By Eric Peters, CIO of One River Asset Management

Price

US money market fund assets hit a record high of $6trln this week. Gov’t debt hit record highs too. As did US equities, in general. Gold is near a record, US home prices too. In a highly financialized fiat monetary system, many drivers work to influence valuations. Cash flows, earnings, leverage, interest rates, money supply, its velocity, tax rates, optimism, pessimism, uncertainty, confidence, stability, volatility, and expectations about how all such things will change. Investors search for fair market value, but for a trader there’s no such thing, only price.

Money can be created in all sorts of ways in a fiat monetary system. This makes it hard to know how much there is at any given point in time. And while it makes sense that the more money lying around, the higher prices should be in the system. But sometimes, money changes hands slowly, and when this happens, prices can actually move lower no matter how much money is in the system. The inverse is also true. And this makes it even harder to determine the fair value of anything, because it requires you to have to anticipate the velocity of money.

There are periods during which the relationship between most or all the variables that investors use to determine fair value remain rather stable. Those are fairly boring times, and the people who profit the most engage in leveraged carry and mean-reversion types of strategies. Such periods give investors a false sense of confidence that market prices can be forecasted with great confidence using a range of inputs. As confidence turns to arrogance, the potential energy for a major market shift builds. Investors get short volatility. This dynamic never changes.

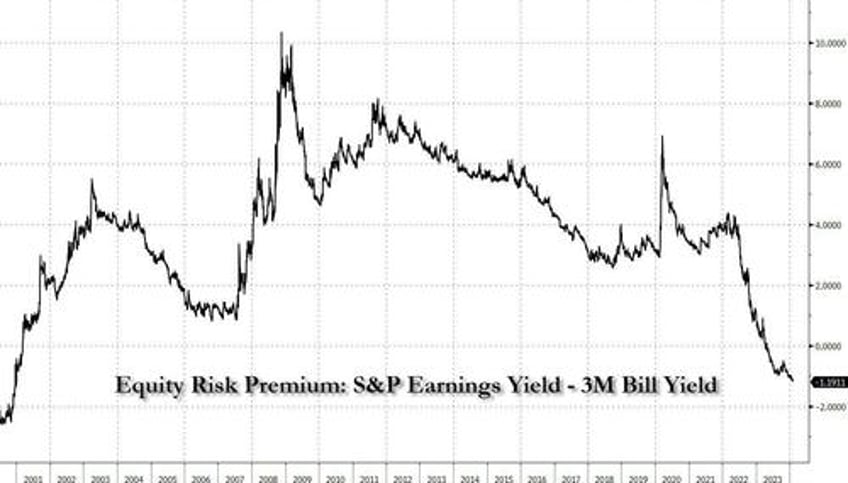

The equity risk premium (ERP) is at 23-year lows. The S&P 500 earnings yield minus 3mth T-bill yields has not been this low since 2001. So, in at least one sense, the market is above fair value. But at the height of the dotcom bubble, the ERP was lower than now. So, all this tells us is that the market is overvalued, and we should not be surprised to see it become more so. No one knows whether the dotcom ERP lows represent an absolute limit. All we know from the past is that when markets move to extreme over/under-valuations, wild moves in price can happen.

If you look at a long-term S&P 500 price-to-earnings ratio, you’ll find that it swings massively. In the early 1980s, investors paid a price of roughly 7x earnings for the S&P 500. In 2001 they paid almost 50x. In 2011 they paid around 13.5x. Now they pay around 27 or so. Wall Street has created armies of analysts to forecast corporate earnings, while relatively little effort is put into forecasting the large swings in the multiple investors are willing to pay for those earnings. Because such forecasts are harder to do; they require less math and more intuition.

For nearly 20yrs, the velocity of money declined. This prompted/allowed policy makers to create massive amounts of money without sparking inflation. No honest economist could really explain it. The Fed got ever more aggressive, searching for the limit. Then along came Covid. Velocity collapsed further, stabilized, reversed. Given that no one really knew why velocity fell, if it now rises powerfully, we’re unlikely to understand why. It won’t really matter though, all that we will need to know is that its effect on prices will dwarf any notion of value.