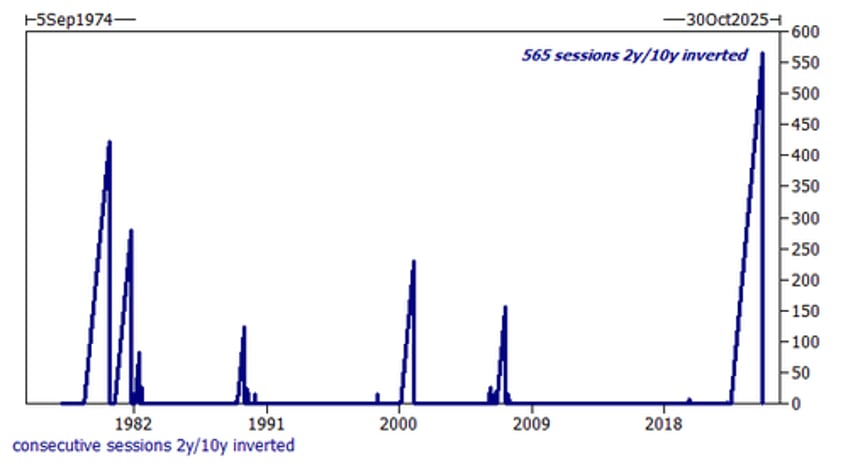

As noted in our Wednesday market wrap, after 26 months, or 565 trading sessions of inversion, yesterday the curve finally disinverted, marking the end of the longest 2y10y curve inversion in 50 years. What this means is a matter of furious debate.

On one hand, there are those like Bloomberg's Simon White, who argue that as a result of the trillions in (excess) reserves sloshing in the system, and repo becoming the primary money-market instrument, the "Yield Curve Is Now Broken As A Recession Indicator" and has become completely meaningless as a market signal.