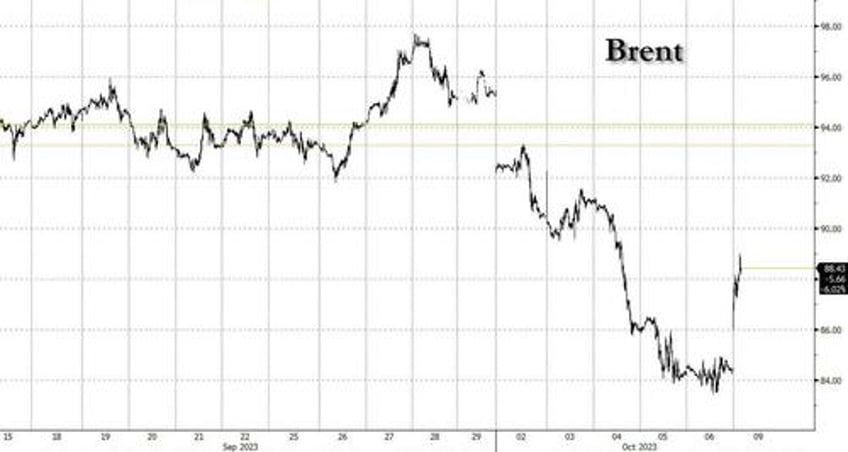

Oil prices have been a veritable rollercoaster in just the past 10 days.

After soaring more than 36% from its June lows to a 1-year high just above $97 at the end of September, Brent tumbled $14 in just six sessions, including last Wednesday's brutal plunge, which was the biggest one-day drop since the UK's Mini-Budget fiasco of Sept 2022 when funds were literally blowing up and liquidating commodities to avoid collapse, and which ended up with another BOE bailout.

What was behind the furious plunge? While there wasn't one single catalyst, Goldman's commodities strategist Callum Bruce views the tumble in oil as driven by three reasons:

- Overvaluation: Goldman's inventory-based modelling suggests oil timespreads and flat price was already elevated versus the bank's forecasted inventory draws. Discretionary positioning was the longest since the Russia-Ukraine war, and the market was very much overbought.

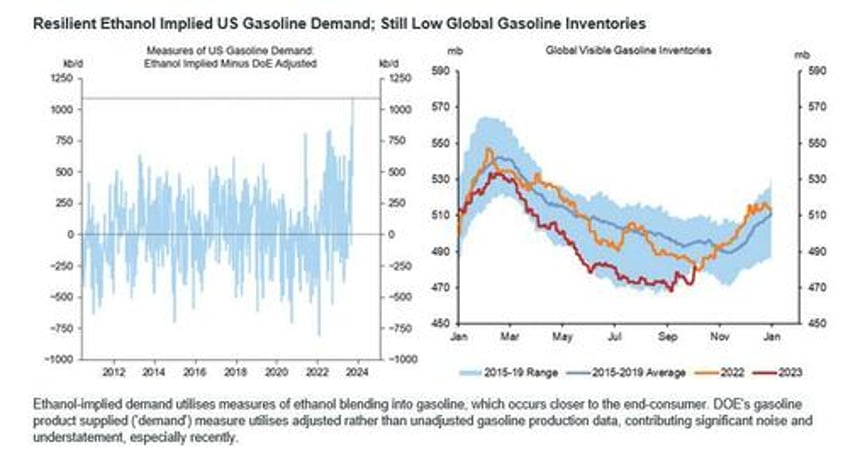

- Recession fears: Renewed fears in a rates-led recession saw significant sell-offs in the more deferred timespreads, implying concerns regarding next year’s demand; this was exacerbated by the strategically timed very weak US EIA weekly gasoline demand print, that as many have observed (and speculated about the EIA's political mandates) were implausibly low. In response, Goldman maintains its relatively serene macro-economic outlook, with FCIs not overtightening and real incomes still rising. Retail prices similarly are not yet at demand destructive levels and demand is still tracking robustly.

- CTA unwinds: Mechanical selling of oil as prices hit sell-stop triggers for short term momentum flows. Admittedly much length likely remains here.

Goldman commodity products trader Madhav Janakiraman chimes in and writes that while “not a lot has actually changed fundamentally…. the market created a bit of downside momentum because of government shutdown risk/chatter about Kurdish crude coming back to market/Russian diesel returning etc. Once that little push occurred, the positioning did the rest particularly because a decent chunk of the length was CTA style momentum following strategies and they were quite close on some of their signals turning. At the same time index, commodity ETFs saw decent outflows into month-end and earlier this week. So retail, pension fund type long term investors were also exiting the space. Discretionary playxers simply didn’t have the ability to stem the tide..."

So while it is tempting to think this is silly CTA led washout and a huge buying opportunity, Janakiraman says that the path risks are still significant. China being out this week for Golden week hasn’t helped either in terms of liquidity. They also tend to be pretty aggressive buyers of physical molecules when they see flat price get to cheap levels. One could also argue at current price set Saudi Arabia is unlikely to bring back crude they have held out from the market "and so it is cheap."

Whatever the reason for the drop, Goldman has stuck to its view of steep deficits into next year driven by (1) robust demand, and (2) significant OPEC+ discipline and pricing power, allowing inventories to draw down to critically low levels once again. The bank also expects prices to reach $100/bbl by mid-24 - driven by deferred timespreads – while the back-end of the curve is kept anchored by plentiful spare capacity and cost deflation in US shale. Meanwhile, the sudden break out of the Hamas-Israeli war in the middle east will likely push oil prices higher and faster (for more see "Oil Could Spike Well North Of $150": Here Are The Main Implications For Oil From The Israeli War".)

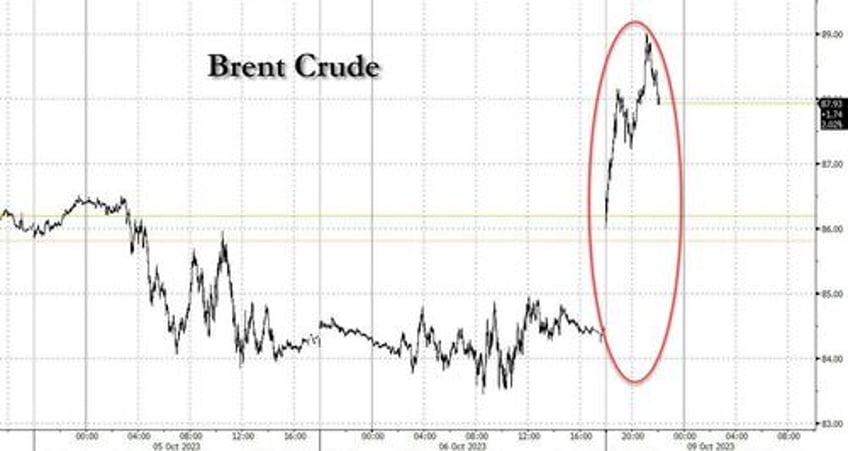

In retrospect, last week's oil tumble now seems like ancient history, and after Saturday's unprecedented events in Israel, oil has moved sharply higher after the weekend attack by Hamas against Israel, with Brent topping $88 a barrel to repair some of last week’s heavy losses, and according to some, set to continue rising until it tops $150.

Here, courtesy of Bloomberg's Jake Lloyd-Smith are five early highlights from the market’s reaction that will help to shape trading in the coming days.

- First, the immediate fallout has been seen right along the curve, with timespreads widening. Among them, Brent’s prompt spread — the difference between its two nearest contracts — gapped out to $1.64 a barrel in backwardation, a bullish pricing pattern. Still, banks aren’t yet rushing to upgrade their price forecasts.

- While the latest events in Israel don’t pose an immediate threat to supply, the risk of escalation across the region remains acute, especially the potential for Hamas-backer Iran to be drawn in. That could pose a risk to supplies from Tehran, particularly if the US enforces sanctions with greater rigor.

- Market watchers are also putting the spotlight on the fallout for Riyadh, which has been both curbing output to bolster prices, while at the same time seeking to normalize ties with Israel. If the latter now proves to be a far tougher ask, the former voluntary supply restrictions could last for longer.

- OPEC+ members are signaling that there'll be no immediate change to their collective stance. Saudi Arabia, Kuwait and the United Arab Emirates’ energy ministers all stressed their support for OPEC+ policy, saying continued cooperation was needed.

- While benchmark prices did take a tumble last week before the weekend assault, the global oil market remains very tight following OPEC+ supply cuts. Further draws in inventories this week, especially at the Cushing hub, could trigger a meaningful surge in prices.

Finally, going back to Goldman, the bank's preferred oil trade is one that is bullish yet net sells volatility. The bank is currently recommending buying a 90-95 Jun-24 Brent Call spread and selling a 80-100 Jun-24 Brent Straddle to benefit from convex and backwardated forward curves, contangoed vol structure, and rangebound price action. Such a strategy raises almost $8/bbl up front, for a max profit of $13/bbl, and currently make profits in the $72-$113/bbl range.”

More on Goldman's current positioning and proposed trades as discussed earlier in "