By George Lei, Bloomberg Markets Live reporter and strategist

Yuan liquidity in the offshore market tightened significantly this week, with the one-month interbank borrowing cost in Hong Kong surging over 120bps, the most since January 2021. Three-month Hibor for the offshore yuan jumped for a sixth straight week, exceeding 4.2% and reaching the highest since November 2018.

Chinese policymakers, taking advantage of favorable seasonality, appear determined to choke off yuan bears as much as they can. The cost of funding offshore is poised to climb further before month- and quarter-end.

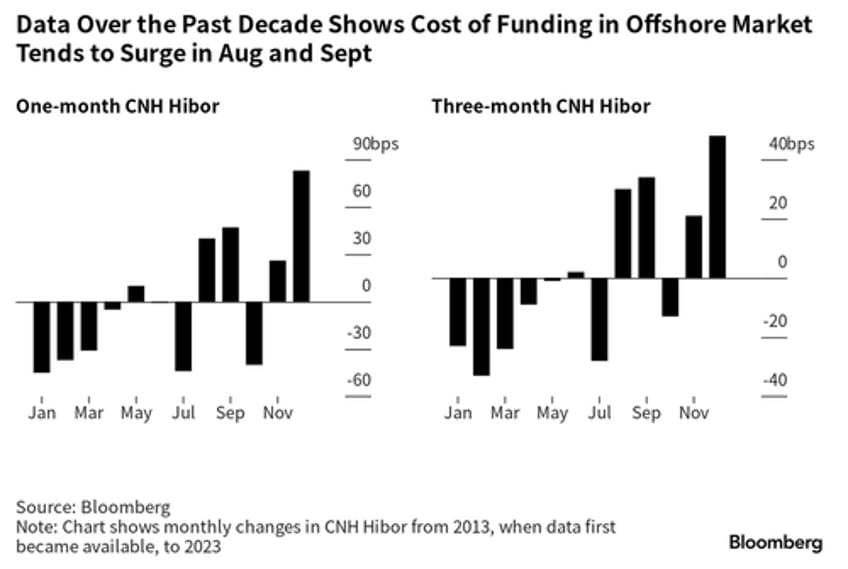

The squeeze is making it much more expensive to borrow (and short-sell) the yuan offshore, adding teeth to warnings from Beijing against “one-way and pro-cyclical bets” on the Chinese currency by foreign speculators. August and September typically see the cost of yuan funding climb in Hong Kong ahead of China’s “Golden Week” national holiday in early October, according to data over the past decade compiled by Bloomberg.

Quarter-end, on top of a market hiatus that sometimes lasts as long as 10 calendar days (domestic trading will be halted from Sept. 29 to Oct. 8 this year), means funding pressure is unusually heavy in September, second only to December. The PBOC is well-aware and taking full advantage of such seasonality to shake up the offshore market. The central bank said on Wednesday it plans to issue more yuan-denominated bills than are maturing in Hong Kong next week, making the life of yuan bears even more difficult. State-owned banks, meanwhile, refrained from providing adequate CNH liquidity via the swap market, according to traders who asked not to be identified as they are not allowed to speak publicly.

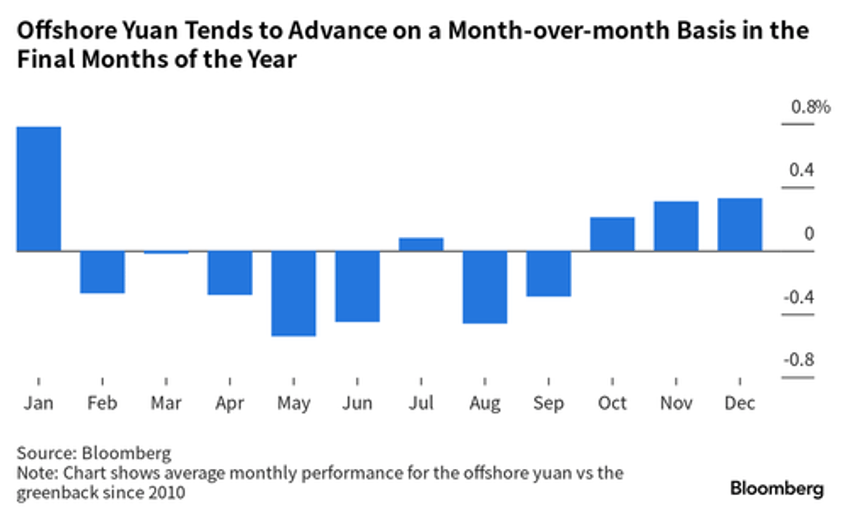

September is also the month when a long stretch of yuan weakness typically nears an end. Greenback purchases tend to pick up in the summer, when Hong Kong-listed Chinese firms declare and pay out dividends. This year’s payment totaled $80.1 billion, of which $68 billion was due in June, July and August, according to Bloomberg calculations. The seasonal outflow, coinciding with a deterioration in Chinese economic data, led to a 2%-plus currency selloff from the end of May to the end of August.

The funding squeeze, taking place at an opportune time, appears designed to achieve the maximum FX market impact, now that dividend outflows taper off while the latest credit and inflation data show signs of economic stability in China. It provides the PBOC with an additional tool to anchor the currency after short-sellers grew more adamant in challenging the daily fixings.

“PBOC’s aggressive efforts are indeed paying off,” Brad Bechtel, global head of FX at Jefferies in New York, wrote on Wednesday, while acknowledging it might be too early to “call a trend change” in dollar-yuan. Policymakers want to stop the currency from weakening further “as much as they can” and the yuan will be “allowed to follow” if the dollar retreats another 3-5%, Bechtel noted.

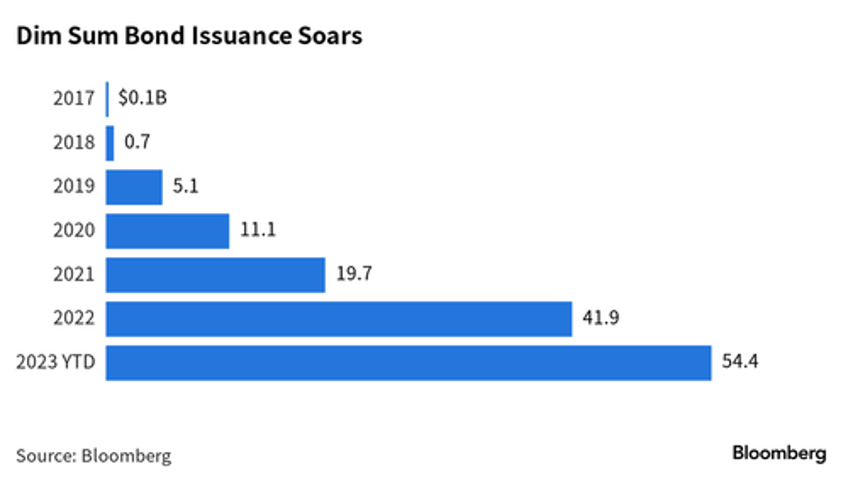

The offshore funding squeeze has so far had little impact on the onshore cost of borrowing, with benchmark Shibor rates picking up slightly yet still below their summer peaks. Should the trend persist, the issuance of dim sum bonds — offshore debt denominated in yuan — could feel the heat. Data compiled by Bloomberg indicate that dim-sum bond supplies have grown to more than $54 billion year-to-date, almost triple the amount for 2021, supported by lower costs and regulatory curbs on certain types of onshore issuances.