Ahead of the August consumer debacle which saw - and continues to see - most retailers report dismal earnings and plunge by double digits on the back of dreadful "recent trends" commentary...

"This is about credit card balances. This is about student loans, which we know is going to come into focus in the next month or two, auto loans, mortgages,” said Adrian Mitchell, who is Macy’s chief financial officer and chief operating officer. “So we just believe that the customer is coming under pressure because these are new realities that they have to continue to deal with as we get through the back half of this year and move into next year.” - Macy's Crashes As Consumer Situation Deteriorates

... July was a blockbuster month for retail names, or as Goldman put it "the best month for the quarter", with the Dept of Commerce reporting stellar retail sales data, including the biggest monthly increase since January, largely on the back of Amazon's record sales on Prime Day.

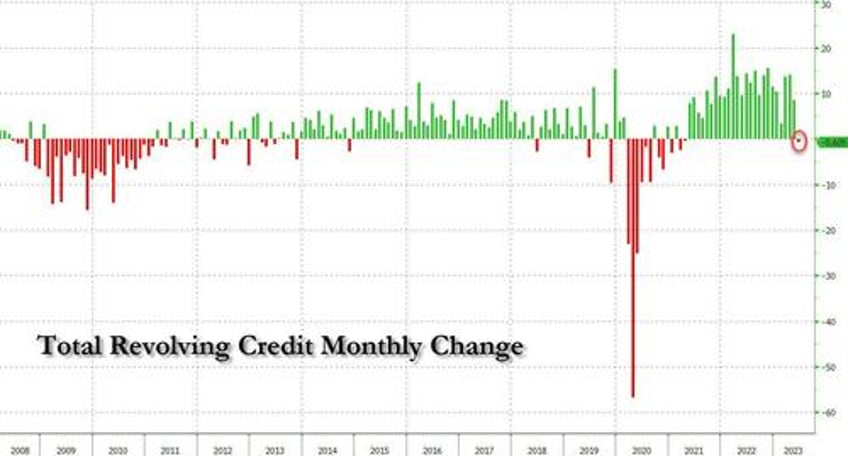

What we didn't know is where all the purchasing power to fund this blow-off top spending spree had come from: recall that at the start of the month, we reported the latest consumer credit data showed that in the month of June, there was a shocking reversal in credit card spending (in fact, consumers were net paying down their credit card debt for the first time in two years) which suggested that US consumers had just maxed out their credit cards and would no longer be able to fund their purchases on credit, which prompted us to caution that households are now aggressively tapping into their savings.

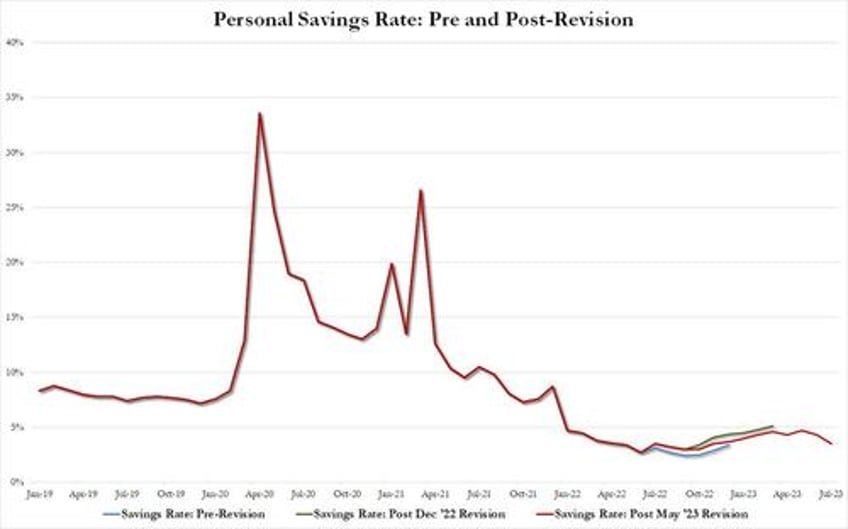

We were right: as today's household income and spending data showed, in July the US household savings rate collapsed by a whopping 0.8% from 4.3% to 3.5%, the biggest one-month drop since the start of 2022.

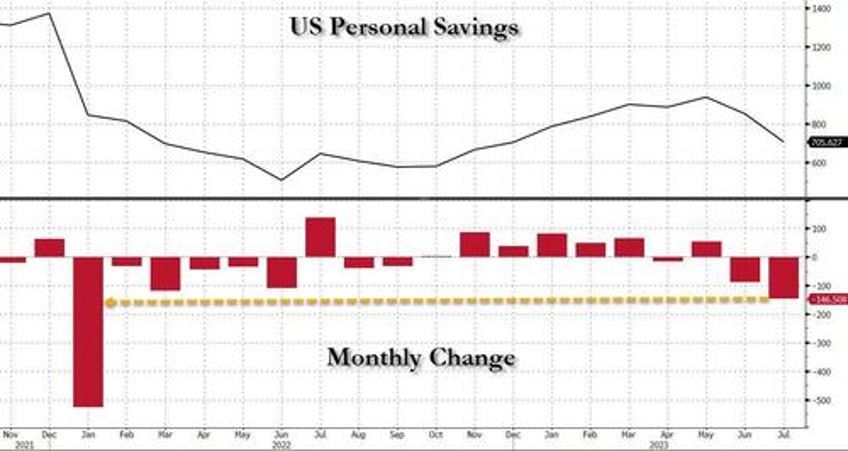

In dollar terms, the total amount of personal savings collapsed by almost $150BN from $852BN to $706BN SAAR, the biggest one month drop since Jan '22.

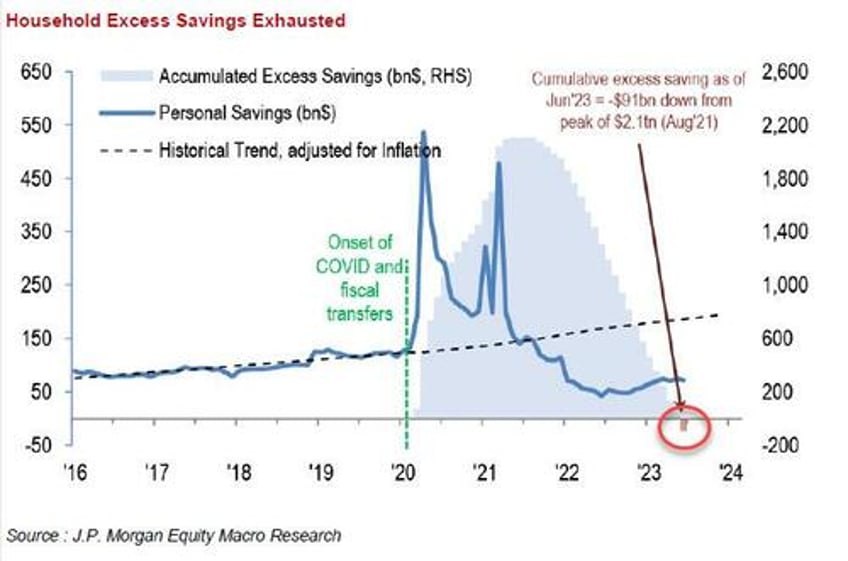

Worse, this rapid savings depletion comes at a time when according to JPMorgan the "excess savings" from the post-covid stimmy bonanza, all $2.1 trillion of them, have finally been depleted.

In our kneejerk comment on the data, we said that "this is where the July spending spree came from: US Savings rate COLLAPSED from 4.3% to 3.5% in July, lowest since Nov 22, and biggest drop since Jan 22."

Fed's Favorite Inflation Indicator Jumps Higher In July, Wage Growth Slowed https://t.co/r0bnVNtZyS

— zerohedge (@zerohedge) August 31, 2023

Two hours later, Obama's top economist Jason Furman echoed what we said, tweeting that "Falling real disposable income and rising consumption in July are reconciled by a step down in the saving rate. I like to smooth over 3 months, is still quite low."

It is not just lower saving rates but other measures of consumer stress are worsening: higher borrowing, more delinquencies. I keep expecting real consumer spending growth to slow more than it has--but so far is holding up remarkably well.

— Jason Furman (@jasonfurman) August 31, 2023

The bigger problem, as we have repeatedly warned, and as Furman also echoed is that "It is not just lower saving rates but other measures of consumer stress are worsening: higher borrowing, more delinquencies. I keep expecting real consumer spending growth to slow more than it has--but so far is holding up remarkably well."

Indeed, however once consumers realize they have to spend several hundred dollars each month on their student loans which are again due and payable, expect all hell to break loose as soon as next month.