Following the mixed picture on Manufacturing PMIs (ISM up, S&P Global down), but strong impulse in prices in both surveys; today's Services PMIs offered no more clarity at all...

- S&P Global's Services PMI printed 51.7 final for March (flat to the flash print) but down from February's 52.3 - that is the lowest Services print since December

- ISM's Services PMI disappointed, printing 51.4 in March from 52.6 in February (and below 52.8 exp).

So both weak at the headline level (which fits with recent weakness in 'soft' survey data).

Source: Bloomberg

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

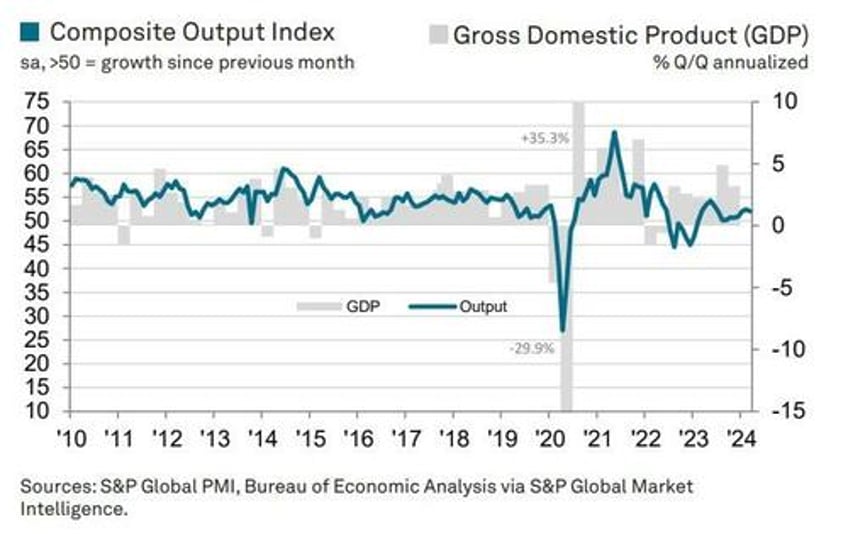

"The US service sector reported a further rise in business activity in March, adding to signs that the economy enjoyed robust growth in the first quarter. Combined with an acceleration of growth in the manufacturing sector, the latest services PMI data point to GDP having risen at an approximate 2% annualized rate in the first three months of the year.

"Confidence in the outlook for the coming year has also lifted higher, which should help to sustain solid growth into the second quarter.

But there is a major problem looming for Powell and his pals...

"The sustained upturn is being accompanied by renewed upward price pressures, however, with wage growth in particular driving costs higher.

Rising raw material and fuel prices are also adding to cost burdens, which is in turn driving average selling prices for goods and services higher at a rate not seen since July of last year.

Both manufacturers and services providers alike are seeing intensifying cost and selling price inflation rates, which is likely to feed through to higher consumer price inflation in the near term."

That surge in prices fits with a resurgent trajectory for wage growth (from ADP) but, as always, the data is there to baffle you with bullshit.

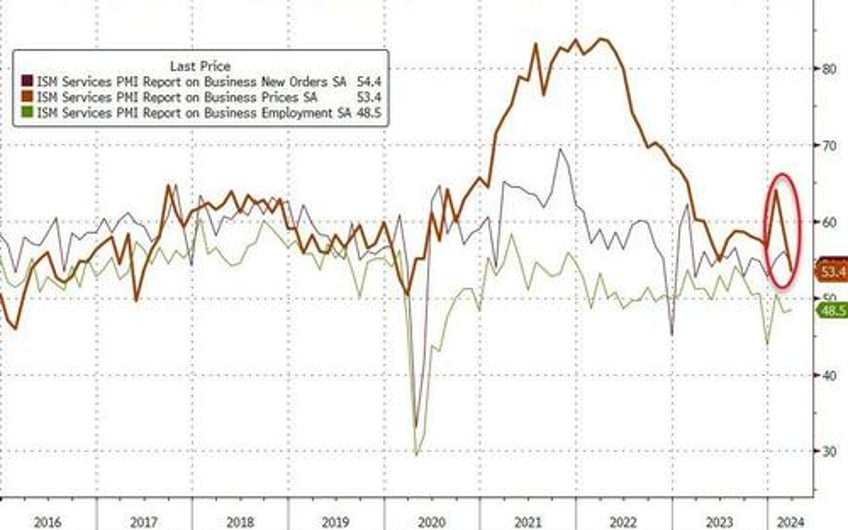

The ISM Service Prices Paid print plunged to 53.4... the lowest since March 2020...

So, take your pick: either Services prices are rising at the fastest pace since July (S&P Global)... or they are rising at the slowest pace since March 2020 (ISM).

Does this sound like prices are plunging?

“Continued inflationary pressure across multiple clinical device categories as contracts expire or are renewed.” [Health Care & Social Assistance]

"Public opinion on the value of higher education compared to the cost is having an impact on our enrollment.” [Educational Services]

Oh and if Prices are plunging, why are barely any of the components down in price?

ISM saying prices lowest in 4 years. Surely commodity prices are tumbling then.

— zerohedge (@zerohedge) April 3, 2024

Let's take a look, shall we? pic.twitter.com/NSybEg7JPj

And then there's manufacturing prices (which ISM sees rising)...

What a fucking joke!