By Michael Msika, Bloomberg markets live reporter and strategist

More companies are flagging concerns over the looming threat of an economic slowdown this earnings season, striking a cautious tone.

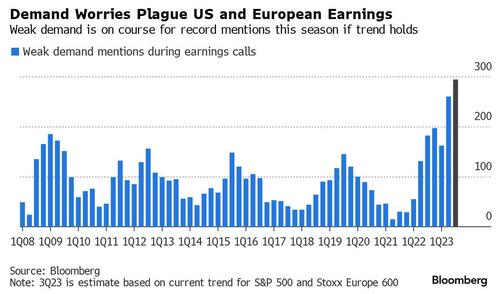

At just over the half-way mark of the reporting period, “weak demand” is among the top trending phrases on earnings calls, according to a Bloomberg analysis of transcripts for the S&P 500 and the Stoxx Europe 600 benchmarks. If the pace of mentions holds for the next few weeks, it would be the most on record, according to data compiled by Bloomberg going back to 2000.

From consumer-facing companies to technology and industrial firms, quarterly reports are reflecting deeper worries ranging from slowing demand to the impact of inflation and higher interest rates on increasingly cost-conscious consumers.

Flagship companies have warned about the outlook in numerous sectors, including Meta Platforms Inc., Worldline SA, Ericsson LM, Alstom SA, FMC Corp., Hennes & Mauritz AB, Pfizer Inc. or Sanofi SA.

Aggressive rate hike campaigns from major central banks to tame inflation are taking their toll on the economy, reducing demand and raising financing costs, while pressuring valuations. The situation is more pronounced in Europe, where PMI data has been weak and shows no sign of recovery. Separately, while companies have passed on higher costs to consumers for most of the year, things are looking more difficult now, putting pressure on margins.

“Corporate sentiment on economy and outlook is downbeat,” Barclays strategists led by Emmanuel Cau wrote in a note tracking earnings. “Our analysis of transcripts from Stoxx 600 firms that have reported thus far reveals that a majority are incrementally negative on the economy compared to recent quarters.”

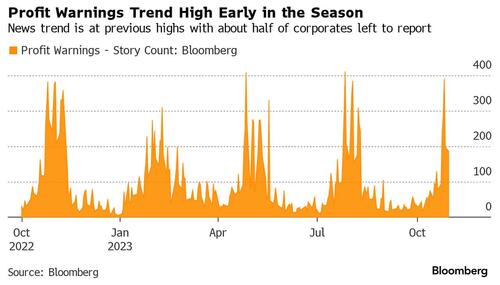

The strategists said companies seem to have become more cautious on the overall outlook for their respective business demand. They see weakening sentiment from firms reflected in the sharply rising trend in profit warnings this quarter. “With almost half the reporting yet to be done, it could notably end up higher compared to recent quarters,” they added.

Caterpillar’s stock slumped Tuesday on signs of slowing demand for its iconic yellow machinery, while Volkswagen AG’s earnings miss raised further concerns about consumer confidence after Tesla Inc.’s grim earnings report earlier this month.

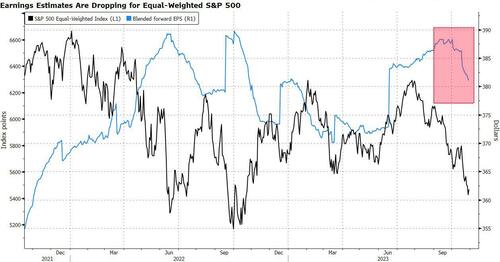

While “weak demand” mentions have jumped, corporate sentiment has dipped and guidance has hit average levels, according to Bank of America strategists led by Savita Subramanian in a recent note about S&P 500 firms. “Until real signs of a pickup in demand emerge, companies have no incentive to give aggressive guidance,” they wrote, noting that real sales growth for companies remains negative at -2.5% year-on-year.

Europe is facing another worrying trend, according to BofA’s Andreas Bruckner, who flags that only 34% of Stoxx 600 companies have beaten on sales so far, the lowest level since the first quarter of 2014 and well below the long-run average of 52%.

“Sales beats near a decade low, while sales surprises are at a record low,” Bruckner wrote in a note on Monday.

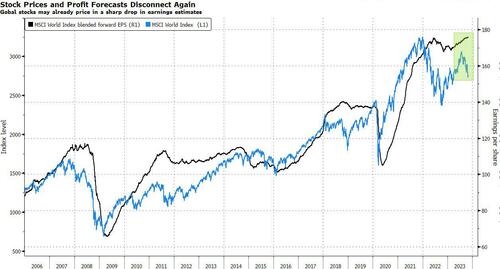

Analysts have started to cut estimates in the past few weeks on numbers that have been resilient yet underwhelming. Still, while further downgrades could be expected, much may already be priced in by the market according to Barclays’ Cau.

“The sharp move lower in the markets already indicates that investors are aware of the impending downgrades which could end up limiting the downside when EPS estimates are slashed finally into next year,” he said.