After two days of tech-led turmoil, the market was decidedly calmer today, with the S&P opening flat, rising, falling and then set to close modestly red on the day...

... as it tracked the 0DTE delta flow almost tick for tick, as it peaked around 10:30am ET, then slumped and failed a second attempt at breaking out...

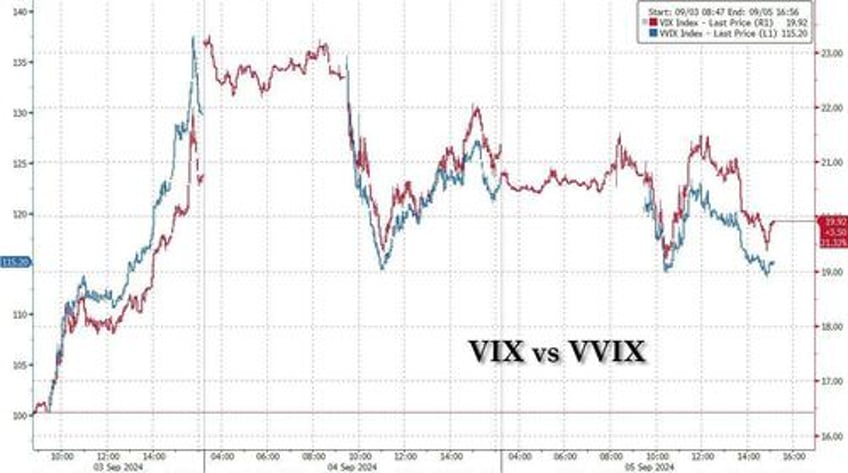

... while both the VIX and VVIX faded attempts to break out and faded, letting the VIX closed below 20 for the first time this week.

As Goldman's trading desk notes, it appears the market is now in wait-and-see mode ahead of tomorrow's critical payrolls report, following a busy start to the week; as the bank puts it, "feels like focus remains on macro data post better ISM services number this am with tons of questions on NFP tomorrow."

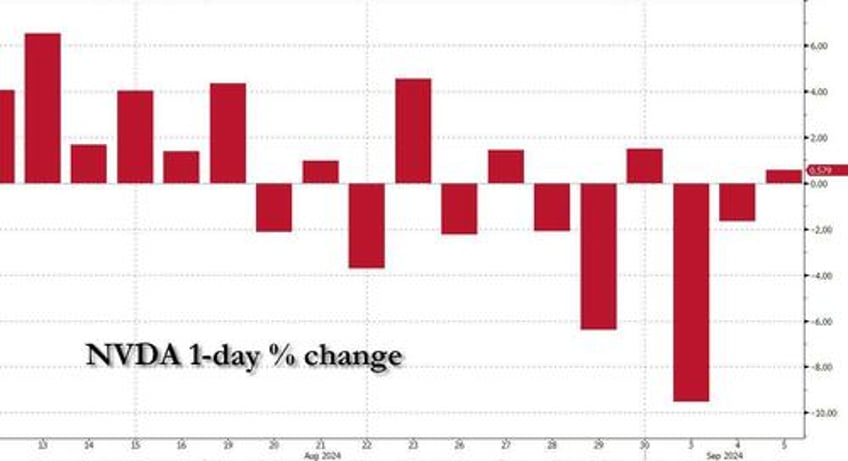

The good news is that unlike earlier this week when the selling was led by tech and semis, today NVDA finally managed to close modestly green after two days of selling and 4 red closes in the previous 5...

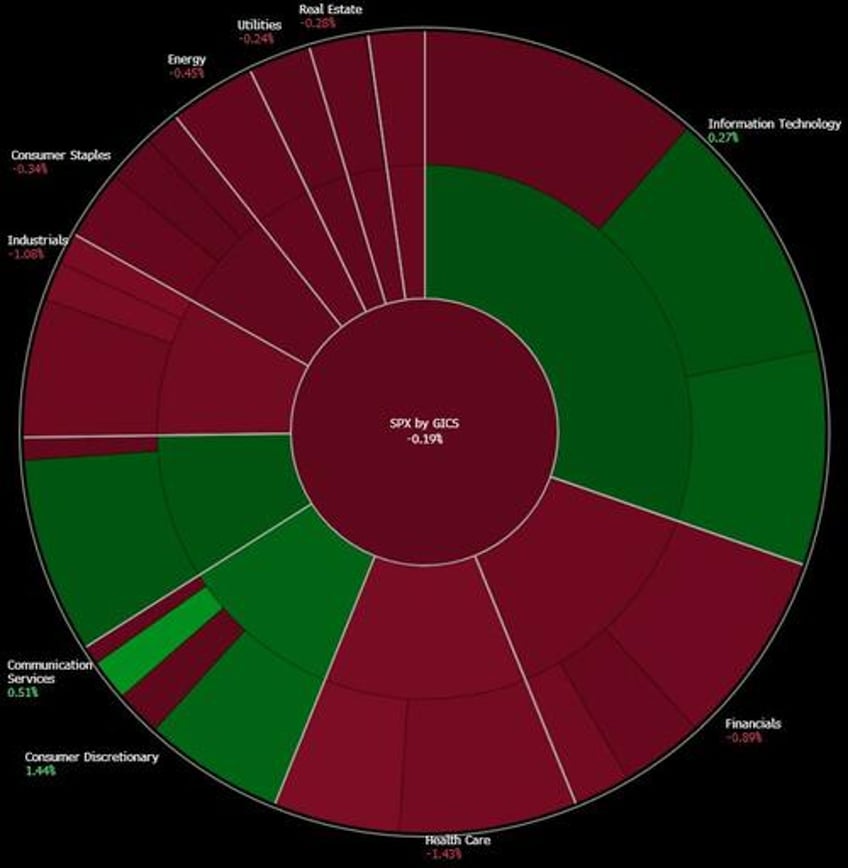

.. and after the recent drubbing for tech and communications, it was the two sectors that staged a rebound, together with solid performance by consumer discretionary, where TSLA (+4.9%) and AMZN (+2.6%) led gains.

Yet even though bond-proxies like utilities and staples underperformed today, Treasury yields sank for the 3rd consecutive day, sliding 2bps to 3.73%, and except for the freak Aug 5 plunge (from which they quickly recovered), yields are now back to 2024 lows...

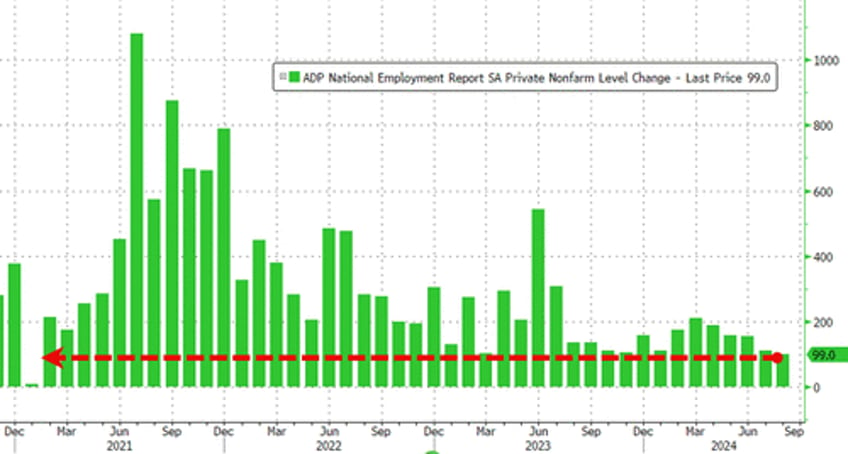

... as the mounting hard-landing panic, which today was boosted by the worst ADP private payrolls report since Jan 2021...

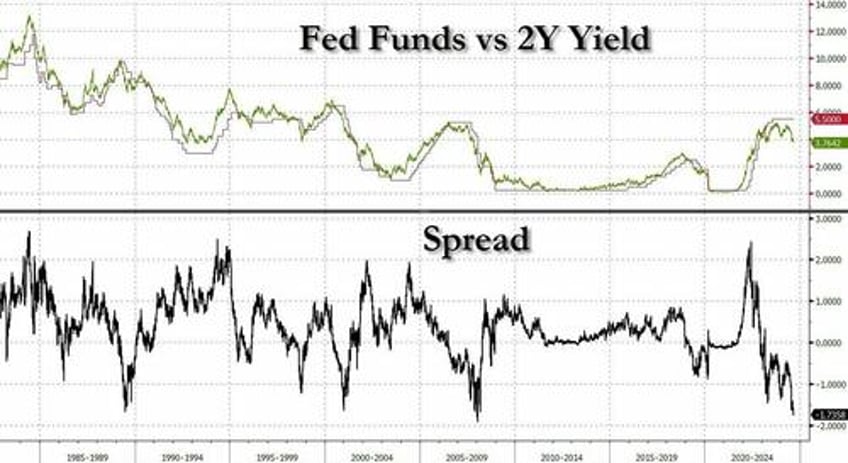

... hints at a bond market that has almost never been more convinced of a very unhappy ending (with just one exception --- spot it in the chart below).

It was this stubborn fear of imminent recession, which sent oil to not just new 2024 lows, but about to take out the 2023 lows as well...

... despite another massive crude inventory draw, the 8th in the past 9 weeks...

... on soaring global recession fears overruled any good news from the OPEC+ decision to hold off on boosting output by at least 2 months.

Then again, the coming recession - which is now virtually assured now at the the 2s10s yield curve disinverted yesterday for the first time after 26 months - will only be a catalyst for the next mega stimulus package, something which gold is well aware of and is eagerly waiting for as it retests its all time highs ...

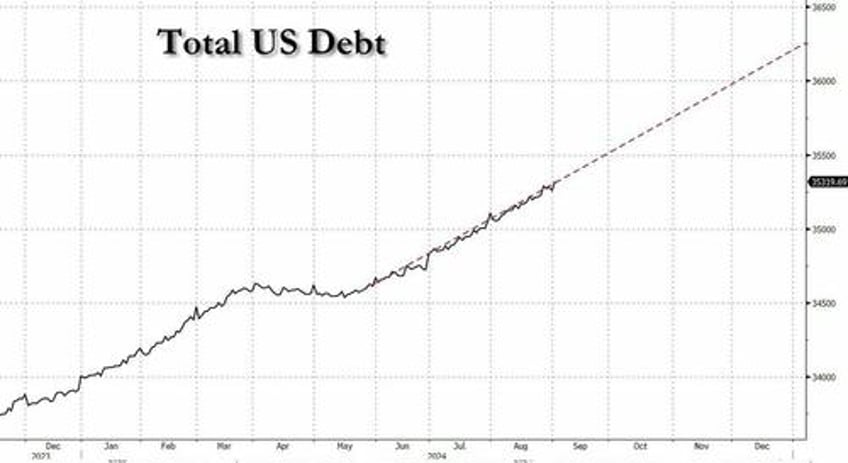

... and with total US debt on pace to hit a record $36 trillion in 3 months...

... the coming debt monetization will make the Fed's post WW2 Yield Curve Control look like amateur hour compared to what is coming.