With Melius Research (who?) writing a note this week asking (and answering) "Dare We Say Nvidia Is Now Cheap?", we couldn't help but get that feeling that investors may have jumped the shark on the AI bubble (now that NVDA's Q2 earnings are behind us).

Of course, there are plenty of superlatives surrounding the AI new world order:

"OpenAI is currently on pace to generate more than $1 billion in revenue over the next 12 months from the sale of artificial intelligence software and the computing capacity that powers it. That’s far ahead of revenue projections the company previously shared with its shareholders, according to a person with direct knowledge of the situation," according to The Information.

That's quite a jump from the $28 million in revenue that OpenAI generated last year (before it started charging for its groundbreaking chatbot, ChatGPT), and the billion-dollar revenue figure means that the recent $27 billion valuation does not look that crazy anymore.

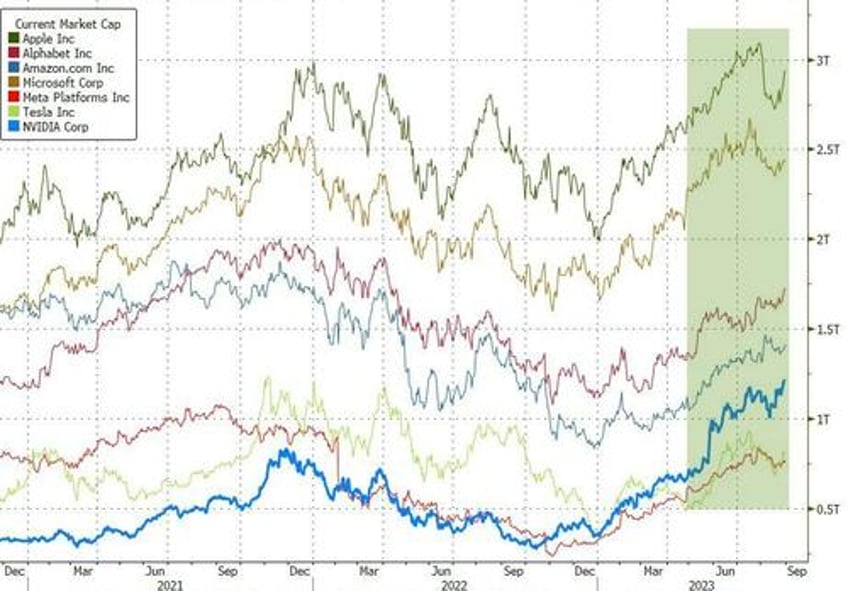

However, a quick glance at publicly-traded companies benefiting from this trend shows - at a minimum - the fervor of future spend is being pulled forward.

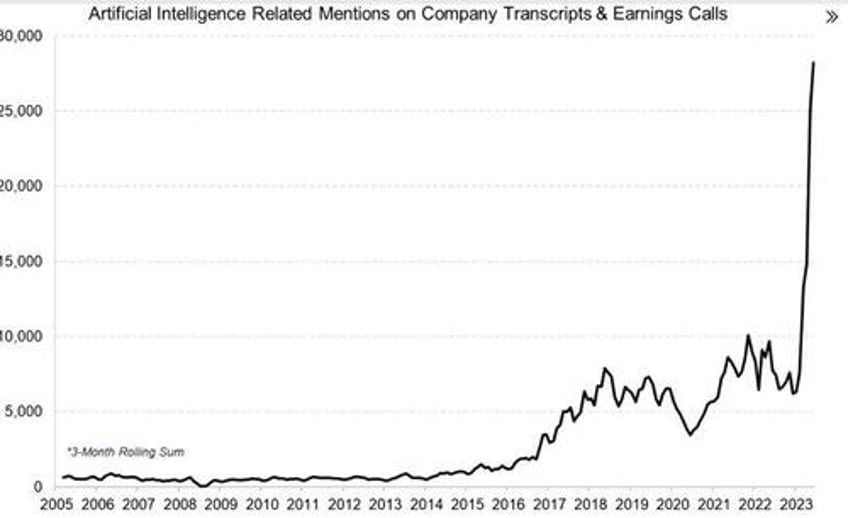

As every CEO and his pet rabbit drops the two most important letters - A and I - in talks with investors and media.

We went from ~500 mentions of AI on earnings calls in 2015 to ~30,000 this year and we still have 4 months left.

But, dare we say it, the froth may be coming off that soy, non-fat, skinny vanilla cappuccino as Bloomberg reports the heavy call-buying of high-flying technology stocks has tapered off, ushering in a more normal options-market dynamic for the biggest names in artificial intelligence.

The regime-change is most clearly seen in the so-called options-skew (difference between the cost of upside and downside bets) for a number of the highest profile AI-beneficiaries.

As excitement mounted in June and July, AI-mania flipped the norm (of puts costing more than calls) on its head with the cost of calls on MSFT, AMZN, NVDA,TSLA, and META generally rising more than put options (gren shaded box), according to data from Nations Indexes.

However, in recent week, things are looking a bit more normal, and calls are back to a discount for most of those companies.

“Tech was in a mini bubble, and AI was in a legitimate full-on bubble in June and July,” said Scott Nations, president of Nations Indexes.

“Now, people realize that we’ve seen bubbles before.”

There is an exception - Nvidia. Calls still cost more than puts, but the gap is narrowing, signaling that the mania over the S&P’s top gainer of 2023 is subsiding, at least a little.

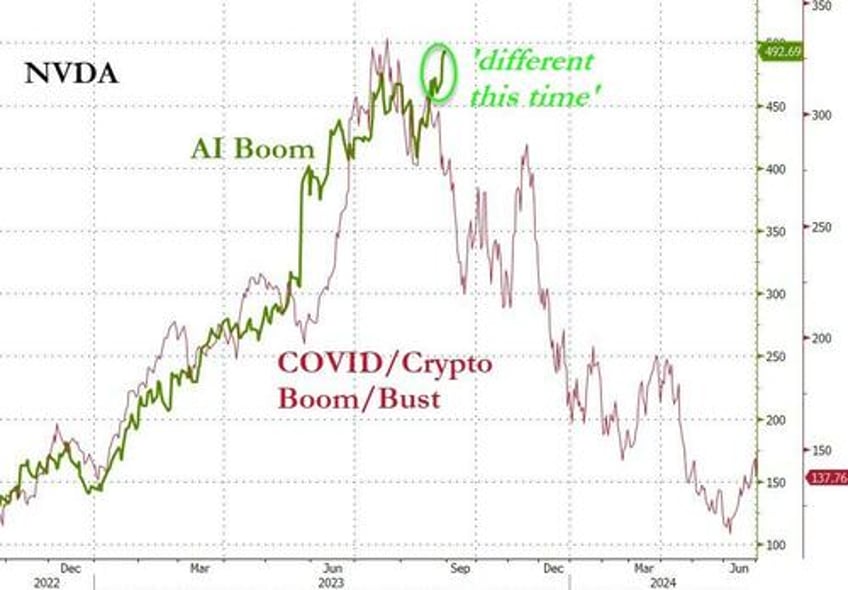

In fact, since the chip giant's blowout earnings spike, it has been unable to extend gains (most notably stalling at its call-wall around $500)...

Indeed, tech might be running out of buyers.

As Amy Wu Silverman, head of derivatives strategy at RBC Capital Markets, warns, chatter of clever chatbots may not fuel stock rallies forever. Eventually, investors will look for signs of progress.

“Unless some other incremental AI news happens, I’m curious who the next incremental buyer is,” Silverman said.

“Retail was actually on this relatively early and had always been on this and then got the institutions - who had started this year fairly bearish and worried - essentially capitulate and have to go in. The bar is higher because who else has to go in now?”

In other words, the retail bagholder is not there for the pros to dump it to - because everyone's already filled their boots... which explains why puts are suddenly more bid than calls.

Is it really different this time?