. With inflation easing, the average ticket was flat but the number of transactions rose by 3.8% from a year ago. E-commerce was a big driver, jumping 22% during the same period, as well as upper-income households that the retailer said drove the bulk of its gains.

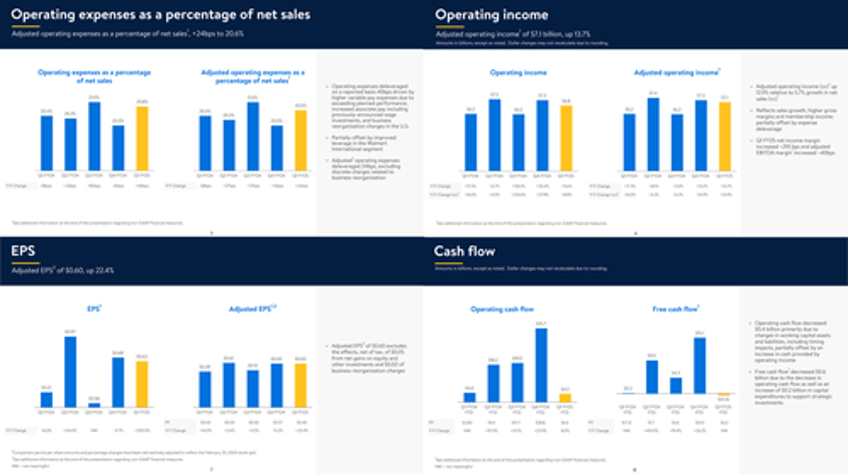

- Revenue $161.51 billion, +6% y/y, beating the estimate $159.58 billion, driven by ha higher number of transactions even as average tickets were unchanged.

- Walmart-only US comparable transactions +3.8%, estimate +3.17%

- Walmart-only US comparable ticket 0%, estimate +1.32% (2 estimates)

- Adjusted EPS 60c, beating estimate 53c (and excludes a net gain of $0.05 on equity and other investments and business reorganization charges of $0.02).

- Total US comp sales ex-gas +3.9%, beating estimate +3.42%

- Walmart-only US stores comparable sales ex-gas +3.8%, beating the estimate +3.45%

- Sam's Club US comparable sales ex-gas +4.4%, beating the estimate +3.33%

- The company said that "globally, eCommerce penetration is higher across all markets led by store-fulfilled pickup & delivery and marketplace"

Summarized:

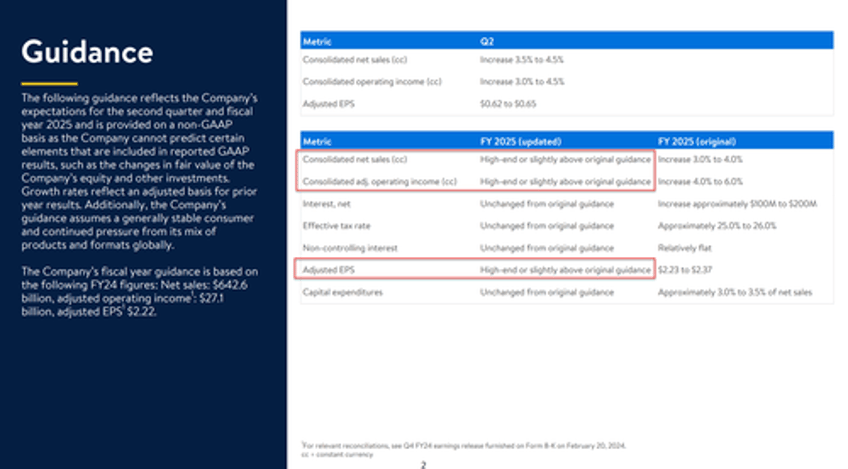

While the current quarter results were solid, Wall Street was more impressed with the company guidance: Walmart now expects adjusted earnings to come in at the high end or slightly above its original guidance of $2.23 to $2.37 per share and revenue growth of 3% to 4% for the full year. Analysts were expecting adjusted earnings of $2.37 per share and a revenue increase of nearly 4% for the full year.

- For Q2, Walmart now sees adjusted EPS in the range of 62c to 65c, vs estimate 64c

- For the full year, the retail giant expects EPS at high-end or slightly above $2.23 to $2.37 (saw $2.23 to $2.27) and vs the estimate $2.37

- Still sees FY capex about 3% to 3.5% of net sales

And visually:

CFO John David Rainey said that sales growth has been fueled by traffic and unit increases,

“We are seeing customers trade into Walmart,” he said of higher-income households who were the largest cohort behind share gains in nearly every category. “We’ve historically been thought of for value, but now it’s value, quality and convenience.”

While the grocery business has been fueling Walmart’s growth, general merchandise has lagged according to Bloomberg, which is to be expected after consumer sentiment crashed in early May to a six-month low due to concerns about inflation and the job market, while retail sales stagnated in April.

And with prices soaring, consumers have been prioritizing staples over larger, discretionary purchases: this has dented sales of competitors such as Home Depot and Target. But as higher-income consumers trade down or search for deals, Walmart is benefiting from a decision to roll out more discounts and new products and revamp stores. Lower-income consumers are buying in similar patterns at Walmart, Rainey said, purchasing more groceries and other necessities than general merchandise.

Meanwhile, Walmart continues to breathe down Amazon's neck as it expanded its e-commerce business and shipped about 4.4 billion units for same-day or next-day delivery over the past 12 months, Rainey said. About 44% of those orders were delivered to customers in less than four hours after ordering. By comparison, Amazon.com Inc. said last month that it shipped more than 4 billion items to Prime members via same or next-day deliveries in 2023.

CFO Rainey said the company has also been focused on keeping costs down, pointing to a 4.2% decline in inventory levels in the US for the quarter as supply normalizes after the pandemic.

Earlier this week, Walmart announced plans to shutter smaller offices and lay off hundreds of employees who are still working from home or can’t move to bigger office hubs. Most relocations will be to the retail giant’s corporate headquarters in Bentonville, Arkansas, where Walmart is building a 350-acre campus. Some employees will be able to work from offices in the San Francisco Bay Area or in Hoboken, New Jersey.

Rainey said the recent relocation moves are about having staff work together and that most of the changes will be done by the third quarter of this year.

“We, like a lot of companies, have relaxed those policies during Covid in the last few years and we think it’s important to get back together. We see the benefit of that,” he said.

Walmart is also investing in non-retail businesses, including advertising, that have faster growth and higher margins than core operations, while exiting areas like health clinics that are proving costly. Newer business lines, including its Walmart+ membership program, fueled the company’s operating income growth for the quarter.

WMT shares surged more than 5% in premarket trading trading, hitting a new all time high The stock has gained 14% so far this year through Wednesday’s close, outpacing the 11% rise in the S&P 500 Index.

Walmart's full Q1 investor presentation can be found here.