Fed Chair Powell is likely to hammer home the message that rate-cuts are coming but not just yet in a keynote address at Stanford University this afternoon. His remarks follow an endless parade of his peers also jawboning market expectations down (successfully) to the point where the market is now more hawkish than The Fed's latest dots.

Fed's Bostic was the latest to speak; reiterating his view this morning that more time is needed to confirm the disinflationary path and that he expects only one rate-cut this year.

“I think it will be appropriate for us to start moving down at the end of this year, the fourth quarter,” Bostic said in an interview with CNBC.

“If that trajectory slows down in terms of inflation, then we’re going to have to be more patient than I think many have expected.”

Additionally, on the anniversary of SVB and the regional banking crisis, Fed Governor Michelle Bowman warned that the central bank should weigh whether discount-window borrowing capacity should be recognized in reviews of lenders’ liquidity resources.

Last week Powell said there is no rush to ease monetary policy.

He is likely "to remain consistent," AmeriVet's Gregory Faranello says in a note. "Perhaps he gets more granular."

Faranello expects the chairman to "stick to the notion on monetary policy that 'at some point this year' it will be appropriate to begin lowering rates."

Treasury yields are rising ahead of the speech and rate-cut odds fading.

The Fed could risk losing its credibility if it cuts interest rates too soon.

“Jerome Powell said very early on he is a student of what happened in the seventies,” according to Eric Veiel, chief investment officer and head of global investments at T. Rowe Price Group Inc.

“If they go ahead and start cutting now, I think they are in danger of making the same mistake.”

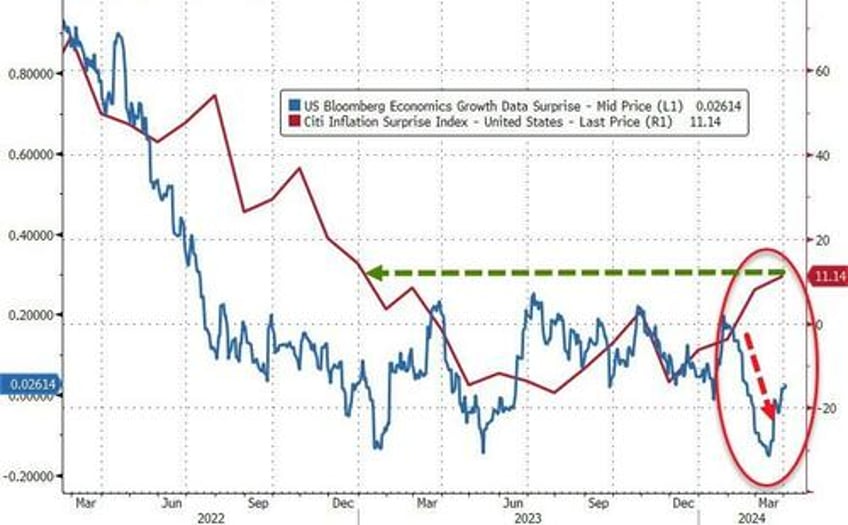

So Powell has lots of potential points to make today, but as many expect, he will carefully walk the tight-rope between being too positive about the economy, overly worried about inflation re-igniting, and avoiding the appearance of politicization - cutting rates in an economy that (based on aggregate data) is firing on all cylinders... with inflation expectations surging...

Watch Powell speak here (due to start at 1210ET)