The first quarter Fed's Senior Loan Officer Opinion Survey (SLOOS) - the one place where every three months investors go to find information on changes to both loan demand and bank lending tightness - was released and revealed more of the same: despite daily propaganda of economic improvement, the SLOOS found that more US banks reported stricter credit standards in the first quarter, while loan demand declined. As a reminder, without ease credit and without rising loan demand, it is virtually impossible for an economy - especially one that is as financialized as the US - to grow; and yet we are bombarded day after day with lies to the contrary.

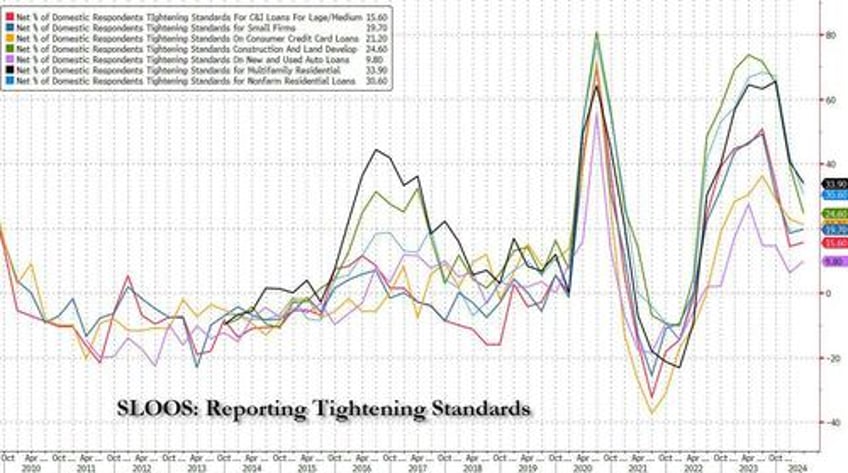

Taking a closer look at the SLOOS survey which was conducted between March 25 and April 8, we find that the net share of US banks that tightened standards on the all important C&I (commercial and industrial) loans for mid-sized and large businesses rose to 15.6% in the first three months of the year, from 14.5% in the fourth quarter.

Other types of loans that saw tightening lending standards include New and Used Auto Loans (tighter standards at 9.8% from 6.3%), and small firm credit (19.7% from 18.6%). At the same time credit eased modestly - even if it was still tighter relatively to baseline - for Consumer Credit Card loans, Construction loans, Multifamily residential loans and nonfarm residential loans.

(for those unfamiliar, the figures in the SLOOS report are calculated as net percentages, or the shares of banks reporting tighter conditions or stronger demand minus the proportion of banks reporting easier standards or weaker demand).

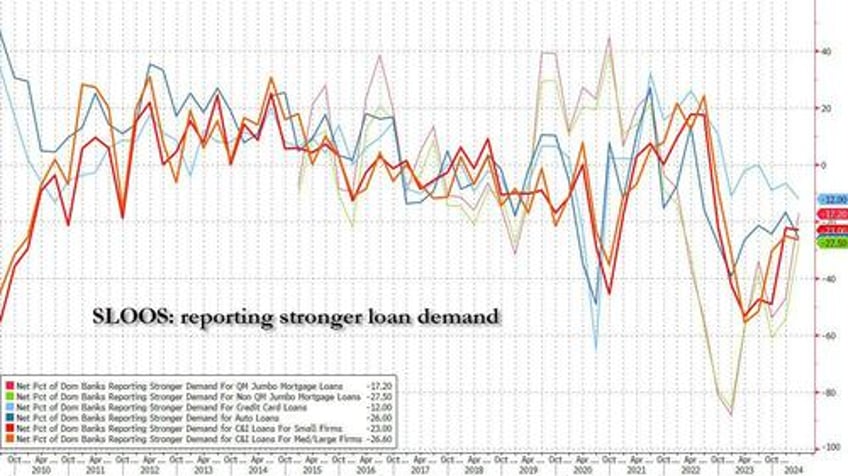

On the demand side, the picture was mixed as well: while demand declined across the board relative to baseline, it dipped modestly for C&I loans at 23.0, down from 22.4, with Credit card loan demand, auto loan demand and C&I loan demand all dropping sequentially, while demand for jumbo loans (both qualifying and non-qualifying) seeing a notable jump.

Excerpting from the report we find the following:

- Survey respondents reported tighter standards regarding loans to businesses, and weaker demand for commercial and industrial (C&I) loans to firms of all sizes. Meanwhile, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories.

- Banks also responded to a set of special questions about changes in lending policies and demand for CRE loans over the past year. For all CRE loan categories, banks reported having tightened all queried lending policies, including the spread of loan rates over the cost of funds, maximum loan sizes, loan-to-value ratios, debt service coverage ratios, and interest-only payment periods.

- For loans to households, banks reported that lending standards tightened across some categories of residential real estate (RRE) loans while remaining unchanged for others on balance. Meanwhile, demand weakened for all RRE loan categories. In addition, banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs); finally, standards reportedly tightened and demand weakened for credit card, auto, and other consumer loans.

- While banks, on balance, reported having tightened lending standards further for most loan categories in the first quarter, lower net shares of banks reported tightening lending standards than in the fourth quarter of last year across most loan categories

Banks have been tightening credit standards since the second quarter of 2022, following a string of high-profile regional bank failures. Meanwhile, the Fed hiked its rate last year to a two-decade high in a bid to curb inflation, and high borrowing costs have weighed on businesses and households.

And here is the bit on the "special question" asked regarding changes in banks’ credit policies on commercial real estate loans over the past year.

A set of special questions asked banks about changes in their credit policies for each major CRE loan category over the past year. These questions have been asked in each April survey for the past eight years.

Banks reported having tightened all the terms surveyed for each CRE loan type. The most widely reported change in terms, cited by major net shares of banks across all CRE loan types, was the widening of interest rate spreads on loans over the cost of funds. Additionally, significant net shares of banks reported tightening maximum loan sizes, lowering loan-to-value ratios, increasing debt service coverage ratios, and shortening interest-only payment periods for all CRE loan types. In addition, significant net shares of banks also reported tightening the maximum loan maturity for nonfarm nonresidential and multifamily loans, and a moderate net share of banks reported doing so for construction and land development loans. Furthermore, significant net shares of banks reported reducing the market areas served for nonfarm nonresidential and construction and land development loans, while a moderate net share of banks reported doing so for multifamily loans. Foreign banks reported tightening across almost all terms for each CRE loan type.9

The most cited reasons for tightening credit policies on CRE loans over the past year, cited by almost all banks, were less favorable or more uncertain outlooks for CRE market rents, vacancy rates, and property prices. Additionally, major net shares of other banks cited a reduced tolerance for risk, increased concerns about the effects of regulatory changes or supervisory actions, and a less favorable or more uncertain outlook for delinquency rates on mortgages backed by CRE properties.

The survey also asked banks about the reasons why they experienced weaker or stronger demand for CRE loans over the past year. More banks responded with reasons for weakened demand than for strengthened demand for CRE loans. The most frequently cited reasons for weaker demand, as reported by major net shares of banks, were an increase in the general level of interest rates, a decrease in customer acquisition or development of properties, and a less favorable or more uncertain customer outlook for rental demand. Of the smaller but sizable share of banks that reported stronger demand, the most frequently cited reasons for stronger demand, as reported by significant net shares of banks, were an increase in customer acquisition or development of properties, a shift in customer borrowing to respondent banks from other banks and non-bank sources, and a decrease in internally generated funds by customers.

Banks also tightened lending standards for consumers: “a significant net share of banks reported increasing minimum credit score requirements for credit card loans, while moderate net shares of banks reported doing so for auto loans and other consumer loans,” the Fed said.

In summary: the US economy remains badly credit-constrained on both the supply (fears of renewed bank shocks) and demand (lack of faith and visibility into the economic future and concerns how the Biden admin will further destroy the economy) side. Which is ironic because if one listens to Biden's department of propaganda, the US economy has rarely had it this well. It makes one wonder: is it all the latest bubble craze, namely private credit that is funding economic growth, or is there no conundrum at all and all the data is simply manipulated to make it seem that the economy is stronger than it is until the election... and which point we get the long-overdue Wile E. Coyote moment.