By Michael Msika and Chiara Remondini, Bloomberg Markets Live reporter and strategists

Italian equities’ stellar performance this year could soon be set for a reality check as sovereign risks return to investors’ radars.

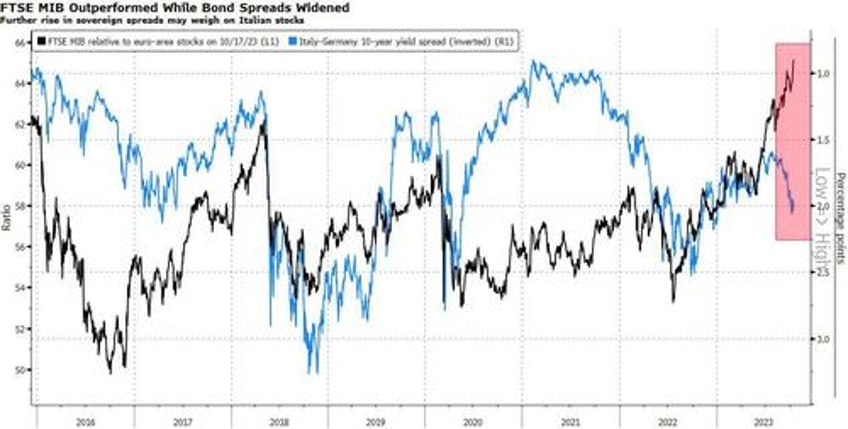

The benchmark FTSE MIB is up 20% this year, outperforming most other major European markets, mostly because of its heavy weighting toward banks which have seen a boost from higher interest rates. But with sovereign spreads recently reaching almost 200 basis points over German bonds — the widest since January — some now see sovereign debt risks as too much to ignore.

Spreads have been widening as Italian Premier Giorgia Meloni laid out a budget outlook that will delay the country from getting its deficit below a European Union target by a year. Italy’s cabinet on Monday approved the new budget law worth €24 billion ($25.3 billion), which includes tax cuts on wages, and said that it faces €13 billion higher costs on its debt due to European Central Bank rate rises.

“Investors appear to be overlooking the possible risks from widening spreads amid a worsening macro picture,” said Fabio Caldato, a partner at Olympia Wealth Management. “We forecast an imminent recession in Italy.”

The new economic forecasts — announced last month — have unsettled investors. Fitch Ratings said they represent “a significant loosening of fiscal policy,” while the International Monetary Fund said Italy will be stuck with a debt burden above 140% of gross domestic product even in five years’ time.

Strategists at Goldman Sachs Group Inc. are now recommending investors avoid Italian stocks. The FTSE MIB is “vulnerable to higher yields, wider spreads and any worsening in growth outcomes,” strategists led by Sharon Bell said in a note on Friday. The gauge has de-coupled from the widening in spreads since July, and this isn’t sustainable, she said.

Italian stocks have outperformed because of the boost to bank earnings from higher rates, but a worsening macroeconomic backdrop could change things. The FTSE MIB is one of the more domestically-exposed indexes in Europe, with about 40% of revenue exposure to Italy and another 25% to the rest of Europe, according to Bell. Goldman’s analysis indicates that a 10 basis point rise in sovereign spreads would mean a 1.5% hit to the FTSE MIB.

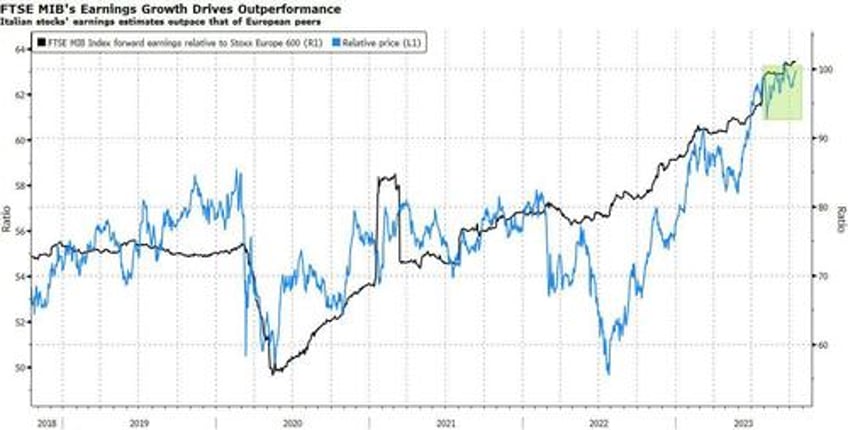

While investors are starting to put Italy’s sovereign debt risk on their radars, they aren’t seeing a repeat of the country’s woes during the 2011 crisis. And Italian stocks still have a lot going for them — the FTSE MIB is the cheapest major benchmark in Europe, trading at around a 37% discount to the Stoxx 600 based on 12-month forward price-to-earnings ratios. It also offers the highest dividend yield forecast at 5.7%.

“These multiples are extremely attractive and make the index cheap compared to other European indexes,” said Margherita Strazzari, an asset manager at Sempione SIM, adding that earnings per share of larger Italian companies have continued to grow. “Italy remains the country with the lowest multiples but with companies with solid fundamentals compared to European peers.”

Ultimately, it will be down to how the economy performs from here. Allianz SE economists led by Ludovic Subran said that Italian government GDP estimates still appear optimistic and, along with an elevated debt-to-GDP ratio, this creates conditions for market turmoil. Still, the economists don’t expect a recurrence of the major financial stress episodes seen by Italy in the past decade.

“With higher interest rates and slowing inflation, thus positive real yields, combined with an economic slowdown, sovereign risk of highly indebted countries like Italy might be put under the spotlight,” said Jacopo Ceccatelli, head of institutional clients at FININT Private Bank. Still, this “has to be put into the context of an ever-growing presence and support of European institutions.”