by Jonas Ekblom and Michael Msika, Bloomberg Markets Live reporters and strategists

The popularity of Danish drugmaker Novo Nordisk has propelled its shares to a sky-high valuation, leaving little room for any disappointment with Europe’s most-valuable company.

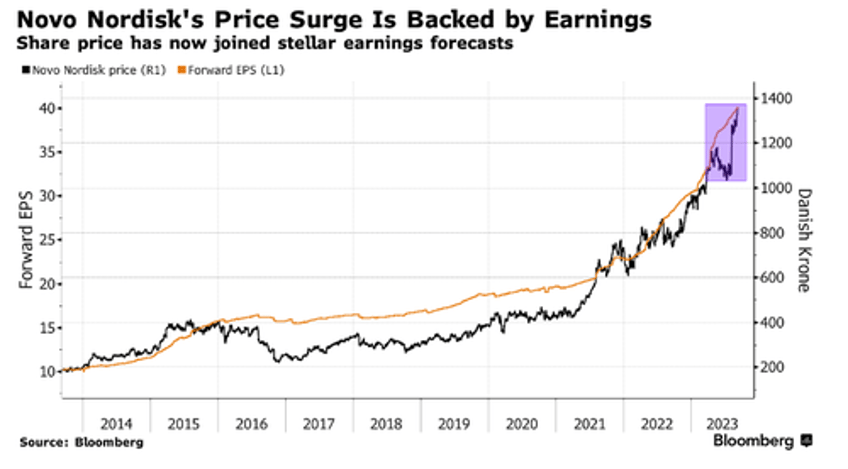

The vast growth potential of weight-loss drugs Ozempic and Wegovy have driven the Danish company’s shares up more than 40% this year. That’s taken its market capitalization surging beyond $400 billion ahead of a stock split that’s due to take effect on Wednesday.

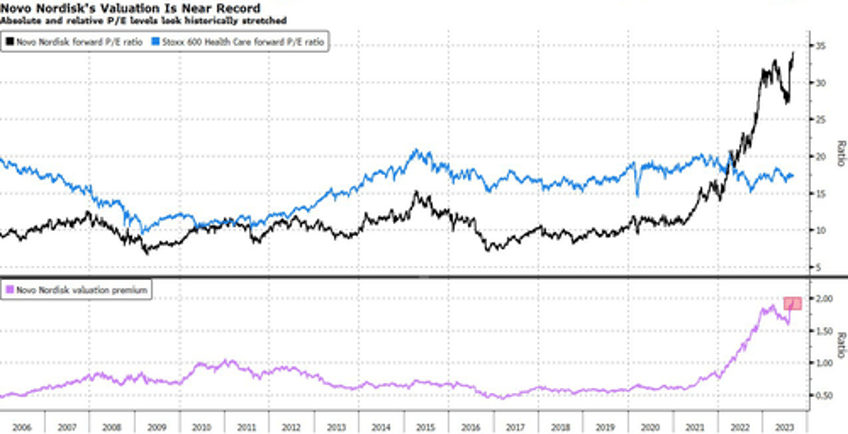

With that has come a valuation that is dividing opinion among analysts. A 12-month forward price-to-earnings ratio of around 34 is nearly double that the Stoxx 600 Health Care subindex. According to UBS Group’s Michael Leuchten, that’s too rich.

"I don’t believe the obesity revenue opportunity will be as big as Novo’s current valuation implies,” Leuchten said in an interview. His price target of 720 Danish kroner is the lowest on the Street, and roughly half of the current price.

With Novo having 18 buy recommendations and only six sells among analysts tracked by Bloomberg, the bears are among the minority. Barclays’ Emily Field is one of those in the bull camp, saying investors need to consider the type of once-in-a-lifetime, society-changing drugs that Novo is producing.

She isn’t alone in that opinion. JPMorgan analyst Richard Vosser boosted his price target for Novo last week to a near Street-high of 1,500 Danish kroner, expecting the company to capture nearly half of a global obesity drug market it projects to be worth $71 billion within a decade.

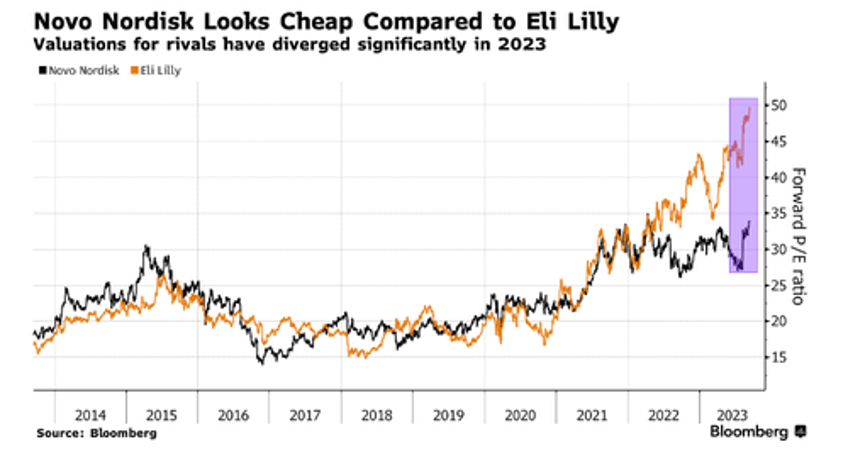

A key catalyst, Vosser says, will be the full data release from a trial investigating how semaglutide, the active ingredient in Wegovy and Novo’s diabetes drug Ozempic, can lower the risk of heart attacks and strokes by a fifth. However, among the risks is rivals catching up. While Novo might have been first out of the door, it isn’t without challengers. Eli Lilly’s Mounjaro is currently the nearest competitor.

“It’s a race-to-arms and can you jump to the conclusion that Novo can win? I don’t think so,” said Leuchten. He thinks Mounjaro has better efficacy and is the most likely winner. Leuchten also has doubts that the pharmacological weight-loss market will be the seismic game-changer for health care that some believe.

“The largest mistake people do is thinking this fixes the problem,” he said. While Wegovy can play a part in fighting rising obesity rates, its high price relative to other weight-loss methods is likely to stymie its success as health-care providers and insurers will increasingly balk at the cost, he said.

The bulls are undeterred and say the stock’s high valuation will end up being justified over time. In fact, compared to Eli Lilly’s 50 times forward P/E ratio, Novo Nordisk even looks cheap. Yet Lilly has been boosted not only by its potential in weight-loss drugs but also a successful final-stage trial of its experimental treatment for Alzheimer’s, another hot area of the pharmaceuticals sector.

“Given this is a multi year story – we’re not looking at this year’s P/E, next year’s P/E — that’s not what’s important,” Barclays’ Field said. “It’s how big can this market be.”